2025 Special Engineering Plastics Battle: Production Capacity and Technology Routes of Kingfa, Watt, Preter, and Nanjing Julong Fully Decoded

Image source: Doubao AI

The year 2025 is a crucial year for the breakthrough and development of China's special engineering plastics industry.

Recently, four leading materials companies—Kingfa Sci. & Tech. Co., Ltd., Watertek Co., Ltd., Pre-tech, and Nanjing Julong—have successively released their semi-annual reports for 2025. Specialty Plastics World has observed that they have devoted considerable sections to disclose the progress in the field of specialty engineering plastics. This article systematically reviews the current layout, technological breakthroughs, capacity expansion, and R&D innovation systems of these leading material manufacturers in the specialty engineering plastics sector, providing the industry with a comprehensive industrial map.

I. Performance and Market Layout of Specialty Engineering Plastics Business of the Four Major Enterprises

Special engineering plastics refer to a category of engineering plastics with high comprehensive performance and a long-term service temperature above 150°C. They mainly include high-performance polyamides (also known as high-performance nylon, PPA), polyarylethersulfone, polyaryletherketone, liquid crystal polymers (LCP), polyphenylene sulfide (PPS), and polyimide (PI). These special high polymer materials possess unique and excellent physical properties and are primarily used in high-tech fields such as electronics, electrical engineering, and specialized industries.

In the first half of 2025, the special engineering plastics market showed rapid growth, with significant differences in business performance among various material companies, and the market structure is gradually becoming clearer.

01 Kingfa Sci. & Tech.

Kingfa Technology has strategically focused on special engineering plastics such as LCP, PPA, PPS, and PEEK. During the reporting period, the sales volume of Kingfa Technology's main special engineering plastic products reached 14,800 tons, representing a year-on-year increase of 60.87%.

It is worth mentioning that high-performance LCP materials achieved a leapfrog growth, with a year-on-year increase of 98.94%. Currently, Kingfa Sci. & Tech. has established a 1 million square meter per year LCP film production line, and the products have been actively validated and promoted by leading customers in the high-frequency flexible circuit board sector. In addition, the fiber-grade LCP resin launched by Kingfa Sci. & Tech. has already achieved mass supply.

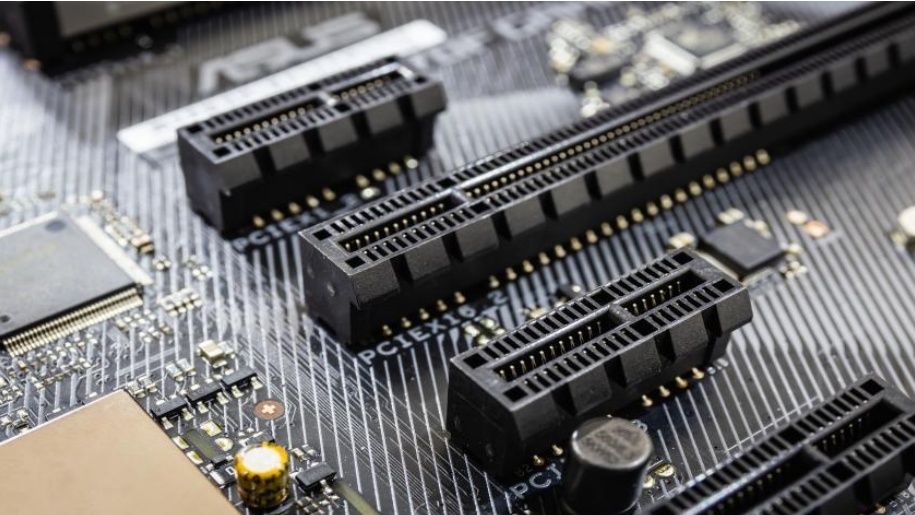

In terms of research and development, Kingfa Technology has developed halogen-free flame-retardant semi-aromatic polyamide resistant to electronic fluorinated liquids, widely used in storage connectors for immersion-cooled servers, achieving high-speed data transmission at 12800MT/s. It has also developed a new generation of low dielectric constant and low dielectric loss LCP, massively applied in high-speed connectors for AI servers, with a transmission rate as high as 224Gbps, setting a new benchmark in the next-generation information technology industry. Kingfa Technology’s ultra-temperature-resistant, fatigue-resistant, and wear-resistant PPA and PEEK materials have addressed the long-term usability issues of key components in embodied intelligent robots and robotic dogs, gaining widespread application in the industry.

The image shows the application scenarios of Kingfa Sci & Tech's special engineering plastics in high-speed connectors (Image source: Kingfa Sci & Tech).

In terms of green development, Kingfa Sci. & Tech. has developed a new generation of green and low-carbon LCP, becoming the first domestic supplier of LCP certified by the International Sustainability and Carbon Certification (ISCC) PLUS, injecting new green momentum into downstream application fields. The company has also developed a new generation of bio-based halogen-free flame-retardant semi-aromatic polyamide, which replaces traditional radiation-crosslinked polyamides and thermosetting plastics, meets application requirements under demanding conditions, effectively enhances recyclability, and further reduces carbon emissions. Additionally, Kingfa has developed polyarylethersulfone for hydrogen production via water electrolysis, which has been put into mass use by representative enterprises in the industry.

In terms of capacity expansion, Kingfa Sci. & Tech.'s 15,000 tons/year LCP synthetic resin project has completed the electromechanical installation of the first phase 5,000 tons/year unit and is about to be put into operation; the 40,000 tons/year special polyamide projects, including transparent polyamide and polyamide elastomer, have been launched, with the first phase capacity of 8,000 tons/year planned to be put into production in the first quarter of 2026; the kiloton-level polyimide project is undergoing electromechanical installation and is scheduled to be put into operation by the end of 2025; the 50,000 tons/year special engineering plastics blending and modification plant has started civil construction, with the first phase capacity of 15,000 tons/year planned to be put into production in the second quarter of 2026.

02 Water Shares

As a leading enterprise in the field of specialty engineering plastics, WOTE Corporation achieved an operating revenue of 906 million yuan in the first half of 2025, representing a year-on-year increase of 12.29%. Revenue from specialty polymer materials accounted for 48.93% of the total, with a year-on-year growth of 5.55%. The shipment volumes of WOTE's specialty polymer materials, including LCP, PPA (covering high-temperature nylon, transparent nylon, long-chain nylon, and nylon elastomers), PPS, and PEEK, all achieved steady growth.

It is particularly noteworthy that the first and second phases of the 20,000-ton-per-year liquid crystal polymer (LCP) resin project at Water Co., Ltd.'s Chongqing base, as well as the first phase of the 1,000-ton-per-year polyaryletherketone (PAEK) resin project, have entered formal production and achieved mass product sales. The production lines for modified LCP, modified PEEK, modified PPA, and modified PPS continue to undergo process optimization, resulting in further improvements in product quality and production capacity. The development achievements in the Vietnamese market are gradually emerging, with the shipment volume of modified materials from Water Vietnam continuously increasing.

- LCPIn 2014, Watertek Co., Ltd. acquired LCP product technology and production lines from Samsung Korea. By 2020, Watertek had independently developed and commissioned a new LCP production line, with trial production passing quality checks in one go. This marked that Watertek had fully mastered the core R&D and production technology of LCP as well as independent equipment development capabilities. In 2021, Watertek became the largest LCP supplier by shipment volume in China. That same year, the company announced the construction of a new 20,000-ton LCP resin material facility, which, upon completion, would bring Watertek’s total annual LCP resin production capacity to 25,000 tons. Watertek’s LCP business has gone through multiple phases, including technology introduction from abroad, digestion and absorption, and independent innovation, and now possesses the strength to compete globally. Watertek’s research on LCP films covers resin for films, film preparation, and preparation of single-layer and multi-layer boards. By designing the molecular structure of LCP and studying synthesis processes, the company first produces semi-finished resins required for LCP films, and then manufactures film-grade resin using methods such as solid-phase tackification. According to the different film-forming processes of downstream customers, Watertek has successively developed film-grade resins suitable for a variety of processing technologies.

- Specialty Nylon SeriesWatts Co., Ltd.'s specialty nylon (high-performance polyamide PPA) series includes high-temperature nylon, long-chain nylon, transparent nylon, and nylon elastomer materials. All of these specialty nylons are available in both bio-based and petroleum-based versions. Watts currently has a designed production capacity of 10,000 tons for specialty nylon series resin synthesis, with 5,000 tons of capacity already built. From the perspective of downstream and end-use applications, high-temperature nylon can be used in fields such as electronics and electrical, automotive, aerospace, and military industries. In the electronics and electrical field, high-temperature nylon can withstand the high peak temperatures of Surface Mount Technology (SMT) reflow soldering processes, making it suitable for use in printed circuit boards. In the automotive sector, due to its excellent properties such as high temperature resistance, wear resistance, fatigue resistance, high strength, and high impact resistance, high-temperature nylon can be used for plastic parts around automotive engines and motor components. In the future, as electronic devices develop towards miniaturization, lightweight, thinness, high reliability, high functionality, and low cost, the demand for high-performance polyamide materials will increase accordingly.

- Polyaryletherketone (PAEK))Wote Co., Ltd.'s polyaryletherketone (PAEK) mainly includes polyetheretherketone (PEEK) and polyetherketoneketone (PEKK). Wote Co., Ltd. plans to build a polyaryletherketone (PAEK) synthetic resin production capacity of 1,000 tons. In May 2025, the first phase of the project with an annual output of 1,000 tons of polyaryletherketone resin materials will enter the formal production phase. Wote Co., Ltd. has already started the development and verification of injection-grade PEEK materials with downstream customers and has secured some orders. Wote Co., Ltd.'s holding subsidiary, Zhejiang Kesai, has the capability for the production and processing of hundreds of tons of PEEK profiles and is gradually supplying PEEK profiles to customers in fields such as precision electronics, electronic information, industrial machinery, and bearings. From the perspective of downstream and end-use application fields, polyetheretherketone (PEEK) stands out in terms of strength, dielectric constant, and chemical resistance, presenting a broad market space in the context of "replacing steel with plastic" and "lightweight" downstream development. Compared to medical metal materials like zirconium and titanium alloys, polyetheretherketone (PEEK) is more suitable as a medical implant material due to its elasticity and density being very close to human bone levels, and its low thermal conductivity enhances post-implantation comfort. Additionally, because polyetheretherketone (PEEK) is resistant to high temperatures, friction, dimensionally stable, radiation-resistant, low moisture absorption, hydrolysis-resistant, non-toxic, and has excellent mechanical and electrical properties, it can be applied in industries such as aerospace, automotive and mechanical industrial seals, petrochemicals, electronic information, rail transportation, medical health, energy, and robotics.

- Poly(arylene sulfone ether)Wote Corporation plans to have a polysulfone production capacity of 10,000 tons, to be implemented in two phases. As Wote Corporation's understanding of the production process of special polymer materials deepens and production technology continues to advance, Wote Corporation proactively reforms the production processes and methods of polysulfone, actively implementing ESG principles into its production lines. During the reporting period, Wote Corporation's polysulfone production line is undergoing process modifications and equipment upgrades.

- Polyphenylene sulfide (PPS))Wotter Co., Ltd. currently mainly provides PPS composite materials to downstream customers. In the downstream application market, PPS can be widely used in new energy vehicles, machinery and instruments, 5G communications, chemical industry, military, medical, aerospace, and other fields.

03 Prit

The business segments of Prett mainly focus on three directions: modified materials business, ICT materials business, and new energy business. The modified materials business segment includes specialty engineering materials (such as modified PEEK, modified PPS, modified PPA, modified PPO, etc.), which are mainly used in automotive parts, electronics and electrical appliances, aerospace, two-wheelers, power and energy storage systems, low-altitude flight, and robotics. The ICT materials business segment mainly revolves around the synthesis and application of liquid crystal polymer (LCP), with LCP products including LCP resin, LCP composite materials, LCP films, and LCP fibers.

Pulead is currently the only company in the world with the capability for LCP resin synthesis, modification, film, and fiber technology, along with mass production capacity. It has an annual production capacity of 4,000 tons of LCP resin polymerization, 5,000 tons of LCP compounding and modification, 3 million square meters of LCP film, and 1,000 tons (1000D) of LCP fiber. In the first half of 2025, Pulead will engage in interfacing and validation work with several domestic and international customers in fields such as automotive electronics, satellite communications, medical, and brain-computer interface. Among these, the validation progress with customers in the electronic communication industry is smooth, and mass delivery is expected to be achieved in 2025. Pulead has conducted joint development and validation work with overseas customers on the application of LCP film products in the brain-computer interface field. The LCP fiber cloth product leverages previous development experience and technical results in high-frequency PCB hard boards for a leading communications customer, and benefits from the very low dielectric constant and dielectric loss of LCP electronic fiber cloth, as well as its unique cost advantages. Pulead is also actively engaging with related customers in other industry fields. LCP products have also achieved mass delivery in areas such as low-orbit satellites and smart homes.

In terms of application scenarios, Polyplastics' LCP products are primarily used in industries focused on high-frequency and high-speed signal transmission for communication and signal information transmission. With the construction and promotion of the new generation communication industry, Polyplastics' LCP products will have broader application demands in fields such as 6G, consumer electronics, automotive millimeter-wave radar, AI servers, brain-computer interfaces, and low-orbit satellites.

04 Nanjing Julong

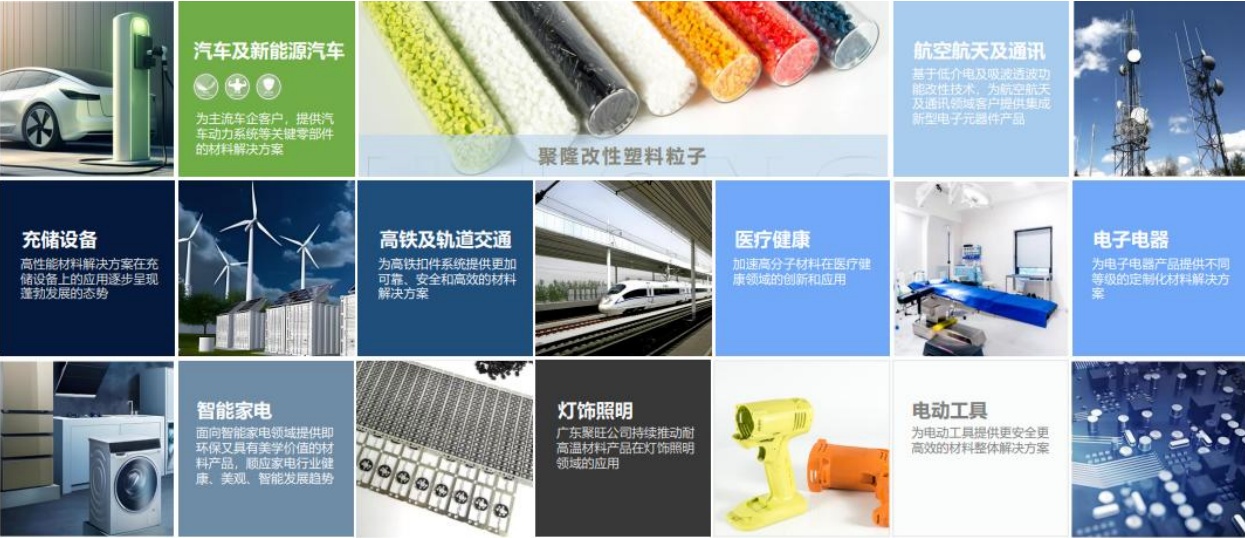

Nanjing Julong's main businesses are divided into four areas: modified plastics, thermoplastic elastomers, carbon fiber composite structural parts and components manufacturing and complete machine assembly, and wood-plastic composites. Among them, high-performance modified plastics are Nanjing Julong’s largest product category, including modified nylon (PA6, PA66), modified long-chain nylon (PA12), modified polypropylene (PP), modified ABS, modified PBT, modified PET, modified PPO, alloy materials (PC/ABS, PC/ASA, PC/PBT, PMMA/ASA), modified PPS, modified PEEK, foamed materials (foamed PP, foamed PE, foamed ABS, foamed PPE/PA alloy), wave-absorbing/transmitting materials (PP, PA6, PA66, PBT, PC), paint-free materials (ABS, PC/ABS, PP), laser welding materials (PP, PA6, PA66, PBT), and PCR (post-consumer recycled modified materials). During the reporting period, Nanjing Julong’s modified plastics business segment achieved operating revenue of 1.134 billion yuan, a year-on-year increase of 30.50%.

In the field of specialty engineering plastics, Nanjing Julong has made significant progress. The modified PPS products developed by Nanjing Julong have found new application expansions in automotive power systems and electronic appliances; PEI products have been successfully applied in optical instruments; polysulfone products have achieved breakthroughs in precision electronics applications. In the field of hydrogen storage, Nanjing Julong works closely with customers to jointly tackle material challenges and co-develop new types of frame materials.

Notably, Nanjing Julong actively implements its global strategic layout by establishing a production base in Mexico, which not only expands its overseas market but also enhances its global service capabilities, further consolidating its position in the industry.

Figure: Terminal applications of modified materials (Image source: Nanjing Julong)

2. R&D Expense Ratio: Walter Shares >PritBlonde TechnologyNanjing Julong

In the new materials industry, to become a qualified material supplier for downstream customers, it is necessary not only to undergo rigorous supplier evaluations and long-term product trials, but also to possess continuous innovation and service capabilities.

Watts Co., Ltd. continues to increase its investment in research and development, with R&D expenses reaching 55.98 million yuan in the first half of 2025, a year-on-year increase of 17.29%, accounting for 6.18% of its revenue in the first half of 2025. The company's innovation capability continues to improve. Watts Co., Ltd. has established several R&D platforms, including a National Postdoctoral Research Workstation, a Guangdong Province Doctoral Workstation, a Guangdong Province Postdoctoral Innovation Practice Base, a Guangdong Province Enterprise Technology Center, and a Guangdong Province Engineering Technology Research and Development Center. Watts Co., Ltd. adheres to a combination of independent R&D and technology introduction, strengthening cooperation with domestic research institutions and universities, and has accumulated a range of cutting-edge patented technologies such as LCD photoresist, polyimide dianhydride monomers, organic photovoltaics and perovskite photovoltaics, anion exchange membranes and AEM electrolyzers, graphene conductive and thermal applications, and bio-based degradable materials.

In the first half of 2025, Polyplast’s R&D expenses amounted to 224.6944 million yuan, accounting for 5.49% of its operating revenue, representing a year-on-year increase of 2.67%. Polyplast continues to deepen the construction of its three-tier R&D architecture—application development, technology R&D, and strategic research—focusing on building innovation capabilities through increased R&D investment, platform optimization, and achievement transformation, thereby continuously enhancing the company’s innovative strength. At the same time, Polyplast is steadily improving its global operational capabilities, achieving significant progress in China-US collaboration, especially in areas such as global projects, group clients, CAE synergy, procurement sharing, and manufacturing capability enhancement. The acceleration of its globalization process has effectively supported the company’s performance growth.

During the reporting period, Kingfa Sci. & Tech. Co., Ltd. achieved an operating revenue of 31.636 billion yuan, representing a year-on-year increase of 35.50%. Research and development expenses amounted to approximately 1.293 billion yuan, up 34.56% year-on-year, accounting for 4.08% of revenue.

The increase is mainly due to the addition of new R&D projects and technological process upgrades, as well as a year-on-year rise in personnel expenses and material inputs. Adhering to the R&D philosophy of "independent innovation, technological leadership, and product excellence," Kingfa Technology has established the "13551" R&D system (comprising 1 central research institute, 3 international R&D centers, 5 technical sub-centers, 5 chemical new material incubation bases, and 1 national industrial innovation center). The construction of the R&D platform driven by industry research, technology research, and product research has achieved remarkable results.

Nanjing Julong, relying on its independent research and development capabilities and innovation ability, gets involved in development during the design phase of customer product R&D. It collaborates with automotive OEMs, railway equipment companies, component manufacturing firms, and aerospace enterprises to complete the preliminary development related to materials. Joint development not only helps to leverage Nanjing Julong's technological advantages but also aids in establishing long-term stable cooperative relationships with strategic customers. During the reporting period, Nanjing JulongThe total operating income was 1.257 billion yuan, representing a year-on-year increase of 25.75%.,R&D expenses amounted to 47.47 million yuan, representing a year-on-year increase of 29.34%. The R&D expense ratio was 3.78%, mainly due to the increase in R&D investment leading to higher R&D expenses.

3. Focus on the Layout of Three or Four Companies

01Walt Corporation

Watts Co., Ltd. has made significant progress in the field of high-frequency communication materials. Watts Co., Ltd. has mastered the dielectric properties and change trends of different materials under high frequencies. Through unique composite modification technology, it has developed injection-molded and extruded products with adjustable dielectric constants ranging from 2.0 to 15.0 under high-frequency conditions, as well as thermal conductive materials with adjustable thermal conductivity from 1.0 to 15.0. These have been applied in products such as 5G base stations, millimeter-wave radomes, and connectors. The "Key Technology R&D Project for Liquid Crystal Polymer Materials for 5G/6G High-Frequency Communication," in collaboration with Shenzhen University, has passed the final phase inspection, preparing for the material demands of the 6G era.

02Preet

Polyplast has achieved remarkable results in the innovative application of LCP. The company has developed multiple types of AI server thermal management materials, including standard specifications, high-flow ultra-thin specifications, and carbon fiber composite anti-static specifications, creating the industry’s most comprehensive server air-cooling material solutions. In the field of active cooling fan materials for mobile phones, Polyplast has not only solved heat dissipation issues, but also simultaneously addressed concerns such as device size, power consumption, waterproofing, and dustproofing. This innovation is expected to become a new industry standard. Furthermore, Polyplast’s LCP film products have made progress in brain-machine interface applications, with joint development and validation work being carried out with overseas clients.

03Nanjing Julong

Nanjing Julong has made significant achievements in the functional development of special engineering plastics. The high-performance anion exchange membrane developed by Nanjing Julong and its application in the field of electrochemical energy conversion have made progress. They have formed the AEM membrane product AEMemr®PAW-1-60 and the polyelectrolyte product AEMemr®PAI-5E, and are currently developing reinforced membranes and low-cost, high-performance second-generation membranes.

04Golden Hair Technology

In addition to breakthroughs in high-performance materials, Kingfa Sci. & Tech. has also achieved significant success in green materials. The company has developed a new generation of green, low-carbon LCP, becoming the first domestic supplier of LCP to obtain the ISCC PLUS (International Sustainability and Carbon Certification). Kingfa has also developed a new generation of bio-based, halogen-free, flame-retardant semi-aromatic polyamide, which replaces traditional irradiation cross-linked polyamide and thermosetting plastics, meeting application demands under harsh conditions, effectively improving recyclability, and reducing carbon emissions. In addition, Kingfa's polyarylethersulfone material for hydrogen production by water electrolysis has been used in bulk by leading companies in the industry.

4. Three Major Opportunities for Specialty Engineering Plastics

With the rapid development of next-generation information technology, new energy, high-end equipment, and other strategic emerging industries, the market demand for specialty engineering plastics will continue to grow. Especially in emerging fields such as AI servers, robots, and low-altitude aircraft, the demand for high-performance specialty engineering plastics is expected to experience explosive growth.

In the first half of 2025, four companies accelerated the expansion of their special engineering plastics production capacity, indicating that the special engineering plastics market will face more intense competition. At the same time, with the continuous expansion of downstream application scenarios, the market demand for special engineering plastics will continue to grow, and the production capacity layout of each company will lay the foundation for future market competition.

Looking ahead, the specialty engineering plastics industry will face three major development opportunities: first, the opportunity for domestic substitution, as the awareness of independent and controllable industrial chains increases, domestic specialty engineering plastics will gradually replace imported products; second, the opportunity for application innovation, where the combination of new materials and new applications will create new market space; third, the opportunity for green development, with bio-based and recyclable materials becoming new growth points for the industry.

Editor: Lily

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track