August Polyethylene Import and Export Volumes Reach New Levels, But Show Contrasting Trends

In August, China's polyethylene import volume showed a downward trend, significantly lower than the same period last year, reaching the lowest level in nearly seven years. Export volume continued to grow, hitting a historical high. The starkly different situation in China's polyethylene import and export volumes is closely related to the continuous increase in polyethylene production capacity and the rising domestic self-sufficiency rate in recent years. The import and export pattern has gradually changed, but China's polyethylene industry still faces the dilemma of "oversupply in the low-end, dependence on the high-end."

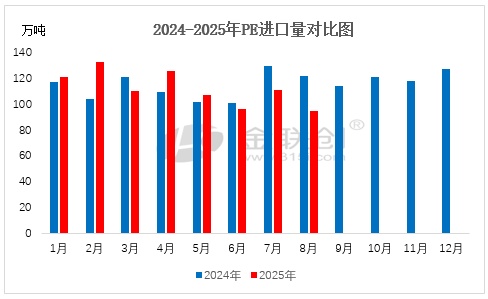

I. Import Volume

Data source: General Administration of Customs, JLC Network Technology Co., Ltd.

Data source: General Administration of Customs, Jinlianchuang

According to customs data, in August 2025, China's PE import volume was 950,200 tons, showing a decrease both year-on-year and month-on-month. From January to August, China's total PE import volume was 8,981,500 tons, a decrease of 0.84% compared to the same period last year.

In August, the import volume of polyethylene saw a decline both month-on-month and year-on-year, with a month-on-month decrease of 14.17% and a year-on-year decrease of 22.14%. By category, the import volume of LDPE was 200,800 tons, down 21.72% month-on-month and 14.12% year-on-year; the import volume of HDPE was 402,500 tons, down 13.65% month-on-month and 25.99% year-on-year; the import volume of LLDPE was 346,900 tons, down 9.76% month-on-month and 21.62% year-on-year.

Overall, in August, the import volumes of high-pressure, low-pressure, and linear varieties all saw a decline, with low-pressure imports experiencing the largest drop, followed by high-pressure and linear. Firstly, in August, there were limited new maintenance units added in China, and some previously maintained units were restarted, resulting in overall adequate supply. Secondly, supply from the Middle East was tight, and the arbitrage window between domestic and international markets was largely closed, leading to a reduction in imported resources. Thirdly, poor market demand has been a concern, resulting in low trading willingness.

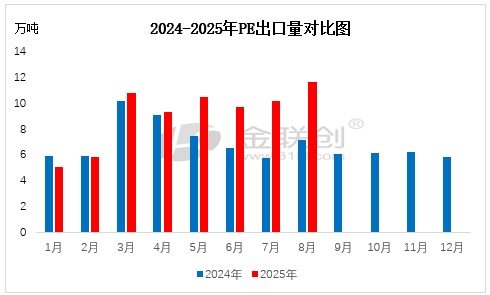

2. Export Volume

Data Source: General Administration of Customs, JLC Network Technology Co., Ltd.

Data source: General Administration of Customs, Jin Lian Chuang

According to customs data statistics, in August 2025, China's PE export volume reached 116,000 tons, showing a growth trend both month-on-month and year-on-year. From January to August, China's total PE export volume was 729,800 tons, an increase of 25.94% compared to the same period last year.

In August, the export volume of polyethylene showed a growth trend both month-on-month and year-on-year, with a month-on-month increase of 14.12% and a year-on-year increase of 61.83%. By product category, the export volumes of all products experienced slight growth. The export volume of LDPE was 30,300 tons, with a month-on-month increase of 21.69% and a year-on-year increase of 33.48%; the export volume of HDPE was 45,200 tons, with a month-on-month increase of 13.28% and a year-on-year increase of 19.58%; the export volume of LLDPE was 40,500 tons, with a month-on-month increase of 9.76% and a year-on-year increase of 261.61%.

In August, China's polyethylene exports continued to maintain a growth trend, reaching a record high. The supply pressure of polyethylene in China increased in August, while domestic demand remained weak, which enhanced the enthusiasm of businesses for exports. Meanwhile, the quality of China's polyethylene products has rapidly improved, gaining recognition in emerging markets such as Southeast Asia. In terms of export flow, China's polyethylene exports mainly went to regions such as Southeast Asia and the Middle East. From the perspective of exporting countries, Vietnam consistently accounted for the largest share, becoming China's largest PE export destination.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics