[Today's Plastics Market] Local Narrow Adjustments: PS, PC Steady to Upward, PE, PVC, ABS, PET Range Fluctuation

Summary: On January 9, a summary of the prices and forecasts for general-purpose and engineering plastics in the market. In terms of general-purpose materials, the PE market is experiencing increased wait-and-see sentiment with localized fluctuations, and some prices have changed by 4-55; the PVC market is generally in a weak adjustment, down by 10-40; ABS has seen some price changes of 30-40; the PS market is relatively supported, with slight local increases of 30-70. In the engineering materials sector, PC is stable and moving upward, with some increases of 50-100; PET is fluctuating within a range, with some decreases of 10; PBT, PA6, and PA66 are operating under a wait-and-see approach.

General Material

PE: Increasing wait-and-see sentiment, with price adjustments as the main focus.

1. Today's Summary

Geopolitical situations such as Russia-Ukraine and Israel-Iran remain uncertain, with short-term potential supply risks persisting, leading to a rise in international oil prices. NYMEX crude oil futures for February contracts increased by $1.77 per barrel to $57.76, a 3.16% rise compared to the previous period; ICE Brent crude futures for March contracts increased by $2.03 per barrel to $61.99, a 3.39% rise compared to the previous period.

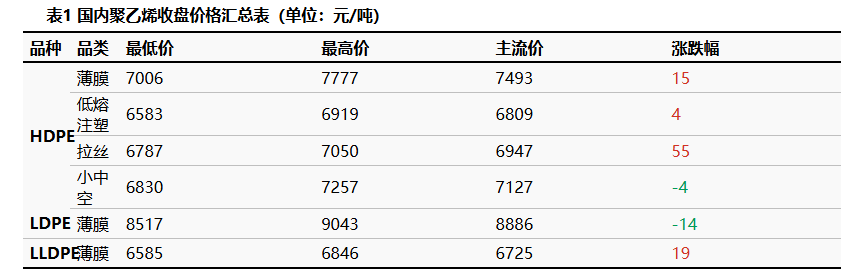

②、 The HD PE market price change range is -4 to -55 yuan/ton, LDPE market price -14 yuan/ton, LLDPE market price +19 yuan/ton.

2. Spot Overview

The supply of spot market resources is tight, but due to the approaching weekend and the slowdown in the futures market, the trading atmosphere today is weaker compared to the previous days. Suppliers' price increase actions have also slowed down compared to earlier. The price change for HDPE in the market is -4 to 55 yuan/ton, for LDPE it is -14 yuan/ton, and for LLDPE it is +19 yuan/ton.

3. Price Forecast

In the short term, the issue of tight market supply will persist, with suppliers primarily focusing on pre-sale resources. Due to the current price level being on an upward trend, suppliers are more motivated to engage in pre-sales. On the demand side, some factories have increased their replenishment activities, which will provide positive support to the market trend.

PVC: Weak oscillation continues, PVC inventory accumulates.

1. Today's Summary

Domestic PVC production companies have reduced their ex-factory prices by 20-60 yuan/ton.

②. Qinzhou Huayi is expected to resume operations next week, and there are no new company maintenance plans at the moment.

③、 The United Nations report predicts that the global economic growth rate will be 2.7% in 2026.

2 Spot Overview

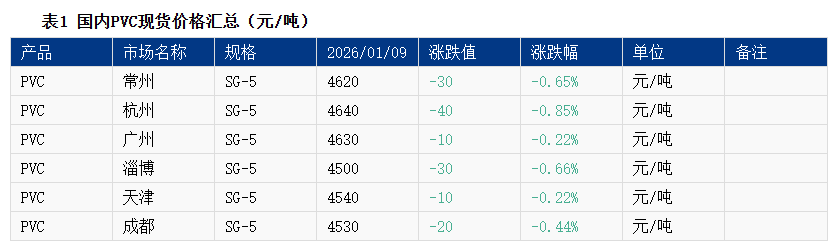

Based on the Changzhou market in East China, today the cash price for calcium carbide using the carbide method in the East China region is 4,620 yuan/ton, a decrease of 30 yuan/ton compared to the previous trading day. 。

The domestic PVC spot market has seen a fluctuating decline in transaction focus, with the supply-demand fundamentals remaining weak. Short-term macro expectations are not optimistic, leading to a downward search for prices during the day. End-user purchases are minimal, and the overall transaction atmosphere is tepid. In East China, the cash price for calcium carbide method PVC is between 4580-4700 yuan/ton, while the ethylene method remains stable at 4650-4750 yuan/ton.

3. Price Forecast

The macro atmosphere is unfavorable, with weak fluctuations during the trading session. In the short term, the policy disturbances are expected to slow down, and the basic situation of PVC supply increasing and demand being weak remains unchanged. There is insufficient transaction information in the market, and due to the impact of slowed terminal orders at the end of the year, the enthusiasm for replenishment and stocking is not high. Industry inventory is expected to continue to accumulate, and the support from bottom cost is inadequate. It is anticipated that the PVC spot market will maintain range-bound fluctuations in the short term, while in the medium to long term, the focus will still be under pressure and look low. The price of PVC in the East China region for calcium carbide method is expected to fluctuate in the range of 4500-4650 yuan/ton.

PS: Cost support is relatively good, and the market is stable with slight increases in some areas.

1 Today's Summary

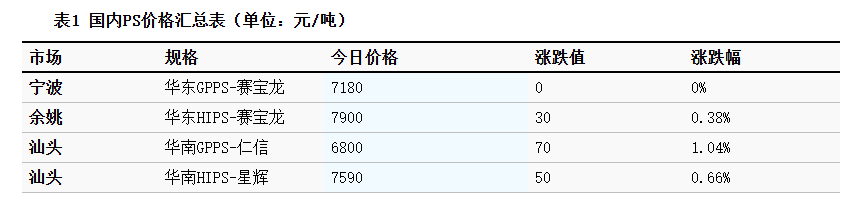

Today, East China GPPS is stable at 7180 yuan/ton.

On Friday, styrene in the East China market increased by 60 to 6,970 yuan/ton, in South China it rose by 55 to 7,005 yuan/ton, and in Shandong it went up by 50 to 6,755 yuan/ton.

2 Spot Overview

Longzhong Information Statistics,Today, the price of East China GPPS is stable at 7,180 yuan/ton. The raw material styrene is consolidating on the strong side, providing good cost support. The supply of goods in the industry is relatively ample, with downstream purchasing mainly driven by just-in-time needs. Some small price increases are being attempted, but after the rise, transactions remain mediocre.

3 Price Forecast

Styrene has risen and is now fluctuating, with cost support remaining acceptable, while the buying sentiment for chasing prices is moderate. Industry supply is relatively high, and downstream procurement is driven by just-in-time needs, leading to considerable supply and demand pressure. In the short term, the PS market is expected to narrow its range of consolidation. The price for toluene modified styrene in the East China market is anticipated to be between 7,100 and 7,850 yuan/ton.

ABS: The manufacturer raised the ex-factory price today, and today's sales were good.

1 Today's Summary:

1. Today, the market prices in East China have been slightly adjusted; the South China market has seen narrow adjustments, and the market transactions today are relatively good.

②. The monthly ABS production in January decreased month-on-month.

2 Spot Overview:

Based on the regions of Yuyao and Dongguan, the East China market prices are narrowly adjusted, and the South China market prices are narrowly adjusted. Today, traders' transactions are satisfactory, with manufacturers such as Lihuayi, Dagang, and PetroChina raising their ex-factory prices. Market sales are decent, and the domestic ABS market is expected to be relatively strong next week.

3 Price prediction:

Based on the Ningbo and Dongguan regions, the East China market prices are narrowly consolidated, while the South China market prices have shown slight fluctuations with small increases and decreases in certain areas. Today's market transactions are acceptable, and some manufacturers have raised their ex-factory prices, leading to an improved sentiment. It is expected that ABS prices will be strong next week.

Engineering materials

PC: The market is steadily moving upward.

1 Today's summary

①、 On Thursday, international crude oil rose, with ICE Brent crude futures for the February contract up $2.03 to $61.99 per barrel. 。

②. The raw material Bisphenol A in the East China market closed at 7,500 yuan/ton, remaining stable compared to the previous period.

As the weekend approaches, domestic PC factories have no recent updates on factory price adjustments.

Spot Price

Today, the domestic PC market is undergoing a volatile adjustment. As of the afternoon close, mainstream negotiations for low-end injection-grade materials in East China are referencing 10,750-13,000 yuan/ton, while mid to high-end materials are being discussed at 14,650-14,800 yuan/ton, with some negotiation centers rising by 50-100 yuan/ton compared to yesterday. As the weekend approaches, there have been no new factory price adjustments from domestic PC plants; in the spot market, some negotiation centers in East and South China are showing a slight upward trend. With expectations of support from the supply side, there is a strong atmosphere of price stabilization in the market, and holders are reporting higher price centers. However, downstream inquiries for immediate demand remain limited, and trading activity is expected to improve further.

