As March draws to a close, can the polypropylene market reverse its downturn?

1. Supply side: Increased maintenance may alleviate pressure, but the suppression from new capacity expansion still exists

Maintenance concentrated release: In mid-to-late March, domestic petrochemical enterprises enter the peak maintenance period, with an increase in planned maintenance facilities (such as Jiujiang Petrochemical, some production lines of Shanghai Petrochemical, Beihai Refining, etc.). Most of the previously shut-down enterprises do not have plans to resume operations. New capacities, such as the 500,000 tons from Inner Mongolia Baofeng, have not yet been put into full production, and it is expected that the supply of polypropylene will decrease in the late part of the month.

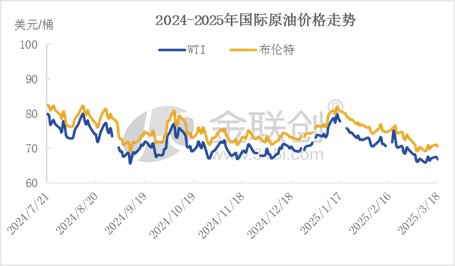

High fluctuation in operating rate: International crude oil prices are declining, oil company profits are recovering, and the operating load rate of oil-based PP is expected to slightly increase.

2, Demand side: slow recovery, orders without growth expectations

Plastic weaving industry: Order changes are not significant, operating rates remain stable, terminal demand is mainly for rigid restocking, and new orders are limited.

Plastic film industry: Orders for films such as CPP and BOPP are average, traditional peak season characteristics have not appeared, the market transactions are light, providing weak support to PP.

Non-woven fabric industry: demand is weak, prices remain stable, and there are no significant signs of recovery in end consumption such as hygiene products.

Daily necessities and injection molding industry: order recovery pace is slow, raw material inventory is being digested, purchasing intentions are cautious.

3, Cost and price: crude oil decline weakens support, spot prices under pressure

Data source: Jinlianchuang

Crude oil prices weaken: International oil prices continue to fall due to the escalation of trade wars and OPEC's increased production, with US oil dropping to around $68 per barrel and Brent to around $71 per barrel, shifting PP production costs downward and weakening price support.

Spot and futures联动压制: Futures market volatility drags down spot prices, lacking momentum for an increase. 注:这里的“联动压制”直译为"联动压制"可能不完全符合英文表达习惯,但根据要求直接翻译。若需更自然的表达,可以调整为"joint suppression"或类似表述,不过这超出了直接翻译的要求。按照指示,保持了原样。

4, Inventory and Sentiment: De-stocking is Expected to Accelerate, but Practitioners Lack Confidence

Petrochemical inventory is neutral to low: As of March 19, the two-oil inventory is 800,000 tons, 35,000 tons lower than the same period last year. Entering the late part of the month, the two-oil companies will start issuing orders for assessment, and it is expected that the inventory reduction will accelerate.

Market expectations are cautious: although increased maintenance provides short-term benefits, the recovery in demand is below expectations. Coupled with the release of new production capacity and low-cost resources, the influx of resources from Shandong Yulong Petrochemical into the North China and East China markets has a significant impact on low-cost resources, leading to insufficient confidence among industry players.

Market forecast, in the short term, due to the continuous decline of polypropylene futures suppressing sentiment, some resources are being sold at a loss, forcing petrochemical companies to lower prices. However, with current prices at low levels and supply-side pressure easing, it is expected that the PP market will consolidate at a low level in the near future, with limited room for further declines. It is predicted that the mainstream price of drawing in East China will fluctuate within the range of 7250-7400 yuan/ton. In the medium term, as petrochemical maintenance becomes more concentrated and downstream demand peaks, this may drive prices to rebound with fluctuations. However, the uncertainty of demand growth may limit the increase in prices.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track