100 billion yen withdrawal! hitachi plans to exit its last home appliance business, potentially impacting abs and pc plastics

According to Japanese media reports, the comprehensive electrical machinery giant Hitachi is considering selling its domestic white goods business, including core product lines such as refrigerators and washing machines, which is Hitachi's last white goods business. It has already approached several companies, including Samsung and LG, to explore acquisition interest. The transaction amount is expected to reach between 100 billion to several hundred billion yen. If this transaction is completed, Hitachi will become the fourth Japanese giant to sell its home appliance business overseas, following Sanyo, Toshiba, and Sharp.

Source of image: Tencent News

Hitachi, as a century-old Japanese industrial giant, is considering selling its domestic white goods business in Japan (including core product lines such as refrigerators and washing machines). This decision is not accidental but a crucial step in its long-term strategic transformation. Behind this decision lies profound industry transformation logic and adjustments in the company's development strategy.

Timeline of Business Sales by Japanese Home Appliance Giants

Hitachi, as a company with a century-long history, has operated in various fields including electric machinery, home appliances, energy, and transportation. In the 20th century, alongside companies like Toshiba and Panasonic, it became a benchmark in the global home appliance industry due to its technological advantages.

According to reports, Hitachi's white goods business intended for sale this time is primarily aimed at the domestic Japanese market, covering products such as refrigerators and washing machines. In fact, Hitachi's overseas home appliance business was already sold to Turkey's Arcelik company in 2021 (with a 60% stake in the joint venture, not a complete sale). Now, the declining development of the home appliance business in Japan has accelerated its path towards continued strategic adjustments.

The strategic contraction of the Japanese home appliance industry is not an isolated phenomenon but a trend that has continued for more than a decade. Using the recent sale by Hitachi as the latest point, we can outline a clear timeline of Japanese home appliance giants exiting the market.

- 2011 Haier Group acquired Sanyo Electric's washing machine and refrigerator businesses in Japan and Southeast Asia for approximately 10 billion yen. This acquisition provided Haier with Sanyo's production bases and sales networks in Southeast Asia, laying the foundation for its market layout in Asia. Panasonic, as the parent company of Sanyo, began gradually withdrawing from the low-profit home appliance sector following this sale.

- 2012 In the same year, Haier Group completed the full acquisition of Sanyo's white goods business, including the rights to use the Sanyo brand in Japan and Southeast Asia. Meanwhile, Panasonic sold Sanyo's consumer electronics business to China's Changhong, further narrowing its focus on the home appliance sector.

- 2016 In the same year, Hon Hai Precision Industry (Foxconn) acquired 66% of Sharp's shares for 389 billion yen, bringing this century-old Japanese company under the umbrella of a Taiwanese enterprise. Additionally, Toshiba sold its home appliance business to Midea Group for $473 million and its medical equipment business to Canon for 665.5 billion yen.

- 2017-2018 Toshiba continues to divest its consumer electronics assets by selling its television business to Hisense Group for 12.9 billion yen, which also includes a 40-year brand license. Through this acquisition, Hisense gains Toshiba's TV development capabilities and overseas channels. In 2018, Sharp acquired 80.1% of Toshiba's personal computer business, further integrating the remaining value of Japan's electronics industry.

- 2020 Hitachi announced the sale of approximately 60% of its overseas home appliance business shares to Turkey's Arcelik, with the transaction completed in 2021. In the same year, Panasonic announced its withdrawal from the LCD panel business, selling the related factories to JOLED.

- 2021 Hitachi and Turkey's Arcelik have established a joint venture, officially transferring its overseas home appliance business. This transaction model is different from previous direct sales, as Hitachi attempts to retain a certain level of control through the joint venture. In the same year, Toshiba announced the sale of 95% of its imaging solutions company to Hisense.

- 2024 Panasonic announced plans to exit the television market and is looking for buyers. Panasonic has successively sold off Sanyo's related businesses and continues to shrink its home appliance line. The company is instead betting on high-profit tracks such as AI data centers, similar to the strategic transformation direction of Hitachi.

