"agent revolution" - basf enters dongfeng liuzhou automotive supply chain

On the surface, this seems to be a routine operation of an international chemical company leveraging local channels to enter the supply chain of vehicle manufacturers. However, a deeper analysis reveals that behind this cooperation is...Under the pressure of cost reduction and efficiency improvement, car companies are forced to abandon the "direct procurement" fantasy and turn to the strategic compromise of the "agency model."It marks the end of an era—the era of industrial idealism that prides itself on "independent control and vertical integration"; and it also heralds the beginning of a new era—the modern supply chain new order of "risk outsourcing, value-added services, and efficiency prioritization."

Let's start with the most straightforward financial logic. High-end coatings, especially electrophoretic paint, primer, and topcoat used for automotive bodies, are typical hazardous chemicals with multiple attributes such as flammability, corrosiveness, and toxicity. Therefore, any transaction involving such products must adhere to extremely strict warehousing, transportation, and management standards. International leading suppliers such as BASF, Covestro, PPG, and AkzoNobel generally adopt the "prepayment, delivery upon receipt of payment" settlement method. This means that the OEM must pay the full amount before the goods are dispatched; otherwise, they cannot take delivery. More crucially,Once the goods arrive, the OEM must assume responsibility for the storage safety of hazardous materials.Including complete compliance requirements for explosion protection, ventilation, temperature control, and leak emergency response.

For a large automotive company like Dongfeng Liuzhou Motor Corporation, this undoubtedly represents a significant burden. Firstly, the substantial advance payments severely strain its cash flow, especially given the current industry-wide challenges of high "two-fund occupancy" (inventory funds and accounts receivable) and compressed profit margins. Secondly, the construction cost of hazardous materials warehouses is exorbitant and requires professional staff, monitoring systems, and emergency plans, with significant operational and maintenance expenses. If inventory accumulates or a safety incident occurs, the losses would be incalculable.

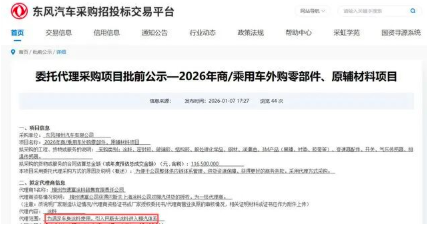

And this time, the choice to introduceLiuzhou City Defu Paint Sales Co., Ltd.As a primary distributor, it has precisely addressed these pain points. According to the disclosed documents, Defu Company will supply Dongfeng Liuzhou Motor using a "distribution model," which means...All financial and logistical risks are transferred to the agent.DeFu not only takes on the responsibilities of warehousing, distribution, and safety management of hazardous chemicals, but also offers industry-standard payment terms, such as "payment 30 days after goods are received and accepted," thereby greatly alleviating the financial pressure on the main engine manufacturers.

More importantly, this model is not a temporary expedient, but a mature strategy developed by international chemical giants after years of deep engagement in the Chinese market.BASF, Covestro, and other multinational companies have long realized that the Chinese market is vast and complex, and a single factory direct sales model cannot cover all regional customers.Thus, they have established regional distribution networks, authorizing local agents to handle sales, service, and after-sales support for specific markets. These agents often possess substantial local resources, professional technical teams, and compliance operational capabilities, enabling them to become "bridges" connecting global brands with local customers.

The differences in core dimensions between the traditional direct procurement model and the agency model:

|

|

|

|

|---|---|---|

| Payment Terms |

|

|

| Storage Responsibility |

|

|

| Logistics response speed |

|

|

| Technical Support Services |

|

|

| Supply Chain Resilience |

|

|

| Impact of "Two Funds Occupation" |

|

|

This table reveals a harsh reality:In the high-end industrial goods sector, whoever controls the "risk management authority" in the supply chain holds the power over pricing and discourse.In the past, automakers sought to leverage their size advantage to lower prices and shorten payment terms through "centralized procurement and long-term agreements." However, today, as raw material fluctuations intensify, environmental regulations tighten, and safety production accidents occur frequently,The automaker has instead become the "risk bearer."Agents, through specialized division of labor, internalize risks and subsequently convert them into service premiums.

It is worth noting that Dongfeng Liuzhou Motor's choice this time is not accidental. Liuzhou Defu Paint Sales Co., Ltd. is not an ordinary trader but a professional service provider with many years of experience in the automotive industry. Its parent company or affiliates have likely established stable cooperative relationships with several major OEMs, having accumulated strong capabilities in paint formulation adaptation, spray process tuning, and on-site technical support.This indicates that the essence of the agency model has evolved from being a "commodity transporter" to a "comprehensive solution provider."。

Moreover, this collaboration also reflects the shift in the overall supply chain mindset of China's manufacturing industry. In the past, automakers pursued "independent controllability," wishing to incorporate batteries, chips, paint, and even screws into their own systems. But the reality is,The division of labor in globalization is already irreversible, and "building everything oneself" will only lead to inefficiency and soaring costs.Nowadays, an increasing number of OEMs are embracing the "light asset operation" concept by outsourcing non-core businesses to professional service providers, while focusing on research and development, design, and brand building.

BASF's involvement is a key part of this transformation. As one of the world's largest chemical companies, BASF not only provides high-quality coating products but also introduces advanced eco-friendly formulations, carbon footprint tracking systems, and digital coating management systems. These added values are precisely where the "value-added services" offered by agents lie.When the paint of a car is no longer just a "shell to shield against wind and rain," but becomes a key component that reflects brand tonality, meets regulatory requirements, and enhances user experience, manufacturers are naturally willing to pay for "professional services."。

The deeper impact lies in the fact that this agency model may be fostering a new industrial ecosystem."Regional Supply Chain Service Cluster"In the future, we may see more local service providers like Defu, focusing on a particular city or industry cluster, integrating products from multiple international brands such as coatings, adhesives, and sealants to form a one-stop supply platform. They are not only sales agents but also technical consultants, compliance experts, and logistics managers.

Certainly, challenges still exist. How can we ensure the quality of service provided by agents? How can we prevent excessive price increases? How can we avoid the potential risks brought by information asymmetry? These issues require the host factory to perform refined management in contract design, performance evaluation, and auditing mechanisms.

It cannot be denied thatThe collaboration between Dongfeng Liuzhou Motor and BASF is a highly forward-looking endeavor.It breaks the rigid framework of traditional procurement and uses market-based methods to solve the complex challenges of industrial goods transactions. It tells us that in an era where efficiency is paramount, true competitiveness no longer comes from "how much production capacity I have," but rather "how quickly, steadily, and at low cost I can acquire the resources I need."

When manufacturers finally learn to "let go" and dealers truly become "partners," the springtime of China's automotive supply chain may just be beginning.。

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories