A Review of Global Developments in Chemical Recycling of Waste Plastics: Practices and Breakthroughs in the Asia-Pacific and Europe-America Regions

In recent years, under the global context of plastic pollution management, waste plastic chemical recycling technology has received widespread attention. According to Lux Research, a technology innovation research and consulting firm, in its analysis of 169 regions across the Americas, Europe, Middle East and Africa, and Asia-Pacific...An analysis of chemical recycling project announcements (including pilot or demonstration plants) indicates that 2024-2025 will be a critical turning point for chemical recycling—specifically pyrolysis—with global pyrolysis capacity potentially reaching 1 million tons per year. Over the next three years, capacity is expected to triple, with the Asia-Pacific region becoming one of the core areas for capacity growth due to a combination of policy support, market potential, and technological investment.

This article focuses on the past two years.Asia-Pacific and Europe-America regionsThe chemical cycle - typical practices in pyrolysis, sorting out the dynamic progress in this area in terms of technological breakthroughs, project implementation, and policy support.

As one of the world's largest producers and consumers of plastic, China's chemical recycling market holds significant potential. According to the "Comprehensive Research Report on Chemical Recycling of Waste Plastics," by 2035, China's annual plastic production is expected to reach 155 million tons. If the chemical recycling rate reaches 30%, it would be equivalent to creating two Daqing Oilfields, with a value exceeding 160 billion yuan. Chemical recycling technology is particularly effective for the approximately 46% of plastic production that consists of low-value waste plastics such as soft packaging and film bags. Currently, the primary methods of handling low-value waste plastics like soft packaging and film bags in China are landfill and incineration.

In terms of policy, in May 2022, the Ministry of Ecology and Environment released a new version of the "Technical Specifications for Pollution Control of Waste Plastics," which, for the first time, explicitly recognized chemical recycling methods for waste plastics. Chemical recycling of plastics involves converting waste plastics into low-molecular-weight feedstocks through processes such as gasification, catalytic cracking, pyrolysis, or chemical depolymerization, and then repolymerizing them into plastics. Chemical recycling technology can greatly expand the range of waste plastics that can be recycled, and plastics produced through chemical recycling have the same properties as new plastics. In June 2024, the State Administration for Market Regulation issued the "Guidelines for the Recycling and Reuse of Plastic Waste," categorizing chemical reuse as a form of material recovery, which has once again increased the attention on chemical recycling. In response, some companies have stated, "The release of the 'Guidelines' makes us more determined to make chemical recycling our main development direction, accelerating deployment around chemical recycling, and continuously exploring the best solutions for waste plastic recycling and reuse."

Enterprises respond actively, accelerating project implementation.

Huicheng Environmental ProtectionScale-up project:The 200,000-ton/year mixed waste plastics comprehensive utilization project of Dongyue Chemical, a subsidiary of Huicheng Environmental Protection, was successfully ignited on April 8, 2025.On July 19th, the project achieved its first product delivery, marking the global debut of a large-scale mixed waste plastic chemical recycling project utilizing the "one-step process." This breakthrough has bridged the "last mile" in transforming low-value waste plastics into high-value products.The total investment of the project is 1.5 billion yuan. It has been selected as a key project of Guangdong Province for 2025. The supporting 1 million tons/year mixed waste plastic resource recycling project has been included in the preliminary preparation plan for key construction projects in Guangdong Province for 2025.

Huicheng Environmental Protection Pyrolysis Unit Corner

The 3rd Chem-RePlas2025 Forum on Chemical Recycling of Waste Plastics has invited experts from Huicheng Environmental Protection to deliver a speech titled "From Pilot to Production: Key Milestones and Challenges in the Commercialization Path of Thermal Cracking."

Shandong Research and Control Project:On April 28, 2025, the Shandong Yankong waste plastic chemical recycling project, supported by Zhejiang KEMAO's technical support, commenced in Weifang. With a total investment of 355 million yuan, the project aims to annually produce 30,000 tons of environmentally friendly high-value-added solvent oil. The products will be widely used in fields such as recycled plastic production and will be exported to countries and regions including the EU and Saudi Arabia.

Closed-loop industrial chain :In April 2024, Chemom, Jingbo Petrochemical, and Jingbo Polyolefins collaboratively completed China’s first chemical recycling closed-loop project for waste plastics. This project was funded by Shiseido China. Chemom converted waste plastics into pyrolysis oil (COMY Oil) through a chemical recycling facility. Jingbo Petrochemical processed the pyrolysis oil into propylene monomers via a catalytic cracking unit. Jingbo Polyolefins then polymerized the propylene monomers into virgin-quality PCR (post-consumer recycled) polypropylene resin, which was subsequently molded by packaging manufacturers into new cosmetic containers. This completed the closed-loop industrial chain of “plastic packaging waste to food-grade new plastic packaging” through primary-level recycling.

Institute of Rock and Soil Mechanics Waste Plastic Film ProjectOn October 15, 2024, the waste plastic cascade reduction and efficient liquefaction dechlorination (RDC) unit reactor, independently developed by the Research Institute of Petroleum Processing (RIPP), passed factory acceptance and was shipped from Nanjing. As the core equipment of the 35,000-ton/year continuous pyrolysis industrial demonstration project for waste agricultural film at the Tarim Branch of Sinopec, the successful delivery of the complete RDC system marks the commencement of the world's first industrial demonstration project for chemical recycling of waste agricultural film and plastics.

Aerospace Pyrolysis Project:At the beginning of 2024, the first industrial application demonstration project of aerospace pyrolysis technology by Beijing Aerospace Power Research Institute was officially launched: a 50,000-ton/year waste plastic chemical recycling coupled with oil sludge resource utilization project. This project marks the first commercial application of the original aerospace pyrolysis technology, with a single-unit processing capacity of 200 tons per day. Upon completion, the project will enable high-value resource utilization of waste plastics from domestic garbage and agricultural films in the Hetao region of Inner Mongolia, as well as hazardous oilfield oil sludge.

Yangtze River Delta National Innovation Center and Shanghai Chemical Industry Park Project:In early 2025, the Yangtze River Delta National Innovation Center and the Shanghai Chemical Industry Park successfully delivered the "turnkey" for their first "equity-investment-combined" joint project — a pilot base for the industrialization of waste plastic to specialty chemicals. The Shanghai Chemical Industry Park handed over a Class A chemical plant covering an area of 1,400 square meters to the major project company of the Yangtze River Delta National Innovation Center — Shanghai Ruishu Lvhuan New Material Technology Co., Ltd. The plant is currently being used as Ruishu Lvhuan's pilot base with a capacity of thousand tons.

Jiahe Juno Cooperation Project:On August 8, 2025, the Jiahe Juneng Weifang Low-Carbon Circular New Materials Project was officially put into operation. The project is located in the Weifang Binhai Economic and Technological Development Zone, covering an area of 89 mu, with a total investment of 450 million RMB. It is jointly invested and constructed by Jiahe Juneng and Sinoma Energy Conservation. The project has a total designed capacity of 60,000 tons per year of plastic oil and will be implemented in two phases. The first phase, with a capacity of 30,000 tons, began construction in November 2024 and entered the trial operation and commissioning stage in August 2025.

Korea, Japan, India: RecyclingPilot technology and circular polymer layout

South Korean companies are at the forefront in handling hard-to-recycle composite plastics.

LG Chem:To recycle composite plastics that are difficult to recycle mechanically, LG Chem has invested in supercritical pyrolysis technology. Even composite plastics such as snack and food packaging, as well as contaminated plastics that are hard to recycle mechanically, can be recycled and reused through this process. LG Chem has established Asia's first supercritical pyrolysis plant. Its chemically recycled plastic product, Circular Balanced, is produced using pyrolysis oil derived from supercritical pyrolysis of waste plastics. The performance is comparable to that of traditional petrochemical products and can be integrated into existing production systems. With ISCC Plus certification, customized supply can be achieved.

LG Chem's Pyrolysis Oil

SK Geo Centric Collaboration Project: SK Geo Centric In collaboration with Plastic Energy from the UK, there are plans to construct a waste plastic pyrolysis plant in Dangjin, Chungcheongnam-do, South Korea. This project follows SK Geo Centric's chemical recycling plant in Ulsan, which is expected to be completed by the end of 2025 and begin operations in 2026, with an annual recycling capacity of approximately 320,000 tons of waste plastic.

Japan and India: Technological Pilot and Circular Polymer Layout

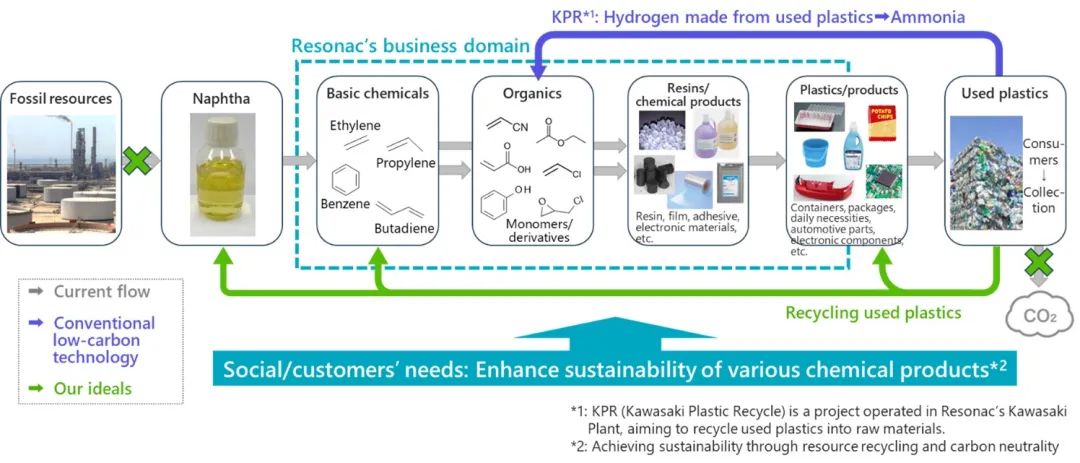

Exploration of Microwave Pyrolysis in JapanResonac and Microwave Chemical have jointly launched a project aimed at developing chemical recycling technology. Since 2022, the two companies have been collaborating on the development of this technology, which uses microwave pyrolysis to break down plastics into basic units. The project plans to carry out pyrolysis of plastics at a demonstration scale of thousands of tons, with the goal of processing several thousand tons of plastic per year. It is also committed to addressing potential challenges that may arise during future commercialization.

