Are traditional luxury cars no longer appealing?

On July 1st, HarmonyOS Intelligent Mobility eagerly announced the sales figures for new cars in June, which totaled 52,700 units.

Among them, the best-selling AITO contributed 44,600 units to the data. Below the sales poster of HarmonyOS Smart Mobility, two lines of small text are particularly noticeable: "Achieving a record-breaking speed with 800,000 cumulative deliveries in 39 months."

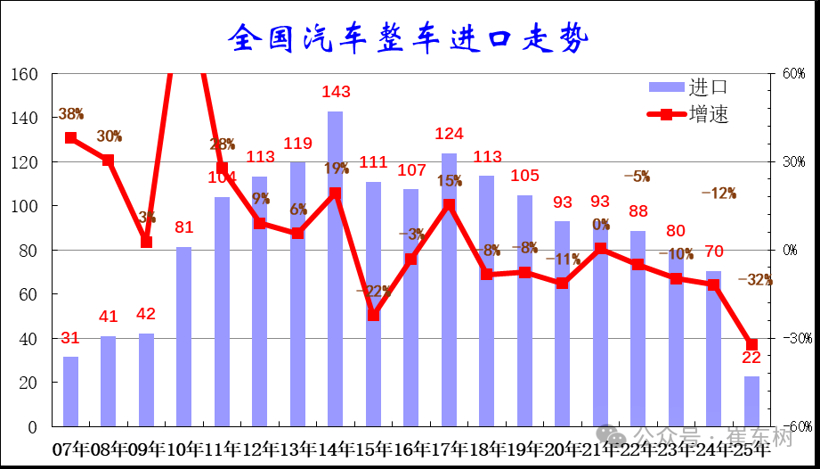

On August 7th, the China Passenger Car Association's half-year import data for Chinese automobiles was finally released.

In the first half of the year, 220,000 cars were imported, including 43,000 vehicles in June. The first sentence in the article by Cui Dongshu, Secretary General of the Passenger Car Association, is also noteworthy: "This is a rare drop from January to June in recent times."

Based on the information from the above two paragraphs, it is easy to conclude that in June, the total number of imported cars in China has not yet surpassed the sales of the AITO brand alone.

The predicament of traditional luxury cars goes beyond the "collapse" in the number of imported cars and the rise of independent luxury brands.

In the first half of the year, the prices of Jaguar and Cadillac dropped to 150,000 yuan, Maserati's prices contracted to 400,000 yuan, and the net profits of traditional luxury brands like Porsche and BBA did not grow at all.

Under pressure, the transformation of traditional luxury cars is imperative.

01A series of "major declines"

"From January to May 2025, 180,000 vehicles were imported, marking a 33% year-on-year decrease, which is a significant decline for the January-May period in recent times."

"From January to June 2025, 220,000 vehicles were imported, a year-on-year decrease of 32%, which is a rare significant decline in the first half of the year."

The same beginning, the same significant decline, but the downward trend in imported cars is no longer uncommon. Looking back at history, the sales of imported cars once reached a historical peak of 1.43 million units in 2014.

Since 2018, the import car market has been continuously shrinking, and there are no signs of recovery so far. As of last year, the total number of imported cars has decreased to approximately 700,000 units, mainly relying on luxury brands for support.

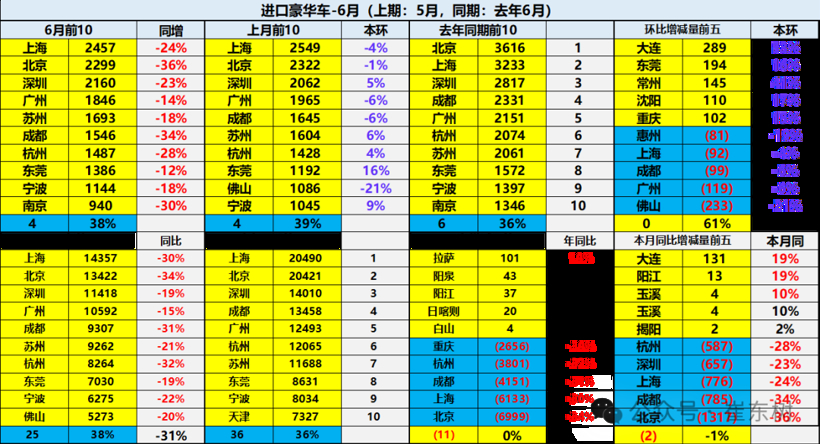

In the first half of this year, the decline in imported cars further intensified, with sales reaching only 220,000 units. Among them, Lexus stood out, with sales of 91,000 units, almost accounting for half of the total and marking a year-over-year increase of 12.2%. However, "one flower alone does not make a spring," as aside from Lexus, there were few highlights in the imported car sector, with some luxury brands experiencing declines of over 50%.

Even Lexus, which has been relatively stable in performance, harbors hidden risks. In just a few years, its sales pillar, the ES series, has fallen from the peak of commanding a premium over list price to a state of trading price for volume. The newly launched 2025 ES model has seen its base price drop to the 200,000 yuan range.

Lexus is not the only one adopting a price reduction strategy. In May, the newly launched Cadillac XT4 had a starting price of 159,900 yuan for the 1.5T version, and even the top configuration was less than 200,000 yuan.

In July, Jaguar officially launched a promotional policy, offering the Jaguar XEL 90th Anniversary Edition at a limited-time price starting from 159,800 yuan. Compared to the guide price of 334,600 yuan, it is reduced by 174,800 yuan, and the reduced price even exceeds the current selling price of the vehicle.

In July, Maserati dealers launched a limited-time exclusive price for the SUV model Grecale starting at 388,800 yuan, compared to the official guide price of 650,800-1,038,800 yuan, reducing the starting price by 262,000 yuan.

However, unlike Lexus, which achieved sales growth through price reductions, the sales of the aforementioned brands continued to decline in the first half of the year, with only a narrowing of the decline.

What's more concerning is that in terms of revenue and profit, which are the core focus of companies, traditional luxury brands generally performed poorly: the net profits of the three major BBA brands plummeted, Porsche lowered its full-year performance expectations, and some brands even turned from profit to loss.

02Independent luxury brands are seizing market share.

The decline of traditional luxury brands is not due to a shrinking market. Data shows that from 2016 to 2024, the domestic luxury car market has demonstrated strong growth momentum, with luxury car sales rising from 1.45 million units to 5.113 million units in 2024, and the penetration rate increasing from 5.9% to 18.5%.

The market is expanding, but the share of traditional luxury brands is shrinking. Behind this seemingly contradictory phenomenon is the precise layout and strong rise of independent luxury brands in the new energy sector.

In 2020, the penetration rate of new energy vehicles in the luxury car market was only 10.8%. Just four years later, domestic luxury new energy models have captured more than 60% of the market share from traditional luxury brands, staging a dramatic takeover.

In the first half of this year, the growth of the Chinese luxury car market did not continue. According to statistics from the China Passenger Car Association and other sources, the total sales of luxury cars (including domestic and imported) in China in the first half of 2025 were approximately 1.6 million units, a slight year-on-year decline of 5%–7%. Although there is still high-end demand, the growth rate has significantly slowed down.

The rare contraction of the luxury market may be related to tariffs, trade, and consumption downgrading.

In the first half of 2025, a total of 4,135 bankruptcy-related cases (including bankruptcy applications, bankruptcy appeals, bankruptcy supervision, among other types) were generated, involving 23,035 bankrupt enterprises. Geographically, 56.57% of these cases were concentrated in the eastern coastal areas, while 43.43% were in the central and western regions, showing a pattern of "coastal concentration, inland diffusion."

According to the statistics on regional changes in luxury cars by the China Passenger Car Association, the eastern coastal areas are the main force in the sales of imported luxury cars.

In 2025, taking Shanghai, where luxury car imports are the highest, as an example. This year, during the "May Day" holiday, the Shanghai local brand Silede, which was launched at the First Food Store, had its products exported to more than 50 countries and regions. Its annual export sales are approximately 50 million US dollars, with 80% of the products exported to Europe and the United States.

Under the high tariff policies in the United States, Sile's orders from the U.S. have nearly dropped to zero, and the factory has been holding six months' worth of inventory. Switching from export to domestic sales has become the "lifeline" for foreign trade companies. Products that were once priced at 1,800 yuan for export are now sold for only 219 yuan, and customers can also use store coupons for an additional 20 yuan discount on purchases over 200 yuan.

From 1800 to 200, the situation of Silede is indeed a microcosm of many foreign trade companies in the Pearl River Delta and Yangtze River Delta under the pressure of tariffs. In the past, when profits were still acceptable, companies could purchase luxury cars to avoid consumption tax and deduct part of the taxes. However, in the context of a sharp decline in profits, the demand for luxury cars plummeted, resulting in a significant loss of corporate customers.

However, the impact on independent luxury brands appears to be relatively minor.

In the first half of the year, HarmonyOS Smart Mobility sold 204,600 vehicles, with the AITO brand alone contributing 154,000 vehicles. NIO delivered 114,100 new cars, a year-on-year increase of 30.6%. Additionally, brands such as Zeekr, Li Auto, Xiaomi, IM Motors, Avatr, Baojun, Denza, and Yangwang are also working together, collectively forming an important force for the advancement of Chinese brands.

In contrast, in response to adjustments in the domestic market and tariff barriers, independent luxury brands have not only held their ground but also made breakthroughs in exports. In the first half of 2025, China's automobile exports reached 3.083 million units, an increase of 10.4% year-on-year, of which new energy vehicle exports were 1.06 million units, a substantial increase of 75.2% year-on-year.

This also means that more sales concessions need to be made by traditional luxury brands.

03The transformation is already imminent.

"If you fail to achieve something, look within yourself for the reason."

Traditional luxury brands, experiencing successive defeats, ultimately cannot avoid their lag in transformation amidst the tide of the times. The reconstruction of external markets and the rise of independent camps serve more like a mirror, reflecting their faltering steps in the fields of new energy and intelligence.

In the race for new energy transformation, independent luxury brands have long completed the breakthrough from 0 to 1. From NIO's battery-swapping ecosystem to HarmonyOS Intelligent Driving's full-stack self-research, Chinese brands have spent ten years building a full industry chain advantage spanning batteries, motors, and electronic controls.

In contrast, traditional luxury brands mostly relied on fuel vehicle platforms for "converting fuel to electric" in the early stages of electrification, which led to frequent issues such as exaggerated range claims and poor user experience. Even when they later introduced models based on pure electric platforms, the product iteration speed was still far behind that of independent brands.

The gap in the field of intelligence is more pronounced. While independent brands use "smart cockpits," "urban NOA," and "driver large models" as their core competencies, traditional luxury brands' intelligent driving systems remain at the highway assistance stage, with significant deficiencies in localization, making it difficult to compete with independent brands.

The good news is that leading traditional luxury brands have begun to accelerate their catch-up efforts. For example, in recent years, BBA (Mercedes-Benz, BMW, Audi) has been intensively forming deep collaborations with Chinese autonomous driving companies.

BMW collaborates with Momenta to develop a truly "locally-grown" Chinese-exclusive intelligent driving assistance solution based on the intelligent architecture and hardware platform of future domestically-produced BMW new generation models.

The next-generation all-electric Mercedes-Benz CLA will be equipped with L2++ high-level autonomous driving technology, developed by Momenta and adapted by a Chinese team, and is expected to be produced domestically in 2026.

Audi has entered into a deep collaboration with Huawei QianKun, and several models equipped with QianKun intelligent driving technology are poised for launch.

At the same time, the pure electric platform models of the three brands have also been launched one after another, with the proportion of electric products increasing year by year. The accumulated problems cannot be solved in a day, and although the chemical reaction from technical cooperation to product launch still requires time to be validated, they have shown a very firm determination to transform and learn from past mistakes.

In contrast, ultra-luxury brands are still responding relatively slowly. Brands such as Ferrari, Lamborghini, and Bentley are currently less affected because their customer base places more value on the "inimitable qualities" such as the century-old brand heritage and handcrafted customization. In the short term, the electrification wave has limited impact on them.

However, this "safety" is being disrupted by the rise of autonomous ultra-luxury brands. The significant order numbers from the luxury brand Zunjie and the high-end attempts by the Yangwang U8 are both challenging and shaking the long-quiet moat of ultra-luxury brands.

For ultra-luxury brands, the real crisis may not lie in the current sales figures, but in the disregard for attempts by independent ultra-luxury brands to break through.

From traditional luxury to ultra-luxury, the harsh reality of the Chinese market is that there is no eternal moat, only respect for trends and quick response.

The gap opened by independent brands with new energy and intelligence is forcing the entire luxury car lineup to redefine the meaning of luxury.

The key to this restructuring has always been in the hands of those players who actively embrace change.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track