[Today’s Plastic Market] Fluctuating Operations! General Materials Mostly Decline, Engineering Materials Individually Strengthen and Rise

Summary: Summary of prices and forecasts for general-purpose and engineering plastics in the market on November 21. In terms of general-purpose plastics, the market continues to be weak, with PP and PE offering discounts to clear inventory; PS market shows increased wait-and-see sentiment; ABS sees local declines of 20-40; EVA weakens further by 50-100. For engineering plastics, PET narrowly declines by 20-40; PC and PA6 remain firm, with some areas seeing an increase of 100; PMMA, POM, PBT, and PA66 are operating steadily.

General Material

PE: The industry maintains a relatively weak sentiment, offering discounts to clear inventory.

Today's Summary

①. The United States proposed a new plan to restart the Russia-Ukraine peace talks, reducing concerns about geopolitical risks, leading to a drop in international oil prices. NYMEX crude oil futures for the December contract fell by $0.30/barrel to $59.14, a decrease of 0.50% compared to the previous period; ICE Brent crude futures for the January contract fell by $0.13/barrel to $63.38, a decrease of 0.20% compared to the previous period.

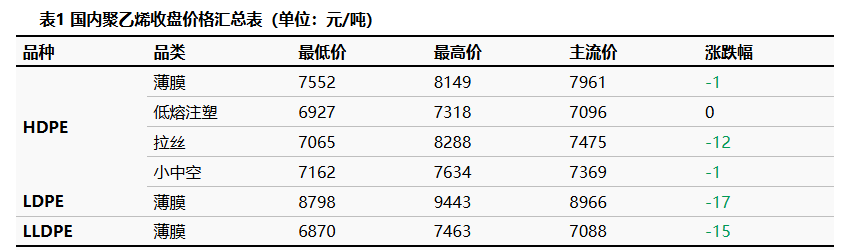

②. The price change range for the HDPE market is -12 to 0 yuan/ton, the LDPE market price is -17 yuan/ton, and the LLDPE market price is -15 yuan/ton.

2. Spot Overview

The cost-side support is unstable, supply remains at a high level, and it is difficult to have any favorable factors for continued stimulation in the short term. Industry sentiment remains weak, with a focus on actively shipping products. Prices have partially declined, and it is difficult for transactions to continue to increase in volume. The HDPE market price fluctuated by -12 to 0 yuan/ton, LDPE market price by -17 yuan/ton, and LLDPE market price by -15 yuan/ton.

3. Price Prediction

The expected cost support from oil is weakening. On the supply side, market supply involves the planned restarts of units from Sinopec UK, Zhenhai Refining & Chemical, and Zhongtian Hechuang, with new maintenance plans for units at Shanghai Petrochemical and Maoming Petrochemical. Overall production is expected to increase, with next week's total output anticipated to be 682,900 tons, an increase of 12,600 tons compared to the current period. On the demand side, next week, the overall operating rate of PE downstream industries is expected to slightly decrease. Northern greenhouse film demand is somewhat weakening, while Southern orders are supporting high-load production for enterprises. However, agricultural film remains in the off-season, and terminal factories show a lack of enthusiasm for raw material procurement. Prices are expected to continue to decline next week, with a range of 20-100 yuan/ton.

PP: The buying atmosphere is lacking, and the polypropylene market is weakly consolidating.

1 Today's Summary

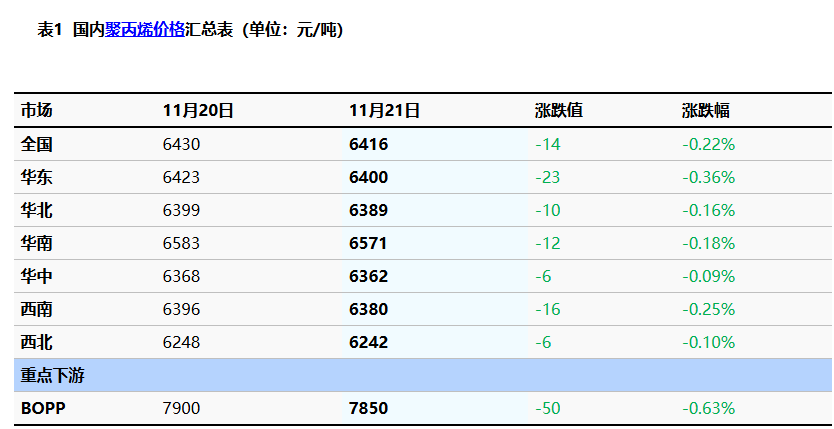

Sinopec East China PP pricing adjustment: Yangzi Petrochemical: PPR pipe material and homopolymer injection molding down by 50 yuan/ton; Zhenhai Refining: unsold M09-GD powder down by 300 yuan/ton; Zhenhai Limited: foam material E08EBJ down by 200 yuan/ton.

Today, the domestic polypropylene (PP) shutdown impact decreased by 1.85% compared to yesterday, now standing at 16.59%. Today's domestic PP facilities: Guangdong Petrochemical's first line (500,000 tons/year) PP facility has restarted. Dushanzi Petrochemical's second line (250,000 tons/year) PP facility has restarted. Shanghai Petrochemical's third line (200,000 tons/year) PP facility is undergoing maintenance. The daily production proportion of drawn wire has increased by 1.84% to 27.29%.

③、 The supply-demand balance in this period continues to remain in a tight balance. However, as the supply-demand gap quickly narrows from negative values, its impact on market prices is insufficient. In the next period, the supply-demand balance gap will slightly widen due to a significant decrease in supply, but since demand is gradually weakening, the support for the market will not be strong. 。

2 Spot Overview

Today, polypropylene raffia in the East China region is priced at 6,400 yuan/ton, down 23 yuan/ton from yesterday, in line with the morning forecast. Morning Futures fluctuated downward today, with polypropylene market offers declining. Over the weekend, buying sentiment in the market was insufficient, and downstream purchasing enthusiasm was limited. Traders were cautious in offering discounts to move goods, with real transactions being negotiable. As of midday, the mainstream price for raffia in East China was between 6300-6500 yuan/ton. 。

3 Price Prediction

The international oil prices are fluctuating widely on the cost side, which has limited guidance for the PP market. From a fundamental perspective, the supply side's support for the market is relatively weak, and the spot resource availability is leaning towards looseness. On the demand side, downstream operations are steadily increasing, but the follow-up of new orders is limited, and the enthusiasm for raw material procurement is not high. In the short term, the overall market still lacks upward momentum. It is expected that the polypropylene market will continue this trend next week. The main characteristic is weak volatility.

PS: Weakening cost support has led to increased market wait-and-see sentiment.

1 Today's Summary

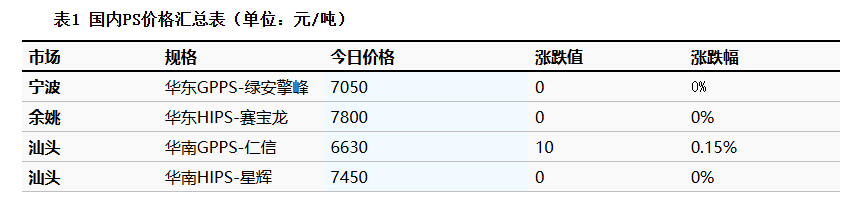

Today, the GPPS in East China is steadily priced at 7,050 yuan per ton.

② 、 On Friday, the East China styrene market fell by 55 to close at 6,560 yuan/ton, South China fell by 60 to close at 6,620 yuan/ton, and Shandong rose by 15 to close at 6,445 yuan/ton.

2 Spot Overview

According to Longzhong Information, today's East China GPPS is stable at 7,050 yuan/ton.Raw material styrene is experiencing a narrow decline, with weakened cost support and increasing market wait-and-see sentiment. Overall industry supply has slightly recovered, while downstream demand remains for essential purchases, leading to slightly lower actual transaction negotiations.

3 Price Prediction

After rebounding, raw material styrene has pulled back, and cost support has weakened. The industry's supply has seen some recovery, but certain grades have tight supply. Downstream purchasing pace has slowed down, and the short-term PS market may remain stable with slight low-end sales. It is expected that the market price of modified benzene in East China will be around 7050-7800 yuan/ton.

ABS: Today's Transactions Driven by Rigid Demand, Prices Decline Locally

1 Today's Summary:

1. Today, the price changes in the East China market are not significant; in the South China market, prices are declining, with transactions driven by just demand.

②. The monthly ABS production in November decreased slightly compared to the previous month.

2 Spot Overview:

Based on the Yuyao and Dongguan regions, the price fluctuations in the East China market are not significant, while the prices in the South China market are declining. Today's market transactions are based on just-in-need demand, with raw material prices fluctuating lower. Today's ABS transactions maintain just-in-need demand, and it is expected that the domestic ABS market prices will continue a downward trend next week.

3 Price Forecast:

Based on the regions of Yuyao and Dongguan, the market prices in East China have stabilized, while the market prices in South China are experiencing a downward trend. Today's market transactions are driven by demand, with supply remaining at a high level. Today, raw material prices have dropped, and manufacturers' sales conditions are average. It is expected that ABS prices will continue to decline next week.

EVA: The market continues to operate weakly and explore downward.

1 Today's Summary

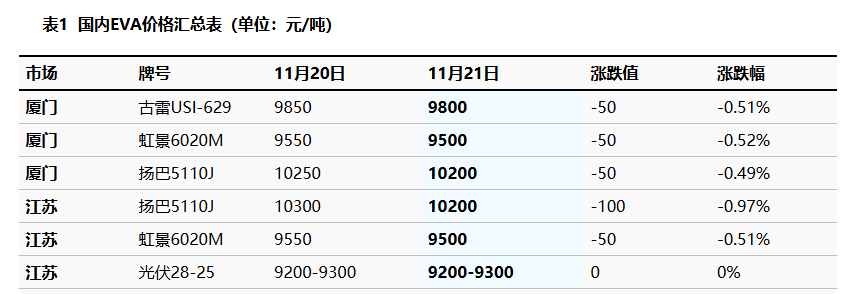

This week, the ex-factory price of EVA petrochemicals has been steadily and slightly adjusted downward.

This week, EVA petrochemical facilities: Zhejiang Petrochemical and Ningbo Taiflex are undergoing maintenance shutdowns; Yanshan Petrochemical facilities are on a prolonged stop, while the rest are in stable production. Korea's Hanwha-GS Energy started operations at its 300,000 ton/year facility on September 25.

2. Spot Overview

Today, the domestic EVA market continues to operate with weak downward movement. As the weekend approaches, the atmosphere in the market becomes increasingly sluggish, with downstream demand lacking support. Transactions are mainly focused on small orders, and the actual trading negotiations are flexibly shifting downwards. Mainstream prices: Soft materials are referenced at 9500-10100 RMB/ton, hard materials are referenced at 9600-10200 RMB/ton.

3 Price Prediction

In the short term, the EVA market lacks significant positive stimuli. News of new production capacity coming online is impacting overall market sentiment, and there is little sign of a significant boost in downstream end-user demand. It is expected that the focus of recent negotiations in the EVA market may trend towards a weak decline. 。

Engineering materials

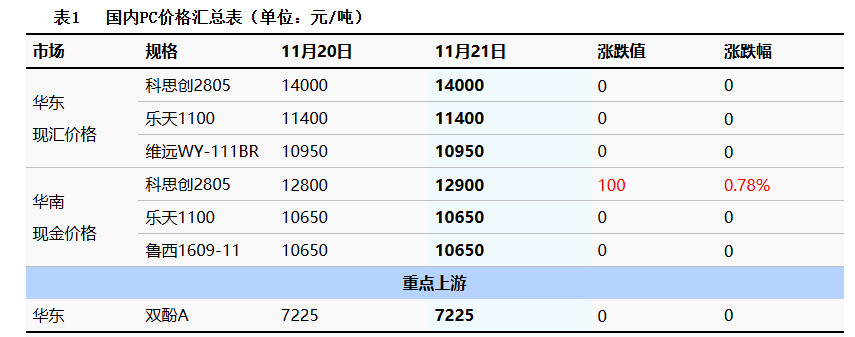

PC: The Firm Market Continues, Trading Atmosphere Remains Quiet

1 Today's Summary

Thursday International crude oil Decline ICE Brent crude futures January contract at 63.38 down 0.13 USD/barrel.

②、 The raw material bisphenol A East China market closed at 7,225. Yuan/ton, stable month-on-month.

3. The domestic PC market remains stable with firm prices.

2. Spot Price

Today, the domestic PC market is running moderately and steadily. As of the afternoon close, the mainstream negotiation reference for low-end injection molding materials in East China is 10,250-13,050 yuan/ton, while mid-to-high-end materials are negotiated at 14,000-14,800 yuan/ton, with the overall focus remaining largely stable compared to yesterday. Approaching the weekend, domestic PC factories have not announced any new ex-factory price adjustments, and the industry's overall production and sales pressure is average. As for the spot market, both East and South China continue to maintain a firm price adjustment pattern. Based on the current fundamental situation of the industry, buyers rarely engage in speculative operations, primarily following the market for steady shipments, with downstream in-field demand-driven purchasing still limited, and small orders dominating trading.

3 Price Prediction

This week, the domestic PC market maintained a strong trend overall. Looking into next week, the dynamics of the domestic PC market may become more differentiated: supply from Shandong PC factories has basically recovered, leading to an increase in the supply of domestic branded materials, while downstream consumption lacks significant stimulus expectations. As a result, spot trading is gradually under pressure, and the focus of negotiations may fluctuate weakly. Meanwhile, low-end materials are supported by the maintenance of Zhejiang Petrochemical PC facilities, and prices continue to maintain a relatively strong trend.

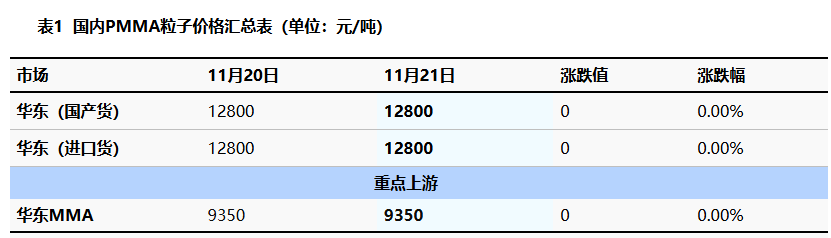

PMMA: PMMA particles are stuck in operation.

1 Today's Summary

①、 Today PMMA particles Market price stability 。

②. Today, the domestic PMMA particle utilization rate is 65%.

2 Spot Overview

As of today, PMMA particles in the East China region were priced at 12,800 RMB/ton, stable compared to the previous working day, in line with the morning forecast. 。 Today's domestic PMMA particles are in a stalemate. The raw material MMA remains firm, providing some cost support. However, demand is weak, and holders are under significant pressure to sell, leading to an increase in low-price negotiations in the market. Overall, trading activity remains limited.

3 Price prediction

Raw materials remain strong, providing continued cost support, while downstream buyers maintain a strong wait-and-see attitude. Sellers mainly test the market with stable prices, offering quotes based on their respective inventory situations. To promote shipping or engage in discount activities, pay attention to the low prices in the market. In the short term, the PMMA particle range tends to consolidate at the lower end.

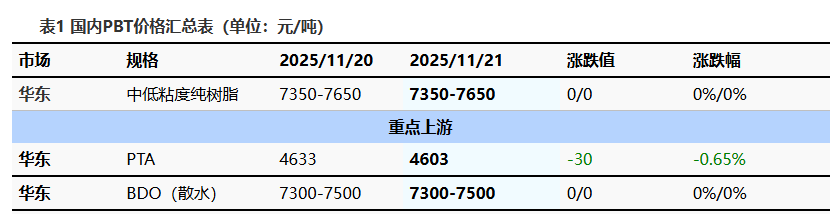

PBT: Slight fluctuations on the cost side, PBT market shows weak fluctuations.

1 Today's Summary

The PBT manufacturers' quotations were adjusted within a narrow range this week.

This week, there are fewer repairs on the PBT equipment.

③ The PBT production for this period is 23,600 tons, a decrease of 700 tons from last week, representing a decline of 2.88%. The capacity utilization rate is 55.45%, a decrease of 1.84% compared to the previous period. 。 This week's average domestic PBT gross profit is at-592 yuan/ton, a decrease of 55 yuan/ton compared to the previous period. 。

2 Spot Overview

Based on the East China region, the current mainstream price of medium and low viscosity PBT resin is between 7350-7650 yuan/ton, which is unchanged from the previous working day. Today, the PBT market is operating weakly, the PTA market has retreated from its high position, and the BDO market is fluctuating within a range. The cost side is fluctuating slightly, having little impact on the PBT market. With demand being tepid, market observation continues, and the focus of discussions remains within the range of fluctuations. , According to Longzhong Information, the price of low-viscosity PBT pure resin in the East China market is 7,350-7,650 yuan/ton.

3 Price Prediction

The PBT market is expected to operate weakly. On the raw material side, the PTA supply side continues to optimize, with an expanded balance sheet inventory reduction. However, there is a lack of substantial external drivers, terminal load is decreasing, downstream purchasing enthusiasm is hindered, and market sentiment is sluggish. In the short term, the PTA spot market is mainly experiencing fluctuations and declines. In the new trading cycle for BDO, sales policy guidance is weak, and many market participants are maintaining a stable and observant attitude, with transactions primarily in contract orders, and few spot offers and bids are heard. There are not many changes in the fundamentals, and a significant change in the PBT market is unlikely. Some market participants have a bearish outlook for the future, and there may be a possible downward drift in the market focus. Therefore, Longzhong expects the East China market for medium to low viscosity PBT resin to be at 7,300-7,650 yuan/ton next week.

PET: Poor market atmosphere for products, slight decline in the polyester bottle chip market.

1 Today's Summary

①. Prices have been reduced by 10-50 by some factories, while others remain stable (unit: yuan/ton).

②. Today, the domestic polyester bottle chip capacity utilization rate is 73.29%.

2. Spot Overview

In the East China region, today's spot price for polyester bottle-grade PET is 5690, down 30 from the previous working day, in line with the morning forecast.

External news is bearish, and bulk commodities are generally declining. The raw material PX has seen a significant drop, dragging down polyester bottle chip prices. Some factories are holding firm to stabilize prices, while others have reduced prices by 10-50. The market focus has shifted downward, with transactions for November-December sources heard at 5660-5720, with some slightly lower or higher. Low-priced sources are mainly being traded, and some traders and end-users are replenishing stocks at lower prices. Spot trading is still acceptable. (Unit: Yuan/ton)

3. Price Prediction

The crude oil market is under pressure, and the commodity sentiment is not good. Raw material support is insufficient, new installations are about to be launched, and terminal demand is in the off-season. Next week, the polyester bottle chip market may maintain weak fluctuations. It is expected that next week the spot price of polyester bottle chips for water bottles in the East China region will be 5,660-5,700 yuan per ton. Pay attention to the downstream pick-up situation.

POM: Low inventory at the petrochemical plant, price trend remains strong.

1. Today's Summary

The Hebi Longyu POM unit will be shut down for maintenance on October 20, with the start-up time to be determined.

2. Tianjin Bohua POM plant was shut down for maintenance on July 7th, and the restart time is yet to be determined.

2 Spot Overview

Based on the Yuyao region as a benchmark, Yun Tianhua M90 is priced at 10,600 yuan/ton today, with the price remaining stable compared to the previous period. Today, the POM market is consolidating sideways. Petrochemical plant inventories are at low levels, with short-term intentions to raise prices, boosting market sentiment. Traders are actively maintaining high price levels in sales, and mainstream quotations remain high. Downstream users are sporadically replenishing inventories, with a fair purchasing atmosphere. By the close, domestic POM in the Yuyao market is priced at 8,100-11,100 RMB/ton (including tax), and in the Dongguan market, POM is priced at 7,300-10,400 RMB/ton in cash.

3. Price Prediction

Due to the collective price increase of domestic materials, businesses have engaged in concentrated replenishment, leading to a release of factory inventory. The fundamentals still provide some support, and the market inquiry atmosphere is strong. Influenced by the mindset of buying on the rise rather than the fall, coupled with the gradual digestion of previous stockpiles by end-user factories, purchasing sentiment among users is relatively positive, resulting in a more active trading atmosphere. Longzhong expects the domestic POM market to maintain a strong consolidation in the short term.

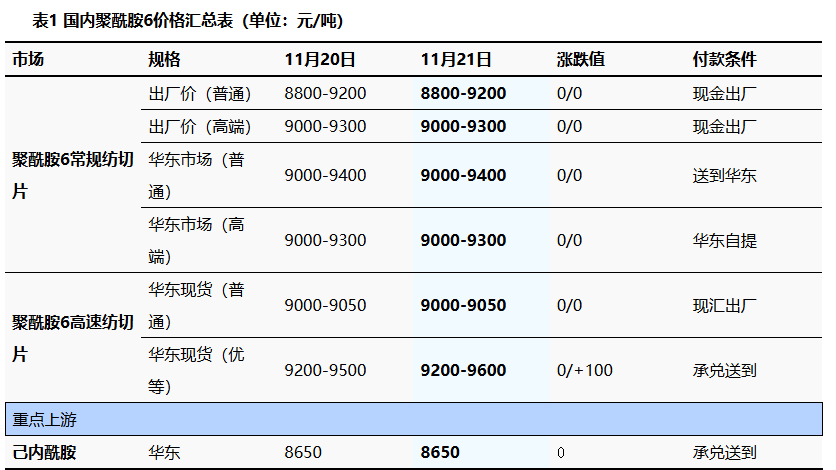

PA6: Cost support is evident, and the PA6 market is operating steadily.

1 Today's Summary

①、 Last week's settlement price for Sinopec caprolactam was 8,730 RMB/ton (six-month acceptance without interest), an increase of 190 RMB/ton compared to the previous period.

②、 Sinopec has reduced the price of benzene at its East China and South China refineries by 200 yuan/ton, effective at 5,450 yuan/ton from October 21.

2 Spot Overview

Today, the polyamide 6 market is operating steadily, with strong support from the cost side of the chips. Some polymerization enterprises are following the raw materials to continue raising the ex-factory price of chips. However, downstream buyers are becoming cautious about replenishing high-priced chips, mainly opting for lower-priced purchases, resulting in average actual transactions and negotiated deals. In East China, conventional spinning PA6 is priced at 9000-9400 RMB/ton with short cash delivery, while high-speed spinning spot goods are priced at 9200-9600 RMB/ton with delivery on acceptance.

3 Price Prediction

From the cost perspective, some caprolactam enterprises are experiencing tight supply and plan to reduce production in the future, which may lead to continued price increases. From the supply and demand perspective, the supply of domestic polymerization enterprises is expected to increase, with Guangxi Hengyi gradually starting production. However, downstream buyers are becoming cautious about purchasing high-priced chips, and market transactions may be limited. It is expected that the PA6 market will perform well next week.

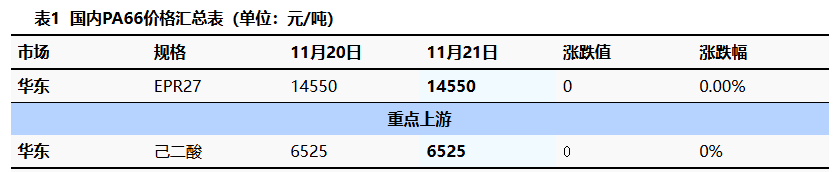

PA66: Downstream On-Demand Purchasing, Market Consolidation Operations

1 Today's Summary

①, 11/20: The United States proposed a new plan to restart peace talks between Russia and Ukraine, easing geopolitical risk concerns, leading to a drop in international oil prices. NYMEX crude oil futures for the December contract fell $0.30 per barrel to $59.14, a decrease of 0.50% from the previous period; ICE Brent crude futures for the January contract fell $0.13 per barrel to $63.38, a decrease of 0.20% from the previous period. China's INE crude oil futures for the January 2026 contract fell 8.2 to 455 yuan per barrel, with a night session drop of 3.3 to 451.7 yuan per barrel.

As of today, the domestic PA66 capacity utilization rate is 67%, with a daily output of approximately 2,650 tons. The capacity utilization rate of some enterprises has slightly decreased, and the downstream demand is average. The supply of goods in the domestic PA66 industry is sufficient.

2 Spot Overview

Based on the Yuyao market in the East China region, today's EPR27 market price is referenced at 14,500-14,600 yuan/ton, stable compared to the previous trading day. 。 Cost pressure is relatively high, the capacity utilization rate of polymer enterprises is relatively stable, market spot supply is sufficient, and downstream procurement is based on, resulting in a temporarily stable market operation. 。

3 Price Prediction

Downstream on-demand purchasing, abundant spot supply in the market, but there is significant pressure on the cost side. The overall fundamentals show little fluctuation, and the domestic PA66 market is expected to experience narrow-range fluctuations in the short term.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

BASF Signs Another Giant: Covestro Already Set Up, Just Missing Wanhua Chemical?

-

DuPont plans to sell Nomex and Kevlar brands for $2 billion! Covestro Declares Force Majeure on TDI / oTDA-based / Polyether Polyol; GAC Group Enters UK Market

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

ExxonMobil Plans to Close UK Ethylene Plant; GPI's Revenue & Profit Both Decline! Haitian's Serbia Base Enters Mass Production

-

Ministry Of Commerce Releases Implementation Opinions On Green Trade, Focusing On Import And Export Of Biodegradable Materials And Other Products