Automobile Dealer Survival Status Survey: Over Half Suffer Losses, Price Inversion Identified as Main Cause

In the first half of 2025, under the dual stimuli of vehicle scrapping renewal and replacement policies, the consumer side of the domestic car market shows a warming trend. However, in stark contrast to the market's heat, the dealer group, which is a core part of the automotive circulation sector, is deeply mired in a survival predicament.

Recently, a report titled "Survey on the Survival Situation of National Automobile Dealers in the First Half of 2025" released by the China Automobile Dealers Association indicated that in the first half of the year, the competition in the automobile market was intensely fierce. Manufacturers and dealers resorted to price cuts to boost sales and vigorously vie for market share, resulting in the dilemma of "sales increase without revenue growth, and revenue growth without profit increase." Particularly, many traditional brands are experiencing varying degrees of price inversion, where retail prices are lower than the cost of purchasing vehicles, a situation that is worsening. The new car business is suffering severe losses, dealers are facing difficulties in capital turnover, and liquidity issues are spreading throughout the entire distribution industry.

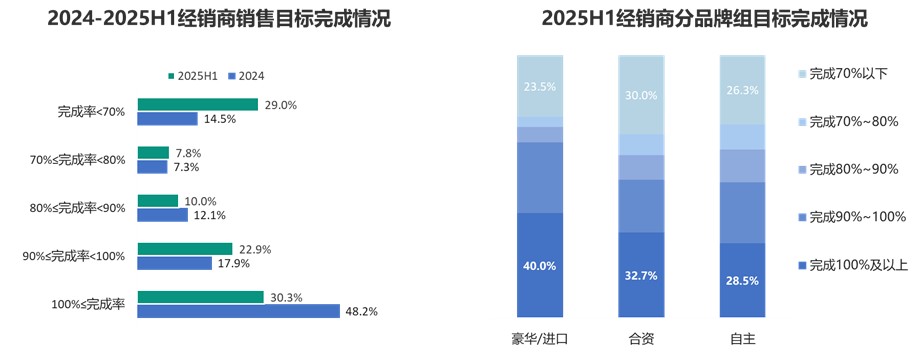

Only 30.3% of dealers have met their sales targets, with significant brand differentiation.

The nationwide survey on the survival status of automobile dealers was officially launched in July 2025. After more than a month of questionnaire collection, the survey covered 4S shops under large and medium-sized automobile dealer groups, as well as small groups and single shops, with a total of 936 valid questionnaires collected.

According to the survey data, in the first half of the year, only 30.3% of dealers achieved their sales targets. 29% of dealers had a target completion rate below 70%, while 40.7% of dealers had a target completion rate above 70% but less than 100%.

Image Source: China Automobile Dealers Association (same below)

This situation reflects that even with policy stimulus, market demand has been somewhat released, but dealers still face significant resistance in actual sales promotion. On one hand, consumer wait-and-see sentiment has not completely dissipated, and sensitivity to price continues to rise, leading to a longer transaction cycle. On the other hand, the sales targets set by manufacturers at the beginning of the year were mostly based on optimistic expectations, which are clearly disconnected from the market's actual capacity, further increasing the sales pressure on dealers.

From the perspective of brand dimension analysis, the target completion rate of different types of brand dealers shows significant differentiation. The target completion rate of luxury brands is slightly better than that of joint venture brands and independent brands. Among joint venture brands, the proportion of dealers who achieve 70% or less of their targets is higher than that of luxury/import brands and independent brands.

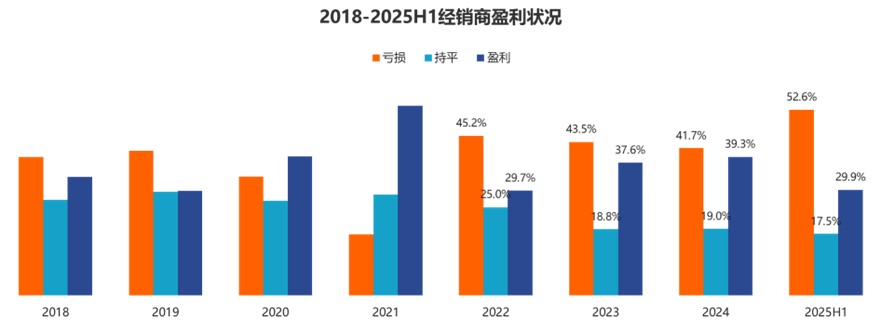

The difference in sales target completion rates is directly reflected in the performance of dealers. Survey results show that the proportion of car dealers experiencing losses in the first half of the year has risen to 52.6%, with more than half of the dealers in a state of loss; the break-even proportion is 17.5%, and the profit-making proportion is only 29.9%. This means that out of every three dealers, less than one can achieve profitability.

