12 Car Dealerships Close Down Every Day: The "Black-Hearted Dealers" in Your Eyes Are Moving Forward in the Storm

"If 83 freezers are not filled within two weeks, the qualification will be directly revoked."

Recently, news of a major channel reshuffle at Wahaha has caused a stir across various industries. Reports state that small and medium-sized distributors with annual sales below 3 million yuan are being collectively dismissed, with some regions being taken over by large distributors. The article opens with a Wahaha distributor with 15 years of experience, whose agency qualification was revoked because only over 40 of their 83 refrigerators were deployed, failing to meet the spot check standard.

When Wahaha distributors are facing a reshuffle, car dealers are also having a tough time.

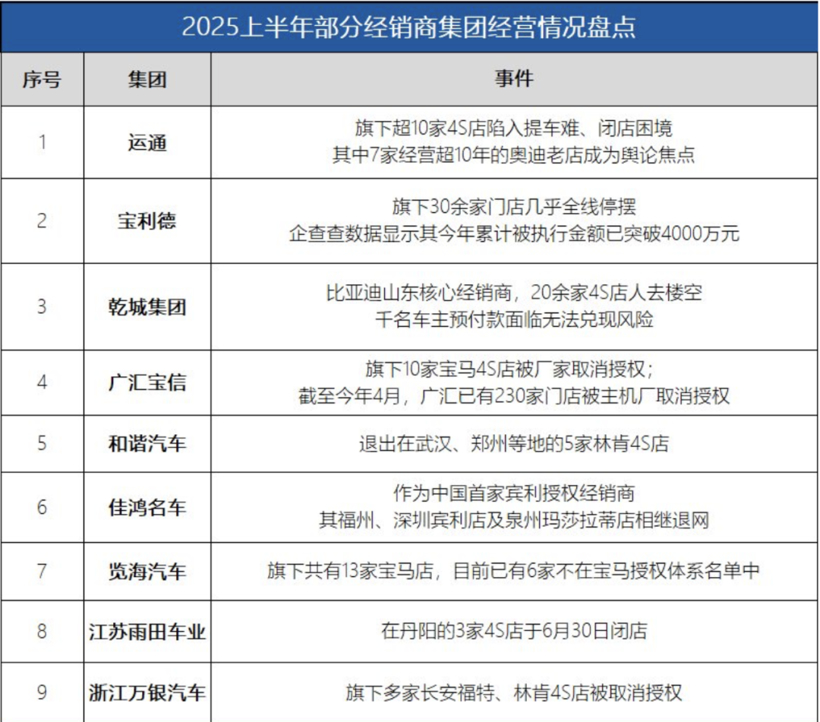

Data shows that in 2024, more than 4,400 4S dealerships nationwide have exited the network, equivalent to 12 stores closing every day. The industry loss ratio exceeds 50%, and the number of 4S dealerships saw negative growth for the first time in 2021. In the first half of this year, over 1,200 4S dealerships are on the brink of bankruptcy, with only 27.5% of stores achieving their sales targets, while more than 70% of dealers are struggling to meet their goals.

Meanwhile, against the backdrop of high inventory levels, industry insiders predict that one-third of dealers will be forced to adjust their business strategies in the second half of the year due to tight cash flow, with some potentially facing the risk of withdrawing from the network. The difficult situation is reflected not only in the figures but also in the dealers' strong desire for profitability, the downturn of 4S stores, and the KPI pressure related to car sales.

01Plummeting Sales: The Multiple Dilemmas Facing Car Dealers

"Selling a car at a loss of twenty to thirty thousand yuan is a common occurrence; if we don't sell, the cash flow may break at any time."

In a 4S dealership in Shanghai, the sales manager looked at the mountainous stock of cars in the parking lot and laughed wryly. Previously, a head of a dealership group had revealed, "For cars priced between 150,000 to 200,000 yuan, dealers often offer discounts of over 50,000 yuan, and even after deducting manufacturer rebates, each car still incurs a loss of 40,000 yuan."

It is evident that selling cars at a loss is not exclusive to any particular dealership but is a predicament faced by auto dealers across the board. Statistics show that in the first half of this year, over 80% of dealerships nationwide experienced price inversion, with about 60% of them facing an inversion margin of more than 15%. As a result, dealers find themselves trapped in a vicious cycle of losing money with every car sold.

Not only are mainstream price range models affected, but luxury brands are also hard to escape this fate.

In the first half of the year, major traditional luxury brands experienced varying degrees of decline in sales in China. The ultra-luxury segment was even more chilling, with Porsche's imported sales in China dropping by 26.1%, and brands such as Bentley, Rolls-Royce, and Maserati generally seeing declines exceeding 20%.

In response, luxury brands are also employing price reductions and promotions. Previously, it was reported that some BMW models had discounts exceeding 150,000 RMB, with the 5 Series' on-road price dropping to the 300,000 RMB range; the terminal discount on Mercedes-Benz C-Class models also exceeded 40%; and Porsche's Cayenne, Panamera, and other models offered discounts of up to 30% off.

Even mainstream and luxury brands are offering discounts and selling cars at a loss, let alone niche brands and models.

In those dealerships where product strength is weak and brand presence is insufficient, we see showrooms with shiny new cars and parking lots that are jam-packed. Clearly, this is not the prosperity of car dealers, but rather the suffocating side of inventory backlogs. By mid-2025, 3.45 million new vehicles were backlogged nationwide, reaching a two-year high. With an estimated value of 150,000 per car, over 510 billion in funds are frozen.

The increasing inventory backlog has caused dealers' inventory turnover ratio (i.e., the ratio of inventory vehicles to monthly sales) to generally exceed the warning threshold.

Data shows that in the first half of this year, the inventory warning index for automobile dealers rose to 56.6%, remaining above the boom-bust line. Against this backdrop, 72.5% of dealers failed to meet their sales targets in the first half of the year.

Therefore, dealers have to bear the huge cost of capital occupation on their own. However, these funds, which should have been circulating, are now lying idle in the dealers’ parking lots, gathering layer upon layer of dust and being soaked by rain again and again.

To reduce inventory pressure, car dealers have adopted various promotional methods to attract customers, with price reductions being a significant component. This is why we see varying discounts at 4S dealerships. According to incomplete statistics, in the first four months of 2025 alone, more than 60 car models were discounted, with the number soaring to over a hundred in May. Some models saw price reductions exceeding 50,000 yuan, and even 30,000-yuan-level low-priced cars reappeared.

The adverse effects of price reductions are also spreading throughout the entire industry chain.

In 2024, the profit margin of China's automotive industry is only 4.3%, and it further declines to 3.9% by the first quarter of 2025. Meanwhile, auto parts suppliers, in order to retain major clients, are forced to accept bids below cost, leading to greater losses with more orders. In the terminal market, over 80% of dealers are caught in price inversions, resulting in an average industry profit margin of only 4.1%.

At the same time, when 84.4% of dealers are selling cars at a loss, can consumers really benefit from it? The harsh reality is no.

Every penny lost by dealers will ultimately be passed on to consumers in another form. Behind huge discounts, there are often hidden mandatory bundled high-priced insurance policies and decoration packages; low-interest loan financial plans come with hidden fees; during after-sales service, the prices of “recommended items” and “factory-recommended” options are outrageously inflated...

A chain reaction caused by "not making money" is viciously cycling through the automotive industry chain.

02Who is creating the channel "black hole"?

"Cars are sold slower than they are acquired; selling cars depends on fate, while acquiring them is a task," a salesperson complained to the Auto Commune. In their view, car manufacturers also bear some responsibility for the difficulties dealers face in selling cars.

Behind the high inventory levels lies a mismatch in the production and sales model. The root cause is the OEMs' blind expansion of production capacity, leading to intensive store openings and inventory pressure, which distorts terminal prices. Moreover, some dealers have stated, "If the manufacturer’s inventory pressure targets are not met, all rebates and subsidies vanish, and the cash flow immediately breaks down. Even if we sell at a loss per vehicle, at least we can get rebates to maintain cash flow."

Therefore, when manufacturers, in pursuit of impressive sales figures, set increasingly demanding targets without regard for the sales capacity at the retail end and shift the pressure onto dealers—penalizing them by withholding rebates or even revoking their dealership qualifications if targets are not met—this greatly increases the pressure on dealers. There have even been rumors that some dealers, in order to obtain manufacturer rebates, falsely report higher shipment volumes, which further exacerbates their financial strain.

However, is the car company at fault?

Considering the issue from different perspectives leads to different answers. An employee from an automobile manufacturer revealed to Auto Commune: "From sales targets to profit goals, from reporting to shareholders to various performance agreements, car companies have to solve these problems one by one. Although selling cars at reduced prices lowers profitability, thin profits and high sales volume is currently one of the few available options."

This is not mere rhetoric. Take the currently hotly debated competition between new energy vehicles and traditional fuel vehicles as an example: as the penetration rate of new energy vehicles continues to rise, some fuel vehicle manufacturers are forced to both enhance their products and lower prices to promote sales. Otherwise, without sufficient sales to maintain their outward respectability, there would be no way to talk about profit or brand influence.

As a result, some "overwhelmed" dealers chose to shift from "BBA" to "Wei, Xiao, Li" (NIO, XPeng, Li Auto), especially those dealers who used to rely on mainstream and luxury brands and were accustomed to "making easy money."

For example, as the current leading automotive dealership group in China, Zhongsheng Group has chosen to join the ranks of Huawei's smart selection car dealerships. By the end of 2024, they will acquire the operating rights for approximately 50 outlets at once. It is worth noting that Zhongsheng Group operates around 420 car dealerships in total, and this number already exceeds ten percent of their current scale, demonstrating Zhongsheng Group's determination to transform.

At the same time, a salesperson from a mainstream luxury brand 4S dealership admitted, "Previously, when selling luxury brand cars, we lost an average of 20,000 yuan per vehicle. After switching to selling AITO cars, the comprehensive gross profit per vehicle has increased to about 13,000 yuan. Everyone wants to make money."

In addition to switching to other brands, some automakers and dealers have also chosen to reduce the number of their stores.

Guanghui Automotive will add 287 closed stores from May to July 2025, accounting for nearly 40% of the total number of outlets at the beginning of the year; Mercedes-Benz plans to cut more than 100 stores starting in 2025 to optimize inefficient outlets and improve overall operational efficiency; Porsche plans to reduce the number of dealers in China to about 100 by 2027.

In the process of channel transformation, lightweighting is also a key step. Lincoln Motor Company has launched the "Sparks of Prairie Fire" plan, reducing the single-store area by 80% to about 800 square meters and lowering the investment threshold to 1.5 to 2 million yuan, which is only one-tenth of the traditional 4S store. This innovation is reshaping the relationship between automakers and dealers.

Currently, new energy vehicle brands are adopting a light-asset operation model at the pre-sales end and a heavy-operation authorized model at the after-sales end, breaking the traditional dealer inventory pressure that existed in the era of fuel vehicles. Taking the cooperation between AITO and Zhongsheng as an example, dealers receive a fixed commission of about 4.5% per vehicle sold, approximately 1,000 yuan, without having to bear inventory risks, which greatly reduces the dealers’ cash flow pressure. In addition, the pilot agency system, with a unified retail price eliminating price wars, allows dealers to earn fixed commissions and service fees, reflecting a shift in channel transformation strategy.

With this transformation, dealers have reaped the benefits, which has also changed the cooperative relationship between car manufacturers and dealers.

Previously, industry insiders have called for: eliminating the one-size-fits-all sales targets, allowing dealers to independently declare a reasonable inventory cap; simplifying rebate rules; and adjusting the rhythm of wholesale.

Currently, there are car manufacturers providing practices for reference. Take SAIC Volkswagen as an example: when a dealer's inventory coefficient reaches 1.6, or if the local market share is stable and the inventory coefficient is above 1.5, the manufacturer stops wholesaling vehicles. This is also an attempt to alleviate the pressure on dealers.

Of course, whether it is car manufacturers redefining the rules or car dealers making their own adjustments, it is a long process. What we need to recognize right now is that the survival pressure faced by dealers needs to be acknowledged and addressed.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories