Aoshengde shuts down lianyungang factory, basf and other giants expand: Global Market Dynamics of Hexamethylenediamine and Opportunities for Domestic Production

Background Briefing

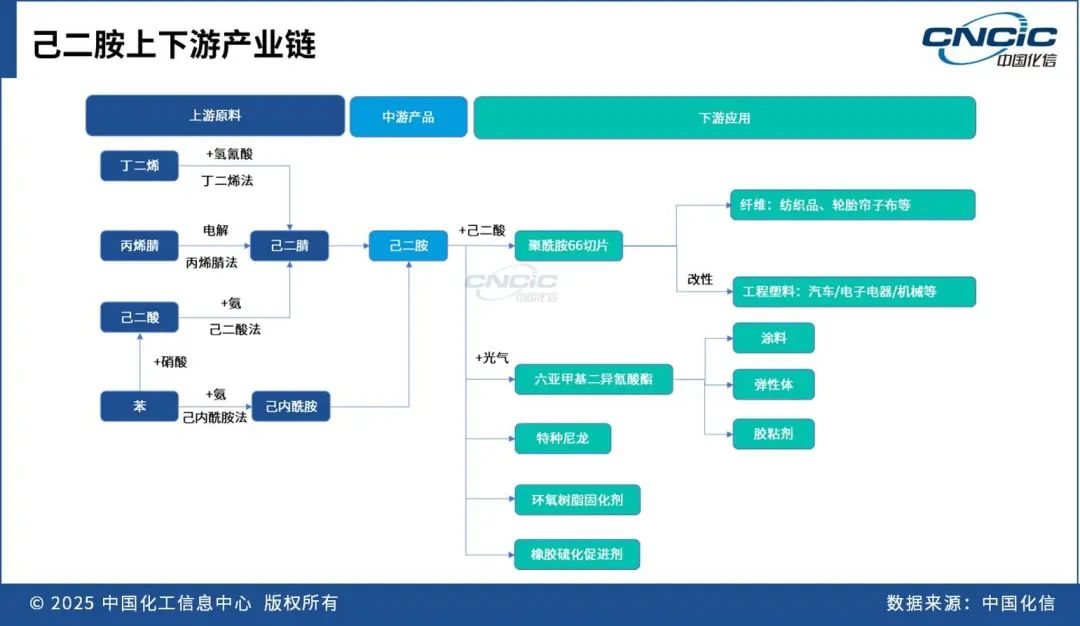

Hexamethylenediamine, also known as hexamethylenediamine, is an important chemical intermediate. It is mainly used for the production of polyamide 66 (also known as nylon 66 or PA66), which is widely used in automotive, electrical and electronic, aerospace, machinery, chemical, and textile industries due to its excellent overall performance. In addition, hexamethylenediamine is also used to produce specialty polyamides (such as PA610, PA6T, etc.), polyurethane raw materials such as hexamethylene diisocyanate (HDI), epoxy resin curing agents, rubber vulcanization accelerators, and as stabilizers in the textile and paper industries, among other applications.

Process technology route

There are multiple routes for the global production of hexamethylenediamine, with the butadiene cyanohydrin method occupying a dominant position.

01

Self-dicarbonitrile hydrogenation method

According to the different raw materials, the process of hydrogenating hexanedinitrile to produce hexanediamine can be divided into three methods: butadiene cyanohydrin method, propionitrile electrolytic dimerization method, and hexanedioic acid catalytic amination method.

02

Caprolactam Ammoniation Dehydration Method

Using caprolactam as a raw material, aminocapronitrile is first produced through ammoniation and dehydration, and then hydrogenated to obtain hexamethylenediamine. Representative companies include Toray Industries from Japan, Yangnong Ruitai under Sinochem in China, and Pingmei Shenma. Toray Industries commissioned its hexamethylenediamine plant in 1965, but at that time, the price of caprolactam was high, making it economically unfeasible.

In April 2024, Jiangsu Yangnong Chemical Group, Xiamen University, and Ningxia Ruitai Technology Co., Ltd. jointly completed the "Key Technology Development and Industrialization of High-Quality Hexamethylenediamine Production via Caprolactam Method," filling the technological gap in the production of hexamethylenediamine using the caprolactam method and breaking the international monopoly.

Ningbo Galnew Material Technology Co., Ltd. has acquired Japanese process technology and patents, and after optimization and improvement, has formed independent intellectual property rights. Pingmei Shenma Group is collaborating with this company to construct the Aisuan project. In June 2025, the first phase of the project, with an annual capacity of 50,000 tons of aminocapronitrile, will be put into production, and there are plans to build a hexamethylenediamine project.

Global Hexamethylenediamine Industry Review

In 2024, global hexamethylenediamine production capacity will exceed 2 million tons per year, with a high market concentration. The capacity is mainly concentrated in international chemical giants such as Ascend, Invista, and BASF, as well as advanced domestic enterprises like Chongqing Huafeng, Pingmei Shenma, and Tianchen Qixiang. The global production and consumption of hexamethylenediamine in 2024 is estimated to be around 1.55 million tons, with an actual operating rate of about 75%.

Ascend is currently the largest producer of hexamethylenediamine in the world, with a total production capacity of 600,000 tons per year. Its production bases include the Pensacola plant in Florida and the Decatur plant in Alabama in the United States, as well as the Lianyungang plant in Jiangsu, China. However, due to multiple factors such as global trade frictions, industry cyclical fluctuations, and increasing market competition, Ascend is facing significant operational pressure. In April 2025, Ascend announced its entry into bankruptcy reorganization to reduce debt and optimize its capital structure; on June 17, the company announced the orderly shutdown of the Lianyungang plant in Jiangsu.

Invista's global capacity for hexamethylenediamine exceeds 500,000 tons per year, with production bases located in the United States, Canada, and Shanghai, China. Notably, Invista originally planned to shut down the hexamethylenediamine and hexamethylendiamine units at its Orange facility in the U.S. starting in 2023. According to the initial plan, the hexamethylenediamine production unit at the Orange facility was to immediately initiate safety shutdown procedures, while the hexamethylenediamine production was scheduled to cease in mid-2024. However, in October 2024, Invista announced a partnership with Dow, deciding to continue long-term production of hexamethylenediamine at the Orange facility, given its demonstrated safety, reliability, and competitive operational capabilities when producing solely hexamethylenediamine. Additionally, in July 2024, Invista announced the restart of the hexamethylenediamine production line at its Maitland facility in Canada, which resumed production in the first quarter of 2025.

BASF announced in June 2025 that its new hexanediamine plant in Chalampé, France, has been successfully put into operation, increasing its global hexanediamine production capacity to 260,000 tons per year. The implementation of this project not only consolidates BASF's competitive advantage in the upstream of the polyamide industry chain but also provides a stable raw material guarantee for the polyamide industry in Europe.

Review of China's Hexamethylenediamine Industry

1

Supply Analysis:

In 2024, there are a total of 8 caprolactam production enterprises in China, with a combined production capacity of 1.37 million tons per year, and the industry's effective operating rate is approximately 55%.

By the end of 2024, China's total production capacity of hexamethylenediamine will reach 1.371 million tons per year, with the new capacity mainly concentrated in the East China region. The domestic production of hexamethylenediamine in 2024 is expected to be approximately 463,000 tons, an increase of 18.4% year-on-year.

From the perspective of competitive landscape, China's hexamethylenediamine production enterprises are mainly concentrated in the East China region, including Shanghai, Jiangsu, Zhejiang, Shandong, and Chongqing. The East China region accounts for 65% of the production capacity. The industry has a high concentration, with the top three enterprises (TOP3) collectively accounting for about 52% of the national total production capacity. Major production enterprises include Invista, Tianchen Qixiang, and Huafeng Group.

From 2021 to 2024, domestic hexamethylenediamine production capacity is rapidly increasing, especially with significant capacity expansion in 2024. The main reasons driving the rapid expansion of China's hexamethylenediamine capacity include:

(1) National policy support. The government has introduced a series of policies to support the upgrading of the chemical industry and the localization of key materials, encouraging enterprises to break through "bottleneck" technologies such as hexanediamine and hexanedinitrile. These policies create a favorable environment for capacity expansion and enhance the overall competitiveness of the polyamide industry.

(2) Breakthrough in the domestication of upstream raw material adiponitrile. Hexamethylenediamine is produced by hydrogenating adiponitrile. In the past, the production technology of adiponitrile has long been monopolized by overseas companies, which restricted the development of the domestic hexamethylenediamine industry. Since 2022, domestic companies such as Huafeng Group and Tianchen Qixiang have made significant breakthroughs in adiponitrile production technology, achieving large-scale production and successfully resolving the supply bottleneck of upstream raw materials for hexamethylenediamine, laying a solid foundation for the capacity expansion of hexamethylenediamine.

(3) Strong demand from downstream markets. The main downstream products of hexamethylenediamine (HMDA) are PA66 and HDI. Among them, the application demand for PA66 in the automotive, electronics, and engineering plastics sectors continues to grow; the consumption of HDI in high-performance coatings and adhesives markets is rapidly increasing. The robust demand in the downstream market directly drives the consumption growth of the raw material HMDA, further promoting capacity expansion.

2

Demand Analysis:

With the rapid growth of PA66 and HDI consumption, the consumption of hexamethylenediamine is expected to increase by 15% year-on-year in 2024.

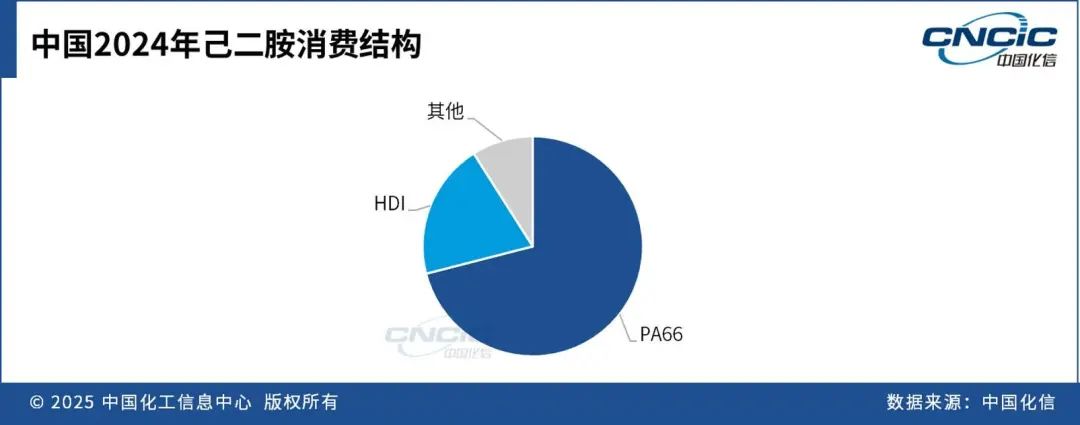

In 2024, China's consumption of hexamethylenediamine reached 495,000 tons, a year-on-year increase of 15.1%. Currently, PA66 is the largest consumption field for hexamethylenediamine in China. In 2024, domestic PA66 production capacity is 1.292 million tons/year, with a production volume of approximately 701,000 tons and a consumption volume of about 725,000 tons.

In 2024, the domestic production of PA66 is expected to grow, primarily due to the continuous release of industry capacity, increased market supply, a favorable export market, and rapid growth in downstream demand. The downstream applications of PA66 are divided into three main categories: engineering plastics, industrial yarns, and civilian yarns. In 2024, the growth in PA66 demand will be mainly driven by the engineering plastics and industrial yarn sectors, with the automotive and electronics industries in the engineering plastics downstream and the tire industry in the industrial yarn downstream being the primary sources of PA66 demand growth.

HDI is the second largest consumption field for China's hexamethylenediamine. As an aliphatic isocyanate without a benzene ring structure, HDI-based polyurethane coatings exhibit high resistance to yellowing and chalking, and can maintain the gloss of the paint surface for a long time. It is widely used in automotive, industrial protection, woodwork, and marine applications. The use of HDI aligns with the trend of upgrading polyurethane coatings towards high performance and environmental friendliness, leading to a continuous increase in consumption. In 2024, domestic HDI production capacity is expected to experience explosive growth. In addition to Covestro maintaining its existing capacity of 80,000 tons/year, Wanhua Chemical's Ningbo plant, Meirui New Materials, and Xinheng Cheng's HDI projects will all begin production, with total domestic HDI capacity reaching 330,000 tons/year by the end of 2024, an output of approximately 141,000 tons, and a consumption of about 130,000 tons.

The application fields of hexamethylenediamine in China also include the production of special polyamides such as PA610 and PA6T, epoxy resin curing agents, a small amount used as rubber vulcanization accelerators, as well as stabilizers in the textile and paper industries.

3

Supply and demand forecasting:

Caprolactam is still in a rapid development stage in China. Due to the accelerated localization of the raw material adiponitrile and the consumption drive from downstream PA66 and HDI, it is expected that the annual average growth rate of caprolactam consumption will remain at 10.1% by 2030.

Currently, the domestic hexanediamine industry is still in a rapid development stage, and PA66 and HDI will continue to be the core driving forces for the growth in hexanediamine consumption.

PA66 Market Outlook

From 2024 to 2030, China's consumption of PA66 is expected to maintain a rapid growth trend, with an overall growth rate of about 8%. The growth in consumption is mainly driven by strong demand in the fields of engineering plastics and industrial yarns. At the same time, domestic PA66 production capacity will continue to expand, with an expected capacity of 2.8 million tons per year by 2030. With the increase in capacity, market supply capability will also be enhanced, and it is anticipated that from 2024 to 2030, the production growth rate will be approximately 11.5%, further driving the demand for hexamethylenediamine.

HDI Market Outlook

As a key raw material for high-performance polyurethane coatings, the demand for environmentally friendly high-performance coatings in industries such as automotive, construction, and woodworking will drive the continuous increase in HDI consumption in China. It is expected that from 2024 to 2030, domestic HDI consumption will grow rapidly at a compound annual growth rate of 8.3%. By 2030, with the gradual implementation of a series of new and expanded projects, domestic HDI production capacity is expected to reach 433,000 tons per year. At that time, market supply capacity will be significantly enhanced, and during the period from 2024 to 2030, production is expected to achieve an average annual growth rate of 8.3%, thereby increasing the demand for hexamethylenediamine.

Market Outlook for Diethylamine

Chinese enterprises are actively planning new construction and expansion projects for hexamethylenediamine, with a total of 1.752 million tons/year of new capacity planned domestically. Strong companies such as Xinhecheng, Zhejiang Petrochemical, Fujian Gulei, Liaoyang Petrochemical, and Hualu Hengsheng are all entering the market. Assuming all these projects are completed and put into production, combined with the exit of some existing domestic capacity, the total domestic capacity for hexamethylenediamine could reach 2.9 million tons/year. Although there is considerable uncertainty regarding the commissioning of some long-term projects, China's production capacity for hexamethylenediamine will still significantly exceed downstream consumption, leading to a more intense competitive landscape in the market.

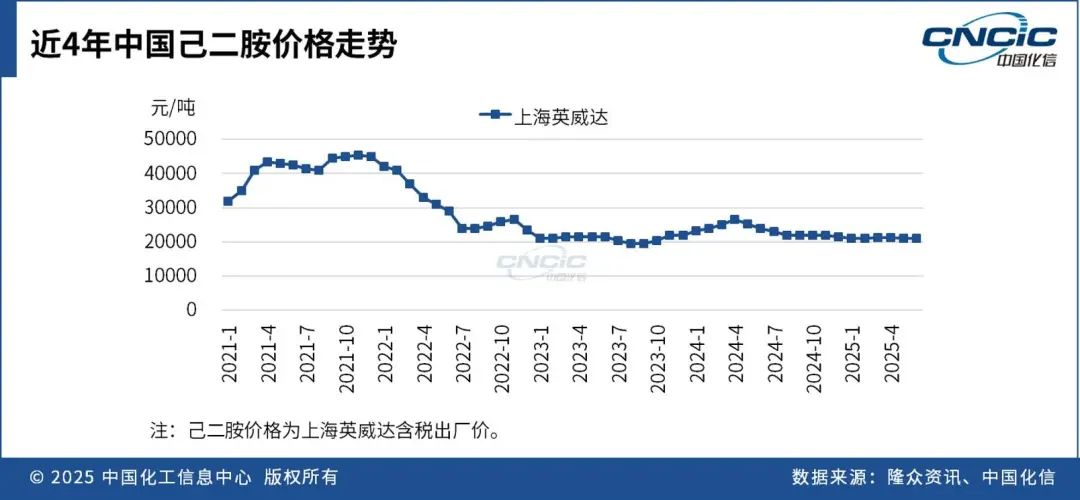

China's Hexamethylenediamine Price Analysis

In recent years, the price of hexamethylenediamine (HMDA) in China has shown a trend of rising first and then falling. In the first half of 2024, the price of HMDA rose, mainly due to the increase in crude oil prices, the continuous rise in the price of butadiene, a raw material for adiponitrile, which pushed up production costs; short-term supply tightness in the HMDA market; and strong demand from downstream PA66. By the second half of 2024, the price of HMDA fell back, reaching 21,000 yuan/ton by the end of the year.

In the first half of 2025, the price of hexamethylenediamine (HMDA) is expected to show a divergent pattern of "international price increase and domestic price decrease" due to three factors: the localization of raw materials, tariff policies, and overcapacity. The hexamethylenediamine industry in China is characterized by a relatively concentrated market structure. If production enterprises cease operations due to equipment maintenance, natural disasters, safety accidents, or other factors, it will directly lead to a short-term supply gap, which will in turn drive the price of hexamethylenediamine to rise rapidly. For those production enterprises that rely on purchasing hexamethylenediamine, they may face the risk of supply disruption.

Thoughts on Ascend's Closure of Its Hexamethylenediamine Factory in China

On June 17, 2025, global PA66 integrated producer Ascend Performance Materials announced the orderly closure of its hexamethylenediamine production facility located in Lianyungang, China. The plant has an annual capacity of 200,000 tons, and its closure will reduce the supply of hexamethylenediamine. In the short term, the supply tightness in the hexamethylenediamine market will intensify, especially in the Asia-Pacific region. Companies relying on the supply from this plant will face raw material shortages and may need to import from other regions or seek alternative suppliers. Additionally, the reduction in supply and market panic may drive up hexamethylenediamine prices. For downstream companies, since hexamethylenediamine is a key raw material for producing PA66 and HDI, the closure of the plant will increase the difficulty and cost for PA66 and HDI producers to obtain hexamethylenediamine. Some companies dependent on the supply from Ascend's Lianyungang facility may reduce production or even halt operations due to insufficient raw materials.

The capacity layout of the Ausun De Lianyungang factory was originally planned to be constructed in three phases. Phase one, with an annual output of 200,000 tons of hexamethylenediamine, also includes specialty amine chemicals such as FlexaTram™ used in coatings, pharmaceuticals, and the oil and gas industries, which began operations in October 2024. Phase two is for the polyamide business, and phase three is for the raw material acrylonitrile. However, Ausun De has announced the orderly shutdown of the factory, less than eight months since the factory officially began operation.

Aosenda's main purpose for setting up factories in China is to be closer to the Asia-Pacific market, reduce transportation costs through localized production, and avoid trade barriers (such as US-China tariffs). However, with the domestic breakthroughs in the production of hexamethylenediamine, domestic capacity has seen explosive growth, and market competition has become increasingly fierce. Local companies, leveraging their understanding of domestic market demand and well-established upstream and downstream industrial chain layouts, have demonstrated competitive advantages in cost control, pricing strategies, and customer service, putting Aosenda at a competitive disadvantage. Closing factories is essentially a loss-cutting measure taken by Aosenda to avoid continuous losses in intense competition.

From the perspective of strategic adjustment, Ausand's closure of the Lianyungang factory highlights its strategic intention to refocus its business on the United States. By integrating internal resources, Ausand can enhance operational efficiency, concentrating limited resources on core business areas and regions with competitive advantages. At the same time, it will pay more attention to the resilience and security of the supply chain, establishing a more complete and controllable production and supply system in core market areas. Additionally, ongoing trade frictions have profoundly impacted Ausand's global business layout—the changes in tariff policies have significantly increased the cost of exporting products from the U.S. to international markets, directly weakening the price competitiveness of its products in the international market and affecting sales. Therefore, in the near future, it is expected that Ausand will focus on serving the customer base in the domestic U.S. market.

For Chinese hexamethylenediamine production enterprises, after Ascend closed its Lianyungang factory, its original market share has become vacant, providing domestic companies with an opportunity to quickly fill the gap. However, the current domestic hexamethylenediamine market has shown a situation of oversupply. If domestic manufacturers want to enhance their competitiveness and expand their market share, the key lies in optimizing production, reducing costs and increasing efficiency, and improving product performance.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track