Ten signals of restructuring in china's automotive industry

By the time the wheels of history roll past 2025, the Chinese automotive industry will also be at an unprecedented turning point.

Over the past year, the Chinese automotive market has experienced a profound industrial restructuring driven by a combination of policy, market, technology, and capital forces, rather than merely changes in sales or technological iterations. Overall, each major event throughout the year has not been an isolated "storm," but rather a wave in the same industrial transformation, collectively sketching a clear roadmap for the Chinese automotive industry as it transitions from the pursuit of scale and speed in "wild growth" to a focus on quality, safety, efficiency, and sustainability in "high-quality development."

Next, we will analyze the ten landmark events in the domestic automobile market in 2025, interpret the industrial logic behind them, and predict the future landscape nurtured under the new rules.

After experiencing the rapid progress and reshuffling pains of the previous years, the intrinsic logic of the Chinese car market in 2025 has fundamentally changed. Policy guidance has shifted from encouraging innovation to balancing innovation and regulation. Market drivers have transitioned from policy subsidies to consumer demand and technological experience. The dimensions of competition have expanded from singular metrics of electrification and intelligence to the compliance, system capabilities, business models, and globalization level of the entire industry chain.

Standardization and restructuring are the core themes throughout the year. Standardization is reflected in regulatory interventions in key technologies (such as assisted driving), market order (such as used cars), and financial health (such as payment terms), aiming to establish long-term healthy rules for the industry. Restructuring is reflected in comprehensive adjustments in industrial structure (state-owned enterprise reform, joint ventures 2.0), technology routes (L3 implementation), design trends (door handle design requirements), and even the capital foundation for enterprise survival.

L3 Mass Production Opens: A Thrilling Leap from Assistance to Responsibility

After years of technological accumulation, road testing, and regulation preparation, by the end of 2025, relevant authorities finally issued production permits for qualified L3 (conditional automated driving) vehicles. This was not achieved overnight; rather, it was due to the continuous improvement in system reliability, data comprehensiveness, and takeover solutions in specific scenarios by leading car manufacturers. The entire domestic intelligent driving industry thus reached a new level.

Image Source: Changan Automobile

The mass production of L3 is undoubtedly a milestone moment in the development of intelligent driving in China, and its significance even surpasses the technological upgrade itself.

Certainly, the industry currently also faces new challenges, primarily the breakthrough in defining responsibilities. The core issue is that under the activated state of the system, the subject of accident responsibility shifts from the driver to the car manufacturer (or technology provider). This will compel car manufacturers to elevate functional safety to an unprecedented level, and research and development investment may shift from algorithm competition to the construction of a comprehensive safety redundancy system.

Additionally, the mass production of L3 will have a very direct impact on the reshaping of the industry chain, leading to an exponential increase in the demand for sensors (particularly the reliability and cost of LiDAR), computing platforms (high computing power and high functional safety grade chips), high-precision positioning, and data closed-loop capabilities. Supply chain companies will face a new round of pressure for technological upgrades and certification qualifications.

Review: Without a doubt, L3 will usher in a new era, marking the transition of intelligent driving from incremental driver assistance functions to a quasi-product form that replaces human labor. Industry competition will enter a new dimension centered around safety and reliability.

The penetration rate of new energy passenger vehicles is approaching 60%: the dominant position is irreversible.

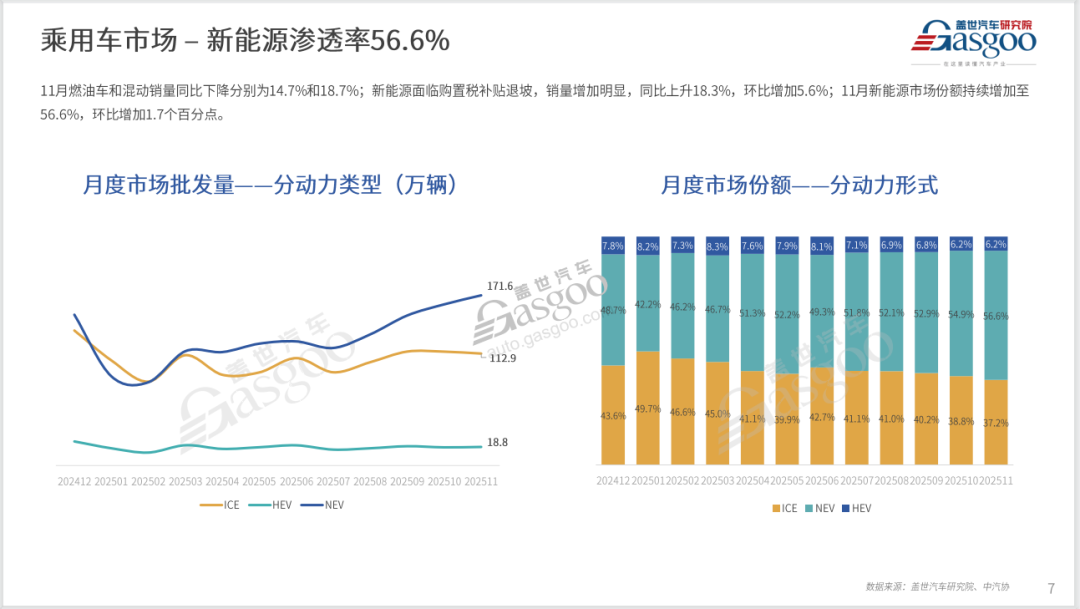

Under the combined forces of deepening trends in oil and electricity price parity, increasingly dense charging networks, extremely diverse model choices, and a comprehensive shift in consumer perception, the penetration rate of new energy passenger vehicles in China is expected to achieve new breakthroughs by 2025. According to data compiled by the Gasgoo Automotive Research Institute, the market share of new energy vehicles in China has continuously grown to 56.6% by November 2025, with a new height of 60% market share being within reach.

The nearly 60% market share of new energy vehicles is not just a simple number; it heralds the end of one era and the full commencement of another. Subsidies have gradually exited the stage of history, and consumers have voted with their hard-earned money, proving that the comprehensive advantages of new energy vehicles in terms of overall vehicle experience, usage costs, and license road rights have become a market consensus.

Currently, the overall structure of the domestic new energy market has begun to take shape, with leading new energy brands (such as BYD) further consolidating their market share, while traditional fuel vehicle brands that are slow to transition face the risk of being phased out. Market competition has shifted from merely having electrification to focusing on the level of intelligence, quality of experience, and cost control capabilities.

Facing the future, infrastructure and energy networks are also under new pressure. Charging networks need to upgrade from mere availability to being fast, efficient, and intelligent. Challenges such as grid load and peak-valley regulation are becoming more prominent, and models like V2G (Vehicle-to-Grid), integrated solar-storage-charging systems, and battery swapping may usher in a development window. In summary, new energy has become the absolute mainstream in the market, and the industry's focus is gradually shifting towards better meeting the mainstream consumer market's demands for quality, safety, reliability, and lifecycle cost. The domestic new energy vehicle market is accelerating into a phase of meticulous cultivation.

Smart driving must not be misused anymore: regulatory measures are being implemented to eliminate marketing hype.

In response to some car companies' misuse of terms like "self-driving" and "smart driving" in intelligent driving promotion, which blurs the boundaries of functions and leads to consumer misunderstandings and even safety incidents, regulatory authorities implemented and strictly enforced the most stringent assisted driving promotion regulations in 2025. These regulations require companies to clearly distinguish between assisted driving and autonomous driving, and mandate market education.

This is a necessary "rectification of errors".

Chaotic publicity not only jeopardizes user safety but also undermines the technical credibility of the entire industry. Strict regulation helps eliminate marketing hype and brings competition back to the track of genuine technical strength and reliability.

Furthermore, promoting the standardization of technical terminology can encourage the industry to establish unified and rigorous descriptions of technical levels and marketing rhetoric, thereby reducing information asymmetry. This compels car manufacturers to invest more resources in genuine technological research and development as well as user safety education, rather than exaggerated advertising. It also paves the way for truly advanced autonomous driving in the future. On the eve of L3/L4 mass production, cleaning up the promotional environment for L2 and below levels helps the public establish correct understanding and expectations, laying a solid foundation for the societal acceptance of more advanced autonomous driving in the future.

The standardization of assisted driving promotion marks the end of the wild growth phase for China's intelligent driving industry, ushering in a new stage of orderly innovation and clear responsibilities within a regulatory framework. In the short term, it may curb some consumers' excessive expectations, but in the long run, it is a necessary path to promote the industry's healthy and sustainable development.

Rectifying "Zero Kilometer" Used Cars: Cutting Off the Gray Industry Chain, Reshaping Market Integrity

"Zero-kilometer" used cars (new cars that have been registered and licensed but have not actually been delivered to consumers for road use, yet enter the market as used cars) is a phenomenon that has long existed. In 2025, following the statements of Wei Jianjun, Chairman of Great Wall Motors, and other automotive executives, it quickly became a topic of interest across the entire industry. Mid-year, there were reports that relevant departments convened industry organizations and car manufacturers to discuss the sale of "zero-kilometer used cars."

Image source: Great Wall Motors

This move directly addresses the chronic issues in the automotive distribution sector.

"Zero-kilometer" used cars are essentially a form of cross-regional informal arbitrage behavior, which disrupts the price management system of OEMs and harms the interests of compliant dealers. The industry calls for the regulation of "zero-kilometer" used cars, which helps stabilize new car market prices, protect authorized dealer channels, and promote the healthy development of the used car market. This is not only a market regulatory action but also a "bone-scraping cure" for the traditional car sales system.

Hong Kong Stock Market Listing Boom: "Blood Supplement" and "Coming of Age" for New Forces and Industrial Chain Enterprises

In 2025, a wave of new car-making enterprises, autonomous driving technology companies, and key component suppliers are rushing to list in Hong Kong. These include vehicle manufacturers like Seres and Chery, battery manufacturers like CATL, autonomous driving companies like Pony.ai, WeRide, and Hesai Technology, smart cockpit companies like Joyson Electronics and Pateo, and even household charging pile companies like Star Charge. Nearly every significant segment in the automotive industry has witnessed emblematic IPO events in Hong Kong.

Image Source: CATL

The wave of listings on the Hong Kong stock market has become a capital reflection of the domestic automotive industry's entry into a period of deep reshuffling.

For many unprofitable new forces, listing for financing is the key to "extending life." The long cycle and heavy asset characteristics of the automotive industry determine that it requires continuous capital output to support research and development, production capacity, and channel construction. Moreover, by broadening financing channels, companies can better cope with uncertainties. In the context of macroeconomic pressure and a tightening private equity financing environment, the Hong Kong stock market provides a relatively stable public market financing platform, which can better help companies reserve "winter provisions."

For enterprises, going public is not the end, but the beginning of a new round of elimination. After listing, companies will face stricter financial scrutiny and performance pressure. Only those with a genuine technological moat, a clear profitability path, and efficient operational capabilities can leverage the capital market for breakthroughs; otherwise, they may expose problems more quickly.

60-Day Payment Terms Fully Implemented: Supply Chain Stress Testing and Ecosystem Restructuring

In June this year, the revised "Regulations on Ensuring the Payment of Small and Medium-sized Enterprises" officially came into effect, setting a 60-day payment deadline as a red line, targeting the persistent issue of payment delays that have long troubled small and medium-sized enterprises. After the policy was implemented, domestic car companies collectively responded with high-profile actions. More than ten car companies, including BYD, Geely, and Changan, have pledged to "reduce the payment period to within 60 days."

In the context of significant cost pressures and widespread cash flow constraints faced by OEMs, limiting supplier payment terms to 60 days is regarded as a turning point in the restructuring of the supply chain ecosystem.

The 60-day payment term is an extreme stress test of the resilience of the Chinese automotive market. From the current implementation situation, it is indeed challenging for many car manufacturers to fulfill the commitment of "supplier payment terms not exceeding 60 days" in a short period.

The automotive industry supply chain system is vast and highly complex, encompassing multiple aspects such as parts manufacturing, technology research and development, logistics distribution, vehicle assembly, and marketing. Any change affects the entire system. Adjusting payment terms is far from a simple change in payment timing; it involves the restructuring of the entire industry chain's capital flow. Car companies need to balance multiple demands in their capital allocation, including production investment, technology research and development, market promotion, and channel maintenance. If payments are significantly tilted towards suppliers in the short term, it will undoubtedly place higher demands on the company's liquidity management.