3 Price prediction

Currently, one PC unit of Zhejiang Petrochemical continues to be under maintenance, leading to a sustained tight supply of low-end PC materials and a clear upward trend in prices. Meanwhile, other domestic PC factories are still facing relatively low pressure in spot sales. Amid partial replenishment and stockpiling operations by industry players, the market is showing a strong atmosphere of price support. Overall, in the short to medium term, there is no expectation of an increase in PC supply, and the domestic PC market is anticipated to maintain a relatively firm trend. Attention should be paid to the further evolution of market dynamics.

PET: The polyester bottle chip market is fluctuating within a range, with spot trading as the main focus.

1 Today's Summary

① Most factories kept their quotes stable, WanKai lowered by 10, Sinopec Yizheng Chemical Fiber lowered by 20, and Haoyuan lowered by 30. (Unit: yuan/ton)

The domestic polyester bottle chip capacity utilization rate has reached 70.59% today.

2. Spot Overview

Today, the spot price for polyester bottle-grade chips in East China is 6030, unchanged from the previous working day, in line with the morning forecast.

Crude oil rose significantly, while some polyester factories announced maintenance plans, putting pressure on the raw material side, leading to weak and volatile fluctuations. With insufficient support from the cost side, most polyester bottle chip factories kept their prices stable, and the market focus adjusted slightly weaker. In some areas, there was tight supply, and some holders were reluctant to sell at low prices. It was heard that the January cargo transactions were at 5960-6080, with mainstream cargo prices at 6010-6050. The basis slightly changed, with the 2603 contract at par to a premium of 40. (Unit: yuan/ton)

3. Price Prediction

The expectations for polyester reduction have advanced, and the performance on the raw material side is relatively weak. In the short term, the supply side is clearly contracting, leading to tight circulation of local resources. However, there is no significant improvement in downstream demand. With a tug-of-war between raw materials and supply and demand, it is expected that the polyester bottle chip market will continue to fluctuate. Next week, the spot price of polyester bottle-grade recycled pellets in the East China region is forecasted to be between 5,950 and 6,150 yuan per ton.

PBT: Raw material trends fluctuate, PBT market observes operation.

1 Today's Summary

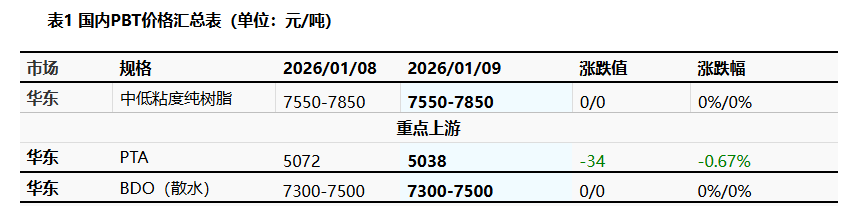

This week's PBT manufacturers' quotes remain stable.

This week, there are fewer maintenance activities for the PBT equipment.

③ In this period, the production of PBT is 25,700 tons, an increase of 900 tons compared to the previous period, with a growth rate of 3.63%. The capacity utilization rate is 60.56%, which is an improvement of 2.14% compared to the previous period. This week, the average gross profit of domestic PBT is -791 yuan/ton, an increase of 49 yuan/ton compared to the previous week.

2 Spot Overview

Taking East China as the benchmark, the mainstream price of medium and low viscosity PBT resin today is between 7550-7850 yuan/ton, which is flat compared to the previous working day. Today, the PBT market is operating with a wait-and-see attitude, the PTA market is showing a strong consolidation, and the BDO market is stable on the surface. The raw material sector is once again caught in fluctuations, but overall support remains acceptable. The wait-and-see sentiment dominates the PBT market, and the supply-demand game continues. , According to Longzhong Information's statistics, the price of low-viscosity PBT pure resin in the East China market is 7,550-7,850 yuan per ton.

3 Price Forecast

The PBT market is expected to fluctuate within a range. On the raw material side, the PTA terminal continues to reduce its load, polyester is expected to reduce its load ahead of schedule, and there is a strong expectation of inventory accumulation in the long term. The recent rapid increase in processing fees needs to be digested, and the short-term PTA spot market is expected to continue a weak and volatile trend. The BDO supply-demand side lacks strong support, and industry players have a general attitude towards buying and selling, with supply-demand orders being negotiated, causing market fluctuations within a range. The raw material trend is stabilizing, but overall trading is average, and the inventory pressure on the PBT supply side persists, with a possibility of weak negotiation focus. Therefore, Longzhong expects the East China market price for medium-low viscosity PBT resin to be 7500-7850 yuan/ton tomorrow.

PA6: Market transactions are limited, PA6 market is consolidating.

1 Today's summary

①、 Sinopec's settlement price for high-end caprolactam in December 2025 is 9,885 RMB/ton (liquid premium grade, six-month acceptance, self-pickup), an increase of 985 RMB/ton compared to the November settlement price.

②、 Sinopec's prices for pure benzene at various refineries in East and South China have been reduced by 150 yuan/ton, now set at 5300 yuan/ton, effective from November 5th.

2 Spot Overview

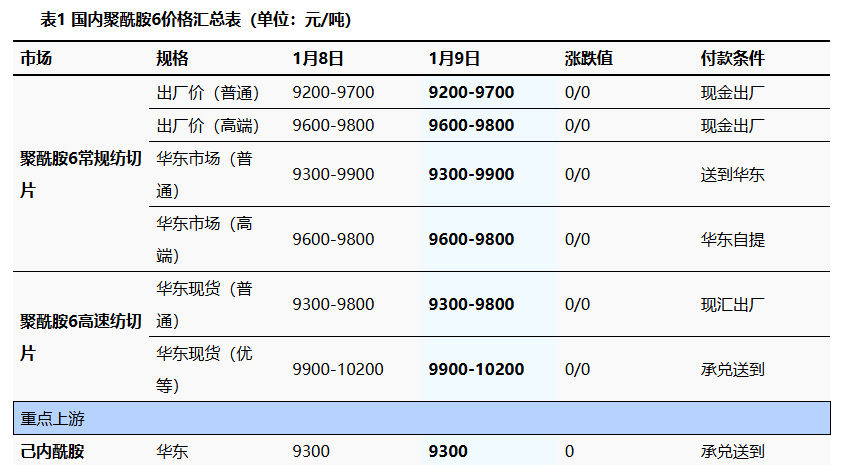

Today, the nylon 6 market is operating in an adjusted manner. The raw material market is temporarily stable, but the cost pressure remains high due to the loss of profit in chip production. Downstream demand is limited, focusing mainly on low-price, essential purchases. Market transactions have generally shifted. In East China, conventional spinning PA6 is priced at 9300-9900 RMB/ton with cash and short delivery, while high-speed spinning spot goods are priced at 9900-10200 RMB/ton with acceptance delivery.

3 Price Prediction

From a cost perspective, the caprolactam market is running weakly, but the cost pressure from chips still exists. From the supply and demand perspective, some polymer enterprises are undergoing maintenance, but Fujian Zhongjin is gradually increasing its load, and production is expected to rise. Meanwhile, downstream demand remains just in need with selective low-price replenishment, and future demand may be limited. It is expected that the PA6 market will stabilize in the near term.

PA66: General demand on the supply side, market fluctuating within a narrow range.

1 Today's Summary

1/8: The geopolitical situations in Ukraine and Israel remain uncertain, with potential short-term supply risks continuing, leading to an increase in international oil prices. NYMEX crude oil futures for February contract rose by $1.77 to $57.76 per barrel, an increase of 3.16%; ICE Brent crude futures for March contract rose by $2.03 to $61.99 per barrel, an increase of 3.39%. China's INE crude oil futures for the 2602 contract fell by 6.8 to 418 yuan per barrel, and increased by 6.6 to 424.6 yuan per barrel in the night session.

Today, the domestic PA66 capacity utilization rate is 70%, with a daily output of approximately 2,850 tons. The capacity utilization rate is relatively stable, downstream demand is generally moderate, and the supply of goods in the domestic PA66 industry is ample.

2 Spot Overview

Based on the Yuyao market in the East China region, the market price for EPR27 today is 14,900-15,000 RMB/ton, which is stable compared to the previous trading day. 。 The cost pressure is relatively high, but the market spot supply is stable. Downstream buyers are cautious in following up with high prices, focusing mainly on essential needs. The market is operating in a consolidated manner. 。

3 Price Prediction

Raw material prices are fluctuating at high levels, and cost pressure persists. The market has ample spot supply, and downstream follow-up at high prices is slow. The fundamentals are relatively stable, leading to narrow fluctuations in the domestic PA66 market in the short term.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Nissan Cuts Production of New Leaf EV in Half Due to Battery Shortage

-

Vynova's UK Chlor-Alkali Business Enters Bankruptcy Administration!

-

Case Study | Clariant AddWorks™ Additives Solve Plastic Yellowing Problem

-

[Today's PP and PE Prices in Fujian] Mixed Changes! PP Up by a Maximum of 475, PE Down by a Maximum of 350

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories