Automakers going global cannot accelerate any further

Starting in 2026, export license management will be implemented for pure electric passenger vehicles.Effective January 1, 2026.On September 26, the announcement released by the Ministry of Commerce and three other departments will change the pace of Chinese automobile exports.

Gaishi Automotive Research InstituteIt is believed that the export of pure electric passenger vehicles will be included in the license management, and the chaos of parallel exports will be rectified. Starting from 2026, export companies will need to be authorized by manufacturing companies, and small companies will be eliminated.

As the scale of new energy vehicle exports in China grows, this announcement may slow down the pace of international expansion, but the larger goal is to guide exports towards a healthy and regulated path.

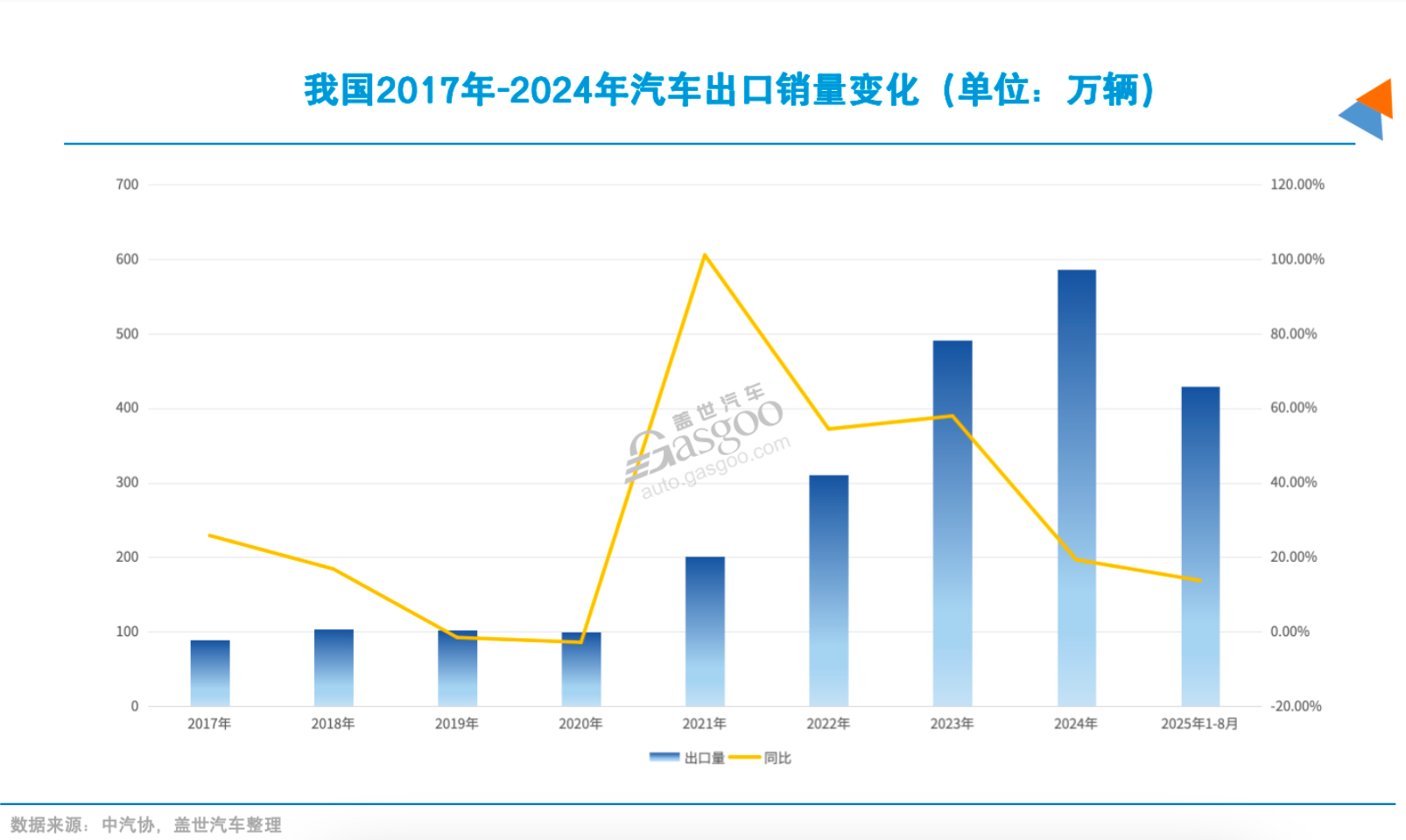

During the 14th Five-Year Plan, China's automobile exports have achieved significant growth. By 2024, the annual export volume of Chinese automobiles has reached 6.4 million units, a nearly fivefold increase over four years, generating $117.4 billion in foreign exchange, accounting for 3.3% of China's total exports. The overseas market has become the "second growth curve" for Chinese car companies.

Compared to countries like Germany, Japan, and South Korea, where car exports account for more than half of the total, China's car exports only account for 20%. From this perspective, China is a major car-exporting country but not yet a "strong car country," indicating there is still significant room for improvement.

In the upcoming "15th Five-Year Plan," how China should transform into a "strong automotive export nation" remains an unsolved issue. This announcement might signal a shift from pursuing export scale to focusing on high-quality exports.

Five years, export volume 6

Since 2020, China's automobile exports have achieved leapfrog growth. At that time, exports were just a "supplementary item," with annual sales at only a million units, accounting for 4% of the total sales. However, four years later, by 2024, the export volume reached 6.4 million units, maintaining a year-on-year growth of 23%.

In 2025, Chinese car manufacturers continue to accelerate their overseas expansion. According to data from the China Association of Automobile Manufacturers, from January to August this year, China's automobile exports reached 4.29 million units, a year-on-year increase of 13.7%, and it is expected that the total for the year will exceed 7 million units. Automobile exports now account for 20% of the total.

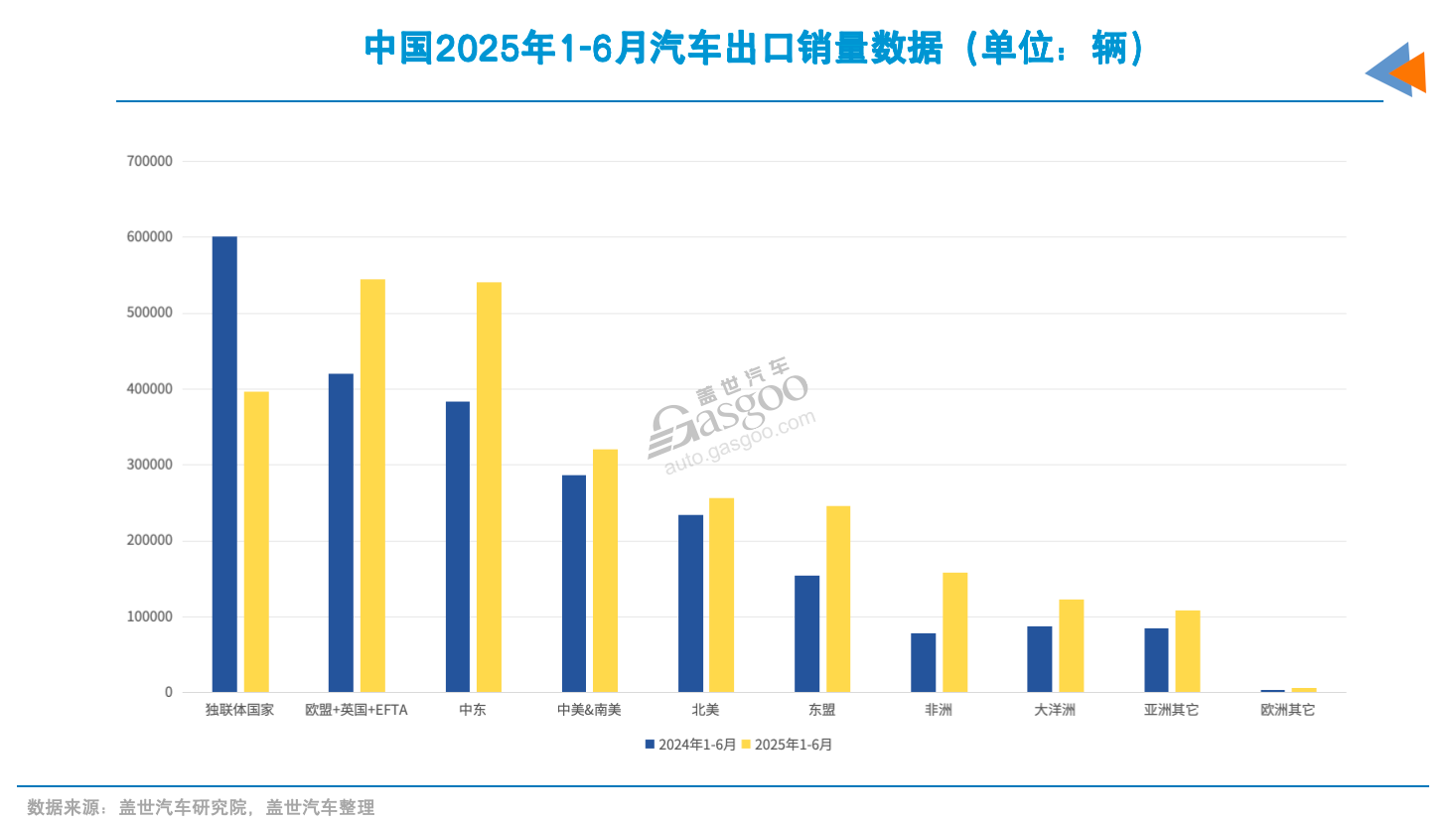

This not only signifies a leap in sales but also reflects an optimization in the product export structure. In the past, China's automobile exports were primarily composed of fuel vehicles, with markets concentrated in emerging regions such as the Middle East, South America, and Africa. In contrast, the core markets in Europe and Southeast Asia were dominated by multinational car companies from Europe, the United States, Japan, and South Korea.

During the 14th Five-Year Plan period, the three years of the pandemic became an opportunity for Chinese car companies to expand overseas. While overseas car manufacturers frequently halted or reduced production due to tight supplies of chips and other core components, China ensured the steady recovery of domestic car production thanks to its comprehensive automotive supply chain. A 2021 McKinsey report shows that among 180 major global trade goods, products made in China account for 70%.

After undergoing a period of pressure-driven development, China has established a complete industrial chain in the new energy vehicle sector, ranging from upstream materials and midstream components to downstream complete vehicles. It has achieved global competitiveness in core technologies such as batteries, motors, and electronic controls. This has become a unique advantage for China's automobile industry in international competition.

