At Its Peak, Changan Automobile Senses a Crisis Signal

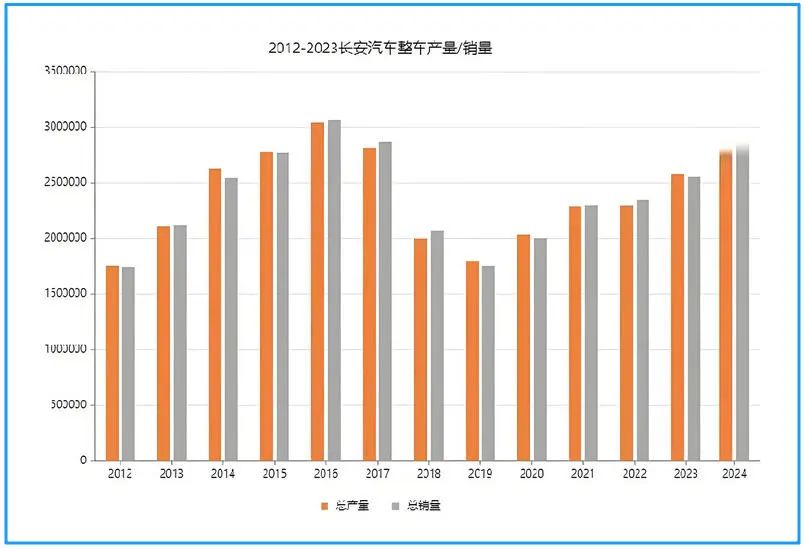

Changan Automobile is a car company with pronounced cyclical characteristics. These cycles are clearly visible in the company’s annual production and sales data, which intuitively reflect Changan’s ups and downs. Moreover, each "V-shaped" trend in these cycles is marked by a distinct, significant event. For example, the starting point of Changan Automobile’s last upward cycle was the launch of the Changan CS75 PLUS in September 2019.

The year 2019 marked the lowest point for Changan Automobile in the past six years. However, thanks to the strong market appeal of the Changan CS75 PLUS, continuous optimization of product structure, asset restructuring, portfolio integration, and other measures, Changan Automobile has been on a steady upward trajectory ever since. This year, Changan Automobile has set a sales target of 3 million units, which, if achieved, will mark a new high in the past nine years.

On the surface, Changan Automobile has relied on one popular model after another in recent years to break free from dependence on joint ventures and enhance the competitiveness of its independent brand. In reality, what Changan Automobile has done right is the transformation of its system capabilities. It has broken free from the constraints of being a state-owned enterprise and, relying on fully market-oriented methods, has formed combat effectiveness comparable to top private enterprises.

At the end of July this year, China Changan Automobile Group was officially established, becoming the third central enterprise in the domestic automotive industry. At the same time, Changan also announced a new goal: to achieve a production and sales volume of 5 million vehicles by 2030 and strive to enter the top ten global automotive brands. This fully demonstrates that the "new Changan" is preparing for the next five years.

01Where should the new cycle begin?

If we take the trough in 2019 as a starting point and use a 10-year cycle for calculation, 2028 could be a turning point for Changan Automobile. However, the rapid changes in the Chinese auto market over the past few years have continuously compressed this timeline, and the transition between the old and the new often happens in an instant. Therefore, Changan Automobile must prepare in advance, which is also determined by the crisis awareness inherently ingrained in its DNA.

After experiencing the growing pains of joint ventures, Changan Automobile has developed a strong sense of vigilance. In the first half of this year, Changan Automobile's sales reached their highest level in nearly eight years for the same period, with the independent brand accounting for over 85% of the entire group's sales, firmly establishing the foundation of its fuel vehicle business. This can be said to have, to some extent, become the confidence behind Changan Automobile's rapid transformation.

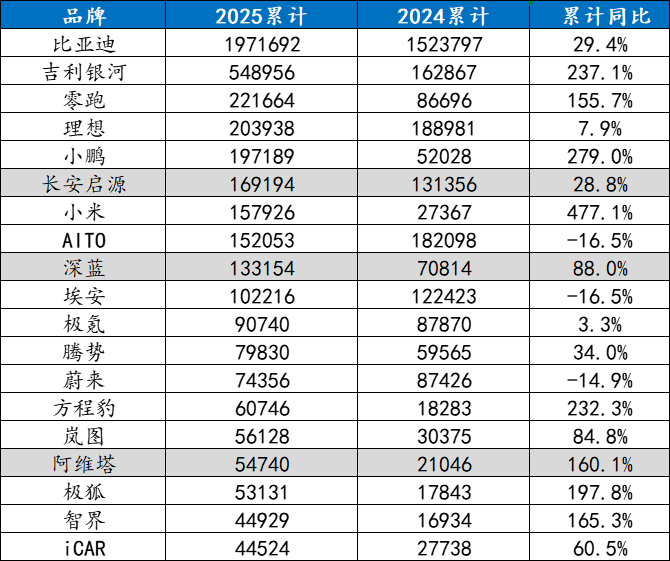

However, when it comes to the sales performance in the new energy sector and overseas markets, Changan Automobile still lags behind other car manufacturers to some extent. In the new energy sector, Changan Automobile mainly relies on its "three main pillars": Changan Qiyuan, Deepal, and AVATR Technology. Judging from their current product structures and brand positioning, these three new energy brands have formed a good complementary and mutually synergistic relationship.

However, as these brands have developed over the past few years, some hidden issues have begun to surface. For example, Changan Qiyuan, as a brand launched only two years ago, spent its first year in an exploratory phase, ending with the A07. It is only with the release of the Q07 this year that Changan Qiyuan is considered to have truly stepped up its efforts. Therefore, Changan Qiyuan is still in its early stages and can provide only limited capabilities.

Deepal Auto was launched a year earlier than Changan Qiyuan and operates with an independent team, giving it a natural first-mover advantage. Although its sales have been rising year after year, it has failed to meet its target sales in the past two years, and is unlikely to achieve them this year either. Perhaps this is what people mean by “the ideal is plentiful, but reality is harsh.” Deepal Auto still needs to work harder.

In recent years, high-end independent new energy brands have been frequently launched. Avatr, as one of the earliest companies to collaborate with Huawei, was born with a silver spoon and aimed to make a significant impact. However, reality dealt a harsh blow, as its sales have remained lukewarm. Now, with four products in its lineup, Avatr urgently needs new growth points.

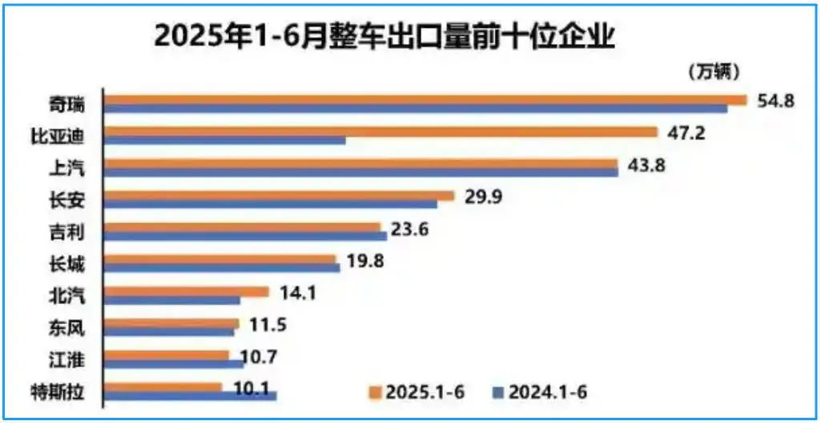

In terms of the overseas market, Changan Automobile contributed sales of 299,400 vehicles in the first half of this year, ranking fourth among independent brands. Although it surpassed Geely and Great Wall, there is still a certain gap compared to the top three. Fortunately, leading independent brands still have a long period of dividends in the overseas market, so this is not the primary task for Changan Automobile.

Therefore, the issues facing Changan Automobile have become quite clear. In the current era of electrification and intelligence, although Changan Automobile started its efforts early, with initiatives like the "Shangri-La" and "Beidou Tianshu" plans, the results show that Changan's performance can only be considered barely passing. However, merely passing is definitely insufficient to support the long-term goals of the "New Changan."

Therefore, as the new head of "New Changan," Zhu Huarong, Chairman of Changan Automobile, took immediate action after assuming his new position. On the evening of August 9, Zhu Huarong posted that on Friday (August 8), he visited Huawei CEO Ren Zhengfei in Shenzhen to exchange ideas and learn about industry competition trends and the future competitive landscape.

Zhu Huarong revealed that President Ren provided targeted and guiding suggestions to support Changan Automobile and the Avatr brand. He was deeply impressed and greatly benefited by President Ren's vision, breadth of mind, wisdom, and passion, and holds him in high esteem. In addition, he also expressed his gratitude for the support and communication from President Xu Zhijun, President Richard Yu, and other leaders.

02It is time for the company to play its role.

Why Ren Zhengfei? Why Huawei? Many people already have a clear answer in their minds: since Huawei entered the automotive industry, it has cooperated with numerous car manufacturers, helping them improve the intelligence and electrification of their vehicles. These partners include not only domestic brands, but also joint ventures and even luxury brands.

The cooperation between Changan and Huawei began with Avatr and extended to Deep Blue Auto. However, it is well known that Huawei and Avatr belong to the Hi mode, whose level of integration is slightly lower than the Huawei-led "HarmonyOS Intelligent Driving" mode. Deep Blue, on the other hand, only features Huawei's QianKun Intelligent Driving system, which is somewhat less integrated than Avatr.

However, how is the external environment? While Huawei is rapidly expanding its partnerships, some car manufacturers that are loosening their restrictions are also deepening their cooperation with Huawei. For example, Dongfeng Company's M-Terrain Technology has recently launched a product that claims to be equipped with Huawei's fully self-developed solutions. In addition to Huawei's intelligent driving and intelligent cockpit, there are also QianKun vehicle control, QianKun car cloud, and Whale Fin communication.

It can be said that the Mengshi M817 is a model that, without being called a certain brand, surpasses that brand. Additionally, there is cooperation between Lantu and Huawei; Lantu has repeatedly stated in public that its electronic and electrical architecture is best suited to Huawei’s intelligent systems. Meanwhile, Dongfeng’s newly established Yipai Technology will also jointly launch new products with Huawei.

It is evident that Huawei is the biggest selling point of these automobile brands.

Let's take a look at the cooperation between Huawei and Changan. It was previously reported that Avita and Huawei are smoothly and orderly advancing the Hi Plus model. The joint team from both sides has nearly a thousand people stationed at Avita's Chongqing headquarters. The first co-created product will be launched in the second half of next year. This is good news for both Changan and Avita.

But one clear fact is that although Changan was the earliest and most deeply cooperative automaker with Huawei, its pace of deepening cooperation has now slowed down. In this era of "fast fish eat slow fish," being slow means falling behind. Obviously, this is a result that Changan Automobile does not want to see.

Therefore, among these modes of external cooperation by Huawei, which one will become the best competitive advantage for car manufacturers? It might be difficult to provide a detailed and specific answer to this question, but for Changan Automobile, it has a backup plan, which is "Yinwang Company." This company hasn't had any new updates in the past year, and this visit by Zhu Huarong to Huawei is very likely to discuss this matter.

The investment in Yinwang by Changan Automobile is a multi-billion yuan project. Therefore, it is far from a simple capital arrangement; it is a crucial move in breaking through the intelligent electric vehicle sector. Such a massive investment undoubtedly carries the dual expectations of technological breakthroughs and market returns. Avatr, Deepal, and even Changan Qiyuan might be involved in this endeavor.

At the end of last year, Zhu Huarong revealed that Yinwang had previously reserved a 20% equity stake in Changan Automobile. Considering the closer cooperation and financial situation between Avita and Huawei, Avita will initially purchase a 10% equity stake in Yinwang. In the future, arrangements will be made for the remaining 10% equity stake reserved for Yinwang based on the circumstances.

Therefore, industry insiders analyze that Zhu Huarong's visit to Ren Zhengfei represents an inevitable complementary integration of resources between the two parties, as well as a strategic move to counter industry challenges.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track