8 major 4s groups overview: New Car Sales Loss Exceeds 2.5 Billion, Difficulty in Making Profit from After-Sales Increases, Polarization Becomes More Apparent

Recently, major listed 4S groups have successively released their financial reports for the first half of the year. As expected at the beginning of the year, revenue performance continues to be on a downward trend. Affected by the price inversion of traditional fuel vehicles, especially luxury brands, the profits of some groups have plummeted significantly.

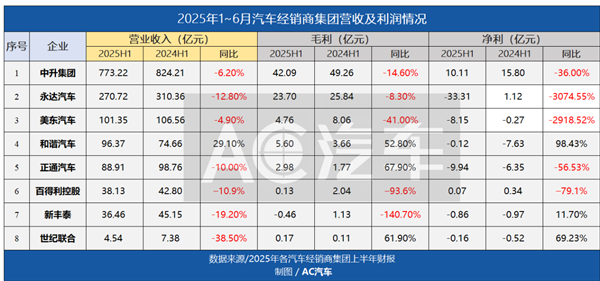

AC Auto compiled semi-annual reports from 8 4S groups, with 7 experiencing a decline in revenue, including a drop of over 38% for Century United. Net profits fell for 5 companies, with Yongda experiencing a staggering decline of 3074%. The notion that "selling cars is not profitable" has triggered a severe "butterfly effect."

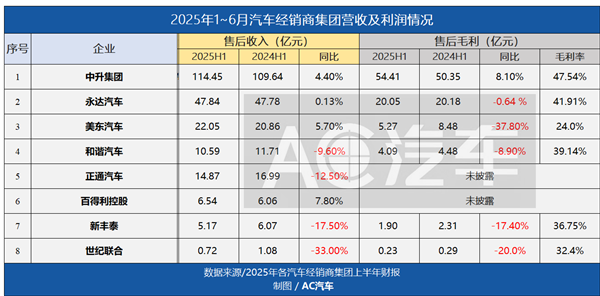

The much-anticipated after-sales business performed moderately overall, with four companies including Zhongsheng showing slight growth. However, there were also four companies whose revenue declined, with most seeing drops of more than 10%. After-sales gross profit margins varied, with Zhongsheng having the highest at over 47%, while Century United maintained the "passing line" of 32%.

Affected by the continuous price reduction of new cars, many groups' used car businesses are generally experiencing a situation of "increased volume without increased revenue" and "increased revenue without increased profit." The collapse of the price order for used cars is evident not only in traditional fuel brands but also in new energy brands, where rapid model updates have led to older models being heavily discounted or even left unasked for.

In terms of brand authorization and outlet layout, groups like Zhongsheng continue to adhere to the "focus" strategy, integrating luxury brand advantage location stores in multiple provinces and cities. Harmony Auto is accelerating its expansion overseas, and after Hong Kong, it is making in-depth layouts in Southeast Asia. Embracing new energy and accelerating transformation has also become the new battleground for competition.

In the current state of accelerated differentiation in the automobile market, any operational moves in any sector of the 4S group must be made with caution. The profit margin is already at its limit, and any transformation bet cannot afford to fail. Consequently, the "giant's turn" has also stirred up waves in the downstream aftermarket.

The more new cars are sold, the more is lost, even industry leaders can't bear it.

In line with overall revenue performance, new car income for the seven 4S groups declined in the first half of the year, with five of them experiencing a drop of over 10%. Among them, Shiji United plummeted by 46%. The gross profit performance has become increasingly bleak, with Baidelai Holdings plummeting by 98.2%, leaving a gross profit of only 3 million yuan, making car sales effectively break-even.

In fact, the 4S group operates with heavy assets. Even for self-owned stores, the team configuration and the occupation of funds for purchasing and sales mean that the stores are destined to be unable to "sell cars at low prices with thin margins and high volume." Therefore, the "break-even" gross profit performance actually hides huge losses, and "the more you sell, the more you lose."

This point is particularly evident in the data from the industry leader Zhongsheng. Compared to the same period last year, new car revenue declined by 4.7%, while gross profit fell by as much as 20%. In the first half of the year, a total of 229,000 new cars were sold, but the gross loss reached 2.388 billion, with a loss of over 10,000 per vehicle.

Similarly, the revenue from new cars at Baideli dropped by 14%, and the gross profit plummeted by 98.2% because it owns more luxury brands such as Porsche and Mercedes-Benz.

In the case of Porsche, domestic sales in the first half of the year decreased by 28% year-on-year, and with the continued sharp decline, Porsche's prices began to soften, and profits are no longer firm. The characteristic of the 4S group's "profit risk reservoir" has led to a rapid shift to losses.

It is not difficult to understand that the used car business of 4S groups has experienced varying degrees of decline: Zhongsheng's used car gross profit was only 257 million yuan, a decrease of 58.4%; Xinfengtai's used car revenue was 160 million yuan, down by 25.9%; even Yongda, which had previously focused on this segment, saw its used car revenue drop by 24.5%.

Overall, although the scale of each 4S group varies, the situation faced by new and used car sales is basically the same. Harmony Auto is the only exception, appearing somewhat "out of place": new car revenue grew by 36.7%, gross profit turned from loss to profit and increased by 231%, driving total revenue growth by more than 29%, becoming the only 4S group to achieve growth against the trend in the first half of the year.

However, upon analyzing the reasons, the answer does not lie domestically. The Hong Kong and overseas markets have become the main growth drivers, with sales reaching 15,725 units, accounting for 51.3% of the total sales, and profits have also been rapidly restored.

Harmony Auto adopts a "low-cost, high-efficiency" operational model, with overseas single-store investment being lower than that of traditional domestic 4S stores. Additionally, the average number of employees per overseas store is also significantly lower than that of traditional domestic 4S stores.

Harmony Auto can be said to belong to a "different track" now. Its domestic market scale is relatively stable, but its overall share is shrinking. The relatively simple overseas markets, especially those that are "lagging in new energy," are the transformation windows it is seizing first.

02. After-sales: "Half are making money, half are struggling," a situation of divergence has already emerged.

In the after-sales sector, the standout is Zhongsheng, with a revenue of over 11.4 billion and a gross profit margin as high as 47.54%, "far ahead" of the competition. However, Yongda, which ranks second, is not far behind, with after-sales accounting for 17.7% of its total revenue, demonstrating a higher revenue-generating capability within the group compared to Zhongsheng.

In sequence, Zhongsheng stated in its financial report that the considerable after-sales performance benefited from 4.54 million active customers and a corresponding after-sales output value of 4 million yuan, which increased by 15.2% and 1.7%, respectively.

Since the end of 2024, Zhongsheng has conducted restructuring and adjustments for over 20% of its stores, including but not limited to converting stores with weak sales capabilities into after-sales service centers, aiming to "improve quality and efficiency" in customer after-sales experience.

In addition, Zhongsheng handled 990,000 vehicle insurance renewals in the first half of the year, a year-on-year increase of 10.6%. Including new car policies, the total reached 1.2 million, a year-on-year increase of 8.6%.

It can be said that "insurance + accident car" remains a key focus for Zhongsheng, and with the construction and use of large-scale paint and body centers, Zhongsheng is implementing a "scale + efficiency" strategy.

For Yongda, "insurance + accident vehicles" is also a dual core. As mentioned in their financial report: adhering to the strategy of all-staff marketing for accident leads, applying vehicle-related insurance products and digital management tools, which led to a 4.8% increase in the number of sheet metal spray jobs in the first half of the year. Additionally, by deepening strategic cooperation with insurance companies around the concept of "repair instead of replacement," both premiums and the number of jobs increased by more than 5% in the first half of the year.

Bidelux, primarily dealing in luxury cars, has not disclosed the gross profit data for its after-sales business. However, in its financial report, the company stated that it enhances the frequency of car owners returning for services by focusing on "service experience" through measures such as dedicated advisors, priority appointments, and value-added benefits. After-sales satisfaction has become the main reason for driving the growth of after-sales revenue, achieving a cumulative after-sales service of 504,000 units in the first half of the year, showing an increase compared to previous years.

However, it is particularly noteworthy that the after-sales services of 4S groups have begun to show differentiation.

Century United's after-sales revenue plummeted by 33%. Excluding the impact of closing underperforming stores to stop losses, even well-operated stores struggle to stand out on their own in the fiercely competitive after-sales sector. Surrounding 4S shops and various independent after-sales outlets are all eroding the store's customer base.

In the first half of the year, Xinfengtai's after-sales revenue and gross profit both declined by over 17%, although the renewal policy volume increased by 19% year-on-year, and the renewal penetration rate increased by 7%. The premium grew by 18%, but the company still lacks effective leverage in the areas of accident car repairs and parts diversification.

In the financial report, it was emphasized that there is a focused transformation in the decoration business. However, a significant proportion of industry practitioners believe that in an environment of shrinking consumption, the total volume of non-essential decoration business has sharply decreased, and a large amount of business has flowed to "high quality and low price" independent after-sales stores.

This perspective is also reflected in Zhongsheng's financial report. In the first half of the year, revenue from the premium business was 1.93 billion yuan, a decrease of 19.7% compared to the same period last year. The main focus of the after-sales segment is inevitably on maintenance, warranty, and body and paint services.

03. The store "outlasts competitors to become the leader," with distinct advantages in "closing, suspending, merging, and relocating."

Outlet redundancy has always been a cause of internal competition and inefficiency among 4S dealerships. Now, with the weakening demand for traditional fuel vehicles, the actions of "closing, suspending, merging, and transferring" stores are accelerating.

The 4S Group is restructuring its internal resources and initiating high-quality asset acquisitions externally, all aimed at increasing the brand's concentration.

As of the end of June, Zhongsheng owned 107 Toyota 4S stores and 58 Lexus 4S stores, making it the largest dealer of the Toyota system in China.

The number of Mercedes-Benz stores is 108, ranking second in the country. These are all part of the "Zhongsheng GO" customer service system, providing a solid foundation.

The adjustment of Yongda outlets is divided into two major sections: fuel and new energy. The fuel vehicle section focuses on luxury brands such as BMW, accounting for 64%.

In the first half of the year, out of the 7 new stores opened, 5 were Hongmeng Zhixing, and among the 14 new energy stores being planned, 13 are Hongmeng Zhixing.

Meidong continues to implement the "one city, one store" strategy, continuously expanding its sales network through new stores and acquisitions. In terms of network changes in the first half of the year, all brands except BMW and Lexus have closed stores.

However, what intrigues the industry is that one of the only two Tesla after-sales service centers in the eastern United States is closing, and this is the only new energy brand tested in the eastern United States.

Overall, by reducing the number of traditional fuel brand stores, 4S groups are able to breathe easier under financial pressure. Amid the wave of "closure, suspension, and merger," more and more cities have only one single-brand 4S store. The strategy of "outlasting competitors to become the leader" means that the remaining stores truly embody "survival of the fittest," with their living conditions significantly improved.

Regarding new energy, leading 4S groups such as Zhongsheng and Yongda have already accelerated their actions, showing no hesitation compared to the first half of 2024.

Many investors have noticed that leading 4S groups are placing more bets on new power brands with strong sales like HarmonyOS Intelligent Drive, Li Auto, and Xiaomi, which obviously creates a competitive situation. Smaller groups have no chance of transformation.

Notably, the notion that "only five new energy brands will remain in the next five years" has been repeatedly emphasized, causing many 4S groups to be pessimistic about the prospects of "ordinary new forces."

It is foreseeable that with the reform and transformation of 4S groups, the car market will develop towards a direction of high resource concentration, both in pre-sales and after-sales.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track