A 12 Billion Yuan Gamble on POE Localization: High-End New Materials Sector Welcomes Another Disruptor

China’s POE sector has finally achieved a major breakthrough! The first phase of Dingjide’s high-end new materials project, with an investment of 12 billion yuan, will officially begin production on September 30. This signifies that the long-monopolized polyolefin elastomer (POE) market, previously dominated by overseas manufacturers, is about to witness another key moment of domestic substitution.

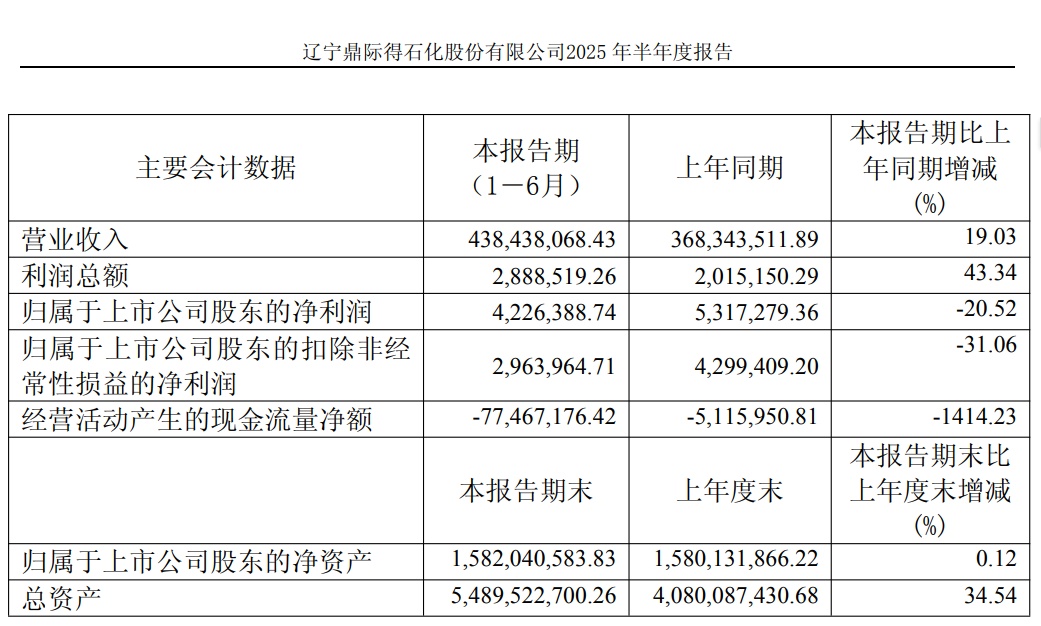

Profit down 20% in the first half-year financial report

Recently, Dingji De Company announced its semi-annual report for 2025. In the first half of 2025, the company achieved operating revenue of 438 million yuan, a year-on-year increase of 19.03%; net profit attributable to shareholders was 4 million yuan, a year-on-year decrease of 20.52%; and net profit attributable to shareholders after deducting non-recurring gains and losses was 3 million yuan, a year-on-year decrease of 31.06%. In the second quarter of 2025 alone, operating revenue reached 239 million yuan, a year-on-year increase of 28.63% and a quarter-on-quarter increase of 19.71%; net profit attributable to shareholders was 8 million yuan, a year-on-year increase of 583.76% and a quarter-on-quarter increase of 325.40%; net profit attributable to shareholders after deducting non-recurring gains and losses was 8 million yuan, a year-on-year increase of 643.02% and a quarter-on-quarter increase of 255.31%.

In the first half of 2025, facing increased industry competition and the risk of raw material price fluctuations, the company remained steadfast in its strategic goals, deepened industry chain collaboration, and strengthened its customer customization service capabilities, ensuring smooth production and operations. Production and sales volumes remained stable with slight growth, consolidating the company's leading position in the fields of polymer material core additives and catalysts.Key focus areas POE Localization process, optimize POECatalyst system to enhance α-Olefin self-sufficiency rate.

Dingjide Company is one of the few domestic professional suppliers that possess both high-performance polymer material catalysts and chemical additives products. The company's main cooperative clients include state-owned enterprises such as the three major oil companies and Wanhua Chemical, as well as private refining companies like Baofeng Energy. Since 2024, affected by the macroeconomic situation, the chemical industry has been under significant downward pressure, with market demand declining and competition intensifying. The terminal sales prices of the company's products have dropped significantly, while the decrease in procurement prices of production raw materials has been much slower than the decline in terminal sales prices. Market demand has decreased, leading to a reduction in orders and gross profit. Meanwhile, the subsidiary, Petrochemical Technology, is in the project construction phase, resulting in a significant increase in related management expenses. Additionally, the costs of equity incentives are allocated according to regulations. These multiple factors have collectively led to an increase in overall expenses for the company and a narrowing profit margin.

Based on the data, it is evident that Dingjide's revenue and profit in the second quarter have improved quarter-on-quarter, signaling a "turning point" in performance. This indicates that the short-term pressures from previous product price fluctuations and increased project investments have gradually eased, while market attention is more focused on the upcoming POE (polyolefin elastomer) project.

Developing a New Growth Curve—POE

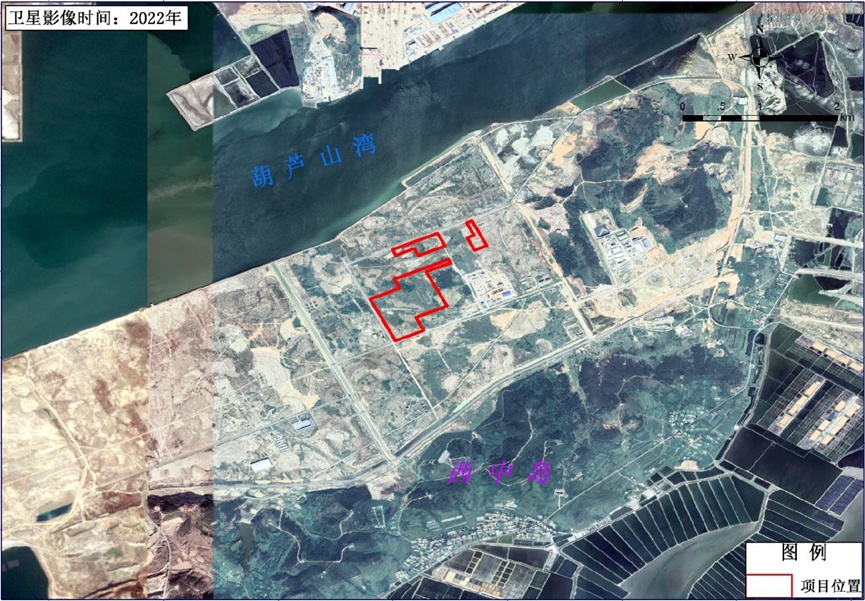

Dingji De Company, with its controlling subsidiary Petrochemical Technology as the main entity, is investing in the construction of a high-end POE new materials project. The project is planned in one phase and implemented in two stages, with a total construction period of 5 years.

The "POE High-end New Materials Project" by Dingjide has passed the investment amount change plan, with the total investment adjusted from the original 10 billion RMB to the current plan of approximately 12 billion RMB. The project is divided into two phases: Phase one primarily involves the construction of a 200,000 tons/year POE joint unit, a 300,000 tons/year α-olefin unit, and a 400 Nm³/h water electrolysis hydrogen production unit; Phase two mainly involves the construction of a 200,000 tons/year POE joint unit and a 250,000 tons/year carbonate unit.

The first phase is expected to be put into production in September, and the second phase is planned to be put into production by the end of 2027. After the project is operational, the estimated annual average revenue will be 11.1 billion yuan, which will effectively address the "bottleneck" issues, fill domestic gaps, and achieve partial import substitution.

Image: Location of the POE project by Dingjide (Image source: Shuttle Dalian)

Public information shows that POE (polyolefin elastomer) materials combine flexibility and weather resistance, and are widely used in fields such as photovoltaic encapsulant films, automotive interiors, and medical consumables. In 2024, domestic consumption reached 910,000 tons. However, core production capacity has long been monopolized by overseas companies, with the domestic localization rate close to zero, indicating vast potential for import substitution. Since embarking on its POE project, Dingjide has constructed a cost barrier that is difficult for the industry to replicate by achieving full industry chain localization, making it a key factor in breaking the overseas monopoly. In the crucial catalyst segment, its investment is 65% lower than its peers (only 70 million RMB versus the industry’s 200 million RMB); the core raw material, alpha-olefin, is self-produced at half the cost; and in-house production of stabilizers avoids price fluctuations from external purchases. Final calculations show that after depreciation, the unit cost is only 10,000 RMB/ton. If the price of ethylene subsequently drops to 6,600 RMB/ton, the cost could be further reduced to 8,500–9,000 RMB/ton.

In June 2025, the pilot plant for the "High-end New Materials" project of Petrochemical Technology successfully commenced trial production with the joint efforts of the company’s management and all employees, and has produced qualified POE products. The production operation is stable, and the product specifications align with international standards for similar products, laying a solid foundation for the smooth commissioning of the Petrochemical Technology’s "High-end New Materials" project with an annual output of 200,000 tons of POE. The successful start-up of the pilot plant also validated the various indicators of the metallocene catalyst for POE independently developed and produced by Petrochemical Technology, reaching an industry-leading level.

Currently, this cost advantage has translated into landing certainty: according to disclosures, mainstream companies such as Dawn Polymer, Huitong Technology, and Kingfa Sci. & Tech. have reported that product performance meets expectations. Products for the photovoltaic sector have also passed in-depth testing by leading downstream photovoltaic enterprises, with weather resistance and mechanical properties meeting application standards. Framework procurement agreements are gradually being implemented, and order reserves are approaching saturation. According to the plan, the POE production line will officially commence operation in September. Industry analysis believes that the current POE market price is at a historical low. Coupled with the continuous growth in demand from domestic photovoltaic and automotive industries, and considering the projected domestic POE demand of 1.25 million tons by 2025, the logic of “rising volume and price” during the industry recovery period has become clear. Dingji is expected to leverage its cost advantage to quickly capture market share in the domestic substitution process, fully unleashing its performance potential.

Source: Liaoning News

3. POEDomestic production capacity breakthrough

In 2024, the domestic consumption of POE is approximately 910,000 tons, with an import dependency of over 90%, indicating a vast potential for domestic substitution.

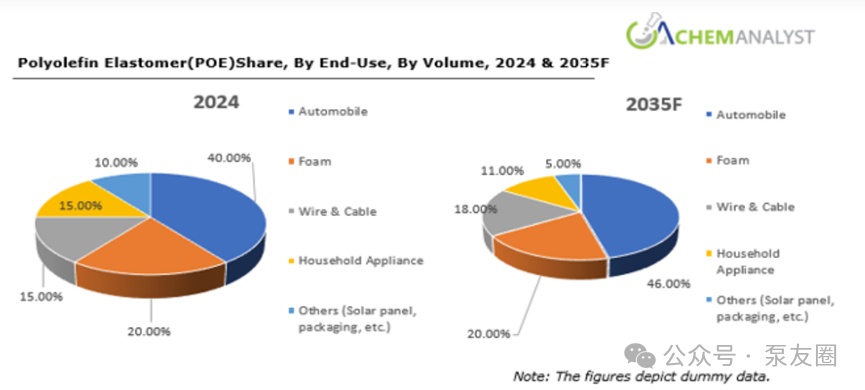

Specifically, global POE consumption is mainly focused on modification, including direct modification, graft modification, and foam modification, and is used in fields such as automobiles, photovoltaics, construction, and home appliances. Among these, the automotive sector accounts for as much as 51% of demand, followed by photovoltaics, construction, and home appliances, which account for 18%, 15%, and 11% respectively. For the automotive sector, downstream customers typically have high requirements for long-term stable supply and product quality consistency. In addition, with the continued rapid growth of global photovoltaic installations and the increasing penetration of POE films, photovoltaics has become the fastest-growing area of demand for POE products.

The future growth drivers of POE mainly come from the surge in photovoltaics, automotive lightweighting, rising demand for healthcare, and trends in sustainable material substitution.

Currently, China has proposed or is constructing approximately 5 million tons of POE production capacity, which will completely change the global supply landscape in the future (Source: Pump Friends Circle).

December 23, 2023BeioyiThe new product launch of Polyolefin Elastomer (POE) has been announced, with the successful commissioning of China's first industrialized POE production unit, independently constructed by Beo Yi Company. This facility is the first in the country to mass-produce polyolefin elastomers (POE) with an annual capacity of 30,000 tons, marking the official start of POE localization. On April 13, 2024, Beo Yi's domestically industrialized photovoltaic-grade polyolefin elastomer (POE) was successfully loaded and dispatched, heading to Changzhou Sveck Photovoltaic New Material Co., Ltd., thereby achieving the first batch sales of photovoltaic-grade products from the country's first industrialized POE unit.

Wanhua ChemicalAround 2016, Wanhua Chemical began the research and development of POE, positioning it as one of its fourth-generation products. The first phase of Wanhua's POE (polyolefin elastomer) project, with an annual capacity of 200,000 tons, is expected to be put into operation in the first half of 2024. The second phase, located at the Penglai site, with an annual capacity of 400,000 tons, is already under construction and is expected to be completed and put into operation by the end of 2025. By then, Wanhua's total POE production capacity will reach 600,000 tons per year.

Maoming PetrochemicalThe 50,000-ton/year POE unit operated steadily in June, with the load increased to 60%. The products are mainly general-purpose grades, filling the gap in the domestic mid-to-low-end market.

Jiangsu HongjingA 100,000-ton POE plant started trial production in June, with 70% of its capacity targeting automotive modified materials (already certified by BYD and CATL) and 30% supplying photovoltaic encapsulant films. It is equipped with a 100,000-ton α-olefin unit to achieve self-sufficiency in raw materials.

4. Opportunities and Challenges Behind the High-End New Materials Sector

Despite a 20.52% year-on-year decline in net profit in the first half of the year, Dingjidede is still pushing forward with its POE (polyolefin elastomer) project, which has a total investment of 12 billion yuan and is about to commence production in its first phase. This strategic choice clearly reflects the structural changes in the current chemical industry: the profits of traditional bulk chemicals continue to decline, and opening up new avenues in high-end new materials has become a necessary option.

Under the wave of domestic substitution, materials such as POE, which have long relied on imports, have become key areas for domestic enterprises to focus on. However, the path for domestically produced POE is not without obstacles. Companies like Dingji and others still face three major practical challenges:

First, technological stability is the core bottleneck for large-scale production. From successful pilot tests to continuous stable mass production, it is still necessary to overcome numerous challenges such as maintaining the activity of metallocene catalysts and ensuring batch consistency of products. This poses extremely high demands on process control and catalyst lifespan.

Secondly, the risk of a counterattack by international giants cannot be ignored. In the past, during the localization process of materials such as MDI and PC, overseas giants have adopted price reduction strategies to squeeze the profit margins of domestic companies. The POE market is still dominated by overseas leaders, and the possibility of a price war is relatively high.

Finally, the downstream certification cycle is long, especially for photovoltaic modules which require 6-12 months, and the automotive sector even needs up to 2 years, resulting in the domestic POE material market penetration being unable to improve rapidly, making it difficult to support performance in the short term.

Despite ongoing challenges, POE, as an indispensable material in the photovoltaic N-type cell and new energy vehicle lightweighting processes, has made a key breakthrough in localization. This high-barrier, high-value track is attracting more and more Chinese companies to heavily invest in the future.

Editor: Lily

Source: China Chemical Industry Park, Changjiang Securities, Pump Friends Circle, Chemical Industry Watch

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track