80% of Store Sales and Profits Decline, Nearly Half of Dealers Suffer Losses, 4S Shops Strike Back at After-Sales… Stores Caught in a "Double Squeeze"?

AC Auto's inventory of the top 50 most discussed topics in 2025 found that new energy, insurance, repair monopoly, 4S store reshuffle, loss dilemma, technician shortage, survival of repair shops, and policies have become the annual keywords.

Key Data

The data, such as "a shortage of 820,000 new energy vehicle maintenance technicians" and "a 70% turnover rate of technicians leaving the industry," directly reflect the core bottleneck faced by the new energy vehicle aftermarket—talent shortage. As the number of new energy vehicles surges, the speed of training professional maintenance personnel is far behind market demand, which has become a key factor restricting industry development and the improvement of service quality.

The "over 30,000 4S shops" experiencing a wave of closures is the most direct evidence of the massive impact faced by the traditional 4S system in 2025. Under multiple pressures such as the impact of the direct sales model of new energy vehicles and declining profitability, the traditional dealership network is undergoing profound reshuffling and restructuring.

The three major insurers have underwritten "24.2 million" new energy vehicles but are still facing losses. This huge contradiction highlights that the insurance business for new energy vehicles is currently in an industry-wide predicament. It profoundly reflects the unequal game between insurance companies and manufacturers regarding pricing and claims data, which is a core contradiction that urgently needs to be addressed in the current new energy ecosystem.

In the context of the broader environment, let's review the survival status of core participants in the industry: 4S dealerships, repair shops, and beauty shops.

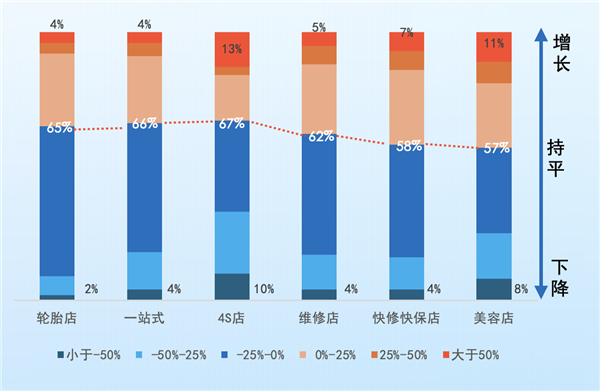

According to F6 data, the growth rate of entry visits to 4S shops is the worst, while quick repair and maintenance shops, as well as beauty shops, show strong market resilience. AC Automotive will conduct a brief review of the operating conditions of these three types of stores.

Chart: Year-on-Year Growth Rate Distribution of Different Types of Store Visits in the First Half of 2025

4S dealer counterattack after-sales

The survival situation of dealers has further deteriorated.

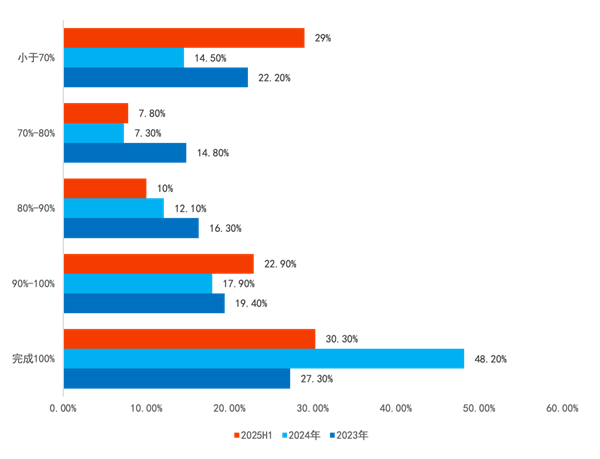

New car losses worsen, while after-sales, finance, and new energy advantages expand.

In 2024, nearly 50% of car dealers achieved their annual sales targets, an improvement from 27.3% the previous year. Among them, luxury brands performed slightly better in meeting their targets compared to joint venture and domestic brands. The reasons for this are twofold: on one hand, new policies effectively stimulated automotive demand; on the other hand, manufacturer support measures such as cash subsidies, relaxed assessment targets, and reduced sales target discounts alleviated dealer pressure. However, the number of dealers withdrawing from the network reached 4,419, indicating that the market situation for 4S dealer groups remains challenging.

In the first half of 2025, only 30% of dealers achieved their sales targets, a decline of 18% compared to 2024, indicating a further deterioration in the survival conditions of car dealers.

Chart: Dealer Sales Target Achievement (2023 vs. 2025H1)

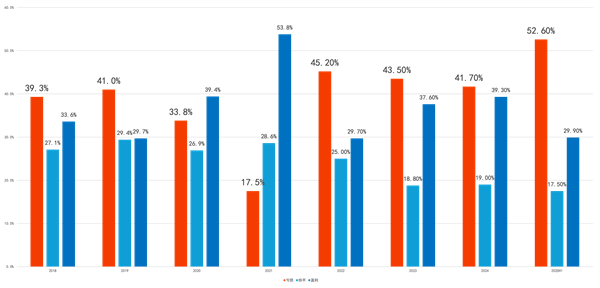

The comparison of dealer profitability from 2022 to 2024 shows a continuous downward trend in the proportion of losses over the three years. In the first half of 2025, the proportion of car dealers experiencing losses rose to 52.6%, with nearly half of the dealers operating at a loss.

Graph: Profitability of Distributors from 2018 to H1 2025

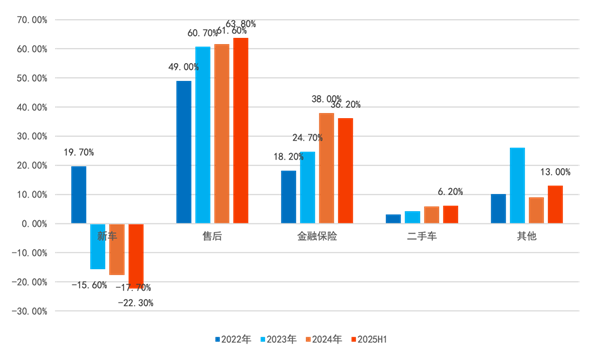

In terms of revenue share, the price war remains intense, with an increase in both the number of discounted models and the extent of price reductions. The proportion of new vehicle revenue and profit has significantly declined, while the improvements in financial services, insurance, and after-sales have been more apparent.

Figure: Dealer Overall Profit Structure 2022-2025 H1

In response to poor profitability, dealers mainly focus on after-sales services, sharing some operating costs by renting out workshops and accepting maintenance and repairs for other brands. However, in terms of parts absorption rates, traditional brands have an advantage over new energy brands. Dealers are adopting a more open attitude to seek external cooperation, and there will be more collaboration opportunities in after-sales services, such as car wraps and light modifications.

The auto repair shop is caught in a "double squeeze."

Double decline in output/profit, price war/marketing war continues.

The losses from new cars at 4S stores have led to an unprecedented emphasis on after-sales service. On one hand, they are accelerating cooperation with new energy vehicle manufacturers, and on the other hand, they are increasing investments in services such as car coverings, washing and beautification, and bodywork painting. This has also, to some extent, encroached on the market share of independent after-sales service.

