After Volatile Swings, Oil Prices End Higher; Plastic Futures Edge Up Across the Board

1. Crude Oil Market Dynamics

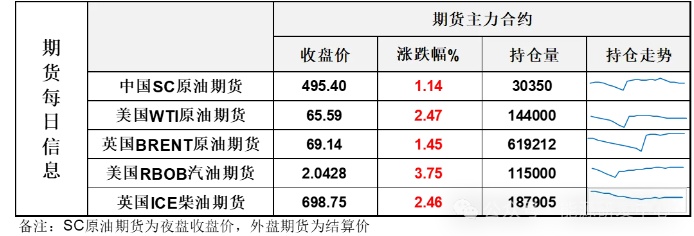

On September 2nd, the ongoing Russia-Ukraine conflict has brought potential supply risks, coupled with the continuation of U.S. sanctions on certain oil-producing countries, leading to an increase in international oil prices. The NYMEX crude oil futures for the October contract rose by $1.58 to $65.59 per barrel, a 2.47% increase from the previous period; the ICE Brent crude futures for the November contract increased by $0.99 to $69.14 per barrel, a 1.45% increase from the previous period. China's INE crude oil futures for the 2510 contract rose by 6.2 to 489.8 yuan per barrel, with a night session increase of 5.6 to 495.4 yuan per barrel.

Market Outlook

On Tuesday, oil prices continued to surge with a strong bullish candlestick. Behind this sharp rise was a turbulent wave of volatility, indicating that more influencing factors are affecting the crude oil market, and that oil price trends are facing an increasingly complex situation. Such movements once again let investors experience the roller-coaster nature of an uncontrollable market. The intraday fluctuations reflect the current instability in the oil market, especially since the final surge in oil prices was driven by a broader market rebound, while the inherent momentum was relatively limited. Interestingly, while oil prices rose, the Brent time spread weakened significantly—a divergence that is thought-provoking. Meanwhile, European diesel saw notable gains due to Houthi attacks on an Israeli oil tanker. On the geopolitical front, issues like the Middle East (Yemen’s Houthis), Russia-Ukraine tensions, and on the macro front, European bonds and US tariffs, are all exerting a complex influence on the market. The oil market is once again entering a relatively chaotic phase, which is expected to keep producing volatile swings. It is advisable to patiently wait for clearer developments and participate cautiously.

Section 2: Macroeconomic Market Trends

Donald Trump: An emergency meeting will be held on Wednesday regarding the tariff ruling. An appeal to the Supreme Court could be filed as early as Wednesday. If the tariff appeal is rejected, the tariffs will have to be withdrawn. If the tariff ruling is unfavorable, trillions of dollars will have to be refunded. The Supreme Court will be urged to expedite the decision. The stock market is down because it needs the tariff policy.

Concerns about the UK's fiscal situation, among other factors, have weighed on the UK bond market.The yield on 30-year UK government bonds has risen to its highest level since 1998, and the pound has experienced a sharp decline.。

3、Officials from Japan's ruling Liberal Democratic Party have successively expressed their intention to resign.Prime Minister Shigeru Ishiba apologized for the Liberal Democratic Party’s defeat in the recent House of Councillors election.

China has decided to implement a trial visa-free policy for holders of ordinary passports from Russia from September 15, 2025 to September 14, 2026.

In August, the China Passenger Car Association reported that the wholesale sales of new energy passenger vehicles by manufacturers nationwide reached 1.3 million units, a year-on-year increase of 24%.

3. Plastic Market Trends

Overnight international oil prices rose, and the main plastic futures contract edged up.

The plastic 2601 contract is quoted at 7,278 yuan/ton, up 0.23% from the previous trading day.

The PP2601 contract is quoted at 6,974 yuan/ton, up 0.30% from the previous trading day.

The PVC2601 contract was quoted at 4,920 yuan/ton, up 0.57% from the previous trading day.

The styrene 2501 contract is quoted at 7,018 yuan/ton, up 0.72% from the previous trading day.

4. Today's Market Forecast

In the short term, the support from the cost side has weakened for PE. On the supply side, some enterprises are undergoing short-term maintenance, resulting in little overall change in supply, while inventory has slightly declined. On the demand side, the downstream is gradually entering the traditional peak season, and orders for product enterprises have somewhat recovered. Therefore, it is expected that the polyethylene market will primarily experience narrow fluctuations today.

PP: From the supply side, the commissioning of two new units in Daxie, along with reduced maintenance of existing units, has further increased supply pressure. The market atmosphere has not significantly improved with the arrival of the peak season, as the increase in downstream orders is limited and factories have insufficient willingness to restock. The future trend will largely depend on whether downstream demand can maintain a high growth rate. In the short term, the market is expected to fluctuate mainly around 6800-7050 yuan/ton.

PVC: The PVC spot market remains in a stalemate, with the spot fundamentals showing a slight increase in supply expectations. Additionally, new production capacities continue to be launched this month, and output is expected to maintain an upward trend. Domestic demand is anticipated to pick up, while exports are focused on fulfilling previous orders. The industry inventory still faces pressure from accumulation. Short-term cost bottom support remains strong, coupled with the impact of industrial policies on cost expectations. Futures prices are expected to remain firm. It is forecasted that the cash price for five-type carbide-based PVC in the East China region will be in the range of 4650-4780 yuan/ton.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track