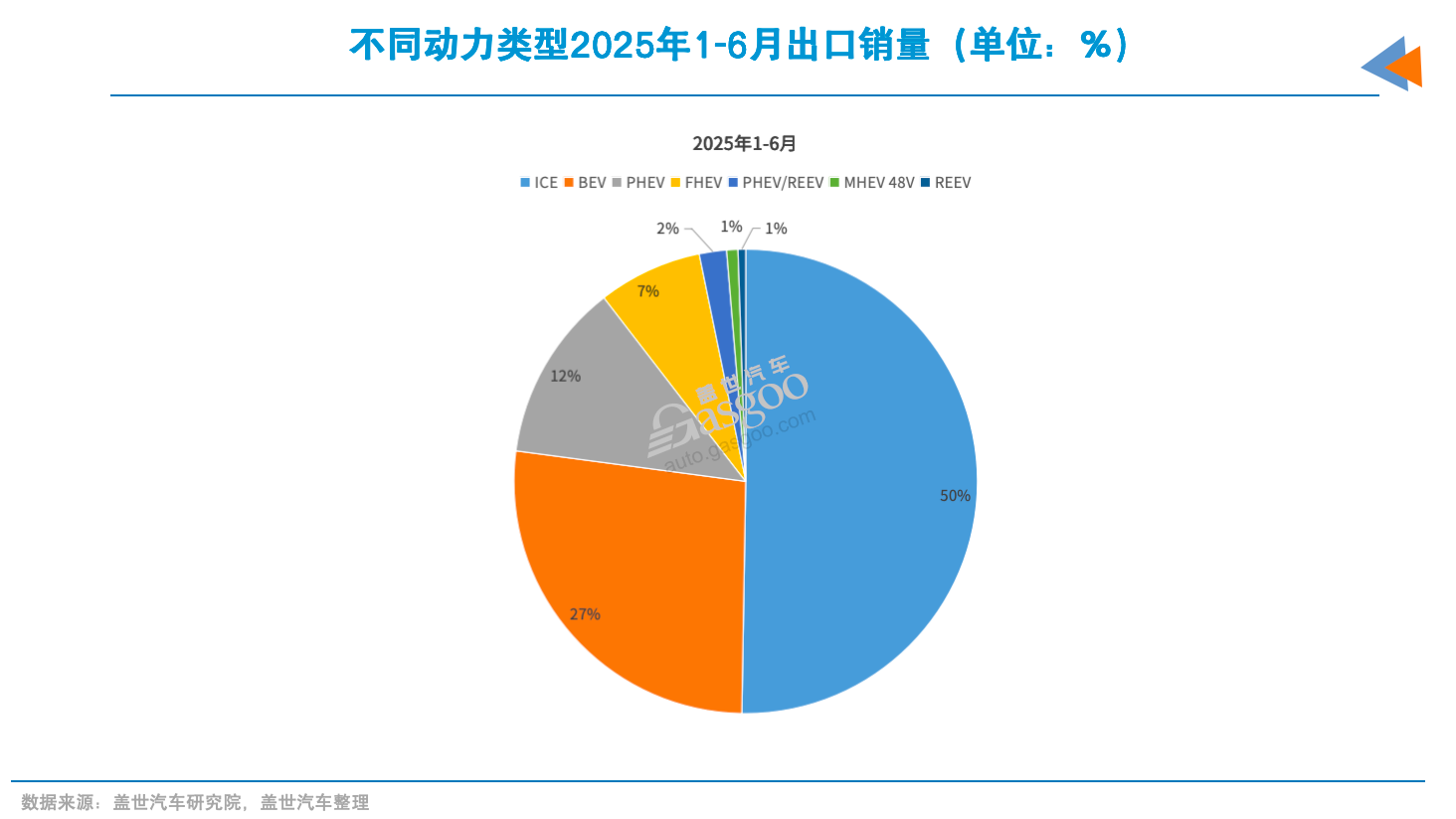

Taking advantage of this opportunity, China's automobile exports have experienced a boom. New energy vehicles have risen to prominence, gradually replacing traditional fuel vehicles as the main driver of export growth. In the first eight months of 2025, China's new energy vehicle exports exceeded 1.5 million units, representing a year-on-year growth of nearly 90%, significantly surpassing the export growth rate of traditional fuel vehicles.