Moreover, for many years, automotive companies and suppliers have mostly relied on long-term framework agreements for cooperation, and the payment terms of old orders have often solidified into commercial habits. If a sudden adjustment is needed, it would not only require renegotiation between the parties but might also involve the revision of contract terms or even the renegotiation of commercial conditions. This process tests both parties' mutual trust and willingness to cooperate, and requires considerable time and process costs, making it difficult to achieve overnight.

In the future, as policies are gradually implemented and companies establish adaptation mechanisms, the automotive industry chain may find a new balance point through adjustments.

State-Owned Enterprise Group Reform Deepens: Elephants Turn Around, Activating the Competitiveness of the "National Team"

In the context of fierce market competition, especially in the transition to new energy where some state-owned car companies show weak performance, the state-owned enterprise reform centered on "mixed ownership reform," market-oriented talent selection and employment, and strengthened technological innovation incentives will enter deep waters by 2025. Some large state-owned automobile groups are introducing strategic investments at the subsidiary level, implementing equity incentives, and experimenting with more flexible research and development and marketing mechanisms.

After undergoing a series of restructurings, Chang'an officially entered the "New Chang'an" phase in 2025. In July 2025, China Chang'an Automobile Group Co., Ltd. was officially established in Chongqing. "New Chang'an" is a newly formed central automotive enterprise, centered around Chang'an Automobile, and separated from China Ordnance Equipment Group. It comprises 117 subsidiaries, becoming a first-tier central enterprise on par with FAW and Dongfeng.

Image source: Changan Automobile

This is the key battle to determine whether China's automotive industry "national team" can dominate the future landscape.

In a brand-new competitive environment, the relaxation of mechanisms for traditional state-owned enterprises not only allows them to better adapt to the current "fast fish eat slow fish" competition rhythm in the automotive industry but also facilitates the integration and focused breakthrough of enterprise resources. It promotes the integration of scattered brands and technological resources under the enterprise, avoiding internal friction and concentrating efforts to create competitive new energy intelligent vehicle platforms and brands.

The success or failure of state-owned enterprise reforms is crucial to the stability of the basic framework of China's automotive industry. Successful reforms are expected to give rise to new giants that possess scale strength, resource depth, and market vitality, forming a new competitive and cooperative landscape with private car companies and technology firms.

Making Friends with Huawei: A Paradigm of Cross-Border Integration and the Redefinition of Industry Roles

In 2025, Huawei, with its comprehensive capabilities in smart cockpits, intelligent driving, electric drive systems, and channels, has become a "strategic partner" for more and more car companies (especially traditional car manufacturers) in achieving intelligent transformation.

The "Huawei phenomenon" essentially reflects the profound reshaping of the automotive industry's value chain by technology companies.

On the eve of the Guangzhou Auto Show, at the Huawei QianKun Ecosystem Conference, Huawei adopted an almost "saturation attack" posture by consecutively launching two new automotive brands—Qijing and Yijing. Qijing is a collaboration between Huawei QianKun and Guangzhou Automobile Group, while Yijing is a new brand born from the deep partnership between Huawei QianKun and Dongfeng Motor. Additionally, Baojun Huajing, which emerged earlier as a result of the cooperation between SAIC-GM-Wuling and Huawei QianKun, marks a new round of expansion in Huawei's brand matrix in the smart automotive field, officially extending from the "Jie" family to the new "Jing" family.

Image source: Huawei QianKun

Huawei has provided partner car companies with a fast-track solution to rapidly enhance their product intelligence levels, promoting the automotive industry's evolution towards more specialized division of labor, similar to the "Intel Inside" in the computer industry. Vehicle manufacturers may focus more on vehicle integration, manufacturing, branding, and user services, while core intelligent technologies are provided by tech companies.

The models empowered by Huawei have generally shown good competitiveness in the market, and indeed attracted more and more domestic and foreign car companies to continuously accelerate and deepen their cooperation with Huawei. "Making friends with Huawei" has become an important strategic choice in the industry. This not only accelerates the popularization of intelligent technology in the domestic automotive sector but also prompts all participants to rethink their core positioning and value in the future industry ecosystem.

Hidden Door Handles "Fade Away": The Return of Design Rationality and Userism

In 2025, the hidden door handles, which were once regarded as a hallmark of technological innovation in new energy vehicles, are seeing a noticeable decline. Not only have relevant departments begun seeking opinions on the safety technical standards for car door handles, but an increasing number of newly released new energy vehicle models are also reverting to traditional mechanical or semi-hidden door handles.

This seemingly subtle design change reflects a profound shift in the industry from pursuing flashy concepts to returning to practical essence.

For automobiles, safety and reliability have always been the top priorities. Issues such as the risk of failure of hidden door handles in extreme weather and potential obstacles during post-accident rescue become more prominent as their prevalence increases. Car manufacturers place safety and reliability above design aesthetics, which reflects the maturity of the product. Moreover, it is worth mentioning that as hidden door handles become a common feature, their value as a differentiating factor has gradually diminished. The possibility for car manufacturers to attract consumers solely through hidden door handles has become negligible. They are now turning to new design languages, material processes, or interaction methods to showcase uniqueness.

The move away from the craze of pursuing hidden door handles marks a more mature and pragmatic stage in Chinese automotive design. This also serves as a reminder to the industry that any technological innovation and design change must ultimately withstand the test of safety, reliability, and convenience—three core user demands.

Joint Ventures Entering the 2.0 Era: From Market-for-Technology to Cooperating for Global Success

Faced with the overwhelming advantage of Chinese brands in the fields of new energy and intelligence, the market share of traditional joint venture car companies continues to shrink. To reverse this decline, mainstream joint venture brands have begun deep self-revision. After entering 2025, many joint venture enterprises have started to evolve towards a new cooperation model, known as the "Joint Venture 2.0 Era." In this model, the Chinese side begins to play the role of technology exporter (especially in electrification and intelligent platforms) and takes the lead in the supply chain, while the foreign side contributes more with brand, global experience, or advantages in specific technical fields. The focus of cooperation shifts from "in China, for China" to "in China, for the world."

This is the inevitable result of a fundamental reversal in the strength of China's automotive industry.

In the era of Joint Venture 2.0, the Chinese partners have gained leadership for the first time in terms of technical routes and product definition, leveraging their advancements in the three-electric systems, intelligent cockpits, cost control, and profound understanding of the local market.

The 2.0 era of joint ventures marks the transformation of China's automotive industry from a "student" to a true "partner." It is not only an innovation in business models but also a historic leap where, after decades of accumulation, China's automotive industry achieves reverse output of technology and industrial chain capabilities, injecting new Chinese momentum into the evolution of the global automotive industry landscape.

Summary:

Looking back at 2025, the top ten events in China's automotive market resemble a multifaceted prism, reflecting the metamorphosis of the world's largest, most dynamic, and most complex automotive market. The tightening of regulations, market rationality, pragmatic technology, capital choices, and deepening cooperation together form a clear picture of an industry maturing amidst turbulence.

This year, China's automotive industry collectively embarked on a profound self-correction: addressing the impatience in promoting technological transitions, rectifying the gray areas in market circulation, improving unhealthy relationships between parts suppliers and manufacturers, refining designs that stray from the essence of user needs, and shifting old mindsets in global cooperation. At the same time, the industry is steadfastly making breakthroughs in areas such as the widespread adoption of electrification, advancements in assisted driving, capital empowerment, and the reform of state-owned enterprises.

In 2025, the key themes will no longer be solely growth or disruption, but rather regulation, reconstruction, and sustainability, indicating that after a period of rapid expansion, the Chinese automotive industry is beginning to systematically build the foundational rules and intrinsic capabilities that support long-term, healthy, and robust development.

The path from being a major automobile nation to becoming a strong automobile country is no longer a vague slogan, but a solid staircase paved by a series of substantial industry events. 2025 is a turning point, and more importantly, a foundational year.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

EVA Morning Prices on September 12: Most of the Market Holds Steady, Highest Rise of 50 Yuan

-

[PET Weekly Outlook] Polyester Bottle Chips Expected to Oscillate and Warm Up with Costs Today

-

Top Ten Personnel Changes in the Auto Industry: Insights into Industry Anxiety and Progress | Vision 2025

-

Domo Chemicals Files for Bankruptcy Protection in Germany! B. Braun Launches New Supply Assurance Program

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories