511% Sky-High Tariff Backfires on United States, Wanhua Chemical Faces Anti-Dumping Measures

Recently, the U.S. Department of Commerce announced the affirmative preliminary ruling in the anti-dumping investigation of diphenylmethane diisocyanate (MDI) originating from China (including polymeric MDI, pure MDI, and modified MDI), determining that the highest dumping margin for Chinese companies reaches an astonishing 511.75%, with the preliminary tax rate for industry leader Wanhua Chemical set at 376.12%.

The present investigation originates from February 12, 2025, when the specially established MDI Fair Trade Alliance in the United States, whose core members include chemical giants BASF and Dow, formally filed an application. The alliance accused Chinese MDI products of being sold in the U.S. market at unfairly low prices, causing substantial harm to the domestic industry.

The United States has always been a major export market for China's MDI. However, in the past three years, China's exports of pure MDI to the U.S. have plummeted sharply, from 4,700 tons and $21 million in 2022 to 1,700 tons and $500,000 in 2024. The export volumes of polymeric MDI were 225,600 tons, 230,200 tons, and 268,000 tons, with transaction amounts of $473 million, $319 million, and $392 million respectively. Although the export volume of polymeric MDI has maintained a certain scale, the transaction amounts have shown significant fluctuations, indicating signs of price pressure.

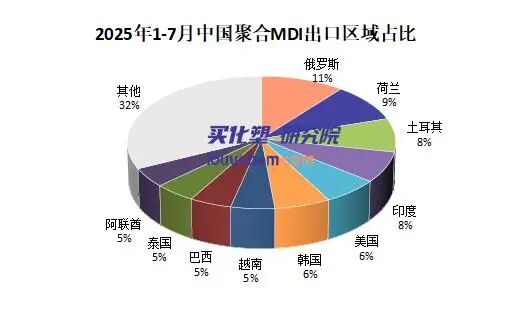

In the first half of 2025, with the dual pressure of anti-dumping and tariff policies, American domestic companies began seeking new supply systems, leading to a significant decline in the export volume of polymeric MDI from China to the United States. From the export data of the first seven months of this year, Russia has emerged as the top export destination with 50,300 tons, while the United States has fallen to fifth place.

If the U.S. Department of Commerce makes an affirmative final ruling in the future, it will have a certain impact on China's major MDI manufacturers, but the actual impact is expected to be relatively limited. At that time, production facilities in countries like South Korea, including BASF Korea and Kumho Mitsui, are expected to increase their export efforts to the U.S. market. This move will lead to a tightening of MDI supply within the Asia-Pacific region. As the world's largest MDI manufacturer, Wanhua Chemical can leverage its high-quality and stable products to quickly fill the supply gap in the Asia-Pacific region, achieving a "rebalancing" of the market.

Secondly, the global capacity layout of Chinese enterprises has become a "buffer." Taking Wanhua Chemical as an example, it not only has a substantial production capacity in China but also has acquired and invested in BorsodChem in Hungary, which has an annual MDI capacity of 400,000 tons. This European base can flexibly adjust the supply chain and increase exports to the United States, effectively hedging against the high tariff barriers that domestic products in China may face.

The recent U.S. anti-dumping investigation into Chinese MDI is a typical reflection of the rising global trade protectionism. By imposing high tariffs to create barriers, the intention is to protect domestic producers in the short term and encourage the reshoring of manufacturing. However, in today's deeply intertwined global economy, especially in the oligopolistic, capital and technology-intensive MDI industry, such a "blocking" strategy may be unlikely to achieve its ultimate goal. It will increase the raw material costs for the U.S. downstream manufacturing sector, weaken the competitiveness of its end products, and ultimately, the cost will be borne by American consumers.

The extremely high tariffs proposed by the U.S. appear to be a trade ruling on the surface, but on a deeper level, they reflect the strong anxiety of the United States over having a "self-reliant and controllable" key basic chemical industry chain, as well as the competitive pressure faced by its traditional giants when confronted with China's powerful and efficient supply chain.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track