5%–10% Is Just the Surface: Behind Dow Greater China's Pricing Letter Lies a Global Repricing of Silicone

In early January 2026, Dow's silicone business issued a price adjustment notice to partners in the Greater China region, planning to implement a 5%–10% price increase on products related to its high-performance construction business starting January 26, 2026. The increase varies among different product lines and market segments. At first glance, this seems like a "routine" price increase letter: a few polite phrases, some cost explanations, and a sentence stating "to be executed if the contract allows." However, when placed within the context of the volatility of the silicone industry chain over the past year, it appears more like a signal flare: silicone is quietly shifting from an era of "competing on cost and scale" to an era of "competing on structure and discourse power."

Let's first look at the core logic of this letter. Dow attributes the price increase to "comprehensive cost pressures": rising costs of raw materials, environmental compliance, and logistics. This kind of phrasing is not new in the chemical industry, but few take it seriously, as in recent years, many categories have seen a more common scenario of "costs rising, prices not rising, ultimately having to bear it themselves." However, the difference this time is that Dow has chosen to focus on the construction sector. High-performance systems such as sealants, curtain walls, and structural adhesives are extremely sensitive to consistency, weather resistance, and project accountability. Customers are often more sensitive to "can we replace the supplier?" than to "how much has the price increased?" In other words, Dow is raising prices in the segment that is most likely to create "stickiness," essentially testing the true elasticity of the market: if costs can be smoothly passed on even in the construction sector, then the "re-pricing" of silicone will no longer be just a slogan, but a reality.

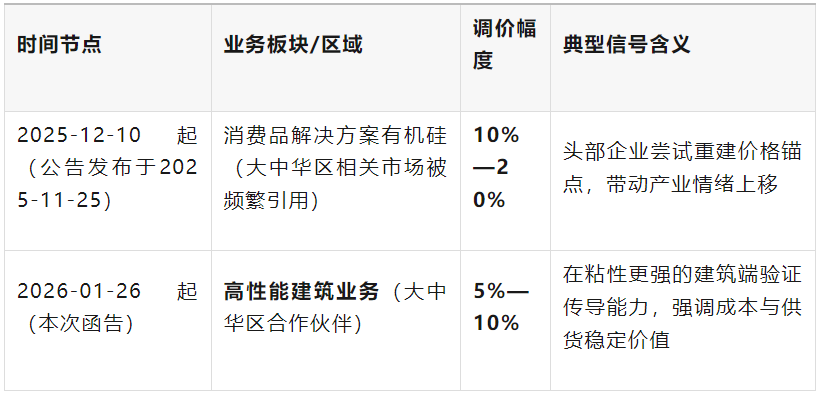

Pull the lens forward a bit more. The information you provided mentions that on November 25, 2025, Dow announced a price increase of 10% to 20% on its consumer solutions silicones business line, effective December 10, 2025. This news has been widely circulated in industry information and interpreted as "overseas giants taking the lead in raising prices, igniting market sentiment." These two actions, one before and one after, may seem to involve different business lines and different price increases, but they reflect the same stance: when the supply-demand dynamic shifts from a "buyer’s market" back to a range where "conditions can be negotiated," leading companies will be the first to adjust their pricing systems back to what they consider a more reasonable level. Many domestic companies might interpret such price increases as "foreign companies wanting to make money again," but what is even more concerning is another layer of implication: the pricing power is shifting from being "solely cost-driven" to a composite function of "cost + structure + geopolitics."

Why is geopolitics being factored into the pricing formula for silicones? Because the supply side of the global chemical industry is undergoing a structural contraction, particularly in Europe. Reuters, in its report on the challenges faced by the European chemical industry, emphasized that high costs and intensified competition are driving a wave of facility shutdowns and asset disposals in Europe. The industry is even discussing policy "lifeboats" to prevent industrial hollowing. More directly, Dow itself announced in an investor press release that it will shut down three upstream assets in Europe, with closures expected to begin in mid-2026 and continue until the end of 2027. Such events do not necessarily result in an immediate reduction of DMC, but they continuously alter market expectations: when a region's chemical system enters an "exit channel," the supply chain premium rises, including higher compliance costs, higher logistics costs, and increased value on "stable supply."

Breaking down the costs reveals that the upstream is not entirely calm. Recent tracking by SMM of the metal silicon spot market shows that the price of industrial silicon, an important upstream component of organosilicon, fluctuates within a range, with the market being quite sensitive to supply and demand expectations. At the organosilicon monomer end, key intermediates like DMC in different regions are affected by methanol, metal silicon, and plant operational disturbances, making the market more of a "seesaw" than a straight line. This means that the "5%—10% increase" seen at the customer level, when traced upstream, may be a series of rather intense chain reactions: a jump in raw material prices, compliance costs adding up, logistics causing further disturbances, ultimately leading to a "necessary adjustment" at the finished product level.

However, this is not the most interesting part. What is more intriguing is "why now?" It is often said in the industry that "price increases need justification," but in reality, successful price increases depend not on justification but on timing. Your analysis mentioned "the positive changes in the global silicone market's supply-demand relationship; production cuts and the exit of overseas capacities present opportunities for domestic companies." This narrative is not without basis. Some industry data indicate that after the rapid expansion of China's DMC capacity in recent years, there are signs of a slowdown in new capacity around 2025, easing supply pressure marginally. When the addition of new capacity slows and demand gradually recovers in sectors like construction, electronics, and automotive, the first change in the market is often not a "price surge," but a "change in transaction logic": sellers no longer rush to secure orders, and buyers start to worry about "not getting stable supplies." At this time, Dow's price increase in the construction sector in Greater China effectively turns this "emotional change" into a measurable business result.

In order to clearly place the two price adjustments on the same map, a small table can be used to condense the key information.

The next critical question is: How will this affect the Chinese market? Many people might intuitively think "prices increase overseas, domestic prices will follow," but the reality is more acute. The long-standing contradiction in China's silicone industry is "strong scale, weak profits," due to homogeneous competition and cyclical fluctuations. The price increases by overseas giants present two opportunities and one pressure for domestic enterprises. The opportunities lie in the fact that high-end construction, automotive, and electronics sectors have higher demands for product consistency, certification systems, and delivery stability. When customers are willing to accept higher prices for stability, the value of domestic substitution should not be measured merely by "how much cheaper it is," but rather negotiated based on "total cost of ownership." The pressure is that if domestic enterprises continue to adopt the emotional strategy of "raising prices when others do, lowering prices even more when others do," then the profit window brought by price increases will be consumed more quickly, ultimately leaving only a mess.

Further analysis of the letter reveals a reminder to downstream customers: you are purchasing not just "siloxane molecules," but an entire risk management package. The shutdown of chemical assets in Europe, the restructuring of global supply chains, and the structural increase in energy and compliance costs, are all turning "stable supply" into an increasingly expensive commodity. When Dow lists the reasons for price adjustments as "raw materials, environmental protection, and logistics," it is essentially telling customers that future contract negotiations will increasingly resemble a "dynamic formula" rather than a "fixed figure." Those who excel at managing fluctuations will be able to negotiate prices more firmly.

So, returning to that seemingly bland statement of "an increase of 5%-10%," its explosiveness lies not in the magnitude but in the direction: silicone is repackaging cost fluctuations, regional exits, and supply chain uncertainties into a value that can be priced. For domestic companies, the real watershed may come in 2026: whether to continue seeing themselves as "capacity providers" or to start viewing themselves as "solution providers." The former will always be caught up in pricing, while the latter has the opportunity to build a moat above the price.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories