All-Electric Drives, China’s Automotive Industry Thrives

Various types of electric vehicles are in high demand in the EU market. Chinese cars, in particular, are very popular, while Tesla continues to decline. Electric vehicles are experiencing overall growth, and Chinese automakers are thriving in the EU, with Volkswagen maintaining its market leadership.

Figure 1 BYD Dolphin and Seagull production factory for one million vehicles (Source: "Car Review" citing BYD Europe)

In August 2025, the EU new car market grew by 5.3% year-on-year. According to data released by the European Automobile Manufacturers Association (ACEA), a total of 677,786 cars were sold in the EU. Statistics for the first eight months show that the EU new car market grew by 0.1% compared to last year. So far, EU car manufacturers have sold 7,168,848 cars in 2025.

The entire European market grew by 4.7% in August, with new car registrations reaching 791,349 units. The statistics for the first eight months show that new car sales amounted to 8,691,840 units, an increase of 0.4%.

In August, despite growth in almost all European markets, the increase mainly came from high-volume markets. In August, new car registrations in Germany increased by 5.0% to 207,229 units. France contributed 87,849 new cars (+2.2%), and Spain contributed 61,315 new cars (+17.2%). However, new car registrations in Italy fell by 2.7% to 67,322 units. The UK reported a decline in new car registrations by 2.0%, totaling 82,908 units.

The electric vehicle market is experiencing comprehensive growth, with all electric models benefiting from the positive performance in August. The number of new registrations for battery electric vehicles (BEVs) increased by 30.2%, reaching 120,797 units. The number of new registrations for plug-in hybrid vehicles (PHEVs) rose by 54.4%, totaling 70,545 units. New registrations for hybrid vehicles increased by 14.1%, reaching 229,970 units. In August, new registrations for gasoline vehicles fell by 16.3%, totaling 178,156 units. Diesel vehicles have dramatically declined. The number of new registrations for internal combustion engine vehicles dropped by 17.5%, with only 59,327 units registered.

Figure 2: New Registration Volume in the EU for August 2025 (ACEA, classified by drive type) (Source: "Car Review")

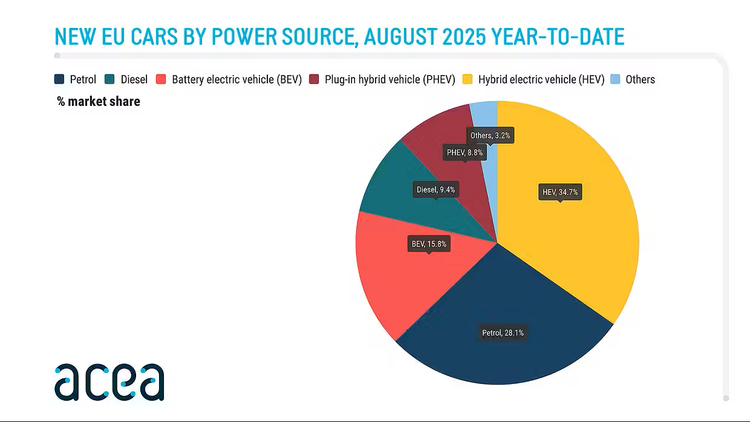

Hybrid vehicles clearly dominate the new car market, with statistical data from this year showing that hybrids account for 34.7% of the new vehicle registration market share. Gasoline cars follow in second place with a market share of 28.1%. Battery electric vehicles significantly lead with a market share of 15.8%, ahead of diesel vehicles at 9.4%. Plug-in hybrid vehicles are catching up, currently holding a market share of 8.8%.

Chinese car companies are developing rapidly, while Volkswagen still maintains a leading position in the market. From the perspective of various brands, European consumers are increasingly favoring Chinese models. BYD's new vehicle registrations reached 67,632 this year, a year-on-year increase of 244%. SAIC Group (MG) sold 136,629 vehicles in eight months, surpassing both Seat and Nissan, with a growth rate of 33.1%. Tesla is still unable to benefit from the electric vehicle boom. In 2025, the American company has sold only 85,673 vehicles so far, a decrease of 42.9% compared to last year.

Eight months later, the Volkswagen Group continues to lead the EU market with a market share of 27.5%, followed by Stellantis Group (15.9%) and Renault Group (11.4%). The strongest single brand is Volkswagen (11.4%), followed by Toyota (7.7%) and Škoda (6.5%). Other brands in order are Renault (6.1%), BMW (5.9%), Peugeot (5.3%), Dacia (5.2%), and Mercedes (5.0%).

The new car registration data from the European Union indicates a clear fact. Pure internal combustion engine vehicles, whether gasoline or diesel, are becoming increasingly unpopular. In contrast, electric vehicles are very popular. Pure electric vehicles are rapidly on the rise, while plug-in hybrid vehicles are still struggling. Compared to Chinese car manufacturers, whose businesses are continuously growing, Tesla is unable to benefit from the electric vehicle boom.

CompilerDr. Liu Xiaoyi (GuanYu Electromechanical Technology (www.costkey-solutions.comFounder and CEO, over 20 years of experience in new production processes, vehicle planning (including new energy vehicles), and cost engineering at Daimler AG (Mercedes-Benz) in Germany; recipient of the German Physics Prize; expert in the Ministry of Industry and Information Technology's "Changfeng Plan" for new energy and intelligent connected vehicles industry think tank; senior technical management at Great Wall Motors and Hichain Energy; author of the key book "Cost Engineering System of Manufacturing Enterprises" in the China National Publishing Group's "National Heavy Equipment Publishing Project"; graduate enterprise mentor at the School of Electronic Information and Electrical Engineering, Shanghai Jiao Tong University; guest professor at the School of Automotive Engineering, Tongji University; specially invited lecturer in cost engineering at the Talent Exchange Center of the Ministry of Industry and Information Technology/China Automotive Industry Training Base/Gaodun Finance and Tax Academy; author of the "Liu Xiaoyi Column" in Gaishi Automotive; CostKey is the first cloud-based enterprise-level cost engineering SaaS software system independently developed by Guanyu Electromechanical Technology, awarded the Shanghai Municipal Science and Technology Commission Innovation Fund.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track