Microwave Pyrolysis Process

Reliance Industries and PolyCycl:Reliance Industries produces ISCC-Plus certified circular polymers at its Jamnagar refinery; PolyCycl has launched the "sixth generation" (Gen VI) chemical recycling technology, which combines continuous pyrolysis with PyOilClean pyrolysis oil purification technology. This reduces impurities in pyrolysis oil without the need for hydrogenation, achieving a conversion rate of 75%. PolyCycl operates a continuous chemical recycling demonstration plant in Chandigarh, India, utilizing its proprietary AutoCharRemoval reactor design.

The EU promotes chemical recycling through dual support of policies and funding.

France’s 500 Million Euro Plan:In February 2025, the European Commission approved a €500 million French scheme under EU State aid rules to support chemical recycling projects for mixed and/or contaminated waste plastics. The types of plastic waste covered by the scheme include pallets, films, non-beverage bottles, and textile materials containing a certain proportion of polyester. The scheme applies to companies of all sizes and sectors, with aid provided in the form of direct grants, up to a maximum of 40% of project costs. The European Commission stated that the scheme is “necessary and appropriate” to promote chemical recycling of plastics and has an incentive effect, as the relevant companies would not make these investments without public support. France has put in place sufficient safeguards to ensure that the scheme has a limited impact on competition and trade within the EU.

OMV ReOil® Plant:OMV has signed a grant agreement with the European Union's Climate, Infrastructure and Environment Executive Agency (CINEA) to receive funding of EUR 81.6 million for the planned industrial ReOil® plant. This is the first time OMV has received such a grant, and it is the largest single public project funding they have received. The plant is expected to process 200,000 tons of waste plastics annually, which would otherwise be destined for landfill or incineration, converting them into sustainable base chemicals through OMV's proprietary ReOil® chemical recycling technology. These chemicals will be used for the production of chemical products, including new plastics. The final investment decision for the project is pending OMV's final approval.

OMV ReOil Chemical Recycling Project

Aduro collaborates with Cleanfarms:2In May 2025, Aduro Clean Technologies signed a memorandum of understanding with Cleanfarms to explore commercial pathways for addressing hard-to-manage agricultural plastics. Aduro's Hydrochemolytic™ technology will be used for the chemical recycling of farm plastic waste, such as silage films and bale wrap. As a producer responsibility organization in Canada, Cleanfarms has extensive experience in agricultural waste management and a nationwide supply chain. The collaboration will proceed in three phases: first, laboratory feasibility testing; next, scale-up and modeling; and finally, the inclusion of agricultural plastics in a demonstration plant. This partnership aims to promote the resource recovery and circular economy of agricultural plastics, reduce landfill, and create new value from agricultural waste.

Dow Inc. invests in Xycle.March 2025,Dow Inc. announced its investment in Xycle, a Dutch pioneer in advanced recycling technology, joining other investors to support the construction of the first commercial-scale chemical recycling plant. The plant, located at the Port of Rotterdam, is expected to start operations in the fourth quarter of 2026 and will process 21,000 tons of plastic waste annually. Xycle employs low-temperature pyrolysis technology to convert hard-to-recycle plastics into pyrolysis oil, which serves as a feedstock for producing new plastics. Dow will purchase these circular feedstocks to manufacture high-value plastics used in food packaging, medical, and automotive parts. By the end of 2024, Dow will also collaborate with Innventure to develop and commercialize chemical recycling technologies. Innventure has established a subsidiary, Refinity, to commercialize these technologies. Refinity will work with Dow to scale up and promote technologies aimed at converting mixed waste—including hard-to-recycle plastic waste—into petrochemical feedstocks.

Germany Pruvia ProjectOn February 26, 2025, German chemical recycling company Pruvia announced the construction of a pyrolysis plant with an annual processing capacity of 35,000 tons. The construction is expected to start in June 2025, with operations commencing in the fourth quarter of 2026. The company plans to double the capacity to 70,000 tons per year by 2028. Pruvia's proprietary continuous pyrolysis technology, LML-R, has been validated at a 100 kg/h pilot facility in Campania, Italy (operational since 2020), and at an industrial demonstration plant in Leuna, Germany (operated in collaboration with the Fraunhofer Center for Chemical-Biotechnological Processes since the end of 2023).

Pruvia Chemical Recycling Project

Swiss company Enespa acquires PlastEco.On January 30, 2025, Swiss company Enespa acquired a 40% stake in Finnish chemical recycling startup PlastEco and will deliver a pyrolysis plant to it. The first module of the plant is scheduled to be put into operation in Lahti, Finland, in April 2025, capable of processing 5 tons of waste plastic per day and producing pyrolysis oil that can be fully reused as plastic raw material. Enespa plans to deliver more plants to PlastEco annually and expand the existing capacity.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track