"15th Five-Year Plan" Auto Market Competition, "AI + Automotive Intelligence" Becomes Key to Breaking the Deadlock

Over the past five years, China's automotive industry has experienced rapid development, driven by the wave of electrification, the transformation towards intelligence, and the localization of supply chains as its foundation.

In 2026, China's automotive industry is set to enter the new development cycle of the "15th Five-Year Plan." Under the current trend of accelerating integration between AI and the automotive industry, what new trends will emerge in the development of the automotive industry over the next five years? What innovative solutions will be born?

To address the core issues of the industry, Lianyou Technology recently held the 2025 AI+ Automotive Digital Transformation Conference and the Automotive Industry "14th Five-Year" Planning Digital Development Summit, themed "Creating AI Potential Together for a Shared Digital Transformation." During the event, industry leaders and authoritative experts gathered to engage in in-depth discussions on the digital upgrading of the entire value chain in AI+ Automotive, including research, production, supply, sales, service, and management, providing guidance for the high-quality development of the automotive industry during the "14th Five-Year" period.

"Three 3:7", the automotive industry is about to undergo reconstruction.

Reviewing the development of China's automotive industry during the "14th Five-Year Plan" period, the dual main lines of intelligent electrification and the strong breakthrough of independent brands run through the entire process, constituting the dual themes of industry transformation.

In 2020, the domestic new energy vehicle market was still in its infancy, with annual production and sales of less than 1.5 million units and a penetration rate of only 5%. However, by 2024, overall production and sales rapidly surpassed 10 million units, and the penetration rate exceeded 40%. In the first half of this year, it further climbed to 44.3%, demonstrating robust growth momentum.

Image source: Gasgoo Auto

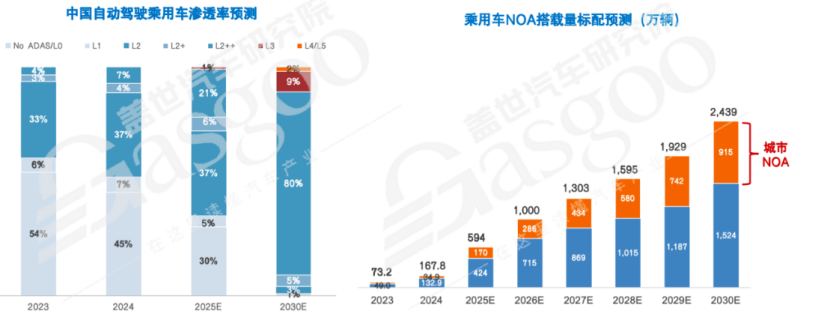

In the field of intelligence, remarkable achievements have also been made. According to analysis data from Gasgoo Auto Research Institute, the installation volume of new cars with L2 and above ADAS in China will reach 10.982 million units in 2024, with a penetration rate of 47.9%. Among them, the penetration rate of L2 and above in new energy vehicles is 56.9%. During the same period, the overall penetration rate of intelligent cockpits in the domestic passenger car market exceeded 70%, while the penetration rate in the new energy passenger car market was close to 90%.

The core driving force behind this transformation is undoubtedly the independent brands. By 2024, Chinese brands have captured a market share of 65.2% in the domestic passenger car market, up from less than 40% in 2020. Especially in the emerging field of smart electric vehicles, independent brands have established a significant leading position thanks to their first-mover advantage and technological innovation.

What will the development curve of China's automotive industry look like in the next five years?

At the summit, Xu Changming, former deputy director of the National Information Center, pointed out that China's automotive industry will continue to transform and upgrade around the "three 3:7" framework: a 3:7 ratio of gasoline to electric vehicles, a 3:7 ratio of joint ventures to domestic brands, and a 3:7 ratio of overseas to domestic markets.

Currently, these three major structural changes have shown a clear evolution trajectory in the domestic automobile market.

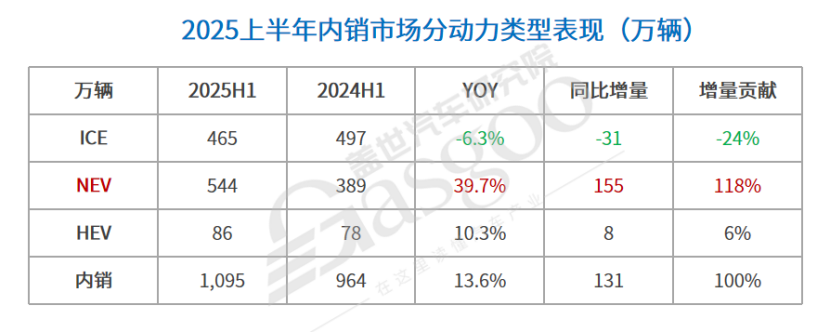

Image source: Gaishi Automotive

According to data analyzed by the Gaishi Automotive Research Institute, in the first half of this year, the domestic passenger car market sold a total of 10.95 million new vehicles, of which new energy vehicles accounted for 5.44 million sales, while fuel and hybrid vehicles combined accounted for 5.51 million sales. The shares of electric and fuel vehicles were 50.3% and 49.7%, respectively.

From the perspective of brand competition, domestic brands dominate the market, with sales share surpassing 68% in the first half of the year. Among them, BYD leads significantly with a sales figure of 1.97 million vehicles, demonstrating its dual competitive advantage in the electric vehicle sector and the mass consumer market. Additionally, Chirey, Geely, and Changan have also performed well, collectively presenting a characteristic of "one strong leader and multiple strong contenders."

In this context, Xu Changming believes that in the coming years, driven by the continued enhancement of competitive advantages of electric vehicles, the accelerated advancement of intelligent transformation, and the expanding consumer base of "post-95" intelligent electric vehicles, the penetration rate of new energy vehicles is bound to continue increasing. Moreover, thanks to the rapid development of electric vehicles, the overall market share of domestic brands will also keep rising.

However, this does not mean that foreign capital has no opportunities.

In the rapidly developing electric vehicle market, Xu Changming believes that mainstream luxury cars and top-tier joint venture brands still have opportunities. The recent continuous increase in sales of Dongfeng Nissan N7, successfully achieving over 10,000 deliveries in a single month, is the most direct proof. In the long run, foreign brands are expected to occupy 60% of the fuel vehicle market and 20% of the new energy vehicle market, ultimately accounting for approximately 32% of the total market share.

While the competitiveness of domestic brands in the domestic market continues to improve, their influence overseas is also rapidly increasing.

In the first half of this year, the cumulative export of passenger cars in China reached 2.581 million units, accounting for approximately 19% of the total passenger car sales. In contrast, in mature overseas automotive markets such as Germany, Japan, and South Korea, the share of new car sales abroad exceeds 80%, and even in the United States, it is over 40%.

This means that for China to further transform from a major automobile country to a strong automobile power, it needs to further increase its market share and influence in overseas markets.

It is worth mentioning that independent car manufacturers such as Chery, BYD, Geely, Chang'an, and Great Wall are accelerating their globalization strategies. By advancing measures like overseas R&D, expanding production capacity abroad, and extending channel networks, they are deepening their presence in overseas markets, providing a solid foundation for Chinese automotive brands to reach 30% of their sales from international markets.

Lianyou AI Factory, creating a new engine for the intelligent upgrade of automobiles.

There is no doubt that China's automotive industry is accelerating into the deep waters of transformation towards intelligence, electrification, high-end development, and globalization.

This transformation has not only reshaped the competitive landscape of the automotive market in China and globally but has also posed unprecedented challenges to the full-chain operational capabilities of automobile manufacturers. In particular, in the face of demands for shorter R&D cycles, improved production efficiency, the construction of international supply chains, and changes in marketing systems, the industry urgently needs more groundbreaking solutions.

At present, AI, with its data-driven intelligent decision-making capabilities, is profoundly restructuring the paradigm of transformation and upgrading in the automotive industry, from product definition to research and development, from production and manufacturing to sales and after-sales, and from the tool level to the value creation level.

Recognizing this trend, Lianyou Technology innovatively proposed the Lianyou AI Factory concept at this event. The aim is to start from application scenarios and build a full-value chain AI application scenario library for the automotive industry, centered around the automotive industry chain. This involves combining an open and cooperative technology ecosystem and business with an organization deeply integrating technology, to help the automotive industry overcome bottlenecks in AI application innovation.

Image source: Lianyou Technology

According to Hu Yongli, General Manager of Lianyou Technology, Lianyou AI Factory initially focuses on single-point innovation. In the future, it will gradually connect these points into a line, reshaping the core business processes in areas such as "research and development, manufacturing, and sales." Then, from line to surface, it will further cover the entire value chain of "research, production, supply, sales, service, and management," assisting the automotive industry in achieving business transformation through AI.

In the manufacturing process, vehicle production scheduling has always been the most challenging aspect in the field of production and manufacturing. This is especially true in a multi-factory, multi-production line, and multi-supply chain collaborative production model, which faces an exponential increase in constraints. In response, Lianyou Technology's AI Factory fully leverages the implicit experience of business experts to automatically read order and resource ledgers, covering hundreds of constraints at once and solving 300,000 variables simultaneously. This reduces the production scheduling cycle from the previous 1-2 days to less than 20 minutes. Moreover, AI Factory supports simulation verification of scheduling results to ensure that the production plan is effectively implemented.

In the marketing process, traditional lead management is a one-way assembly line that mainly relies on manual completion, resulting in strong subjectivity and low efficiency. However, AI Factory can leverage AI to mark leads in real-time, identify high-quality leads, prioritize distribution, and even automate appointment scheduling, group creation, process quality inspection, recommend conversation scripts, and extract profiles. This achieves an end-to-end closed-loop lead management system while enhancing efficiency and conversion rates.

As independent car manufacturers accelerate their expansion into global markets, Lianyout Technology's AI Factory can also provide support for Chinese car companies in digital and intelligent upgrades in overseas markets. This includes assisting in the establishment of overseas distribution systems, export customs clearance trade systems, end-to-end cost management systems, overseas process management systems, and overseas parts logistics management systems.

In terms of dealer management systems, according to Hu Yongli, Lianyou Technology's solution has already covered four to five thousand primary dealers in China. Now, following domestic car companies going abroad, Lianyou Technology is introducing this mature management model into overseas markets such as Europe, the Middle East, and Russia.

Including the overseas production capacity construction of autonomous vehicle manufacturers is also a key focus for Lianyou Technology. It is reported that in a project at a leading autonomous vehicle manufacturer's factory in Thailand, Lianyou Technology helped build a parts logistics management system that covers five major business capabilities—material order management, customs management, warehouse management, supplier collaboration management, and quality management—along with 15 core business scenarios, to achieve transparency in the production process and remote visibility.

In addition to overseas production, manufacturing, and operations management, Lianyoutech can also provide relevant services to automotive companies during the research and development phase. For example, they can construct and deploy telematics systems in overseas markets, allowing users to experience the same intelligent functions abroad as they do domestically after exporting Chinese-made vehicles, while fully complying with overseas market regulations.

During this event, Lianyou Technology, together with automotive enterprise clients, ecosystem partners, and academic institutions, launched the "Intelligent Flame Plan." The goal is to create an application scenario library for the entire value chain of AI + automotive, covering research, production, supply, sales, service, and management. The initial phase of the plan will release 100+ scenarios with a roadmap for 1000+ scenarios. There is a future investment plan of 120 million yuan to promote the successful application of AI + automotive across the entire value chain.

In the wave of the "AI-defined car" era, AI has long surpassed the boundaries of a mere technical tool and transformed into the core engine driving the transformation and upgrading of the entire automotive industry, reshaping the competitive landscape of both domestic and global markets.

As AI further penetrates various stages of the automotive industry chain, the future will belong to those companies that can transform data into insights, algorithms into experiences, and technology into value.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics