Authoritative release: Analysis of the Economic Operation of China's Plastic Processing Industry in the First Half of 2025

In the first half of 2025, under the strong leadership of the CPC Central Committee with Comrade Xi Jinping at its core, China’s economy maintained steady progress, with major economic indicators performing well. New quality productive forces developed actively, reform and opening up continued to deepen, major risks in key areas were effectively prevented and resolved, and new achievements were made in high-quality development.

Supported by the continued release of the effects of national macroeconomic policies and the gradual recovery of domestic and international market demand, China's plastic processing industry continues to show a stable and positive development trend, with increasing development momentum and steadily expanding market demand across multiple fields. Currently, the industry faces both strategic opportunities and challenges. The plastic processing industry is characterized by a solid foundation, numerous advantages, strong resilience, and great potential, and the conditions and fundamental trends supporting long-term positive growth remain unchanged.

Production Volume of Plastic Products

According to data from the National Bureau of Statistics, from January to June, the total output of plastic products by aggregated statistical enterprises nationwide reached 38.424 million tons, a year-on-year increase of 5.0%. The industry as a whole operated steadily.

1. Production Situation of Subdivided Industries

From January to June, in the various segments of the plastic products industry, the production of plastic films was 9.178 million tons, an increase of 5.5% year-on-year (among which the production of agricultural films was 405,000 tons, an increase of 4.0% year-on-year); the production of foam plastic products was 1.311 million tons, a decrease of 1.2% year-on-year; the production of artificial leather and synthetic leather was 1.12 million tons, a decrease of 0.9% year-on-year; the production of daily-use plastic products was 2.66 million tons, a decrease of 1.2% year-on-year; and the production of other plastic products was 24.155 million tons, an increase of 8.7% year-on-year. See Table 1 for details.

Table 1: Plastic Products Subsector Production from January to June 2025

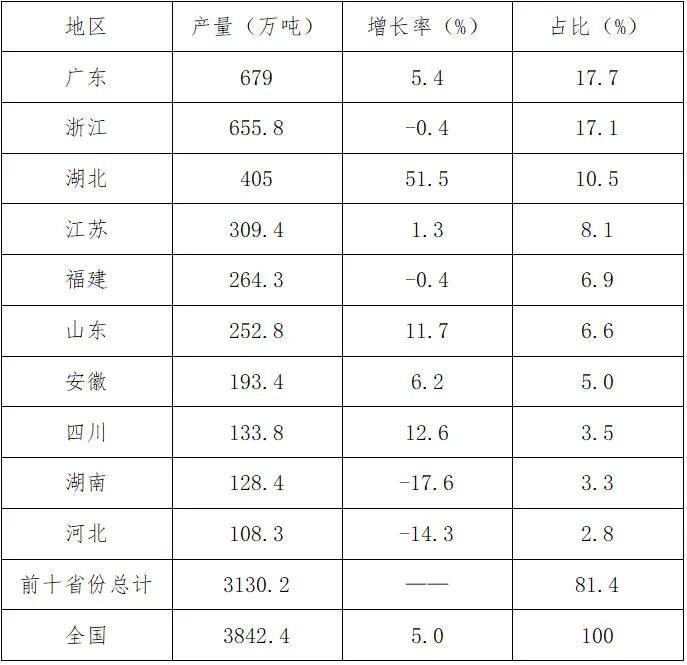

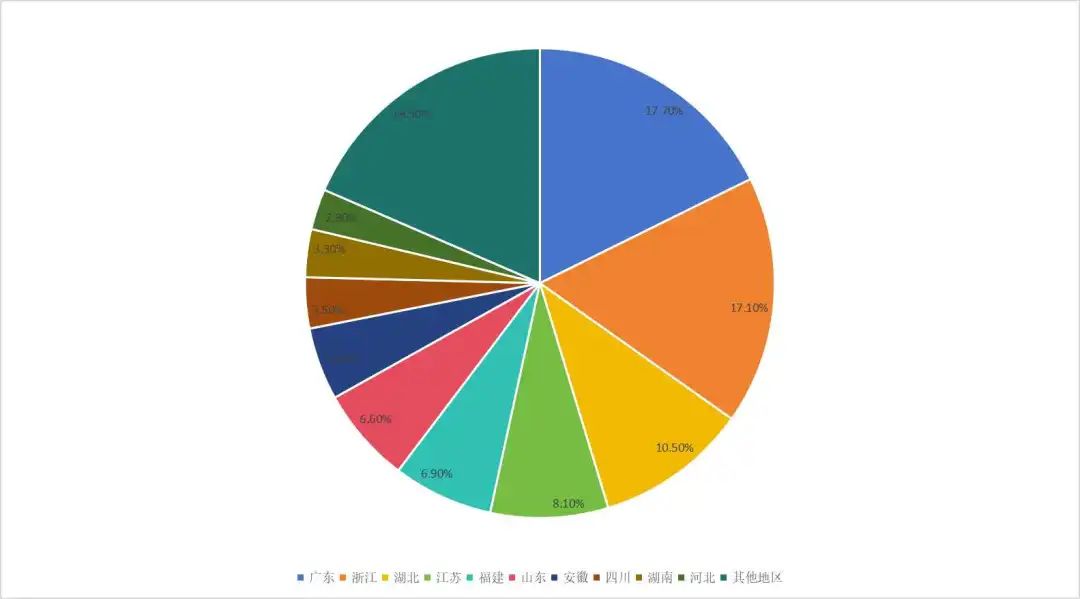

2. Production of Plastic Products in Certain Provinces and Regions

From January to June, Guangdong Province produced 6.79 million tons of plastic products, an increase of 5.4% year-on-year. Zhejiang Province produced 6.558 million tons, a decrease of 0.4% year-on-year. The combined output of Guangdong and Zhejiang accounted for 34.7% of the national total, maintaining their leading positions in the industry. From January to June, the total output of plastic products in the top ten provinces nationwide was 30.312 million tons, accounting for 81.4% of the national total. For details, see Table 2 and Figure 1.

Table 2: Production of Plastic Products in Selected Provinces of China from January to June 2025

Figure 1: The proportion of plastic products production in certain provinces and regions of China from January to June 2025.

Plastic processing equipment situation

According to data from the National Bureau of Statistics, from January to June, the national production of specialized equipment for plastic processing was 153,000 units, a year-on-year decrease of 0.3%. There are 751 companies in the summary of specialized equipment manufacturing enterprises for plastic processing, with a total operating income of 48.55 billion yuan, a slight year-on-year decrease of 0.8%. The total accumulated profit was 4.25 billion yuan, a slight year-on-year decrease of 6.7%.

Industry Performance Situation

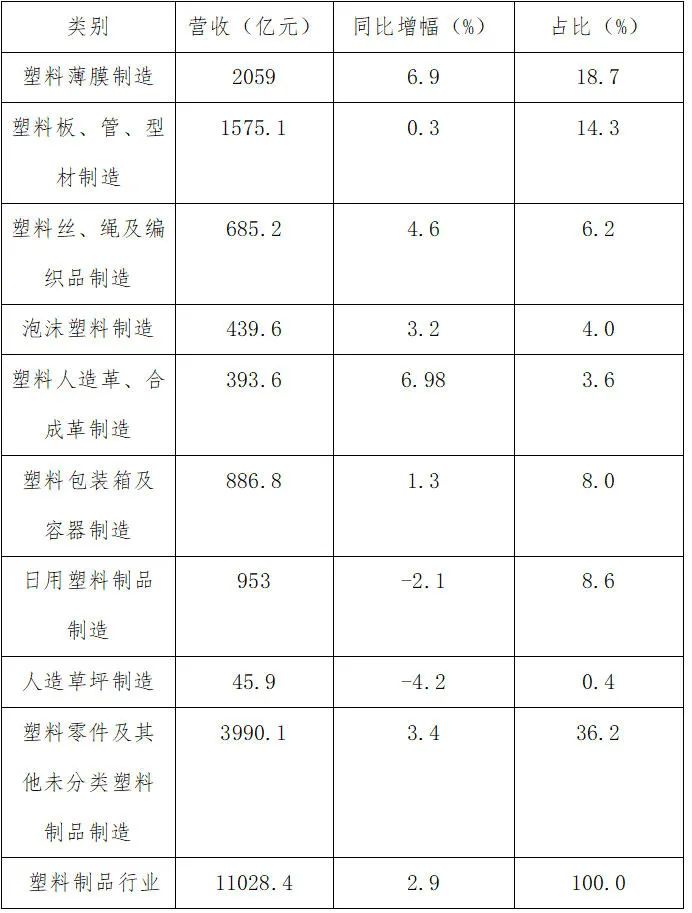

According to data from the National Bureau of Statistics, from January to June, the number of enterprises above the designated size in the plastic products industry has steadily increased, and industry concentration continues to improve. The main business income of 24,142 enterprises above the designated size increased by 2.9% year-on-year. Total profits decreased by 1.3% year-on-year, reflecting that under various complex factors, the overall profitability of the industry remains weak.

In specific sub-sectors of the plastic products industry, despite overall pressure on the industry, most areas are showing growth trends. Notably, sub-sectors with a significant revenue share, such as plastic film manufacturing, plastic artificial leather and synthetic leather manufacturing, as well as plastic filament, rope, and woven products manufacturing, have all maintained stable growth. See Table 3 for details.

Table 3: Revenue and Year-on-Year Growth Rate of Sub-sectors in the First Half of 2025

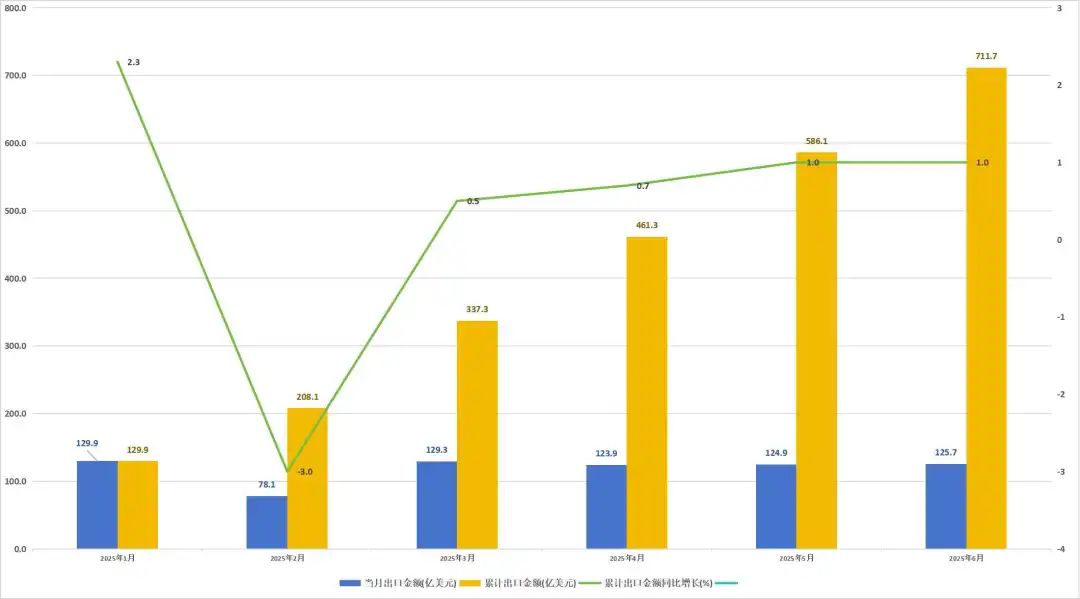

Plastic Products Export Situation

Under the backdrop of significant external environmental uncertainty and instability, the industry is facing pressure on foreign trade, with export value stabilizing month by month after the first quarter. According to data from the General Administration of Customs, from January to June, the total export value of China's plastics and its products reached 71.17 billion USD, a year-on-year increase of 1.0%. The total import value was 28.55 billion USD, a year-on-year decrease of 4.9%. The trade surplus was 42.56 billion USD, accounting for 7.3% of China's total foreign trade surplus. Refer to Figure 2 for details.

Figure 2: Export Trends of Plastics and Plastic Products from January to June 2025

The first half of 2025

Analysis of the Overall Economic Performance of China's Plastic Processing Industry

Positive factors are increasing, and multiple sub-industries are showing growth trends.

In the first half of 2025, despite the pressure on the plastic industry due to the imbalance between strong supply and weak demand in the national economy, many segments within the industry showed a positive growth trend, thanks to the support of national policies and the gradual recovery of market demand. The year-on-year production of several sectors, including plastic films (including agricultural films), plastic artificial leather synthetic leather, plastic thread/rope and woven products manufacturing, and foam plastic products, remained stable with an increase.

In response to the complex international situation, the industry's exports demonstrate resilience.

In the first half of 2025, faced with the challenges posed by U.S. tariff policies and the increasingly stringent EU policies towards China, China's plastic processing industry chain has collaborated to enhance its risk hedging capabilities. While striving to maintain the European and American markets, efforts have been intensified to expand into emerging markets. Although the growth rate of exports has slowed, the year-on-year increase has still been maintained. In the first half of the year, the total export value of China's plastics and their products was higher than the same period last year, highlighting the industry's resilience.

3. The market competition is intense, and the industry is experiencing growth without an increase in profits.

Due to the continued weakness in domestic market demand, the cumulative finished goods (inventory) in the plastic products industry increased by 2.7% year-on-year from January to June. The rising inventory pressure has affected the end prices of finished products, leading to a 1.3% decline in cumulative profits for the industry during the same period. The number of loss-making enterprises increased by 4.9% year-on-year, further intensifying the operational pressure on businesses.

Outlook for the Plastic Processing Industry in the Second Half of the Year

In 2025, China's plastic processing industry will fully implement the decisions and arrangements of the Central Committee of the Communist Party of China and the State Council, focusing on the main line of high-quality development. The industry will continue to deepen transformation and upgrading, steadily promote the construction of a modern industrial system, deepen reform and innovation, and continuously create new prospects for high-quality development.

At the macro level, on July 30, the meeting of the Political Bureau of the CPC Central Committee set the tone for economic work in the second half of the year, emphasizing the deep advancement of building a national unified market, promoting the continuous optimization of market competition order, governing disorderly competition among enterprises in accordance with laws and regulations, and advancing capacity governance in key industries, thus setting a clear direction for the development of the plastic processing industry. With the gradual balance of supply and demand in the industry in the first half of the year, and the continued release of the effectiveness of growth stabilization policies in the second half, the confidence in industry development will be further enhanced, and market vitality will be further strengthened.

At the micro level, the traditional peak consumption season will successively commence in the second half of the year. Under the guidance of a series of consumption-promoting policies, the demand in the application market will also continue and concentrate its release. Currently, the growth of emerging industries such as new energy, low-altitude economy, robotics, and bio-manufacturing has created new demand for high-end materials, with various polymer composite materials receiving strong support from national policies. The ongoing technological revolution and industrial transformation will open new avenues for the industry's transformation and upgrading, thus promoting the further development of the plastic processing industry, a key link in the industrial chain. Moreover, as the country continues to expand high-level opening-up and intensifies policy efforts to stabilize foreign trade, supporting enterprises in securing orders and exploring markets, new momentum in the industry’s foreign trade is expected to be further stimulated, and the industry's development prospects are optimistic.

Looking ahead to the whole year, although China's plastic processing industry faces multiple challenges such as insufficient effective domestic demand and a complex international trade environment, the industry is expected to maintain a steady and positive economic trend thanks to its complete industrial chain, strong technological innovation capability, and the advantage of a super-large-scale market.

In the next phase of work, the China Plastics Association will continue to play a bridging role, implement the spirit of national high-quality development, and guide the industry to advance the "five transformations" of functionalization, lightweighting, precision, ecological, and intelligent development. By adhering to technological innovation, practicing the concept of green development, promoting industry transformation, strengthening standardization work, and deepening international exchange and cooperation.Preparation for the 2026 China International Plastics ExhibitionIn all aspects, we will make every effort to carry out relevant work, continuously promote the economic recovery and improvement of China's plastic processing industry, and achieve the goals and tasks of the "14th Five-Year Plan" with high quality. This will lay a solid foundation for a good start to the "15th Five-Year Plan" and make new contributions to the industry.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track