- 2025 Hitachi is considering selling its domestic home appliance business in Japan, with potential buyers including South Korea's Samsung and LG, as well as some Chinese companies. The transaction is expected to amount to 100 billion to several hundred billion yen. If the deal goes through, Hitachi will become the fourth Japanese giant to sell its home appliance business overseas, following Sanyo, Toshiba, and Sharp.

This timeline reveals thatThe systematic withdrawal of the Japanese home appliance industryThe trajectory. From the forced sales of Sanyo and Toshiba in the early days, to the subsequent equity transfer of Sharp, and now Hitachi actively seeking strategic divestment, Japanese companies have gradually abandoned their once-proud consumer electronics business. In the process of selling, the brand value and technological accumulation of Japanese companies have become the main targets of Chinese companies' bidding.

Why does Hitachi want to sell even its domestic home appliance business?

Financial PerformanceDespite the fact that Hitachi Global Life Solutions (Hitachi GLS) generated 367.6 billion yen in sales and 39.2 billion yen in adjusted EBITA profit from its white goods business in the 2024 fiscal year, sales declined by 2% year-on-year, indicating a clear growth bottleneck. In contrast, Hitachi's social infrastructure businesses (such as power and railway systems) and digital businesses provide more stable cash flow and higher profit margins. This performance disparity has accelerated management's decision to "let go" of the appliance business.

Source: Home Appliance Network

According to statistics from Euromonitor International, in 2024, Haier holds a 22.8% share of the global refrigerator market, ranking first in the world. In the washing machine sector, Haier (27.5%) and Midea Group (13.1%) also rank as the top two.

The changes in the global competitive landscape are another important factor. After 2010, the advantages of Chinese companies in cost control, market responsiveness, and supply chain efficiency have gradually eroded the competitiveness of Japanese brands in price-sensitive markets. According to statistics from Euromonitor International in the UK, Haier holds a 22.8% share of the global refrigerator market in 2024, ranking first in the world. In the washing machine sector, Haier (27.5%) and Midea Group (13.1%) are also in the top two positions.

Challenges of Technological IterationEqually not to be overlooked is that the home appliance industry is currently undergoing a profound transformation towards intelligence and the Internet of Things (IoT), and Japanese companies are noticeably lagging behind in user experience innovation and software ecosystem development. While Chinese companies quickly launch smart home appliances integrated with AIoT technology through flexible supply chains, Japanese companies remain overly focused on refining hardware performance. This path dependency further weakens their market competitiveness.

Hitachi's strategic adjustment reflectsThe Deep Transformation Dilemma of Japanese Manufacturing IndustryOn one hand, the low value-added characteristic of traditional home appliance business is gradually diverging from the profit models of the digital age; on the other hand, the fierce competition in emerging areas requires companies to continuously invest in technological innovation. Given limited resources, it is not surprising that Hitachi chooses to scale down its traditional business lines and concentrate its resources on areas with greater growth potential.

"China's Receiver: Profit or Loss?"

The strategic moves of Chinese home appliance companies frequently taking over Japanese brand businesses have sparked widespread discussion in the industry. Behind this phenomenon lie both obvious advantages and potential risks. From Midea's acquisition of Toshiba's white goods, Haier's acquisition of Sanyo, to Hisense taking over Toshiba's television business, the "takeover" actions of Chinese companies need to be assessed in the context of specific historical stages and development strategies.

Rapid acquisition of brand value and technological accumulationThe most direct benefit for Chinese companies acquiring Japanese home appliance businesses is evident. When Midea Group acquired Toshiba's white goods business for $473 million in 2016, it not only obtained the global usage rights to the "Toshiba" brand for 40 years but also gained over 5,000 related technology patents. For Midea, which was advancing its internationalization strategy at the time, this acquisition provided a fast track. Similarly, when Haier acquired Sanyo Electric's white goods business in 2012, it gained Sanyo's production bases, sales networks, and technical teams in Japan and Southeast Asia, significantly reducing the time and cost required to independently develop these markets. These acquisitions allowed Chinese home appliance companies to skip the lengthy brand-building period and stand directly "on the shoulders of giants."

The breakthrough of channel resources and market access.Another important consideration is that Japanese home appliance companies have been operating in the global market for decades and have established a comprehensive channel system, especially having strong consumer recognition in markets such as Southeast Asia. Before acquiring Toshiba's home appliance business, Midea Group's overseas sales accounted for 40%, but only one-third were from its own brand exports, and it was still weak in mainstream markets in Europe and the United States. By acquiring Toshiba, Midea quickly gained access to Toshiba's channel network in Japan and Southeast Asia.

Strategic Collaboration and Industrial UpgradingThe potential should not be underestimated. After Chinese companies take over Japanese home appliance businesses, they usually combine the technological advantages of Japanese companies with the scale production and cost control capabilities of Chinese enterprises, resulting in a "1+1>2" synergy. After acquiring Sanyo's white goods business, Haier implemented a dual-brand strategy of "AQUA" and "Haier" in the Japanese market, with products designed and developed locally in Japan. Their coin-operated commercial washing machines hold the largest market share in Japan. This synergy has helped Chinese companies achieve industrial upgrading.

However,Potential risks of mergers and acquisitionsIt is also worth being vigilant. After overseas mergers and acquisitions, the integration of multiple brands and local channels will be a challenge in the future, especially in achieving the coordinated development of multiple brands while ensuring that they do not affect each other. The lifetime employment culture of Japanese companies and the efficiency orientation of Chinese companies may lead to management conflicts. Moreover, as the global market awareness of Japanese home appliance brands gradually declines, the acquirer may face the risk of brand devaluation.

Industrial Development StageIn different periods, acquisitions hold different meanings. In the early 2010s, Chinese home appliance companies were in the "catch-up" phase, and acquisitions were primarily aimed at acquiring technology and brands. By the 2020s, Chinese companies had achieved technological parity or even leadership, and acquisitions were more about supplementing channels or gaining access to specific markets.

How to impact the plastic industry chain?

Hitachi's decision to sell its white goods business not only reflects changes in the home appliance industry landscape but will also have a profound impact on the upstream plastic raw materials market. As an important downstream application field of engineering plastics such as ABS and PC, changes in the white goods industry are directly related to the supply-demand balance in the plastics market.

White goods such as refrigerators and washing machines extensively use plastic casings and internal components. ABS resin, due to its good impact resistance, molding processability, and relatively low cost, has become the preferred material for appliance casings. PC/ABS alloy materials, because of their excellent overall performance, are expected to maintain an average annual compound growth rate of about 8.5% from 2025 to 2030. The application proportion of flame-retardant materials in the electrical and electronic field has significantly increased, with the UL94V0 standard becoming an industry entry threshold.

The current situation in the PC raw material market is also not optimistic. The polycarbonate (PC) market is experiencing an unprecedented downturn. As one of the five major engineering plastics, PC has been widely used in the electronics and electrical industries for its excellent impact resistance, transparency, and heat resistance. However, in recent years, domestic PC production capacity has expanded rapidly. By 2025, global PC production capacity is expected to reach 8.5 million tons, with China accounting for over 50% (approximately 4.73 million tons per year), but the capacity utilization rate continues to decline.

In the context of overcapacity, any contraction in the home appliance industry will exacerbate competitive pressure in the plastics market. After Japanese companies sell their white goods businesses, if the acquiring party undertakes production integration or relocation, it may lead to short-term order fluctuations, further affecting the procurement of plastic raw materials.

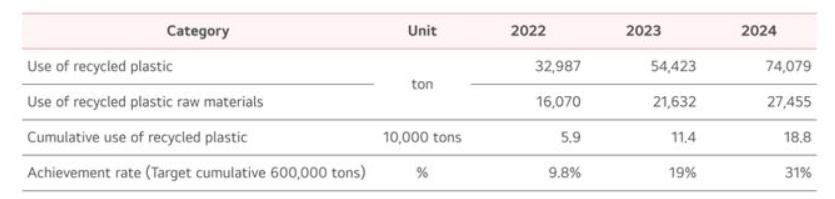

Environmental policies and material innovation are also reshaping the structure of industry demand. For example,LG Since 2021, a total of 188,000 tons of recycled plastic has been used, with a medium to long-term goal of reaching 600,000 tons by 2030. In 2024, the company plans to use 74,079 tons of recycled plastic in a single year. The application range of recycled plastics covers multiple core product lines, including televisions, air conditioners, and refrigerators.

Source of image: LG Electronics

Editor: Lily

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track