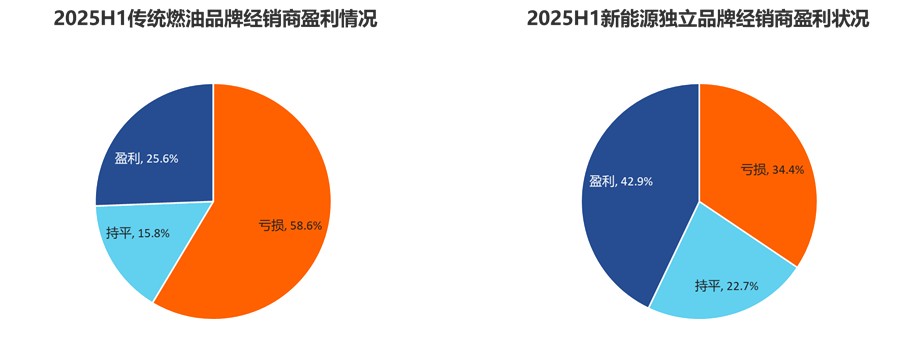

A more detailed breakdown of brand types shows that dealers of independent new energy vehicle (NEV) brands are performing better than those of traditional fuel vehicle brands. The profit and loss situation for independent NEV brand dealers is as follows: 42.9% are profitable, 22.7% break even, and 34.4% are operating at a loss. For traditional fuel vehicle brand dealers, the figures are: 25.6% profitable, 15.8% break even, and 58.6% at a loss. The former has a relatively higher proportion of profitability and a lower proportion of losses, thanks to the continued growth in demand for NEVs and relatively reasonable pricing strategies from the brands, making them the core driver of profits. In contrast, the profitability of traditional fuel vehicle dealers is significantly lower, while the loss proportion is notably higher. Affected by price wars, inventory backlog, and the shift in consumer demand, traditional fuel vehicle dealers are not only suffering heavy losses in new car sales, but also experiencing a decline in after-sales service visits due to the slowdown in vehicle ownership growth, further squeezing their profit margins.

This gap in data indicates that the transition to new energy has become an important breakthrough for dealers to improve their operational status. Traditional fuel vehicle brands that fail to adjust their strategies in a timely manner will face a more severe survival crisis.

In the composition of the dealer's gross profit, the gross profit contributions from new cars, after-sales, and financial insurance are -22.3%, 63.8%, and 36.2%, respectively. The gross profit contribution from new car sales remains negative, and the loss from new cars has further intensified. The gross profit contribution from after-sales services has slightly increased, while the gross profit contribution from financial insurance has declined to a certain extent.

It is worth noting that there is an essential difference in the gross profit composition between new energy independent brand dealers and traditional fuel vehicle brand dealers. In the 4S stores of new energy independent brands, the gross profit contributions from new cars, after-sales, and financial insurance are 16.8%, 54%, and 17%, respectively. Compared with traditional fuel vehicle brand dealers, new energy brand new car sales have shown relatively better profit contributions.

The core reason for losses in the new car business of traditional fuel vehicle brand dealers lies in the increasingly severe phenomenon of "inverted pricing"—that is, the retail price of cars is lower than the purchase cost for dealers. Surveys show that in the first half of the year, 74.4% of car dealers experienced varying degrees of inverted pricing, with 43.6% of dealers seeing the price inversion exceed 15%.

Severe price inversion has eroded the dealers' working capital, causing widespread reports of significant financial pressure among dealers, especially those dealing with traditional fuel vehicle brands. Price inversion has led to substantial losses in new car sales for these dealers. Dealers of independent new energy vehicle brands mainly face pressures such as low after-sales revenue and long investment recovery periods.

Long rebate cycles and restricted redemption have led to declining dealer satisfaction with the OEM.

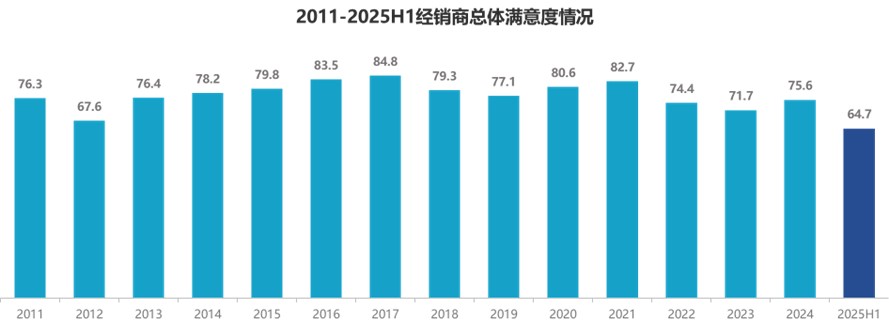

In addition to the pressures brought by market competition and price inversion, cracks have also appeared in the cooperative relationship between dealers and automakers, primarily reflected in a significant decline in dealers' satisfaction with automakers. According to survey data from the China Automobile Dealers Association, dealers' satisfaction with automakers has dropped noticeably, with an overall satisfaction score of only 64.7 points, a sharp decline compared to the end of 2024. The core issue lies in the accumulation of multiple operational pressures.

The previous text mentioned that the severe price inversion has significantly compressed profit margins. Under financial pressure, dealers' tolerance for inventory weakens, and a slightly higher inventory coefficient can exacerbate cash flow issues. Moreover, manufacturers have reduced rewards for achieving basic target goals, leading to an imbalance between effort and return, further lowering dealer satisfaction.

Surveys indicate that among the four major business segments of automobile dealerships, customer satisfaction with new car and used car businesses is relatively low. Issues with new cars include excessively high sales targets, insufficient brand competitiveness, and too many assessment criteria. For used cars, manufacturers provide inadequate support, and price fluctuations in new cars lead to instability in used car prices. In the after-sales segment, dealers report a continued decline in after-sales service visits, while manufacturers are increasing, rather than reducing, parts sales targets. Additionally, high parts prices exacerbate customer attrition, leading to decreased satisfaction with after-sales services.

One of the core issues causing dissatisfaction among dealers is undoubtedly the rebate policy of manufacturers. It is reported that the rebates set by manufacturers for dealers are complex and varied, mainly divided into basic rebates and vague rebates, with the latter generally accounting for a higher proportion. Due to the lack of transparency in the rules for vague rebates and unclear assessment criteria, dealers find it difficult to accurately calculate the actual rebates received, leading to significant uncertainty in business expectations.

The China Automobile Dealers Chamber of Commerce previously pointed out that the current rebate policies of automobile manufacturers are complex and have ambiguous areas. Rebates, as one of the important sources of income for automobile dealers, are complicated in their composition, including fixed rebates and non-fixed rebates. However, non-fixed rebates often have many uncertainties, such as the standards and participation conditions for phase-based promotional rebates which are often unclear, and the issuance of special subsidies is also filled with uncertainties. This ambiguity makes it difficult for dealers to effectively anticipate and plan for rebate income, thereby affecting their cash flow and business decisions.

From the perspective of rebate cycles, dealers are facing increased financial pressure. A survey by the China Automobile Dealers Association indicates that manufacturers typically have a rebate cycle for dealers of 2-3 months, while some manufacturers implementing quarterly assessments have rebate cycles exceeding 3 months. Research data previously released by the National Federation of Industry and Commerce Automobile Dealers Chamber of Commerce also shows that the rebate settlement period for some brands can be as long as 90 days or even 180 days. For dealers who are already experiencing tight finances, excessively long rebate cycles mean increased capital occupancy costs, further exacerbating their operational burden.

In terms of rebate redemption forms, dealers' autonomy has been severely restricted. According to a survey by the China Automobile Dealers Association, the main forms of rebate redemption are: full cash rebate to the dealer's account for free use; partial cash, partial conversion to vehicle purchase funds; and full conversion to vehicle purchase funds or related uses. The survey shows that only a few manufacturers provide full cash rebates to dealers' accounts. This redemption method leads dealers into a cycle of "exchanging rebates for inventory"—to obtain rebates, they must continue to purchase vehicles from manufacturers, further increasing inventory pressure; if they do not purchase vehicles, they cannot receive rebates, making it even harder to maintain their cash flow.

Many parties advocate for optimizing rebate policies, and the industry needs to collaborate to break the deadlock.

The China Automobile Dealers Association suggests that manufacturers simplify rebate policies by implementing a single monthly assessment, eliminating quarterly and annual assessment targets, achieving rebate redemption within two months, and removing restrictions on the use of rebates.

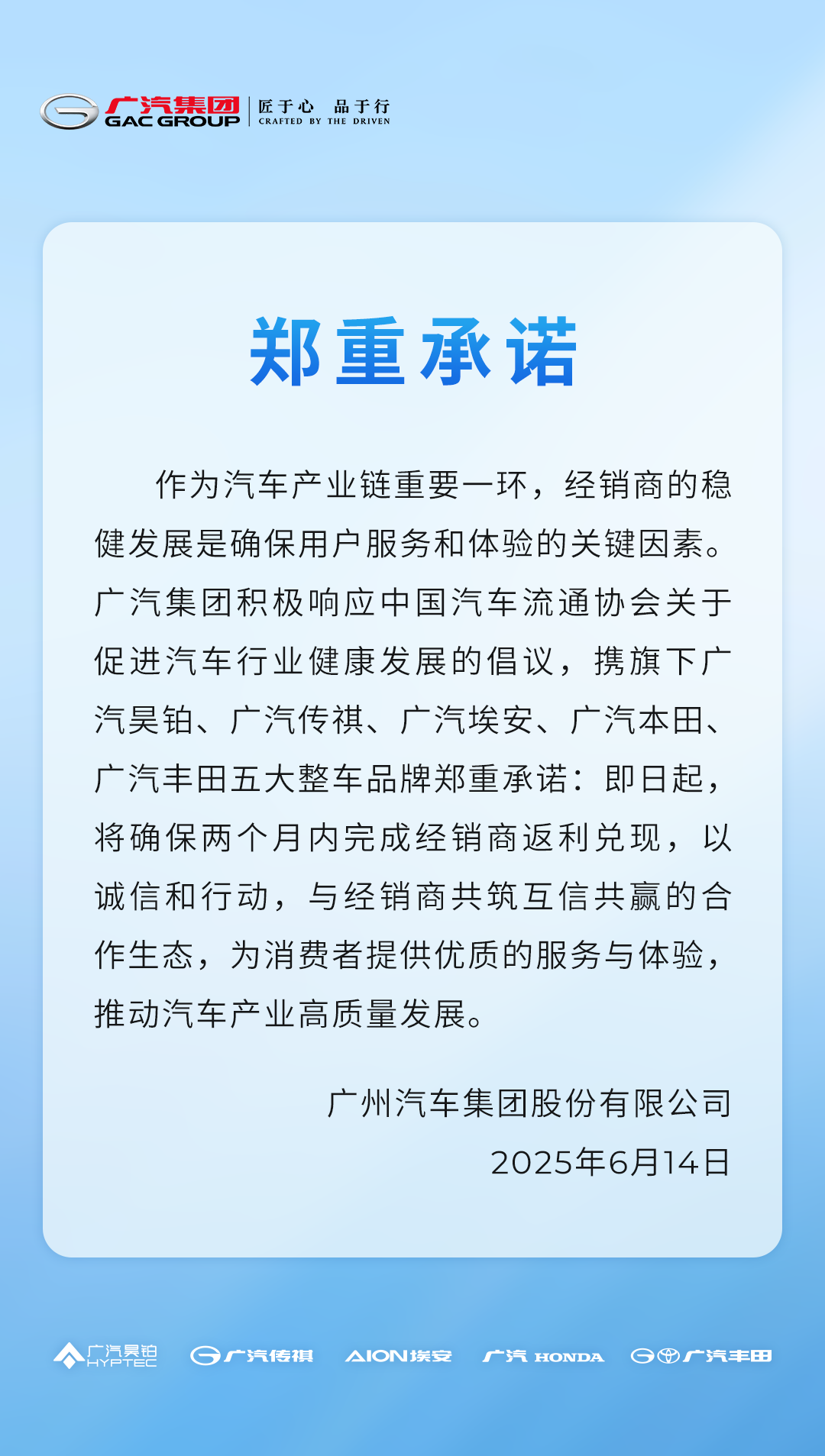

In fact, some manufacturers have already taken the lead in taking action. For instance, on June 14 this year, GAC Group, along with its five major automobile brands—GAC Aion, GAC Trumpchi, GAC Honda, and GAC Toyota—solemnly committed to ensuring the fulfillment of dealer rebates within two months from now. With integrity and action, they aim to build a mutually trusting and win-win cooperative ecosystem with dealers, provide consumers with quality services and experiences, and promote the high-quality development of the automotive industry.

Image source: GAC Group

On June 23rd of this year, the National Federation of Industry and Commerce Automobile Dealers Chamber of Commerce also proposed related initiatives, including:

1. Establish a clear and explicit rebate policy. The Chamber of Commerce urges automobile manufacturers to simplify rebate settings and clarify rebate standards, eliminating ambiguous rebates. Particularly for non-fixed rebates, a relatively clear calculation standard should be established based on objective market conditions, allowing dealers to have expectations and plans.

2. Shorten the rebate redemption period. The chamber of commerce stated that some automobile brands have already reduced their rebate redemption period to within 30 days, which fully reflects these brands' social responsibility and brand image. Therefore, the chamber of commerce calls on all brands to adjust their rebate redemption period to no more than 30 days to alleviate the financial pressure on dealers.

3. Do not impose excessive restrictions on the redemption and use of rebates. The chamber of commerce calls on automobile manufacturers to return rebates to dealers in cash directly and ensure that dealers can freely use them. At the same time, do not set overly harsh assessment conditions for rebate redemption in order to reduce the operational burden on dealers.

Overall, the survival dilemma of car dealers is not caused by a single factor, but rather the result of multiple factors working together.

From the market perspective, the domestic automobile market has fully transitioned from an "incremental market" to a "stock market." The market growth space is gradually narrowing, and OEMs are adopting a "price for volume" strategy to compete for limited market share. This has transferred competitive pressure to the dealers, triggering an industry-wide price war.

From a policy perspective, although the scrapping, renewal, and replacement policies have stimulated consumer demand, the policy benefits are more concentrated on sales growth and have not effectively addressed the profitability issues of dealers. Instead, the inventory pressure and capital occupation caused by the increase in sales have further exacerbated the operational burden on dealers.

From the perspective of manufacturer relationships, the long-standing cooperation model of "manufacturer-led, dealer-passive" has not fundamentally changed. Manufacturers lack consideration of dealers' actual operating conditions in the establishment of assessment targets and the design of rebate policies, leading to an imbalance of interests between manufacturers and dealers.

In the face of the current predicament, the automotive circulation industry urgently needs to seek breakthroughs from multiple dimensions. For traditional fuel vehicle brand dealers, on one hand, they need to accelerate the transition to new energy by introducing new energy brands and expanding new energy vehicle sales business, cultivating new profit growth points. On the other hand, they need to optimize their business structure by enhancing the proportion of value-added services such as after-sales, used cars, and automotive finance, thereby reducing dependence on new car business. As for independent new energy brand dealers, they need to focus on addressing the issues of low after-sales output value and long investment recovery period by improving the after-sales service system and launching personalized service products to enhance customer loyalty and after-sales profitability.

For manufacturers, restructuring the "partnership" with dealers is crucial. Manufacturers need to abandon the assessment orientation of "focusing on sales volume over profits" and set sales targets reasonably based on actual market demand to avoid excessively transferring operational pressure to dealers. At the same time, they should simplify rebate policies, shorten rebate cycles, and realize cash rebates to effectively alleviate dealers' financial pressure. Additionally, manufacturers should enhance collaboration with dealers by means such as joint marketing and sharing customer data to help dealers reduce operating costs and improve profitability.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track