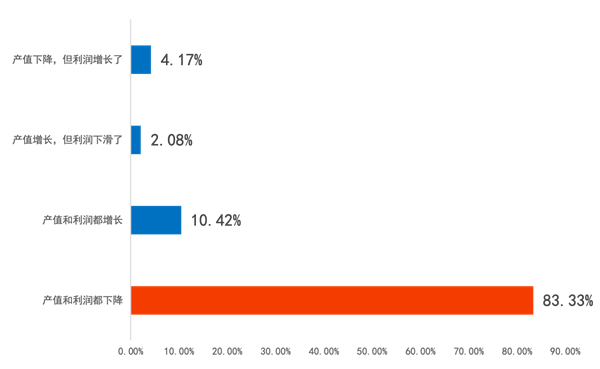

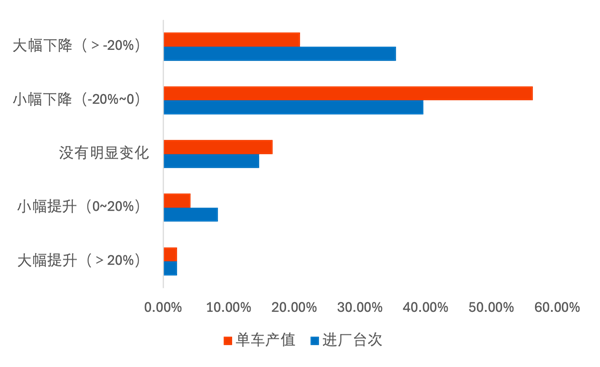

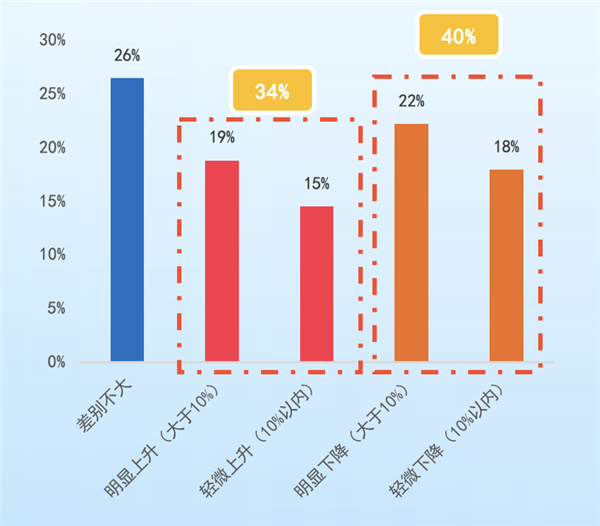

In the first half of 2025, a survey conducted by AC Auto on the operation of automotive service stores (sampling survey) showed that over 80% of independent aftermarket stores experienced a decline in both output value and profit. The main reasons for this were customers replacing old cars with new ones, price competition, and the diversion of business through new media channels. Price wars and marketing battles are still ongoing.

Graph: Performance of Automotive Service Stores in Terms of Output Value/Profit/Number of Vehicles Serviced in the First Half of 2025

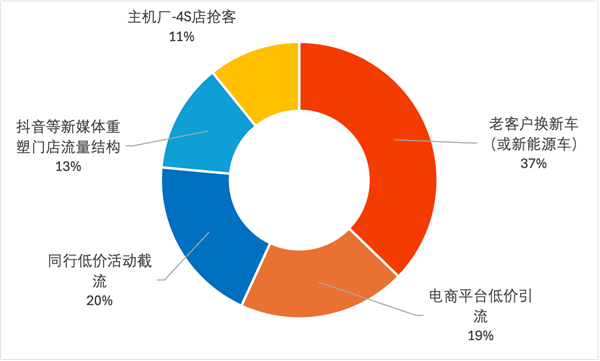

In 2025, the customer traffic structure in automotive service stores is undergoing significant changes. The most significant factor driving current changes in store traffic is existing customers replacing their old cars with new ones, particularly new energy vehicles (NEVs). As the penetration rate of NEVs continues to rise and the vehicle replacement cycle for consumers gradually shortens, there is customer attrition as original customers replace their old cars, especially with NEVs.

Secondly, there is the price war. Price-sensitive customers are more easily attracted by short-term discounts, leading to customer diversion. Online platforms attract car owners to place orders online and receive in-store services through subsidies and package deals, gradually changing customer consumption paths, which has a dual impact of both drawing and diverting customers from traditional stores.

The enhanced after-sales service of 4S stores and the overtaking on curves in the video era pose challenges to many traditional stores.

Figure: Reasons for Changes in Store Traffic in the First Half of 2025

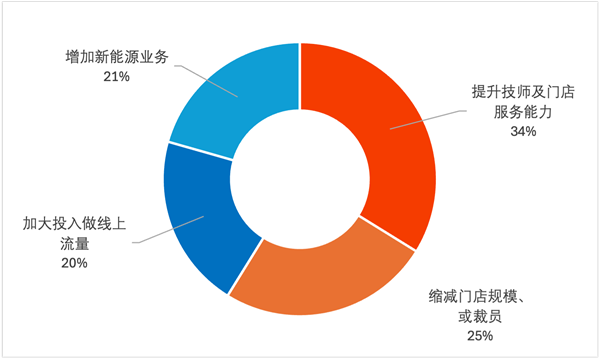

In response to market competition, many stores are enhancing their service capabilities (accounting for 34%) while increasing their investment in new energy and online marketing.

Figure: Store Response Strategies to Market Changes

In 2025, the customer flow structure of car service stores is shifting from "natural traffic" to "diversified drivers". Customer retention, pricing strategy, online channel layout, and content marketing have become important variables affecting the survival and development of stores.

AC Auto believes that stores should improve in the following four areas: first, strengthen the maintenance of old customers and awaken dormant customers; second, respond reasonably to price competition to avoid falling into a vicious cycle of low pricing; third, actively layout new media content on platforms like Douyin, accurately target audiences, and build store IP; finally, collaborate with e-commerce platforms to broaden traffic channels and enhance service conversion capabilities.

The car beauty shop is relatively resilient.

Is the beauty business a "lifesaver"?

AC Auto will release the "2025 Car Wrap and Film Store Research Report" during the summit on November 24-25. Before the official release, some key data on store operations will be shared.

Compared to 4S shops and auto service shops, the business situation of car film shops is more optimistic, with 60% of the shops showing stable or growing conditions. (It is worth noting that this survey result is consistent with the related business conditions of F6 beauty shops.)

Graph: 2025 Store Operations of Car Wrap Films

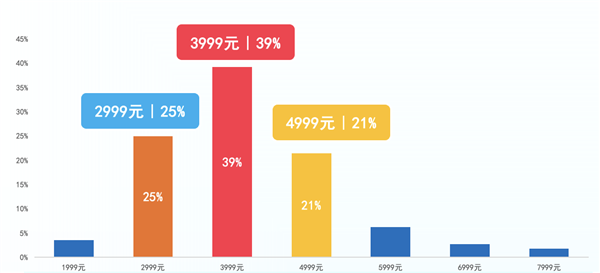

In terms of price, AC Auto conducted research from the perspectives of both car owners and stores. A price of 3999 yuan is seen as the end of market price competition, with nearly half of store owners believing that the price of mainstream basic car covers will be around 4000 yuan. However, the expected price for 2024 is around 6000 yuan—indicating that the price war for car covers is not over yet.

Diagram: The Price Floor of Basic Mainstream Car Covers in the Eyes of Store Owners

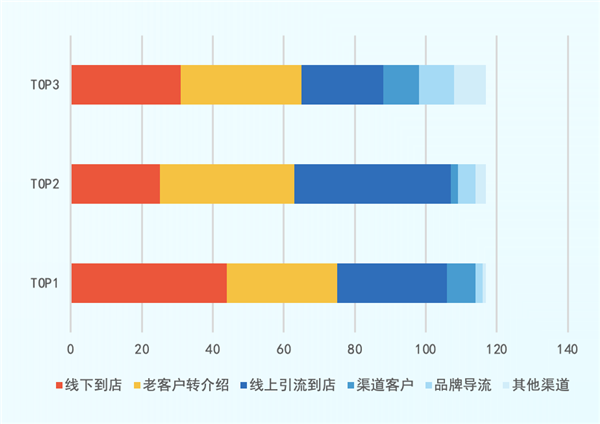

In terms of customer traffic, offline in-store users remain the core contributors to value, but the proportion of online traffic is increasing year by year. At the same time, brands and multi-channel customers are also empowering store operations. More and more brands are establishing headquarters live streaming rooms to assist franchise stores in brand strength, product strength, and marketing capabilities.

Figure: Customer Sources for Car Wrap Film Stores in 2025

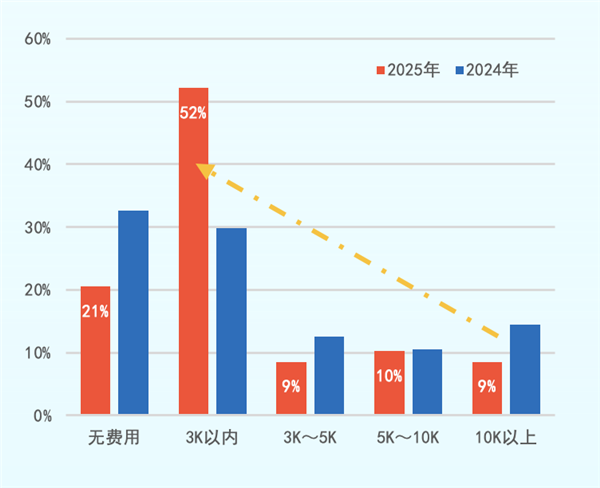

In terms of marketing expenses, as short video platforms pass the window period (with the aftermarket sector developing relatively later than other industries), most stores have fallen into a marketing dilemma of "no traffic without investment." For individual stores, continuous investment results in a relatively low ROI. Therefore, compared to the data from 2024, stores in 2025 will control their monthly marketing budget to within 3,000 yuan.

Graph: Marketing Expenses for Car Wrap Stores in 2025

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track