The "Absentees" and "Presenters" of the 2025 Guangzhou Auto Show

On November 21, the 2025 Guangzhou Auto Show opened. Compared to previous years, the exhibition hall, though bustling with people, couldn't hide the subtle changes in the overall atmosphere. For instance, the number of participating brands has decreased, the ultra-luxury segment has collectively withdrawn, and the scale of new car launch events has shrunk. Additionally, the auto show no longer deliberately creates hype, instead presenting a more rational and realistic state after the industry has entered deeper waters.

In such an atmosphere, we can more clearly recognize that the new pattern of competition in the second half of the Chinese automotive market is becoming clearer.

More than 20 brands are absent.

One of the most at this year's auto show is the collective absence of over 20 automotive brands.

This list includes both ultra-luxury brands such as Porsche, Bentley, Lamborghini, and McLaren, as well as joint venture and independent brands like Beijing Hyundai, Dongfeng Peugeot-Citroën, FAW Bestune, and Polestar. This phenomenon is not accidental, but rather a direct reflection of different types of brands losing competitiveness amidst market changes.

The core reason for the absence of ultra-luxury brands is the impact of Chinese electric vehicle brands, which has weakened their brand power in the Chinese market, leading to a continuous decline in sales and overall performance falling into a slump. According to data from the Passenger Car Association, the sales of imported cars in China reached only 360,000 units in the first three quarters of 2025, a year-on-year decrease of 32%.

Image Source: Porsche

The decline in ultra-luxury brands is particularly significant. For example, Porsche's sales in China fell by 26% year-on-year; Bentley's sales during the same period were less than a thousand units; Maserati launched drastic price cuts to save the market. Reports indicate that Maserati's Grecale Folgore model has seen a price reduction of up to 540,000 yuan, now starting at just 358,800 yuan, directly competing with Xiaomi Auto and Li Auto.

Behind the sluggish performance of super luxury brands is the effective high-end strategy of Chinese brands. The AITO M9 has successfully penetrated the 500,000 yuan market. With Huawei's smart technology empowerment, its monthly sales consistently rank among the top in high-end SUV sales. The Yangwang U8 has firmly established itself in the million-yuan market with its unique floating water function and exceptional performance. The high-end model S800 under the ZunJie brand has also gained recognition from specific consumer groups through its differentiated smart experience, directly competing with the Mercedes-Maybach.

The rise of high-end models in China has not only broken the monopoly of foreign brands in the high-end market but also redefined the value standards of luxury cars.

Image source: HarmonyOS Smart Travel

Another category of absent participants includes poorly managed joint ventures and independent brands, which is a result of accelerated consolidation under extreme competition in the car market.

Brands such as Shenlong Automobile, Beijing Hyundai, and Dongfeng Fengxing have not set up booths at this auto show, either due to their low market share in the mainstream market or a lack of competitive new product iterations.

For example, Beijing Hyundai and Dongfeng Peugeot-Citroën Automobile's annual sales are now less than 200,000 vehicles; Dongfeng Fengxing has long relied on a low-price strategy, but under the impact of competitors' new energy models, gasoline vehicle sales are unstable, and due to insufficient technological reserves, it is difficult to break through in the new energy vehicle market.

Missing the Guangzhou Auto Show reflects the rational considerations of car companies in the face of intense market competition—rather than spending a fortune on building exhibition booths to create presence, it is better to invest limited resources in terminal promotions, channel optimization, and other aspects that can directly drive sales.

After all, in the era of internet information, exhibitions are no longer the only major channel for showcasing new cars and new technologies.

The widespread absence of brands is actually an inevitable result of the market competition reaching an extreme stage. After years of rapid growth, the Chinese automotive industry has shifted from an incremental market to a stock market.

In the context of a relatively stable overall market size, ongoing price wars, configuration wars, and marketing wars have significantly weakened the profitability of some brands. According to published financial report data, several listed car companies experienced a phenomenon of "increased revenue but not increased profit" in the first three quarters of 2025, with some companies even falling into a predicament of losses.

The essence of industry involution is essentially the catalyst for accelerated market clearing. Within a limited market space, resources are continuously concentrating towards leading enterprises, while weaker brands face the fate of being marginalized. Geely Automobile Holdings Limited's CEO, Gui Shengyue, stated at a recent performance briefing that next year will be a critical period for the Chinese automotive industry, and without strong profitability, survival for enterprises will be exceptionally difficult.

The consensus in the industry is that the shutdown and transition have become an irreversible trend, and this process will intensify in the future. The list of absentees at the Guangzhou Auto Show is a microcosm of this elimination race.

As industry insiders say, "When the industry enters the knockout stage, both scale and profit are indispensable; otherwise, it is difficult to even ensure qualification for participation."

The protagonist is "them".

Despite the absence of some brands, the car companies that remained showcased a stronger presence, demonstrating a "the strong get stronger" trend. Perhaps due to the reduced number of exhibiting brands and the substantial financial backing, "taking over entire halls" has become an important way for car companies to display their systematic layout in recent years.

At this year's Guangzhou Auto Show, BYD has reserved Hall 2.1 on the first floor of Area A to showcase several of its sub-brands, including Denza, Fang Cheng Bao, and Yangwang, as well as the "Eye of the Sky God" assisted driving solution and megawatt flash charging technology. Additionally, the outdoor area is specifically used to demonstrate the emergency floating water capability of the Yangwang U8, showcasing a comprehensive product matrix and technological depth.

Image source: Guangzhou Auto Show Media Window

GAC Group occupies Hall 2.2 on the second floor of Area A, bringing together GAC Toyota, GAC Honda, GAC Trumpchi, Aion, and Haobo, showcasing the synergistic effect of the group's comprehensive electrification.

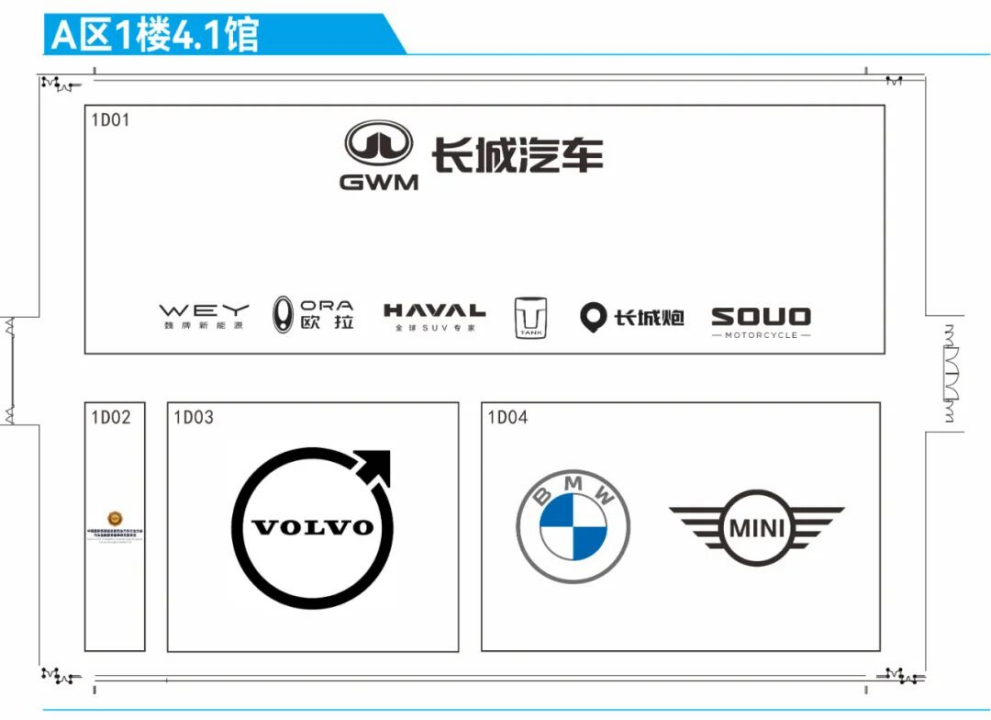

Chery Automobile and Great Wall Motors, two major traditional domestic brands, occupy half of an exhibition hall, with several of their sub-brands showcased together in one hall. Geely's brands, such as Lynk & Co, Zeekr, and Galaxy series, are exhibited independently, scattered across different areas.

In the joint venture camp, brands with relatively stable market performance such as Volkswagen and Toyota (including Lexus) remain active. Volkswagen participated jointly through Volkswagen Anhui, SAIC Volkswagen, and FAW-Volkswagen, focusing on showcasing new energy models like the ID. ERA production version. Among Toyota's joint venture brands, FAW Toyota showcased the newly launched TiME 3.0 technology brand and the INP navigation driving assistance system developed in collaboration with Momenta; GAC Toyota brought the production version of the Bozhi 7, among others.

The new forces and technology companies are also the focus of the auto show. Hongmeng Zhixing gathered the "Five Realms" models: Wenjie, Zhijie, Xiangjie, Zunjie, and Shangjie, which made a collective appearance, further expanding the exhibition area. Interestingly, Wenjie and Zhijie also set up independent booths in other exhibition areas, creating a pattern of "multiple points of simultaneous voice."

Xiaomi Motors continues to maintain the popularity of "technology crossover" with the sustained strong sales of SU7 and YU7, along with its unique ecosystem appeal.

In addition to jointly exhibiting with its main brand and Firefly, NIO has set up an independent booth to further expand its coverage from the high-end to a broader market. Although NIO's profits are under pressure, its battery swapping system, self-developed platform, and brand resilience still provide it with strong competitiveness, so the scale of the exhibition hall remains at a high level.

Car manufacturers that can "book the entire pavilion" or occupy a large exhibition area are mostly leading players who maintain a steady position in the current market competition. For example, BYD, with its vertically integrated system and multi-brand strategy, has consistently led in sales in recent years. GAC Group, leveraging a dual approach of "joint ventures + independent brands," has a strong foundation in the South China market. Of course, the fact that GAC Group and BYD are booking the pavilion is also related to the Guangzhou Auto Show being their home ground.

Image Source: Guangzhou Auto Show Media Window

In addition to vehicle manufacturers, the strong presence of leading suppliers is also a major highlight. Huawei not only provides intelligent technology support for multiple brands but has also established a dedicated exhibition area for "Intelligent Automotive Solutions," showcasing its full-stack capabilities in areas such as assisted driving, intelligent cockpits, and intelligent electric drive. According to statistics, Huawei's QianKun Smart Driving ADS has already partnered with 33 models, and the sales of cooperative models exceeded 100,000 units last month.

Ningde Times also stepped into the spotlight, showcasing its latest battery technology while prominently displaying a flying car in collaboration and model cars equipped with its battery products, highlighting its determination to continue leading in the field of power batteries.

In fact, it has become common for supply chain companies to settle in core exhibition areas. This also indicates that in the era of intelligent electrification, competition in the industry has shifted from "the vehicle determines everything" to "system capabilities determine the limits." Competition among car manufacturers increasingly relies on deep technologies such as power batteries, chips, algorithms, and vehicle systems. Without strong supply chain support, it is difficult to gain an advantage in fierce competition.

The relationship between parts suppliers and automobile manufacturers has evolved into a mutually dependent and empowering showcase pattern, which is a hallmark of the deep integration of the industrial chain.

Electric vehicles are still the mainstream.

The absence of about 20 brands reflects the weakness of fuel vehicles and the rise of new energy vehicles to some extent. In this year's auto show, new energy vehicles are still the mainstream. The number of exhibiting new energy models reached 629, accounting for a staggering 58%, a significant increase from 43.7% in 2024, covering the entire price range from entry-level commuting to high-end luxury. Among the 93 globally debuting new cars, most carry dual labels of electrification and intelligence.

This echoes the market data. According to data from the China Association of Automobile Manufacturers, in October 2025, the sales proportion of new energy vehicles in China surpassed the 50% threshold for the first time, reaching 51.6%. Data from the Ministry of Commerce shows that the number of applications for car trade-in subsidies in 2025 exceeded 10 million, with new energy vehicles accounting for 57% of the total.

From the perspective of specific models, domestic brands remain the most proactive in releasing electric vehicle models. In the entry-level market (under 100,000 yuan), "technology accessibility" has become the key term in the competition for electric vehicles.

The Leapmotor A10, as a popular new car at this year's auto show, is priced starting at around 80,000 yuan. It is the first in this price range to feature LiDAR and L2+ level advanced driver assistance systems, while also offering a range of over 500 km and fast-charging technology. It directly challenges the market share of existing popular models such as the BYD Yuan UP and Geely Xingyue.

A similar trend is also reflected in the Changan Qiyuan Q05, a compact SUV in the 100,000 RMB price range, which is also equipped with LiDAR.

In the mid-to-large SUV segment, the Voyah Lanshan has garnered significant attention. As one of the first SUVs equipped with Huawei's QianKun ADS 4, it offers four LiDAR sensors at a price point of 400,000 RMB, thereby redefining the value system of high-end new energy assisted driving. Meanwhile, the Chery iCAR V27 enters a new niche market with its combination of "rugged styling + range-extended power."

In the sedan market, the Haopu A800 highlights the Huawei HarmonyOS cockpit and QianKun intelligent driving, along with a length of 5130mm and a wheelbase of 3020mm. With its range-extending power, it elevates the intelligent experience of mid-to-large sedans to new heights.

At the same time, the MPV market has also welcomed important new products: the Xiaopeng X9 Super Extended Range version offers a pure electric range of 452 km and a comprehensive range of 1602 km, making extended-range MPVs a new choice for family users. The Geely Galaxy V900 further enriches the supply of the mid-to-large MPV market with its 6/7/8-seat layout and advanced driver assistance features supported by lidar.

Although the lineup of new models from joint venture brands is not as large as that of domestic brands, they have clearly accelerated their investments in electrification and intelligentization.

Buick showcased its flagship MPV, the Zhijing Shijia Plug-in Hybrid version, at this auto show. Built on the million-level "Xiaoyao" architecture, it is equipped with lidar and the "Xiaoyao Zhixing" advanced driver assistance system, enhancing its technological capabilities in the high-end MPV market.

Toyota's products exhibit a "dual-track" characteristic: the sixth-generation RAV4 from FAW Toyota has been fully upgraded in its hybrid system (fifth-generation intelligent electric hybrid technology) and intelligence, continuing to solidify its position in the compact SUV market; the GAC Toyota bZ4X integrates Huawei's HarmonyOS cockpit, electric motors, Momenta's assisted driving system, and the Xiaomi ecosystem, along with a pure electric range of over 700 km, making it an important milestone in Toyota's electrification transformation.

Nissan is also entering the competition for intelligence with the new generation of the Teana at this auto show, which comes standard with HarmonyOS Cockpit 5 and HUAWEI SOUND, marking an acceleration in the pace of smart experience upgrades for joint venture models.

The debut of the all-electric Mercedes-Benz CLA further indicates that luxury brands are approaching a new threshold in terms of technological maturity on pure electric platforms. The 800V high-voltage architecture, dual-speed electric transmission, and advanced urban assisted driving capabilities make it one of the few luxury models that can match the pace of independent brands in terms of technology.

Image source: GAC Group

Looking at all the new products, two major trends can be observed:

Firstly, the widespread adoption of advanced driver assistance systems is accelerating. Lidar is no longer exclusive to high-end cars priced at two to three hundred thousand yuan, but is now being introduced to models in the 100,000 yuan range. Urban NOA (Navigate on Autopilot) and ready-to-use advanced driver assistance are becoming the "new standard" for new energy vehicles.

Secondly, the range and energy replenishment system have been comprehensively upgraded. With a range of 500-700km becoming the standard, the widespread adoption of high-voltage platforms, ultra-fast charging systems, and new battery materials continues to enhance the actual convenience of using electric vehicles.

In the context of such product trends, the scene presented at the Guangzhou Auto Show is very clear: electric vehicles have become increasingly mature mainstream products. While fuel vehicles still exist and continue to upgrade, their presence has gradually shifted towards structural demand.

The car is no longer the only "protagonist."

If the core focus of auto shows in the past twenty years has always been the launch of new cars and model unveilings, in the past two years, there has been a change—the car is no longer the absolute main character.

More and more companies are choosing to showcase their core capabilities through flying cars, robots, chips, batteries, energy replenishment solutions, software systems, and more. Most exhibiting companies have shifted from showcasing individual products to demonstrating their technological systems, expanding from competing on single vehicle models to competing on whether they possess a complete technological chain and ecological capabilities. The Guangzhou Auto Show is no exception.

BYD's exhibition layout is quite representative. At this year's auto show, BYD set up two technology-centric exhibition areas: one for showcasing the "Heavenly Eye" advanced driver assistance solution, presenting its complete technological path of perception, decision-making, and control; the other focusing on demonstrating the megawatt fast charging technology, showcasing its technical capability of "charging for 5 minutes, driving for 400 kilometers."

By modularizing its core technological components, BYD aims to convey a message to consumers that it is not just a car manufacturer, but a versatile company with full-chain capabilities in electric drive systems, intelligence, and ultra-fast charging technology.

XPeng Motors also focuses on cross-domain capabilities as a highlight of their exhibition. Flying cars, bionic robots, and other tech products have become some of their most eye-catching exhibits.

Xpeng's flying car is not just a conceptual display; it is already capable of vertical takeoff and landing, as well as low-altitude flying, having undergone multiple real-world tests. It represents a new form of urban transportation that may emerge in the future. The robot demonstrates highly humanoid movement capabilities, able to perform complex tasks in everyday scenarios.

This reflects Xiaopeng's deep thinking about the future mobility ecosystem. Xiaopeng Motors Chairman He Xiaopeng previously announced that Xiaopeng Motors will transform from an explorer of future mobility to an explorer of mobility in the physical AI world.

GAC Group also showcased its layout in the field of innovation by setting up the "Tech GAC" themed exhibition area for the first time, where it concentrated on displaying its core achievements in electrification and intelligence. These include the magazine battery technology, third-generation hybrid technology, "Xingyuan Range Extension" technology, as well as the GOVY AirCab multi-rotor flying car and the fourth-generation embodied intelligent humanoid robot GoMate Mini.

Image source: GAC Group

In the view of some automotive companies, advanced technologies such as flying cars and embodied intelligence are not actually disconnected from the automotive industry. This is because the underlying technologies of both originate from the same sources. The environmental perception technology used in assisted driving, the motion control technology for chassis control, and the energy distribution technology for battery management can all find application scenarios in these new fields. Moreover, whether it is flying cars or robots, they will ultimately become part of the extended mobile space of automobiles.

Moreover, many brands are also beginning to emphasize the presentation of "technical ontology." For example, several companies are showcasing self-developed chips, intelligent cockpit OS, central integrated electronic architecture, new generation battery materials, and hydrogen energy technology.

Ningde Times showcased a new battery material system, Huawei brought a complete set of intelligent driving assistance ecosystems, and OEMs presented domain controllers and central architecture layouts, all releasing a common signal: the competition in the automotive industry has shifted from individual capabilities to systematic capabilities. The core of future competition lies in the "full-chain strength."

This means that auto shows are shifting from traditional new car competitions to industry chain capability competitions. In the past, "whose car looks the best, has the highest configuration, and offers the most competitive price" determined the popularity of auto shows. In the future, "who has mastered key technologies, who has built ecological capabilities, and who can create platform systems" will be the core competitive advantages of the industry.

The shift is driven by the real need for value reconstruction in the automotive industry. As core technologies for electric vehicles gradually mature and hardware costs continue to decline, relying solely on car manufacturing for profit is becoming increasingly difficult.

Industry analysts have pointed out that as core components such as assisted driving and power batteries gradually become standardized, the profit margins of vehicle manufacturing will be further compressed. Against this backdrop, extending into the upstream and downstream of the industrial chain and exploring new business growth points have become strategic choices for some car companies.

At a deeper level, the competitive threshold among automotive companies is experiencing a structural enhancement. In the future, companies that can stand firm must possess capabilities in R&D systems, supply chain integration, software technology, and the synergy of battery and energy systems.

The Guangzhou Auto Show once again allows the industry to directly see the change in the competition model—when companies no longer view cars as the final product but as carriers of a technological ecosystem, the significance of the auto show shifts from showcasing finished products to showcasing the future.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

BASF Signs Another Giant: Covestro Already Set Up, Just Missing Wanhua Chemical?

-

Clariant Plans to Shut Down Multiple Plants! Wingtech Releases Latest Statement! Oriental Yuhong Acquires Stake in Brazilian Company

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

ExxonMobil Plans to Close UK Ethylene Plant; GPI's Revenue & Profit Both Decline! Haitian's Serbia Base Enters Mass Production

-

Ineos Styrolution Closes French Plant! UK Lincolnshire Plans £35 Million Waste Plastic Recycling Facility