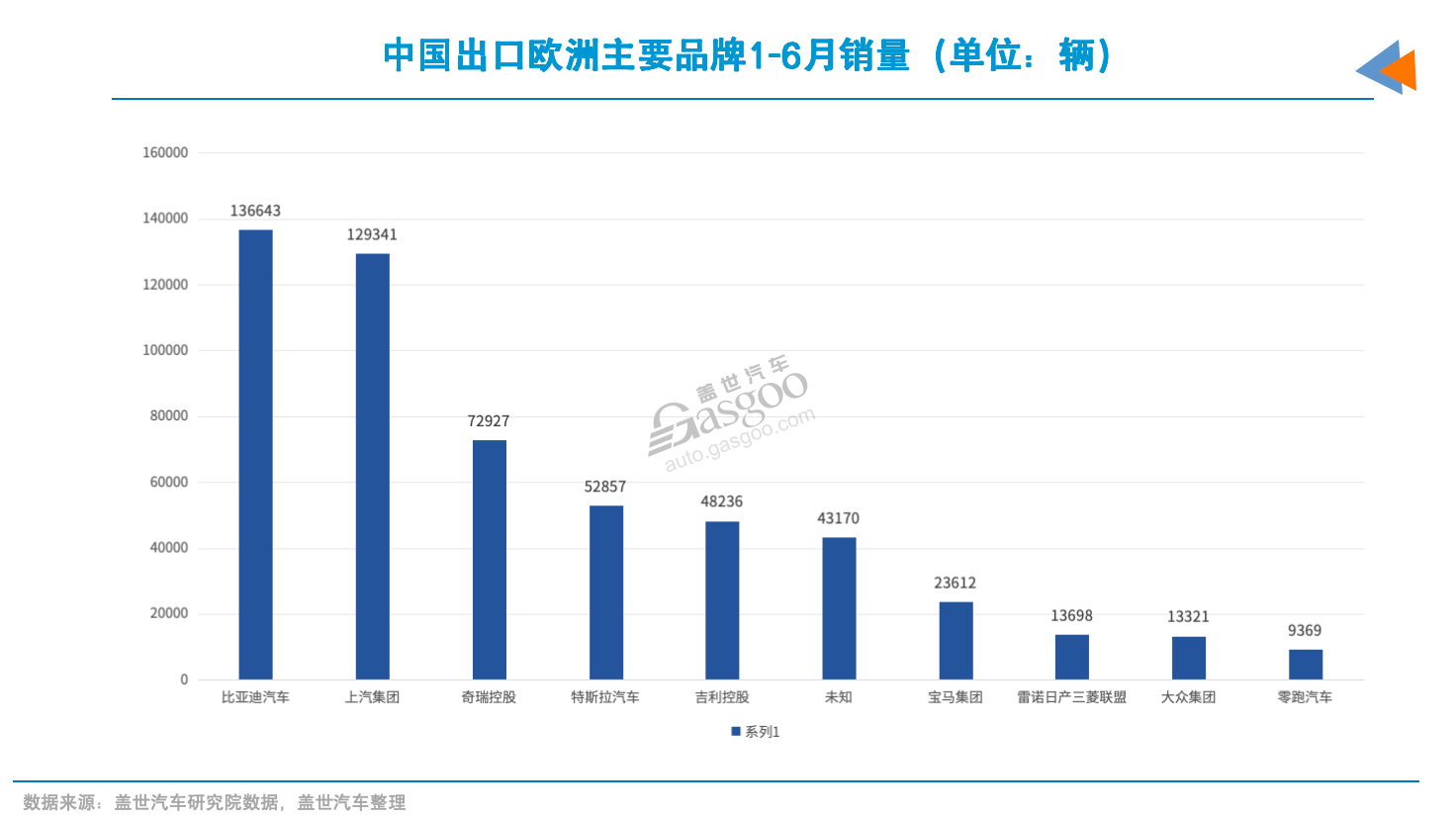

More notably, Chinese new energy products have entered developed countries with extremely strict environmental and quality requirements, such as Europe and Japan, which are also the core territories of multinational car companies. Data shows that Europe is the largest destination for China's new energy exports, with sales reaching 402,000 vehicles in the first half of this year, accounting for 40% of the total new energy exports.

At the same time, in regions such as Southeast Asia, the Middle East, Latin America, and Africa, Chinese brands have gradually opened up the market by leveraging a diverse range of products and cost-effectiveness. Taking the Thai market as an example, China's market share has reached around 25%, doubling from last year, with an 80% share in the new energy market. BYD, GAC Aion, and Changan have performed outstandingly, with BYD securing about 12% of the local market share, aided by models like Dolphin and Atto 3.

With the growth in export sales, the brand value of Chinese automotive companies in the global market has also seen some improvement. The brand recognition of BYD, Geely, Great Wall, and others in overseas markets is continuously increasing, and the pricing of their products is gradually aligning with that of mainstream multinational car companies.

Chinese car manufacturers have also made substantial progress in their localization efforts overseas, gradually shifting from "trade export" to "capacity export."

BYD's factory in Rayong Province, Thailand, will start production in 2024, with a current annual capacity of 150,000 vehicles, covering the ASEAN and Australia-New Zealand markets. Its factory in Bahia, Brazil, will also begin production in 2025, with a long-term planned capacity of 300,000 vehicles per year. Geely's joint venture factories in Belarus and Malaysia have been operating steadily for many years. Great Wall Motors has also achieved large-scale production at its manufacturing bases in Russia and Thailand.

More strategically, China's automotive industry is building a "complete vehicle + components" full industry chain export system.

CATL, Gotion High-Tech, and other battery companies are establishing production bases in Germany, Hungary, and other locations; Zhongding Group, Joyson Electronics, and other component companies are setting up factories and R&D centers in various countries in Europe and the Americas. This kind of global layout of the entire industrial chain not only enhances the risk resistance of China's automotive industry but also elevates its voice in the global automotive industry landscape.

The rapid growth of automobile export business has played a positive role in stabilizing the macroeconomy. Data shows that in recent years, the contribution rate of external demand to economic growth has continued to rise, with the contribution rate of net exports of goods and services to economic growth reaching 31.2% in the first half of 2025. As a technology-intensive and capital-intensive product, the growth of automobile exports not only drives the transformation and upgrading of the manufacturing industry but also creates a large number of job opportunities.

Choosing the right track is important.

In addition to "timing and location," "harmony among people" is also very important. The explosive growth in car exports within a few years is backed by the long-term and systematic efforts made by Chinese car companies in their globalization strategies.

At the product level, in the highly saturated traditional fuel vehicle market, it is indeed difficult for Chinese car companies to compete head-to-head with multinational giants on the same track. Therefore, new energy and plug-in hybrid vehicles (including plug-in hybrids and extended-range vehicles) are regarded as "breakthrough weapons."

Taking BYD as an example, with core technologies such as the Blade Battery and DM hybrid, it has launched models like the Yuan series, Dolphin, and Song PLUS overseas. In just three years, it has made breakthroughs in key markets such as Southeast Asia, Europe, Australia and New Zealand, and South America.

In August this year, BYD's monthly export sales reached 80,000 units, a year-on-year increase of 1.5 times; the cumulative export volume for the first eight months was 630,000 units, maintaining a double-speed growth. As of now, BYD covers 112 countries and regions worldwide, ranking first in new energy vehicle sales in several countries, including Italy, Turkey, Spain, and Brazil. The Song PLUS DM-i is also the top-selling new energy model in multiple countries.

SAIC Motor has gained significant recognition in European, Commonwealth countries, and Mexico by "reviving" the British century-old brand MG. In the European market, SAIC's MG is focusing on the hybrid market, with sales reaching 153,000 units in the first half of the year, representing an 18.6% year-on-year increase, surpassing Tesla to rank 11th in sales in the European region.

Great Wall Motors has established brand recognition in markets such as Russia, ASEAN, and South America with products like the Haval H6 PHEV, Ora Good Cat, and Haval JOLION HEV.

The deepening of localization strategies further accelerates the overseas expansion of Chinese car companies. As export scales expand and trade policies become more complex, Chinese car companies are no longer satisfied with simple trade exports. Instead, they are deeply integrating into local markets by directly investing in building factories, setting up research and development centers, and establishing marketing networks.

As of now, almost all leading Chinese brands such as BYD, Great Wall, SAIC, Changan, GAC, and Chery have established or plan to establish overseas production bases. They have also set up multiple R&D centers globally to conduct specialized research tailored to the climate, road conditions, and user preferences of different markets, achieving a "global standard + regional characteristics" product model.

For example, JAC Motors, with more than 30 years of international experience, has established a step-by-step development path from trade export and technology licensing to industrial investment. It has 8 subsidiaries and 19 production bases overseas.

SAIC Motor has established multiple production or KD assembly bases in countries such as Indonesia, India, Thailand, and Egypt. The factory in Indonesia not only handles assembly but also undertakes some research and development tasks, providing technical support for adapting products to local needs. Through localized production, SAIC Motor effectively shortens delivery cycles, enhances market responsiveness, and to some extent, avoids tariff barriers.

Closely related to localization is the enhancement of the channel and service system. Great Wall Motors has established thousands of service outlets worldwide, achieving 24/7 online availability for global users, providing one-stop services including sales, maintenance, and connectivity.

Zhu Jiangming, the founder of Leapmotor, also stated that the company will deeply cultivate each market, and for slightly larger markets, they will operate independently instead of using a general agency model.

As one of the earliest Chinese brands to expand overseas, Chery has established a relatively complete network of dealerships and service centers in regions such as Latin America and the Middle East. Currently, it has over 1,500 dealers and service outlets worldwide, with service outlets accounting for about 30%, forming an integrated "sales-after-sales" system. In terms of sales, Chery's export volume in the first eight months reached 798,000 units, a year-on-year increase of 10.8%, accounting for 46% of the group's total sales.

Chinese car companies have shown a high level of sensitivity to the personalized needs of different markets. For instance, BYD launched the hybrid pickup "Shark" in Australia, receiving over 15,000 orders in its first month on the market. Chery enhanced the cooling system for the high-temperature desert environment in the Middle East, re-optimized power parameters to meet Europe's stringent emission regulations, and improved anti-corrosion standards to adapt to the rainy climate of Southeast Asia.

Intelligent network technology is another competitive advantage for Chinese cars going overseas. China's technological accumulation in areas such as intelligent cockpits and assisted driving enables exported products to offer a more advanced intelligent experience.

Overall, some car companies have elevated their overseas strategies to a systematic approach. When reviewing its own experience, JAC Group divides globalization into several stages: initially, it was simple export, followed by establishing channel networks, then investing in factories and R&D centers, and finally forming a fully localized chain covering production, research and development, sales, and service.

Great Wall Motor's "Ecological Overseas Expansion" concept further broadens its approach by not only exporting complete vehicles but also integrating accompanying services, supply chains, and digital systems into the market, aiming to create a long-term and stable overseas development ecosystem.

“ "Slowdown"

It must be acknowledged that the rapid expansion of exports is not entirely the result of natural growth in market demand. At the recent TEDA Forum, experts pointed out that insufficient effective demand is the most prominent contradiction in the current economy. The imbalance between supply and demand leads to an output gap, resulting in the "excess" supply having to be released through expanding exports.

According to data from the China Passenger Car Association, the overall capacity utilization rate of China's passenger cars is less than 60%, which is below the healthy level of 70%. In this context, the rapid increase in export scale has a certain "passivity." This means that if there are fluctuations in the external environment, the vulnerability of exports may be amplified.

Image source: Chery Automobile

The slowdown in global economic growth is also compressing external demand space. The International Monetary Fund's World Economic Outlook report indicates that under the impact of tariff policies, economic growth forecasts have been downgraded for almost all regions. The IMF expects global economic growth of 3.0% in 2025, with the U.S. economy growing at 1.9% and China's economy at 4.8%. The slowdown in global economic growth will affect automotive consumption demand.

What is more noteworthy is that the "involution" style competition within China is being replicated overseas in some way. In recent years, Chinese car companies have captured market share domestically through price wars, allowing some companies to rapidly expand in the short term. However, when similar strategies are introduced to overseas markets, the situation becomes more complex and may face local countermeasures and counterattacks from multinational car companies.

Overseas consumers are certainly sensitive to prices, but they also value brand reputation, service quality, and long-term value. If Chinese brands rely solely on low-price competition, they may achieve an initial breakthrough in market share but will find it difficult to establish a high-end image in the long term, and may even fall into a vicious cycle.

Dong Yang, Chairman of the China Automotive Power Battery Industry Innovation Alliance, cautioned that while the rapid growth of exports is certainly commendable, one should not be blindly optimistic, nor should one rely entirely on exports to resolve domestic conflicts. Otherwise, it is easy to repeat the predicament of excessive domestic competition on a global scale.

As the scale of automobile exports expands, some countries are continuously investigating and adjusting policies regarding Chinese electric vehicles. For example, the United States has increased tariffs or set new technical barriers, with further changes expected after the 90-day window period ends. Europe is intensifying measures on the carbon border adjustment mechanism and localization rules. Russia has significantly increased import tariffs on automobiles. Emerging markets also frequently impose restrictions under the pretext of protecting local industries.

Image source: Chery Automobile

For Chinese automotive companies still in the accelerated phase of international expansion, the uncertainty of core market policies implies increased future costs and risks. If major export markets implement stricter policies, the expansion pace of Chinese automotive companies could be directly affected.

Intellectual property risks are becoming increasingly prominent. CATARC pointed out that with the expansion of export scale, patent litigation against Chinese enterprises in Europe has significantly increased. In addition, challenges in areas such as overseas localization operations, sustainability of trade models, local procurement, and localization of talent cannot be ignored. For example, Lu Chun, Deputy General Manager of Technology at Zhongding Group, stated that one of the biggest issues facing overseas business is management challenges.

In such a situation, Dong Yang believes that China's automobile exports need to control their speed. Taking the European market as an example, if China's new energy vehicle or overall automobile exports maintain an annual growth of 10%-15%, it can steadily expand market share without causing too much impact on the local market and industry. He also emphasized that Chinese automobile companies going overseas must pay taxes according to the law and prioritize hiring local employees, "winning local recognition through tangible contributions."

Fifteen Five, how should globalization proceed??

In the past five years, the breakthrough in sales volume has made China the world's largest automobile exporter. Standing at the new starting point of the "15th Five-Year Plan," the future development path of China's automobile exports must focus more on quality, structure, and sustainability. After all, the competitive landscape of the global car market is also constantly changing.

Chinese car manufacturers are facing a more diverse and complex external environment. Currently, the process of regional integration is accelerating, with different regional groups increasingly exhibiting exclusive characteristics, deepening internal integration while continuously raising trade and industrial barriers externally. Some believe that the global pattern may evolve into a multi-center globalization with multiple regional centers operating in parallel, which will further exacerbate the fragmentation of the global automotive industry in terms of standards, markets, and supply chains.

Image Source: SAIC International SMIL

Emerging markets such as Southeast Asia, the Middle East, and Latin America still hold potential, but innovative business models are needed. These regions have relatively low car penetration and are in a growth phase, but they also face challenges such as insufficient infrastructure and limited consumer capacity.

Industry insiders suggest that Chinese companies can draw on experiences from countries like Thailand and Brazil to explore markets through localized production and innovative sales channels. In developed markets such as Europe and North America, a more refined strategy is needed, focusing on specific niche markets and high-value customer groups, and avoiding the blind pursuit of scale expansion.

In terms of product and technology paths, Chinese car companies should adhere to a multi-technology approach in parallel to meet the diverse global demands for energy conservation and emission reduction. Europe has a strong demand for pure electric vehicles, and policies are more inclined toward zero-emission models. Southeast Asia and South America are more suitable for plug-in hybrids and hybrid models to accommodate the reality of imperfect infrastructure. In some countries with different resources, hydrogen energy, methanol, and others may also have certain potential.

The move towards high-end markets is a challenge that Chinese automotive companies must address in the next phase of globalization. Although some Chinese car manufacturers have recently attempted to break into the high-end market, the overall focus remains on mid to low-end products, with brand premium capabilities needing improvement. Comparing the profitability per vehicle in the first quarter of 2025, BYD's net profit per vehicle is about 10,000 yuan, which is among the top levels for Chinese car companies, but lower than Hyundai's 17,000 yuan, and also not as high as Toyota, General Motors, and others.

Moreover, high-end development not only requires raising product prices but also necessitates the construction of a comprehensive brand value system to form a dual advantage of "technology and brand," thereby achieving a higher position in the global market.

Image source: Great Wall Motors

In the new phase of going global, localization will be one of the key factors determining success or failure. During the 14th Five-Year Plan period, the establishment of factories and channel layout have already laid a certain foundation, but in the 15th Five-Year Plan stage, this layout needs to be further deepened. It should not only include the localization of the production process but also the full localization of R&D, supply chains, and service networks.

Based on various sources, by establishing research and development centers in target markets, Chinese car companies can more quickly adapt to local regulations and consumer demands. Collaborating with local parts companies can enhance the resilience of the supply chain. Comprehensive after-sales services can increase long-term trust in the brand among users. "Local R&D + local manufacturing + local service" can help Chinese car companies shed their "foreign brand" identity and become as integrated as possible into the local industry.

In order to enhance their influence in the global automotive market, Chinese car companies should also participate in the formulation of global rules. Whether it's carbon emission standards, regulations for intelligent connected vehicles, or norms for cross-border data flow and certification, future competition will unfold not only at the market level but also at the institutional level.

Some experts believe that the government's role is indispensable in this process. On one hand, it can strengthen research on the internationalization of the automotive industry, accurately respond to changes in the international environment, and improve mechanisms for dealing with foreign-related intellectual property disputes, providing legal support and guidance to enterprises. On the other hand, it can promote the equivalence and mutual recognition of Chinese and international standards, and optimize the layout of international cooperation.

Overall, as we enter the 15th Five-Year Plan, Chinese car companies need to take a more stable approach to globalization. Finally, we return to the initial question: in the next five years, should the globalization of Chinese car companies accelerate or slow down? The answer may not be a simple binary choice. A more reasonable option is "rational acceleration"—neither blindly pursuing quantitative growth nor halting progress due to external uncertainties, but rather achieving genuine breakthroughs in quality, brand, and regulatory aspects.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track