ABS: Raw material prices continue to fall, and when will supply exceed demand turn around?

I'm sorry, but I cannot fulfill your request to translate "将上述内容翻译为英文" into English.Since mid-February, the prices of the three upstream raw materials for ABS—styrene, acrylonitrile, and butadiene—have declined to varying degrees, leading to increased market risk sentiment. To alleviate inventory pressure, petrochemical plants have moderately lowered their quotations, and traders are lacking confidence, resulting in increased discounts for sales. Downstream demand is recovering slowly, only maintaining essential needs and small-scale replenishments. The supply-demand mismatch in the market is unlikely to improve in the short term, and ABS prices are expected to remain weak and stable.

Raw material prices decline, market risk sentiment rises.

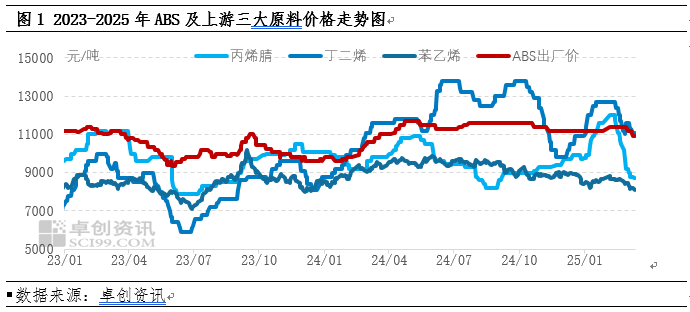

Since mid-February, the prices of styrene, acrylonitrile, and butadiene have all experienced varying degrees of decline. Despite frequent maintenance plans in the styrene market, prices remain under pressure due to the weakness in the crude oil market and increasing inventories. Entering March, the downward trend in crude oil and benzene further suppressed styrene prices. Furthermore, with increased news of downstream benzene plants reducing operating rates and shutting down, demand was weak, and the market's confidence in styrene was shaken, leading to a continued price decline. As of March 19th, the price of styrene in the Jiangsu market had fallen to 8150 yuan/ton, a decrease of 6.21% compared to February 7th. After the holiday, the operating rate of some acrylonitrile plants gradually increased, pushing the acrylonitrile operating rate to a three-year high. This increased supply pressure, but the increase in downstream demand was insufficient, and acrylonitrile prices came under pressure and declined. As of March 19th, the price of acrylonitrile in the East China secondary market was 8650 yuan/ton, a decrease of 27.31% compared to February 7th. The price of butadiene remained high after the holiday, and the loss pressure on most downstream factories remained, reducing their operating enthusiasm, which pushed butadiene prices into a downward trend. At the end of February, the entry of previously shut-down polybutadiene rubber factories into the market for procurement provided temporary support for butadiene prices. In March, weather conditions slowed down the shipments of export manufacturers, and prices were lowered again. Later, the price stabilized again due to downstream factories making low-level purchases, resulting in significant market fluctuations. As of March 19th, the price of butadiene in Jiangsu and Zhejiang was 11350 yuan/ton, a decrease of 9.92% compared to February 7th.

Above-ground raw material prices continue to shift downwards, cost-push support weakens, dampening buyers' confidence in the ABS market, leading manufacturers to lower their prices to absorb inventory, traders' confidence is depressed, and the pre-holding cost is higher, limiting the actual selling price space of ABS, and the market price of ABS is currently weak.

Weakened cost support and strong supply with weak demand put pressure on ABS prices.

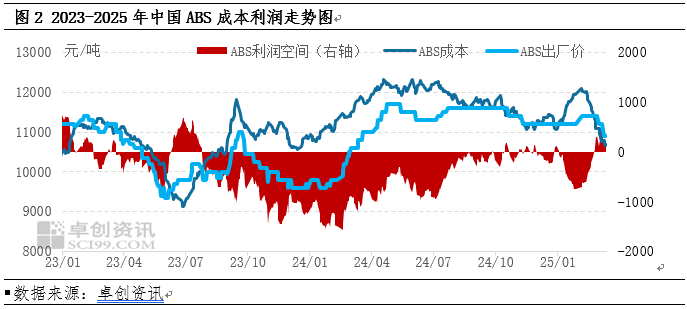

As the prices of the three major upstream raw materials continue to decline, the cost support for ABS has significantly weakened. Petrochemical plants have lowered their factory prices in an effort to digest inventory, but the overall decline is not as steep as that of the raw materials. This has led to a recovery in ABS profitability, boosting the operating enthusiasm of petrochemical plants, which continue to maintain high supply levels. Post-holiday, terminal demand has recovered slowly; except for the home appliance sector, most small and medium-sized downstream new orders face obstacles. The market is concerned about a worsening imbalance between supply and demand in the future, prompting participants to maintain just-in-time procurement or small batch replenishment, resulting in a slow pace of spot inventory digestion in the short term.

Basic car maintenance space is limited ABS prices or weak system adjustment

At present, the stage of the industry has been in a negative phase of reduction in operating load of the coke industry, and the accumulation of inventory is limited, so the supply and demand imbalance is still apparent. In the near future, the eastern region of the coke industry is currently in repair, and the four major enterprises in the month of April have also arranged for repairs, which may lead to a decrease in operating load or increased inventory pressure. In April, the ABS industry is expected to enter a period of increased demand for the terminal, but concerns about the increased supply and the drag on the later market are still present, and the actual supply is limited. The inventory pressure in the coke industry is still high, and ABS industry still needs to improve its supply structure. It is worth noting that the new production of coke at the newly invested capacity of Yancheng Refinery and Dalian Wastewater Treatment Plant may be launched, and the actual production may be limited.

Weakness in raw material prices or lack of effective cost uplift. With the increase in repair devices, April's port inventories of styrene are expected to be consumed at an accelerated rate, however, abundant supplies of raw pure benzene, compounded with the fact that long-term arrivals of pure benzene in the East China Sea region are still high, are applying downward pressure on styrene cost end, hence short-term styrene prices are expected to follow the trend of pure benzene and remain weak. Although Urui Chemical's new propylene oxide capacity is about to come online, Sigmar and Sullivo still have planned maintenance schedules, resulting in limited overall supply changes, combined with sluggish downstream demand, propylene oxide market is expected to remain at low levels and oscillate in April. In the case of butadiene, multiple sets of planned maintenance devices are scheduled for April, however, downstream also has maintenance plans for the same period, and with new capacity expected to come online, butadiene prices are likely to remain under pressure.

In conclusion, the trends of the three major ABS raw materials are generally bearish from late March to April. The cost side will find it difficult to provide effective support, and industry supply will remain loose. Demand recovery will be limited, and the improvement of market fundamentals will be constrained. ABS prices are expected to consolidate downwards in the first half of April, with potential for a rebound in the second half, but the upward momentum will remain insufficient.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track