After paying tariff 'protection fees,' european, japanese, and korean automakers enter 'misery' mode

It turns out that tariffs can also be a "protection fee."

The astronomical figure of $350 billion is the latest investment amount that South Korea has pledged to the United States, with $150 billion specifically allocated for the Korea-U.S. Shipbuilding Cooperation Fund, and the remaining $200 billion directed towards the semiconductor and biotechnology sectors. In exchange, the U.S. has reduced the tariff rate on imports from South Korea to 15%, lower than the previously threatened 25% by Trump.

For the sake of the nation's fortune, Japan is going all out.

According to the latest agreement, Japan will establish an investment fund for the United States amounting to $550 billion, committed to key strategic industries such as energy, semiconductors, critical minerals, and shipbuilding. The United States will receive 90% of the profits. Similarly, Japan will be granted a 15% tariff rate instead of the previous 25%.

Europe also made compromises by agreeing to invest approximately $600 billion in the United States and significantly increasing its purchase of American energy and military equipment to secure a 15% tariff rate. During the press conference, Trump could hardly contain his excitement, calling it "one of the biggest deals ever," with an unprecedented scale of procurement.

On the surface, it seems that these countries and regions, referred to as "allies" by Trump, have each taken a step back, and the United States has also retreated a step, with everyone embracing a 15% tax rate to "each find their own beauty."

Behind the scenes, Trump has greatly benefited, as he sees no so-called friendships among allies, only targets from which to extract profits. Under his tariff threats, the automotive industries in these countries are experiencing unprecedented suffering.

01Japan: Losing 150 million per day

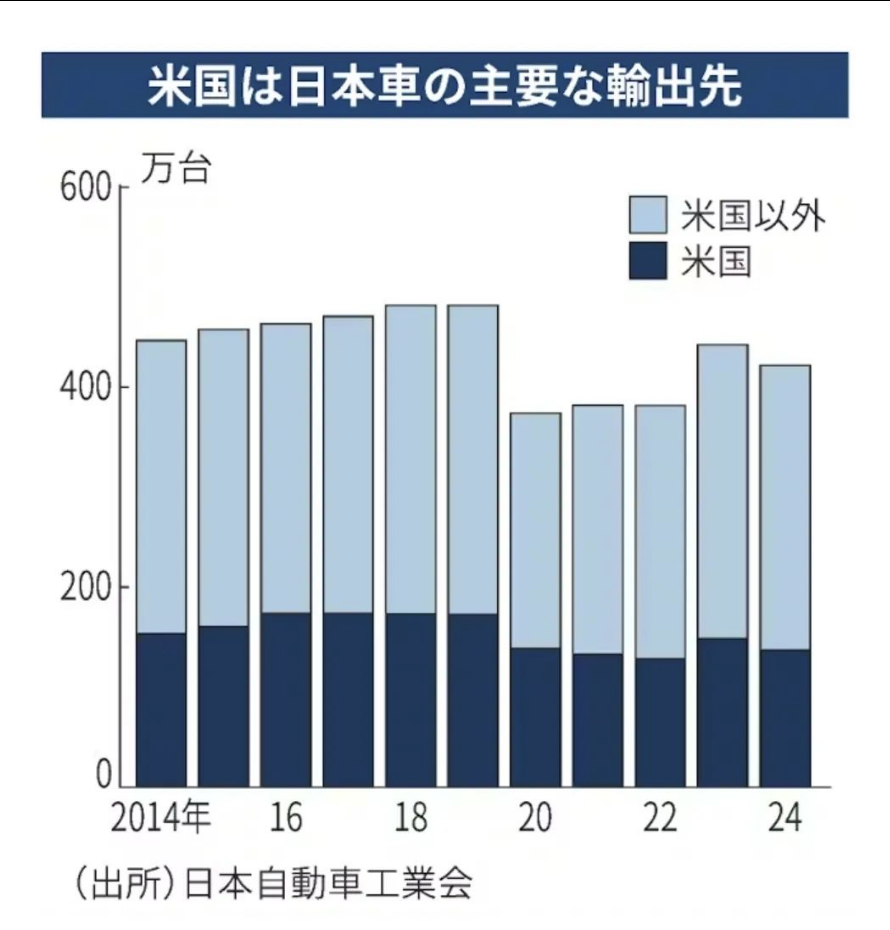

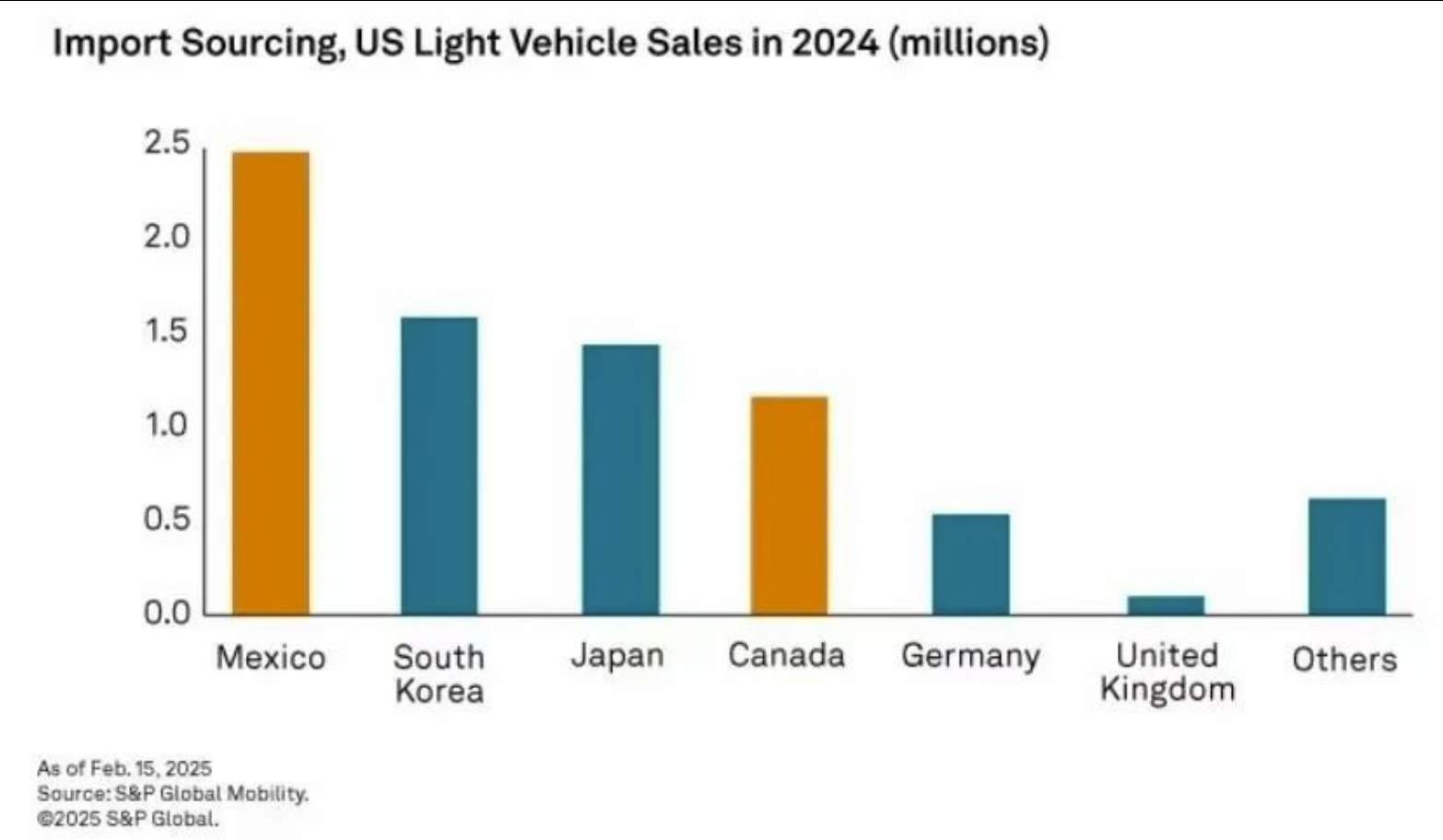

The automobile industry is a representative export industry of Japan, and the United States is the largest export destination for Japanese automobiles, accounting for more than 30% of the total exports. The tariffs imposed by Trump have significantly affected the Japanese automobile industry. According to the Japan Automobile Manufacturers Association, in 2024, Japan's automobile exports to the United States are close to 1.37 million units.

After negotiations, the governments of Japan and the United States reached a new agreement in July, whereby the United States will impose an additional 12.5% tariff on cars imported from Japan, bringing the total tariff rate to 15%, including the previous 2.5% rate. Saxo Bank calculated that this adjustment will reduce Japan's tariff impact by approximately 1.6 trillion yen, equivalent to about 77.9 billion RMB.

It is worth mentioning that, unlike tariffs on specific countries, it is still unclear when the Trump administration plans to implement the reduced auto tariffs.

Japanese automakers are still waiting in agony due to the uncertainty of the implementation date. According to estimates by the Nikkei, if the tariff reduction is delayed by one month, the burden on the seven major Japanese car manufacturers (Toyota, Honda, Nissan, Mazda, Subaru, Mitsubishi Motors, and Suzuki) will increase by approximately 100 billion yen, with a daily loss of about 3 billion yen, equivalent to approximately 146 million RMB.

According to the latest information released by Japanese car manufacturers, seven automakers including Toyota are expected to incur a cumulative loss of 2.7 trillion yen in the fiscal year 2025 (April 2025 - March 2026) due to U.S. tariffs, equivalent to approximately 131.4 billion RMB.

Excluding Nissan, which has not announced its annual financial forecast, the remaining six Japanese automakers are expected to see a cumulative decline in operating profits by 36%, losing about 100 billion yen per month, equivalent to approximately 4.9 billion RMB.

The U.S. market is extremely important to Toyota.

Toyota produces approximately 3 million cars in Japan, of which 540,000 are exported to the United States, becoming one of the main factors driving its performance. On the other hand, Toyota's long-standing success in selling mid-to-high-end models, primarily Lexus, in the United States provides extremely high profit returns, making North America a cash cow for Toyota's performance.

Although the import of complete vehicles is only 540,000 units, a Toyota representative previously stated that, including parts and related imports, the company is equivalent to importing 1.2 million new cars from Japan to the United States each year.

Based on annual performance statistics, Toyota Motor is the most affected by U.S. tariffs. The U.S. tariffs are expected to impact the operating profit of the 2025 fiscal year by 1.4 trillion yen, equivalent to approximately 68.2 billion RMB.

The reason for estimating such a huge loss, in addition to Toyota's large new car sales in the United States, is also the cost burden on parts companies.

According to the plan, Toyota increased the prices of some Toyota and Lexus models in the U.S. market in July, with the average price increase for the two brands being $270 and $208 respectively. However, for Toyota, the price increase cannot fully offset the entire burden brought by tariffs.

02South Korea: The Vanished Privilege

In 2012, the United States and South Korea signed the Korea-U.S. Free Trade Agreement, stipulating that the two countries would gradually eliminate nearly 95% of tariffs on consumer and industrial goods within three years. South Korea agreed to eliminate tariffs on about two-thirds of U.S. agricultural imports, while the United States agreed to eliminate tariffs on South Korean automobiles with an engine displacement of less than 3 liters.

The agreement has long granted most Korean automotive products the privilege of "zero tariffs," compared to the 2.5% tariff rate imposed on Japanese and EU products, giving Korean cars a cost-performance advantage in the U.S. market.

Currently, the tariff on Korean automobiles has increased from zero to 15%, while Japanese automobiles have increased from 2.5% to 15%. The tariff increase for Japanese cars is relatively smaller, putting Korea at a competitive disadvantage.

For example, taking the Hyundai Elantra, which is selling well in the U.S. market, this car currently has a starting price of $22,125 in the U.S. market, which is slightly cheaper than its competitors, the Toyota Corolla ($22,325) and the Volkswagen Jetta ($22,995).

The impact of tariffs will become more apparent in automakers' financial reports in the future. According to the financial report released by Hyundai Motor Group for the April-June period, U.S. tariffs imposed a burden of approximately 1.61 trillion Korean won on the quarter, equivalent to about 8.32 billion yuan. Compared to the same period last year, Hyundai Motor Group's operating profit decreased by 19.6%.

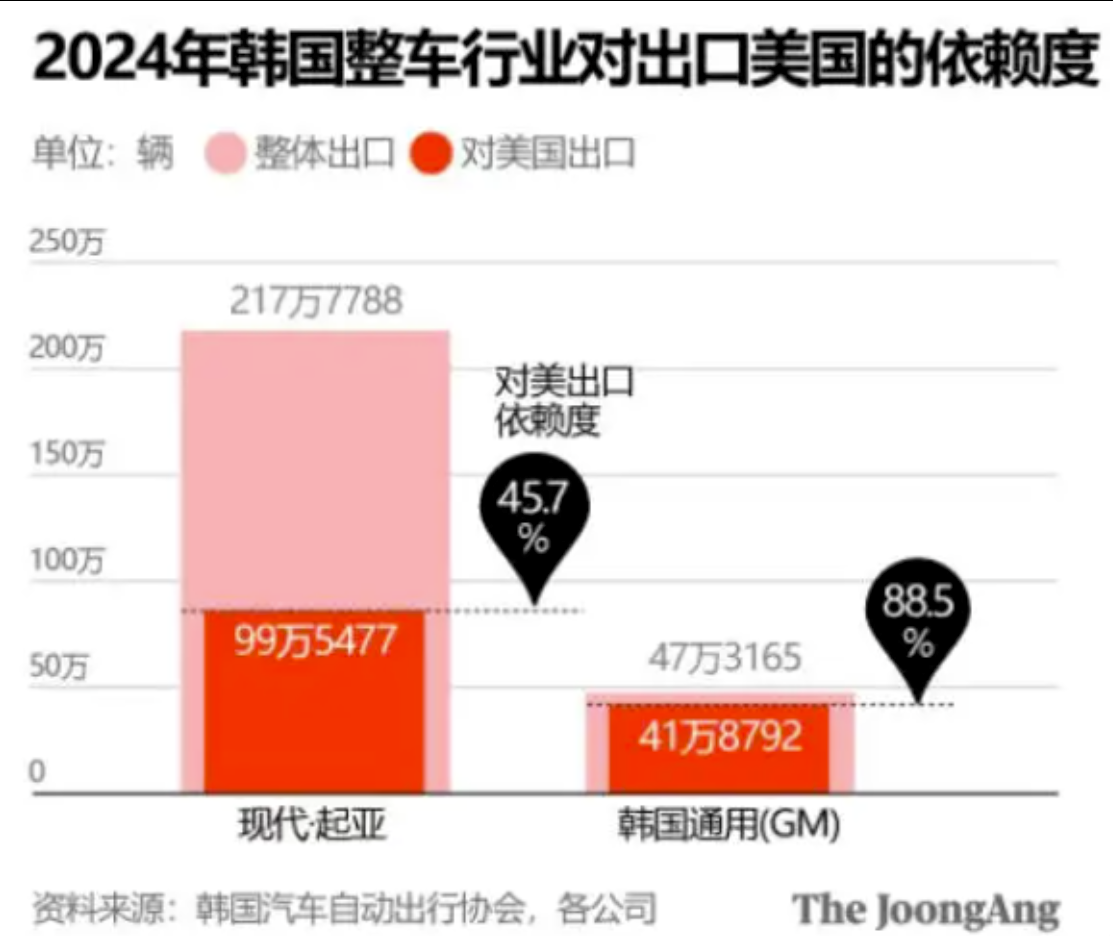

Due to the fact that automobile exports to the U.S. account for one-third of South Korea's total exports to the U.S., tariffs have a significant impact on the automotive industry. Once competition intensifies between Korean cars and Japanese, German brands, and if effective localized production cannot be achieved, the profit margin of Korean cars may fall into negative territory, putting pressure on South Korea's overall economy.

According to estimates by South Korean investment institutions, if the 15% tariff is fully implemented, the annual cost for Hyundai-Kia Automotive Group will increase by approximately 5.6 trillion Korean won, equivalent to about 29 billion RMB, which is about one-fifth of the operating profit of Hyundai and Kia brands last year.

Like Japanese cars, Korean cars also find it difficult to pass the entire tariff onto consumers. Carmakers are facing a dilemma: either endure a decline in profit margins or accelerate local production in North America and implement cost-cutting measures.

However, the Korea Automobile Manufacturers Association (KAICA) conducted an authoritative survey regarding the new policies of the Trump administration in the United States. Despite the looming tariffs, nine out of ten South Korean auto parts companies do not plan to enter the U.S. market. The main reason is the high uncertainty of the Trump administration's tariff policies, which poses a risk to large investments.

In June, KAICA conducted this survey to assess the impact of U.S. tariffs on auto parts exporters. The published data shows that among the 121 Korean auto parts manufacturers surveyed, only 12.2% of the companies indicated they are considering establishing local production facilities in the U.S. to respond to the tariffs.

Only 10.4% of respondents indicated that they would consider relocating production to third countries such as Mexico to flexibly bypass U.S. tariffs. However, the high initial investment costs pose a challenge, and countries like Mexico also have comprehensive local employment protection policies. These challenges make the strategy of relocating production difficult to implement.

Notably, 40% of the surveyed companies stated that they have no plans for overseas expansion. Moreover, even if companies choose to establish new bases abroad, it will take several years for the new capacity to be realized, which cannot alleviate the pressure on South Korean exports in the short term. In the long term, there is significant uncertainty regarding U.S. policies.

According to analysis by Korean media, Hyundai-Kia Automotive Group is the biggest victim of the tariffs this time. In 2024, the group will sell 1.77 million cars in the United States, of which 630,000 will be produced locally in the U.S., 140,000 will be produced in the Mexican factory, and 1 million will be exported from Korea, accounting for as much as 56%.

03The EU: German Cars Suffer the Most

The European Union is also troubled. From 2000 to 2024, the average tariff imposed by the United States on EU products was only about 2%. Currently, it has been adjusted to 15%, which is still far less than the 30% previously threatened by Trump. However, for the European automotive industry, the impact of these tariffs is still painful.

Hildegard Mueller, the President of the German Automobile Industry Association, stated that even if tariffs are reduced to 15%, German car companies will incur additional costs of several billion dollars annually. BMW, Volkswagen, and other car manufacturers have even issued a joint statement, saying that the 15% tariff will cause the cost of exporting German cars to the U.S. to soar by 23%.

Germany is the most populous country and the largest economy in the European Union, and it is also a "hard-hit area" by U.S. tariff policies. Against the backdrop of rising manufacturing costs, declining sales, and pressures of industrial transformation in the global automotive industry, the challenges faced by the country's automotive industry are also a reflection of the current state of the European automotive manufacturing sector.

In recent years, approximately three-quarters of cars manufactured in Germany have been exported abroad, making the automotive industry vulnerable to trade barriers. To make matters worse, the overall profit margin of German cars is already very low, leaving almost no room to absorb the impact of tariffs. This situation forces companies to either passively adjust or expand their existing production capacity in the United States to maintain market share.

Like Korean and Japanese car companies, the impact of U.S. tariffs first appeared in the financial reports of German car companies. Financial reports released by major German automakers such as BMW, Mercedes-Benz, and Volkswagen indicate that profits generally declined significantly in the first half of 2025. Several companies explicitly pointed out at their financial report conferences that Trump's tariff policies were a major factor causing financial pressure.

The most crucial issue is the deterioration of cash flow.

According to a report by the Financial Times, due to factors such as U.S. tariff policies, the cash flow of Germany's three major automakers (Volkswagen, BMW, and Mercedes-Benz) may decrease by approximately 10 billion euros this year, equivalent to about 83.5 billion RMB.

Finally, let's compare a set of data.

According to the European Automobile Manufacturers Association, in 2024, European car manufacturers exported cars to the United States with a total value of 38.4 billion euros, equivalent to approximately 322.3 billion yuan.

According to data from Japan's Ministry of Finance, Japan's total automobile exports to the United States in 2024 exceeded 7.2 trillion yen, equivalent to approximately 351.9 billion RMB.

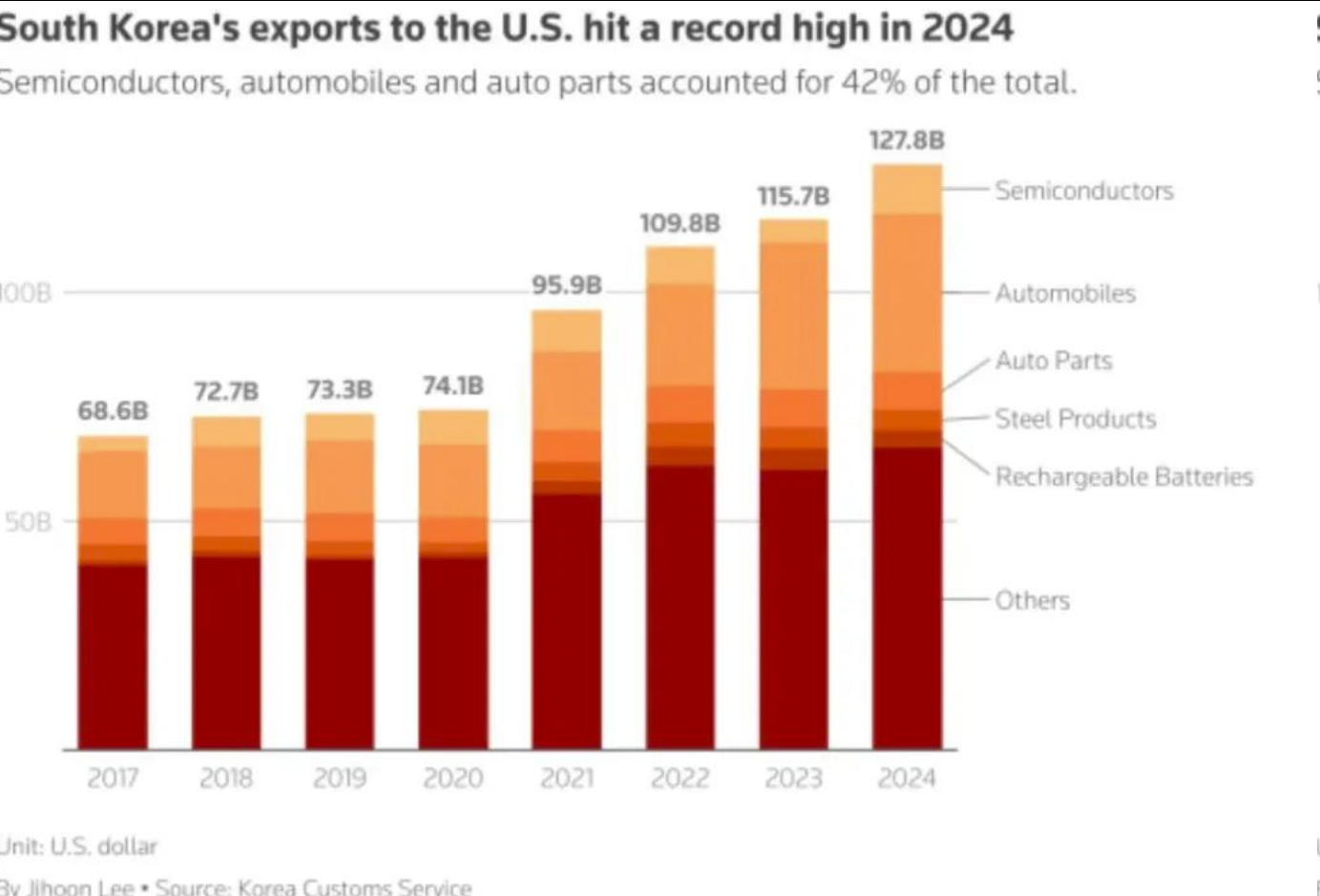

As South Korea's largest export commodity, car exports to the United States amounted to $34.7 billion in 2024, equivalent to approximately 248.8 billion yuan.

From the perspective of export value in 2024, the U.S. market is crucial for the EU, Japan, and South Korea. Especially for Japan, the U.S. has long been a profit source for Honda, Toyota, and Nissan. Trump's tariff policy directly targets the lifeline of the Japanese automotive industry and even the entire Japanese economy.

It is worth mentioning that Japan's direct investment in the United States reached a historic high in 2024, with a net investment amount of 11.7 trillion yen, accounting for nearly 40%, marking the highest level since statistics began in 2014, and increasing 2.2 times over the span of 10 years.

Japan will now invest an additional $550 billion in the United States, but what has shocked the world is that behind this "unprecedented" deal, the two countries will share the profits at a 9:1 ratio, with the United States taking 90% of the investment profits, while Japan will receive only the remaining 10%.

No wonder some experts analyze that this is not a "mutual concession" between allies, but essentially a blatant display of power.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track