[Today’s Plastic Market] Narrow Range Adjustment! General Materials Maintain Downward Trend, Engineering Materials Experience Local Fluctuations, PA6 Continues to Rise by 100

Summary: November 18th Plastic Market General and Engineering Material Prices and Forecast Summary. In terms of general materials, the market atmosphere is dull, with PP and PE slightly weak and fluctuating; PVC, PS, and ABS see a small decline of 10-40; EVA is stable and consolidating. In terms of engineering materials, PC sees an individual drop of 50; PET has a narrow decline of 10-20; PA6 quotes remain firm, with some increasing by 50-100; PMMA, POM, PBT, and PA66 are running stably for now.

General material

PE: Trading atmosphere has weakened, and spot offers from sellers have shown some relaxation.

1. Today's Summary

Russia's previously attacked port has resumed normal loading operations, alleviating geopolitical concerns and leading to a decline in international oil prices. NYMEX crude oil futures for the December contract fell by $0.18 to $59.91 per barrel, a decrease of 0.30% compared to the previous period; ICE Brent crude oil futures for the January contract fell by $0.19 to $64.20 per barrel, also a decrease of 0.30%.

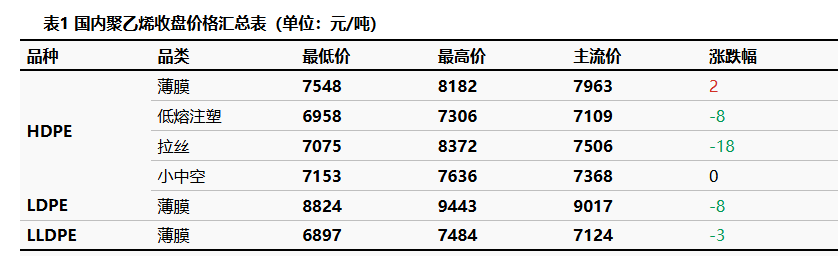

The price fluctuation range for the HDPE market is -18 to 2 yuan/ton, the price for the LDPE market is -8 yuan/ton, and the price for the LLDPE market is -3 yuan/ton.

2. Spot Overview

Today, China's polyethylene spot market is experiencing weak fluctuations. Due to the decline in futures, market trading sentiment has weakened, and holders are somewhat flexible in their spot quotations. Currently, there is still pressure on market supply, while the demand side is expected to weaken. The HDPE market price fluctuation is -18 to 2 RMB/ton, the LDPE market price is -8 RMB/ton, and the LLDPE market price is -3 RMB/ton.

3. Price Forecast

On the supply side, although some major maintenance units have gradually resumed operations, the number of temporary shutdown units has increased recently, resulting in overall market supply remaining relatively unchanged. On the demand side, downstream industries are gradually entering the off-season, with the agricultural film and pipe industries showing particularly evident signs. Demand in the northern regions is gradually decreasing. In summary, polyethylene market prices are expected to remain weak in the short term.

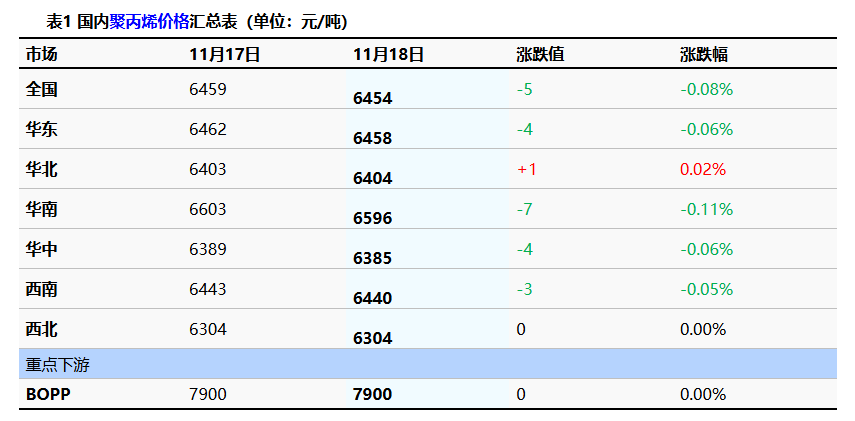

PP: The demand side is flat, and the polypropylene market is weakly organized.

1. Today's Summary

①, Adjustments in Sinopec East China: 1. Zhong'an Joint Venture: Homopolymer raffia series decreased by 50 yuan/ton, T30S decreased from 6400 to 6350, T03C simultaneously, Y26 from 6500 to 6450; copolymer K8003 decreased by 50 yuan/ton, price decreased from 6700 to 6650, M30RH decreased from 6850 to 6750; 2. Anqing Petrochemical: Homopolymer raffia series decreased by 50 yuan/ton, T30S decreased from 6400 to 6350, F03T simultaneously, V30G decreased from 6450 to 6400; copolymer series price adjustment, K8003 decreased from 6650 to 6600, M30RH decreased from 6650 to 6550; 3. Jiujiang Branch: Homopolymer raffia series decreased by 50 yuan/ton, T30S decreased from 6400 to 6350, F03D/G simultaneously, decreased from 6500 to 6450.

Today, the domestic polypropylene shutdown impact increased by 0.3% compared to yesterday, reaching 17.92%. The daily production proportion of raffia decreased by 0.25% compared to yesterday, reaching 23.85%, while the daily production proportion of low-melt copolymer remained stable at 8.06%.

③、The supply and demand balance in this period continues to maintain a tight balance.,As the supply-demand gap quickly narrows from a negative value, it is insufficient to impact market prices significantly. In the next period, the supply-demand balance gap will slightly widen due to a significant decrease in supply, but the weakening demand provides limited support to the market.

2. Spot Overview

3Price prediction

The current supply-side pressure is manageable. On the demand side, the follow-up of new orders downstream is limited, with most purchases driven by just-in-time demand at lower prices. The weak demand provides insufficient support for the PP market, and there is no significant driving force in the market, leading to cautious trading. It is expected that the polypropylene market will primarily undergo weak consolidation tomorrow, with market fluctuations around 6,350-6,580 yuan/ton.

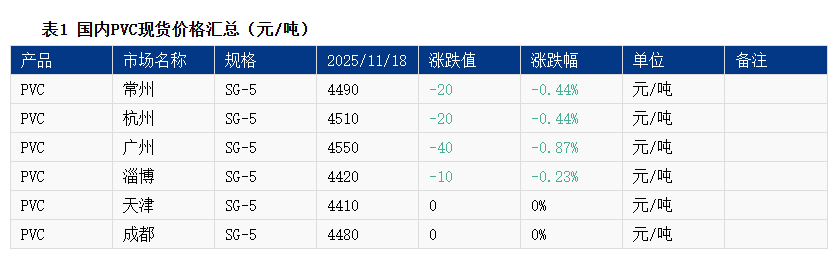

PVC: Seeking low prices during the trading session, with no highlights in supply and demand.

1. Today's Summary

Some domestic PVC manufacturers have reduced their ex-factory prices by 20-50 yuan/ton.

②, Hengtong maintenance, LG unit has not yet been restored.

③、 There is currently no official notification regarding India's anti-dumping policy on PVC imports, and the possibility of it not being implemented or being postponed until next year cannot be ruled out.

2 Spot Overview

Based on the East China Changzhou market, the cash price for acetylene-based Type V today in the East China region is 4,490 yuan/ton, down 20 yuan/ton compared to the previous trading day. 。

The domestic PVC spot market is stable with a cautious outlook, and transactions are primarily based on intraday prices. The price focus has slightly decreased compared to the previous period, with some increase in transaction volume. Influenced by the stock index and short-term expectations of the fundamentals, intraday prices continued to decline in the afternoon. However, considering the uncertainty of anti-dumping measures, there is still a bottom support in the short-term market. In East China, the cash price for calcium carbide method is at 4450-4550 yuan/ton, while the ethylene method remains stable at 4500-4700 yuan/ton.

3. Price Forecast

The domestic PVC supply and demand market remains weak, with maintenance reductions pushing supply to stay at a high level. Domestic demand is stable, while there is uncertainty in foreign trade exports. However, the recent strengthening of upstream cost support has led the spot market to primarily stabilize weakly. In the short term, stock indices and policy-driven risk aversion sentiments will influence market trends. It is expected that PVC will continue to fluctuate weakly within a small range, with the cash on delivery price of acetylene-based type 5 in the East China region fluctuating between 4,450-4,600 yuan/ton.

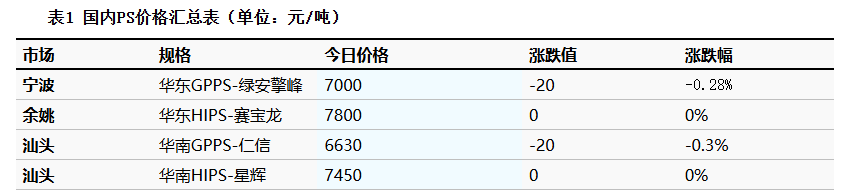

PS: The market has slightly declined, and trading volume is average.

1 Today's Summary

Today, East China GPPS fell by 20, closing at 7,000 yuan/ton.

② 、 On Tuesday, the East China styrene market fell by 35 to close at 6,500 yuan/ton, South China fell by 35 to close at 6,555 yuan/ton, and Shandong fell by 50 to close at 6,335 yuan/ton.

2 Spot Overview

Longzhong Information reported that today the price of GPPS in East China fell by 20 to 7000 yuan/ton.Due to a slight pullback in raw material styrene, some grades have slightly reduced prices for sales. Overall industry supply has slightly recovered, downstream sentiment has become more cautious, trading is stagnant, and transactions are average.

3 Price prediction

The price of raw material styrene has slightly declined, providing moderate cost support. Industry supply has somewhat recovered, and downstream purchasing pace has slowed. In the short term, the PS market may see some slight price reductions for sales. It is expected that the price of transparent modified polystyrene in the East China market will be around 6950-7800 yuan/ton.

ABS: Raw materials fluctuate downward, making today's ABS prices likely to fall rather than rise.

1 Today's Summary:

1. Today, the prices in the East China market are declining; the prices in the South China market are also declining, with market transactions driven by essential needs.

In November, the monthly output of ABS slightly decreased month-on-month.

2 Spot Overview:

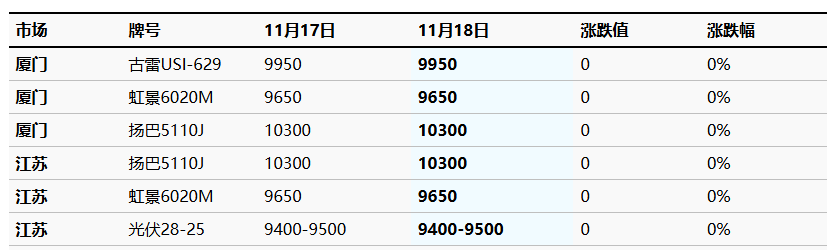

Table 1 Domestic ABS Price Summary (Unit: Yuan/Ton)

Based on the regions of Yuyao and Dongguan, prices in the East China market have stabilized, while prices in the South China market continue to decline slightly. Today, market transactions are driven by rigid demand, and the price of styrene raw materials increased before adjusting downwards. The market sentiment for ABS is average, with manufacturers maintaining shipments based on rigid demand. It is expected that the domestic ABS market price will continue to decline slightly tomorrow.

3Price prediction:

Taking Yuyao and Dongguan as benchmarks, the market prices in East China have stabilized, while the market prices in South China have shown a downward trend. Today's market transactions are driven by rigid demand, with supply remaining at a high level. Raw material prices declined today, and manufacturers' sales are average. It is expected that ABS prices will continue to show a bearish trend tomorrow.

EVA: Market Offers Remain Stable, Atmosphere is Flat

1 Today's Summary

This week's EVA petrochemical ex-factory prices have remained stable with a slight downward adjustment.

② This week's EVA petrochemical plants: Zhejiang Petrochemical and Ningbo Formosa are shut down for maintenance; Yanshan Petrochemical plant has been shut down for a long time, while others are in stable production. Hanwha-GS Energy in Korea started operations of its 300,000 tons/year plant on September 25.

2. Spot Overview

Today, the domestic EVA market is operating stably, with little change in the market fundamentals. The downstream end-user demand is following up, but the transaction atmosphere is dull. Industry players are cautiously observing with a wait-and-see attitude, continuing stable market operations, and practical negotiations are flexible. Mainstream prices: Soft material reference 9600-10200 RMB/ton, hard material reference 9700-10300 RMB/ton.

3 Price Prediction

In the short term, the EVA market continues its weak consolidation trend. Although there is a slight reduction in the supply due to some petrochemical maintenance, it has a limited substantive boost to market sentiment. Downstream demand is slow to follow up, coupled with the plans to launch new production capacity by the end of the year, leading to an expected increase in market supply. The market lacks substantial positive support. Overall, it is expected that the domestic EVA market will continue to operate in a weak consolidation trend in the near future. 。

Engineering materials

PC: Market Mildly Consolidates

1 Today's Summary

Monday International Crude Oil Downward, ICE Brent crude futures for January contract at 64.20, down 0.19. Dollar per barrel.

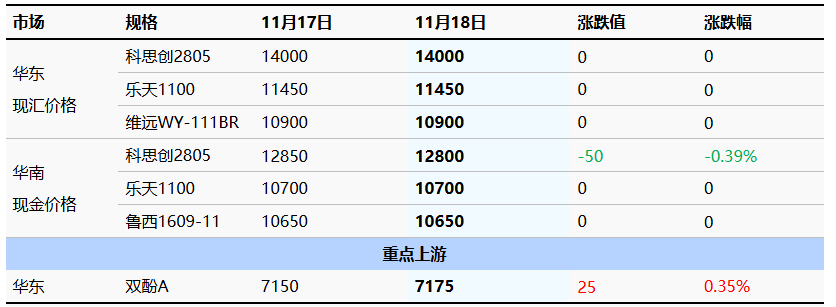

②、 Bisphenol A closed at 7175 in the East China market. ... yuan/ton, an increase of 25 yuan/ton from the previous period.

This week, the latest domestic PC factory shipments remained stable, with Zhe Petrochemical auction prices rising by 100 yuan/ton.

2. Spot Overview

Table 1 Domestic PC Price Summary (Unit: Yuan/Ton)

Today, the domestic PC market is showing a narrow range of fluctuations and is consolidating. As of the afternoon close, the mainstream trading reference for low-end injection molding grade materials in East China is between 10,150 and 13,050 yuan/ton, while the mid-high-end materials are trading at 14,000 to 14,800 yuan/ton, with the overall focus remaining relatively stable compared to yesterday. This week, the latest ex-factory prices from domestic PC manufacturers are stable or down by 100 yuan/ton. Zhejiang Petrochemical has seen four rounds of bidding with transactions opening flat, up by 100 yuan/ton compared to last week. In the spot market, both East China and South China are generally consolidating, and news from the upstream and downstream of the industry chain is sparse. Market sentiment among industry participants is cautiously mild, with pricing mainly following factory news, while downstream demand is sluggish, resulting in limited trading volume.

3 Price Prediction

Currently, one production line of Zhejiang Petrochemical's PC plant and Pingmei Shenma's PC plant continue to undergo maintenance, while Lihuayi Weiyuan's PC plant has restarted but is yet to stabilize. The supply of spot goods from manufacturers remains relatively low, and other domestic PC manufacturers are also facing little overall pressure on sales. The market is maintaining a relatively firm trend. Overall, recent fundamental news remains limited in fluctuations, and it is expected that the domestic PC market will continue in a stable and moderate consolidation pattern.

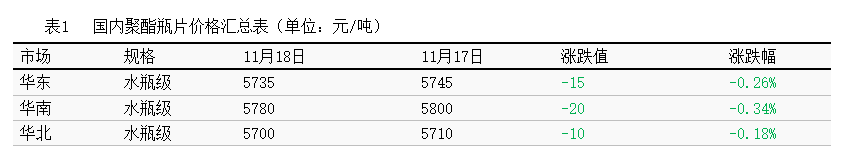

PET: Crude oil drag leads to a narrow decline in the polyester bottle chip market.

1 Today's Summary

1. Wankai and Sinopec Yizheng Chemical Fiber lowered by 20, Huaron lowered by 10, other factories remain stable (unit: yuan/ton).

②. Today's domestic polyester bottle chip capacity utilization rate is 73.29%.

2. Spot Overview

Today, the spot price of polyester bottle-grade chips in the East China region is 5735, down 15 compared to the previous working day, in line with the morning forecast.

Crude oil has declined, dragging down raw materials continuously. With insufficient cost support, most polyester bottle chip factories are holding prices steady, while some have lowered prices by 10-20. The market focus has slightly declined, with reports of November cargo transactions at 5700-5750, with some slightly lower around 5630; December cargo transactions were at 5700-5740, and there have been no reports of actual transactions for high-priced cargo, with transactions primarily focused on low-priced goods. The basis for the futures contract 2601 is at a discount of 20 to a premium of 60. (Unit: RMB/ton)

3. Price Prediction

There are many bearish factors in the market, and the sentiment among industry players is cautious, with actual orders being scarce and trading stagnant. The lack of support from raw materials, combined with a stalemate in supply and demand, may lead the polyester bottle chip market to continue its weak performance. It is expected that tomorrow, the spot price for polyester bottle-grade chips in the East China region will be between 5600-5750 yuan/ton. Attention should be paid to the downstream purchasing situation.

PMMA: PMMA particle sorting operation

1 Today's summary

①、 Today's PMMA particles Market price stability 。

②. Today's domestic PMMA particle utilization rate is 65%.

2 Spot Overview

As of today, PMMA particles in the East China region are priced at 12,800 yuan per ton, remaining stable compared to the previous working day, in line with morning expectations. 。 Today, the PMMA particle market is weak and steady. There is a stalemate in the raw material sector, with no favorable support from the cost side. The demand side remains sluggish, and holders are under pressure to sell, resulting in increased negotiation space for quotations. Transaction signs are mediocre, with actual transactions tending towards the lower end.

3 Price Forecast

The trading atmosphere at the raw material end has slowed down, and the support from cost factors has weakened. Industry participants are mainly observing future market trends. Downstream factories fully meet rigid demand, with limited proactive market replenishment, and in the case of insufficient follow-up on actual transaction volume, short-term prices for actual orders tend to operate weakly.

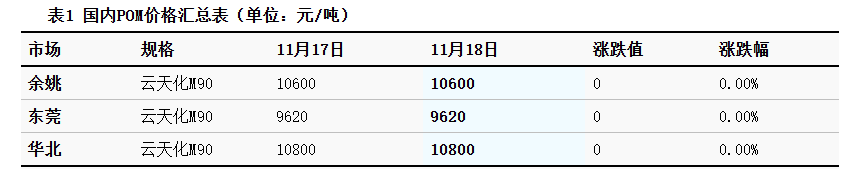

POM: Strong fundamental support, market offers rising

1. Today's Summary

The Hebi Longyu POM unit will be shut down for maintenance on October 20, and the start-up time is not yet determined.

The Tianjin Bohua POM plant was shut down for maintenance on July 7th, and the restart time is undecided.

2 Spot Overview

Based on the Yuyao area, today the price of Yuntianhua M90 is 10,600 yuan/ton, stable compared to the previous period. Today, the POM market saw a slight increase. Due to the tight supply of spot goods from petrochemical plants, there is a strong intention to maintain prices in the short term, and the market continues to have a bullish atmosphere. Traders are actively supporting prices to sell, with some grades seeing slight increases. Downstream users tend to buy when prices are rising rather than falling, with some replenishing as needed, negotiating on a case-by-case basis. By the close, the domestic POM market in Yuyao had a tax-inclusive price of 8,100-11,100 yuan/ton, while in Dongguan, the cash price for POM was 7,300-10,400 yuan/ton.

3. Price Forecast

The inventory at petrochemical plants is low, and the ex-factory prices are showing strong stability, with solid support from the fundamentals. The atmosphere for speculation and price increases is strong in various regions, and traders are actively supporting prices while selling. The mainstream quotations are firm, and some individual quotations may continue to rise. Due to the "buy high, don't buy low" mentality, downstream users are replenishing their stocks as needed, making it difficult for transactions to see a significant increase. Longzhong expects that the domestic POM market will experience minor fluctuations with a stable upward trend in the short term.

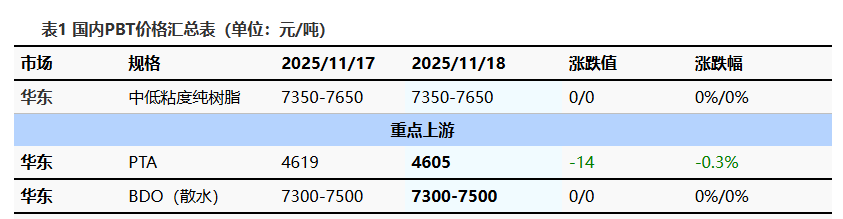

PBT: Continued Weak Demand, PBT Market Observes Operations

1 Today's Summary

This week's PBT manufacturers' quotes have been adjusted slightly.

This week, there is less maintenance on the PBT equipment.

③ The PBT production for this period is 23,200 tons, an increase of 1,100 tons from last week, a growth rate of 4.74%. The capacity utilization rate is 57.29%, an increase of 2.77% from the previous period. 。 The average domestic PBT gross profit this week is -537 yuan/ton, down 44 yuan/ton month-on-month 。

2 Spot Overview

Taking the East China region as a benchmark, the mainstream price of medium and low viscosity PBT resin today is between 7350-7650 yuan/ton, unchanged from the previous working day. Today, the PBT market is operating with a wait-and-see attitude. The PTA market has slightly declined, while the BDO market is undergoing slight adjustments. The overall cost trend is relatively weak, and demand remains sluggish, making it difficult to support the PBT market. Market participants are adopting a wait-and-see attitude, with negotiation focus showing slight fluctuations. , According to Longzhong Information statistics, the price of low viscosity PBT pure resin in the East China market is 7,350-7,650 yuan/ton.

3 Price Prediction

The PBT market is expected to remain weak and observant. On the raw material side, the supply and demand of PTA remain tight, with a continuous destocking in the balance sheet. However, there is a lack of substantial external benefits, downstream purchasing enthusiasm is hindered, and cost support is weakening, leading to a short-term expectation of a pullback in the PTA spot market. The BDO market is quiet, with major players cautiously observing, and spot transaction activity is generally moderate, resulting in a stalemate in the market. Due to the lack of clear bullish or bearish guidance in the fundamentals, the PBT market may continue to operate in a wait-and-see manner, with the focus of negotiations fluctuating within a range. Therefore, Longzhong expects the East China market price for low to medium viscosity PBT resin to be between 7350-7650 yuan/ton tomorrow.

PA6: Cost support continues to strengthen, and the PA6 market runs firmly.

1 Today's Summary

①、 Sinopec's caprolactam weekly settlement price last week was 8,730 yuan/ton (with a six-month acceptance draft, interest-free), an increase of 190 yuan/ton compared to the previous period.

②、 Sinopec's price for pure benzene at its East China and South China refineries has been reduced by 200 yuan/ton, now set at 5450 yuan/ton, effective from October 21.

2 Spot Overview

Today, the nylon 6 market is operating firmly, with the price of caprolactam continuing to rise, enhancing the cost support for chips. Some polymerization enterprises have followed suit by raising their chip ex-factory prices, but the downstream market has shifted to a cautious attitude towards restocking high-priced chips, primarily opting for lower-priced purchases in actual transactions. In East China, the regular spinning nylon 6 is priced at 9000-9300 RMB/ton cash on short delivery, while high-speed spinning spot is priced at 9200-9400 RMB/ton payable on delivery.

3 Price Prediction

From the cost perspective, some enterprises producing caprolactam have plans to reduce production, which supports its price. From the supply and demand perspective, domestic polymer enterprises maintain stable supply, while Guangxi Hengyi is gradually ramping up production. However, downstream buyers are cautious about restocking high-priced chips, and market transactions are expected to be primarily at lower prices. It is anticipated that the PA6 market will operate steadily in the near term.

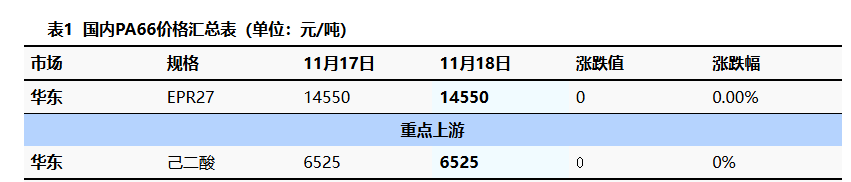

PA66: Cost pressure persists, market remains stable and consolidating.

1 Today's summary

①, 11/17: The previously attacked Russian port has resumed normal loading, alleviating geopolitical concerns, leading to a drop in international oil prices. NYMEX crude oil futures for the December contract fell by $0.18 per barrel to $59.91, a decrease of 0.30% from the previous day; ICE Brent crude oil futures for the January contract fell by $0.19 per barrel to $64.20, a decrease of 0.30% from the previous day. China's INE crude oil futures for the January 2026 contract rose by 1.9 to 460.8 yuan per barrel, and the night session rose by 1.1 to 461.9 yuan per barrel.

As of today, the domestic PA66 capacity utilization rate is 69%, with a daily output of approximately 2,700 tons. Some enterprises have stable capacity utilization, downstream demand is generally moderate, and new capacity is being gradually released, resulting in ample supply of goods in the domestic PA66 industry.

2 Spot Overview

Based on the Yuyao market in the East China region, today's market price for EPR27 is 14,500-14,600 yuan/ton, stable compared to the previous trading day. 。 The cost pressure is relatively high. The market supply is sufficient, and downstream purchases are primarily based on demand, resulting in a weak market. The market is in a state of oscillation and consolidation.

3 Price Prediction

Raw material prices are fluctuating, with stable support from costs. Downstream demand is driven by basic needs, and the current spot supply in the market is adequate. It is expected that the domestic PA66 market will experience short-term fluctuations and consolidation.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Fire at Sinopec Quanzhou Petrochemical Company: 7 Injured

-

DuPont plans to sell Nomex and Kevlar brands for $2 billion! Covestro Declares Force Majeure on TDI / oTDA-based / Polyether Polyol; GAC Group Enters UK Market

-

Zf asia-pacific innovation day: Multiple Cutting-Edge Technologies Launch, Leading Intelligent Electric Mobility

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

[International News] European Plastic Recycling Industry on the Verge of Collapse! BASF Plans to Spin Off This Business, Lanxess Faces Pressure in Third Quarter Performance