60 days passed, car company payment period promise, don't take it too seriously?

On June 1st this year, the revised "Regulations on Ensuring the Payment of Small and Medium-sized Enterprises" was officially implemented, setting a 60-day payment deadline as a red line to tackle the persistent issue of delayed payments that has long troubled SMEs. Following the policy's implementation, domestic car manufacturers collectively responded with high-profile commitments. More than ten car companies, including BYD, Geely, and Changan, pledged to "reduce the payment period to within 60 days," which was seen as a turning point in the restructuring of the supply chain ecosystem.

However, more than 60 days have passed since the car companies publicly made their commitments, and the actual implementation presents an intriguing "temperature difference." On one hand, some suppliers report that although car companies have publicly promised to shorten the payment period, they encounter "soft resistance" in practice: acceptance processes are artificially prolonged, payment methods are covertly adjusted, and some car companies have not explicitly defined a "60-day payment period" in new contracts. On the other hand, some suppliers confirm that their cooperation payment terms with car companies have indeed seen substantial improvement, and the pressure on their cash flow has been significantly alleviated.

The subtle gap between "promise and reality" is like a multifaceted prism, reflecting the deep-seated struggle in the execution process of the 60-day payment terms. Is it merely "all talk and no action," or is it steadily progressing? The answer may lie in these seemingly contradictory pieces of feedback.

Promises about billing periods cannot be taken seriously?

"When you take it seriously, you lose." Recently, when Gasgoo Auto released the industry survey titled "60 Days Have Passed, How is the Implementation of the Car Companies' Payment Term Commitments?", a netizen expressed such sentiment.

The implication is that this "payment term commitment" was somewhat insubstantial from the start, like bubbles on the water's surface—appearing bright, but if you seriously poke at them, you're likely to end up with nothing but emptiness.

In the automotive supply chain, payment terms have never been as simple as a mere "promise". Automakers hold the power with their orders, and suppliers, especially small and medium-sized ones, often have to choose between "accepting the payment terms" and "losing the business". Previously, calls to "shorten payment terms" and "ensure timely payments" might have been statements made under industry pressure, but when it comes to execution, any hiccup in the automaker's cash flow, internal approval processes, or even the payment rhythm of downstream dealers can stretch the payment terms like a rubber band. The promised "60 days" can quickly turn into "wait a bit longer" or "next month for sure".

The aforementioned survey by Gasgoo Automotive revealed the "limited" effectiveness of the implementation of payment term commitments. This survey received nearly 200 valid responses, involving suppliers from various sub-sectors such as automotive fasteners, automotive electronics, automotive glass, vehicle interior and exterior trim, automotive power systems, and automotive chassis systems.

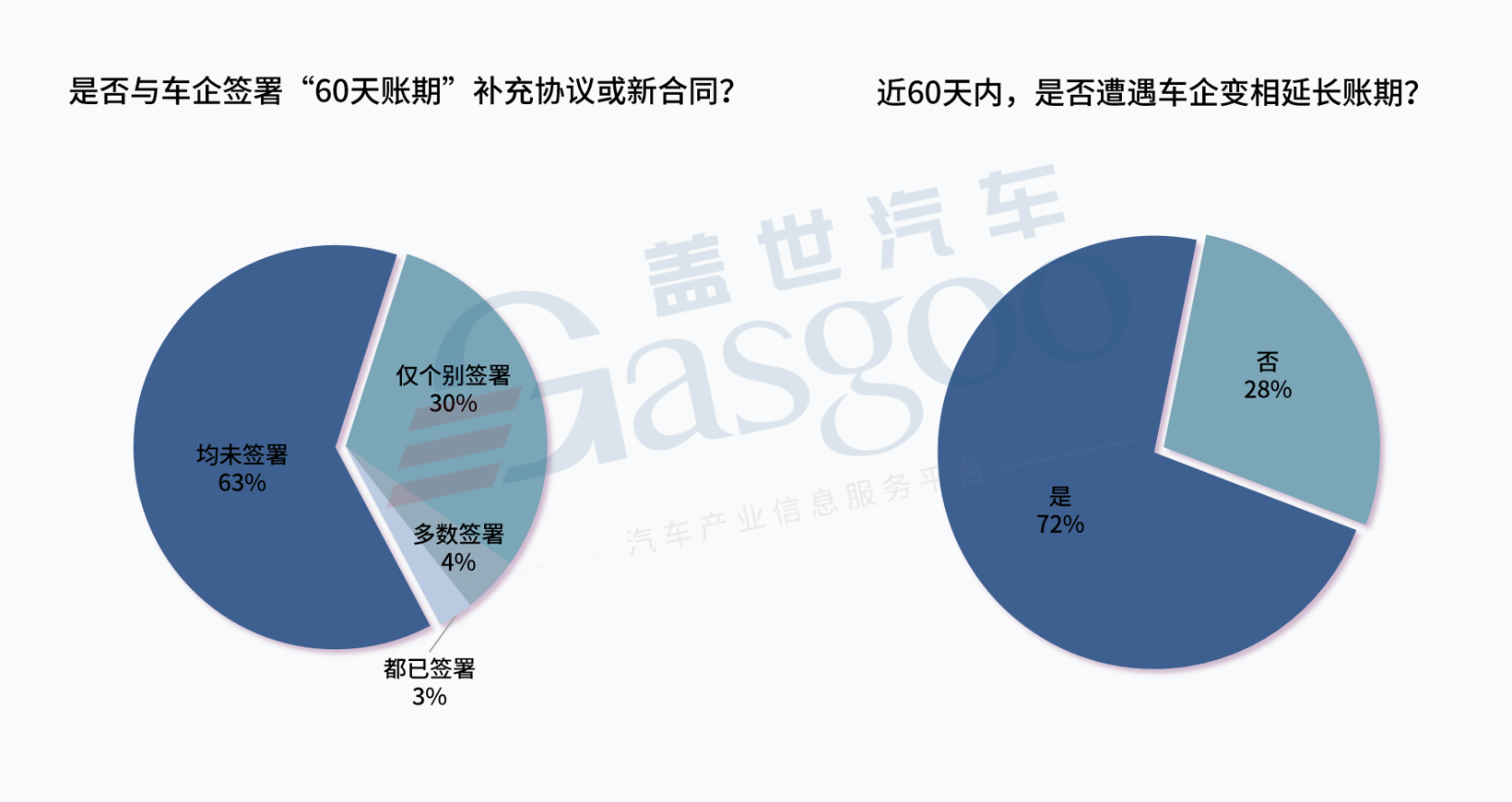

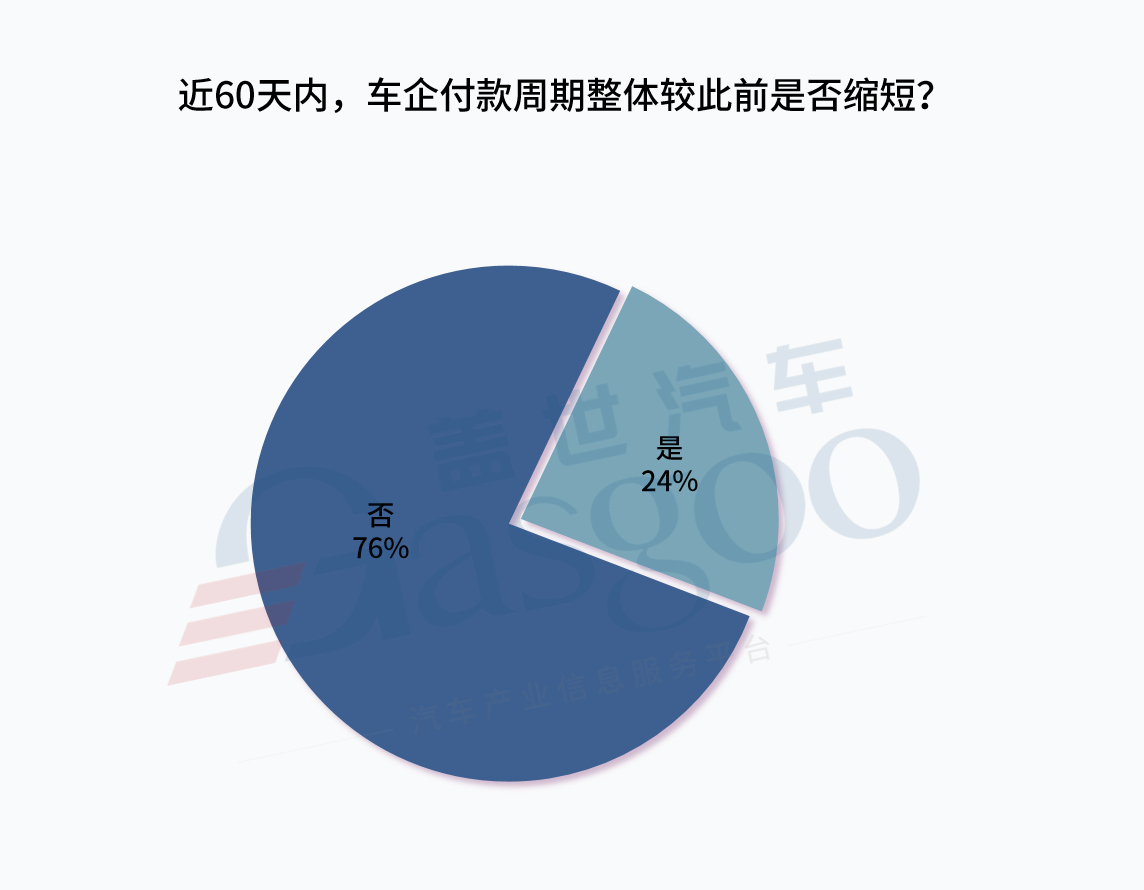

The survey results show that more than 60% of suppliers have not signed a supplemental agreement or new contract with automakers that clearly stipulates a "60-day payment period." Only 30% stated that they have signed such agreements or contracts with specific automaker clients.

It is worth noting that in this survey, more than 70% of suppliers indicated that they have experienced disguised extensions of payment terms by car manufacturers in the past 60 days. This means that even suppliers who have signed "60-day payment term" contracts with car manufacturers are not spared from such situations, such as ambiguous starting points for payment terms, delays in acceptance, reconciliation, or approval processes, and being forced to accept commercial acceptance bills or other non-cash payment methods.

A supplier in the automotive chassis field reported to Gasgoo that in the past two months, the company has not signed a supplementary agreement or new contract with automakers specifying a "60-day payment term." Furthermore, during this period, they have faced situations where automakers have indirectly extended payment terms. On one hand, they are required to sign consignment agreements, and on the other hand, they have to accept bank acceptance drafts.

Another supplier in the automotive electronics field admitted that using bank acceptance bills to indirectly extend the payment period is very common in the industry. For the company in question, within the last 60 days, the average payment cycle of cooperating car manufacturers is "90 days + 6 months acceptance," which has not shortened compared to before.

A certain supplier in the smart driving field has a different situation. According to their disclosure, car manufacturers have informed them that the payment period will be shortened to 60 days. However, even so, within the last 60 days, they have still encountered situations where the period was effectively extended. Overall, the average payment cycle of cooperating car manufacturers has been adjusted from the previous 90 days to around 60 days, but the payment methods include acceptance bills and others.

A certain automotive interior and exterior supplier stated that it has signed relevant supplementary agreements or new contracts with car manufacturers, but in the past 60 days, it has encountered situations where car manufacturers have indirectly extended payment terms. "Some car manufacturers settle payments after production, and the settlement dates are often vague."

Another supplier in the automotive interior and exterior field stated that some automotive clients have not yet signed with them.Supplementary agreements or new contracts related thereto,In the past 60 days, we have encountered car companies indirectly extending payment terms, with multiple reminders met with responses such as 'approval needed from the group's finance department' or changes in system processes that prevent completion of the procedure and delay payment. Additionally, they do not pay for development design fees, and tooling production is not settled within a year, requiring deep discounts to set the price and receive payment.

In addition, a supplier in the intelligent cockpit and intelligent driving sector has also faced car manufacturers indirectly extending payment periods. "The payment period of car manufacturers is usually 60 days after the invoice is issued. Before that, there is a lengthy acceptance and various approval processes, some lasting as long as 2 to 3 months. Furthermore, although it is 60 days, there is currently an acceptance of 180 days."

Some netizens even listed a schedule: "Production in January, account reconciliation on February 15th, invoicing at the end of February, 60-day monthly settlement (end of April), then a 180-day commercial acceptance bill or bank acceptance bill (6 months), and by the end of October, it is possible to receive payment for the goods from January. Meanwhile, there might be an 'abnormal quality' issue, delaying it by another 1-2 months." Although this schedule does not focus on "nearly 60 days."The situation of.The above content undoubtedly intuitively reflects the significant operational space car companies have in indirectly extending payment terms.

The occurrence of situations like the ones mentioned above has also resulted in limited improvement in the overall payment cycle for suppliers within the survey over the past 60 days. Survey data indicates that for nearly 80% of these suppliers, the average payment cycle from partner car manufacturers has not been significantly shortened compared to before.

The situation may not be that bad.

"Seres signed a contract with the supplier, with a standard payment term of 60 days."

The new central SOE has fulfilled its responsibilities.

"The payment period for Li Auto has been changed to 60 days, with direct cash payments and no acceptance."

"Xpeng Motors fulfills its 60-day payment term commitment, with multiple suppliers receiving emails to sign supplementary agreements."

In the past two months, news of this kind has been emerging successively, highlighting the positive changes in the industry's supply chain cash flow.

The research results from Gasgoo Automotive also demonstrate the initial effectiveness of this transformation. As previously mentioned, in this survey, 30% of suppliers revealed that they have signed supplementary agreements or new contracts with some automaker clients that explicitly stipulate a "60-day payment period." Additionally, 7% of suppliers indicated that they have signed such agreements or contracts with most or even all of their automaker clients. Correspondingly, 24% of suppliers stated that, in the past 60 days, the average payment cycle of their cooperating automakers has shortened compared to before.

According to in-depth interviews and surveys conducted by Gasgoo with more than a dozen suppliers, some suppliers indicated that the payment terms from automakers have been shortened to 60 days, while others pointed out that there are currently agreements with 60-day and 90-day payment terms.

The feedback from the suppliers is echoing the actual actions at the automotive companies' level, and the recent measures taken by many car companies have shown the industry tangible progress.

In late July, Li Auto announced that the company had completed the adjustment of payment terms with all direct procurement suppliers by mid-July. The contract payment term is 60 days, with monthly payments made twice a month. In terms of settlement methods, the vast majority are conducted via telegraphic transfer, with only a small portion using bank acceptance.

In July, it was reported by the media that a notice email from XPeng Motors was obtained from its supply chain. The email indicated that XPeng Motors announced the standardization of the original payment cycle to within 60 days. XPeng Motors Chairman He Xiaopeng later confirmed this information, stating, "After nearly a month of internal discussions, XPeng has developed relevant steps for the adjustment and execution of the payment cycle, and has recently begun to push forward."

Image source: Screenshot from @XP-He Xiaopeng's Weibo

China FAW Group, GAC Group, and Seres Group have disclosed the execution status and many details of their payment terms commitments.

According to "Made in China" reports, in the new procurement contract signed by China FAW, "60-day payment" is detailed in the settlement terms, and the start time for payment is clearly specified.

In fulfilling the commitment to payment terms, China FAW has also introduced special support for small and medium-sized enterprises. Starting from June 2025, for certified small and medium-sized enterprise suppliers, 100% cash payment will be implemented, changing the previous "cash + bank acceptance bill" mixed payment model.

GAC Group, in addition to the standard 60-day payment term, has established a negotiation mechanism for suppliers with long production cycles for raw materials, high capital occupation, and short-term financial strain. This mechanism shortens the payment cycle to within 30 days or provides advance payments to alleviate their financial pressure.

According to GAC Group, since its establishment, it has always used cash transfers as the main settlement method. Although from 2023, it introduced a bank acceptance method subsidized by GAC Group, the proportion settled through this method is currently only about 5%. It is also revealed that for bank acceptance, GAC bears the full interest subsidy, so there is no difference for suppliers between choosing bank acceptance and cash transfer.

Seres has a standard payment term of 60 days in its contracts with suppliers, and this standard is not a "special clause" for new partner companies but a uniform regulation that applies to all suppliers.

Xu Haidong, Deputy Secretary General of the China Association of Automobile Manufacturers, stated in an interview with CCTV's "News 1+1" that currently, major central enterprises such as FAW, Dongfeng, and Changan, major state-owned enterprises like GAC, SAIC, and BAIC, as well as private enterprises such as Geely and Great Wall, and new power companies like Seres, Li Auto, and XPeng, are all actively responding. "The China Association of Automobile Manufacturers has also conducted some relevant statistics, and it should be said that these major automobile companies and key automotive enterprises are already taking action."”

From this perspective, the implementation of the 60-day payment terms by car companies may not be as bad as imagined. Judging from the specific actions of these car companies, the trend of shortening payment terms within the industry seems to be becoming increasingly clear.

Automakers still need some time.

However, it must be acknowledged that in terms of actual progress, many car companies are still in the stages of exploration and adjustment.

In this survey, an automotive electronics supplier revealed to Gasgoo Auto that the company has not yet signed a supplementary agreement or new contract with automakers specifying a "60-day payment term," but the automakers have provided a timeline.

In fact, for many car companies, fulfilling the promise of "supplier payment terms not exceeding 60 days" within a short period is indeed challenging. After all, the supply chain system of the automotive industry is complex and extensive, involving numerous upstream, midstream, and downstream segments. Every minor adjustment could affect the operation of the entire chain. The cash flow of car companies must not only consider settlements with suppliers but also cover production and manufacturing, R&D investments, and market promotion, among other aspects. To shift a large amount of funds towards supplier payments in the short term inevitably requires a process of reallocation and balance. Moreover, the cooperation between many car companies and suppliers is often based on long-term framework agreements, and the payment terms of old orders have already been fixed. If a sudden change is needed, it requires thorough communication and negotiation with suppliers, which may even involve the revision of contract terms. This process is cumbersome and naturally time-consuming.

Image source: Shetu.com

Xu Haidong mentioned in an interview with "News 1+1" that during the process of adjusting the payment cycle, car companies need to prepare funds, and relevant procedures, including acceptance, launch, payment, and related supply and sales contracts, all need to be adjusted. Many companies must first achieve a 60-day payment term for new orders, while some old orders will be gradually resolved, which is understandable.

Moreover, the financial conditions and operational pressures of different car companies vary. For some companies that are in a transitional period or have poor market performance, their capital chains are already relatively tight. Completely fulfilling the promise of shortening the account period in a short time will undoubtedly increase their financial burden, forcing them to adopt a more cautious approach and gradually advance account period adjustments. Additionally, some car companies have relatively complex internal approval mechanisms. From the formulation of account period policies to their specific implementation, multiple departmental reviews are required. Any delay in any link may slow down the overall progress.

However, even with these practical obstacles, shortening the payment cycle is already an inevitable trend from the perspective of the industry's overall direction. Those car companies that have already taken proactive steps undoubtedly provide some feasible ideas for the "latecomers."

For example, as previously mentioned, specifying "60-day payment" in settlement terms and implementing cash payments. In this survey, many suppliers called for "stopping consignment requirements, stopping commercial acceptance and even bank acceptance," "strengthening contract and process management, clarifying responsibilities and obligations," and "abolishing offline settlement," all of which are undoubtedly specific directions for promoting the standardization of payment terms.

For example, the digitization of the settlement process.In this survey, an automotive interior and exterior supplier proposed a similar suggestion, which is to adopt a digital reconciliation system to reduce occurrences of human-induced delays.

According to the "Made in China" report, Tian Haifeng, General Manager of the Supply Chain Management Department at China FAW, revealed that suppliers can independently initiate settlement processes through the system, and the financial system automatically generates payment lists and completes payments. Acceptance certificates are automatically generated by the production system based on acceptance records at regular intervals, with strict control times. "The entire process is executed online, eliminating the impact of human factors, and the previous issues of 'waiting for approval' and 'waiting for acceptance' have been resolved."

In the digitalization domain, GAC Group is also making efforts by achieving full-process transparency through its digital system. Reportedly, it has integrated all business nodes such as demand forecasting, order issuance, acceptance, and warehousing into a digital system to realize visual management and control. Both the suppliers and the company can view the progress of each stage in real-time, with the payment period starting from the time the goods are warehoused, completing acceptance upon warehousing, eliminating ambiguous time nodes. If a supplier fails to issue an invoice on time, the system will automatically remind them, and purchasers will also manually urge them. In the future, GAC plans to add warning functions to each business node within the existing digital system, especially for the "reconciliation and settlement" and "invoice issuance" nodes, where periodic reminder functions will be set. This will enable precise and intelligent control of supplier payment terms, while simultaneously enhancing the awareness of all company employees and incorporating settlement efficiency into KPI assessments.

Moreover, it is generally believed within the industry that Chinese car companies should look up to foreign enterprises like BMW, which often have more mature and standardized systems in supply chain management and payment term execution. Many foreign or joint venture companies will clearly define payment terms with suppliers at the beginning of their cooperation and strictly adhere to the contract, rarely delaying payments arbitrarily. This is attributed to their well-established internal approval processes and strong sense of contractual obligation.

Regulation still needs to be strengthened.

On July 9th, the Ministry of Industry and Information Technology opened an "Online Platform for Reporting Issues (Suggestions) on Key Automotive Enterprises' Compliance with Payment Term Commitments."https://sme-dj.miit.gov.cn/carTo address issues (suggestions) regarding key automotive companies' adherence to their payment cycle commitments and the implementation of the "Regulations on Ensuring Timely Payments to Small and Medium-sized Enterprises," we are accepting reports from SMEs and coordinating with relevant parties to promote solutions.

The online feedback window that has been launched mainly addresses four types of issues and suggestions: including key automobile companies failing to fulfill the commitment of a 60-day payment period, setting payment terms in procurement contracts that exceed 60 days; key automobile companies setting unreasonable starting times for payment periods, unjustifiably delaying the issuance of inspection or acceptance certificates to indirectly extend payment periods, and using the receipt of third-party payments as a payment condition or paying according to the third-party payment ratio; key automobile companies forcing or indirectly forcing small and medium-sized enterprises to accept non-cash payment methods such as commercial bills or electronic receivables; other issues related to key automobile companies' inadequate implementation of the "Regulations on the Payment of Small and Medium-sized Enterprises."

Image source: Ministry of Industry and Information Technology Micro Report

As Wang Tie, Director of the China Automotive Strategy and Policy Research Center at the China Automotive Technology and Research Center, stated, these four types of issues cover various aspects such as contract terms design, payment process loopholes, ambiguous acceptance rules, and misuse of payment tools. They are conducive to accurately identifying and addressing the actual problems faced by small and medium-sized enterprises, ensuring that the commitment to payment terms is effectively implemented.

However, it is worth noting that from the results of this survey by Gasgoo, many suppliers remain cautious about this, with over 90% of participants stating that they have not attempted to use this channel from the Ministry of Industry and Information Technology to complain about payment period issues.

The underlying reasons can be attributed to two main points: firstly, the belief that complaints are unlikely to be effective, and secondly, the concern about retaliation from car companies or potential loss of orders, with the latter concern often being more prominent.

A supplier in the automotive electronics field expressed concern that the handling was insufficient, with complaints only receiving "coordination" without mandatory constraints (such as being delayed under the guise of "in process"), which cannot fundamentally resolve the issue.

An automotive glass supplier stated, "For now, being able to maintain normal operations is enough. Our partners are long-term collaborators and relatively stable, and we are not willing to damage these relationships."

A certain supplier in the smart cockpit and smart driving field frankly stated that they do not want to offend their customers and are basically maintaining the status quo.

This phenomenon reflects a severe imbalance of power in the supply chain of the automotive industry on one hand—small and medium-sized enterprises are consistently in a disadvantaged position when collaborating with major car manufacturers and find it difficult to effectively safeguard their legitimate rights and interests. On the other hand, it clearly indicates that merely setting up an online channel for reporting issues may not be sufficient, and industry regulation still needs to be further strengthened.

As a result, during this survey, many suppliers put forward suggestions, including "regulations should be formulated to further ensure the implementation of payment term commitments."Strengthen the regulatory oversight of the use of acceptance bills and standardize the management of amounts and payment terms of accounts payable by main engine factories."The relevant departments need to continue strict inspections and visits regarding car companies' payments." "Strictly check contract contents and periodically track payment status." "The local government where the enterprise is located should establish a supervisory window to regularly check the company's payment situation," etc.

Overall, relevant departments still need to further strengthen regulatory measures, strictly constrain key automotive companies' issues with payment terms, clarify penalties for breaches, and increase the cost of violations. At the same time, it is necessary to establish and improve the rights protection mechanism for small and medium-sized enterprises, providing them with stronger legal support and protection to eliminate their concerns about defending their rights.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track