Six-Seater SUVs Go Wild, But MPVs' "Golden Age" Still Shines?

The mainstream MPV market, once monopolized by the Buick GL8, experienced an unprecedented golden age in 2025. Amidst a flourishing landscape, independent brands achieved high-end breakthroughs with the labels of new energy and intelligence.

And when Yu Chengdong announced the upcoming debut of the Luxeed V9, the first MPV under Harmony Intelligent Mobility Alliance, during a live broadcast in December, and when Leapmotor's 10th-anniversary event saw the D99 debut with the positioning of a "flagship of technological luxury," the entire year's MPV market concluded with unprecedented fervor.

For years, we have been looking forward to the MPV market transitioning from niche to mainstream, from business to family use, and completely liberating itself from its isolated survival mode.

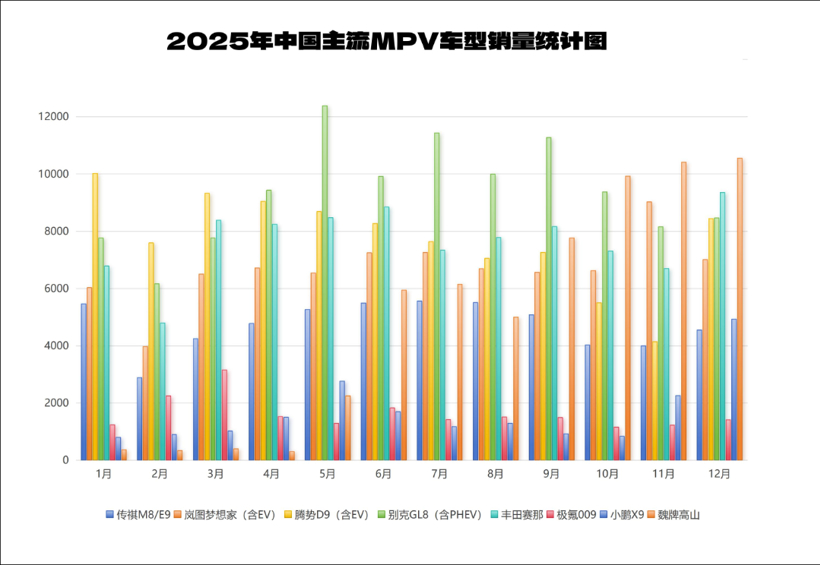

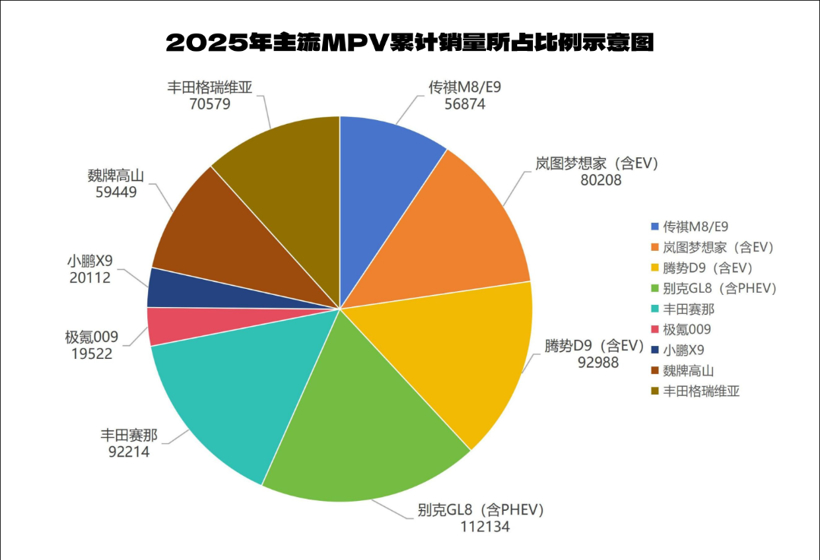

In 2025, according to data from the China Passenger Car Association (CPCA), China's MPV market sales exceeded 1.03 million units, showing a slight year-on-year increase. Sales of new energy MPVs surged by 36%, accounting for nearly half of the market share. Although Buick GL8 remained at the forefront of sales, it barely managed to hold its position thanks to a diverse range of model series. Perhaps, the imagined scenario is finally starting to emerge.

MPVs have never been the most attention-grabbing vehicles for consumers. In both public discourse and at dealerships, changes in this market rarely take center stage. Over the past year or so, the most that's happened is that some busybodies have repeatedly brought up the bizarre appearance of the Li Auto MEGA to grab eyeballs. But with the "big car culture" increasingly becoming the underlying tone of the Chinese auto market, it would be wrong to say that MPVs have no potential.

Even as large SUVs gradually pose a threat, the market remains favored by automakers, who hope to carve out space by offering comfortable, family-oriented vehicle designs, leveraging the specific product attributes of MPVs.

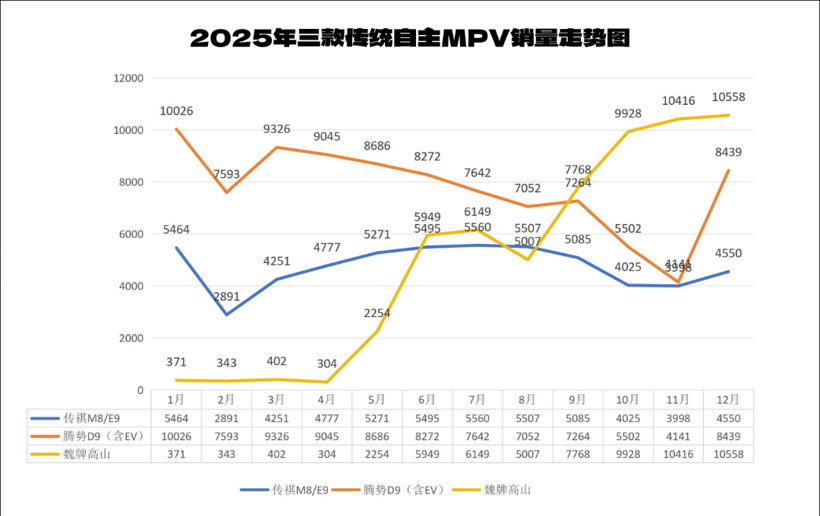

In the new era, MPVs are no longer considered just "tools." The packaging of technological advancements and changes in consumer awareness have made everyone eye this lucrative market. Last year, the sudden emergence of the Wey Gao Shan seemed somewhat fortuitous, but with new brands like Lantu and XPeng venturing into this space, despite external doubts, the arrival of the MPV's springtime is undeniable.

01The rise of independent brands: no longer low-key.

Looking back, few newcomers have been able to penetrate the MPV market. Buick GL8, with its "land-based business class" brand image, has dominated the field, while Toyota Alphard occupies the million-yuan-level market. The remaining independent brands such as Dongfeng Fengxing and Wuling only occupy the low-to-mid-end MPV market, mainly used as means of production.

Around 2020, the strong rise of the GAC Trumpchi M8 gave us hope that the market landscape would be disrupted. However, given the limited market capacity, the return on investment in the MPV segment is far less attractive to most automakers than entering the booming SUV market.

Products like the Roewe iMAX8 and Maxus G10, which defied the trend, have successively become market cannon fodder, further warning everyone: rather than rashly launching MPVs, it's better to experiment with various low-cost SUV products, experiment, and experiment again. As long as you can make one a hit, you'll have achieved great success.

Until the industry transformation entered deep water and intelligence fully permeated the Chinese auto market, everything changed. The new car-making concept pioneered by Li Auto, on the one hand, realized the "mobile home" with the Li ONE, directly igniting the minds of Chinese users and comprehensively bringing this trend into the MPV market. On the other hand, it was precisely this thinking that linked home and car together that gradually gave various car companies the idea of re-creating the form of automobiles.

Constrained by market perceptions, people generally believe that when MPVs are associated with family use, products like the Toyota Sienna and Granvia are sufficient to meet the demands of new users. However, as the idea of "TVs, refrigerators, and large sofas" permeates every market segment and intelligent ecosystems gradually take shape, MPVs, with their inherent spaciousness, naturally attract a portion of large family vehicle users.

Judging purely by sales figures, it's clear that Buick and Toyota MPVs still hold significant value. Their family product lines often achieve sales of over ten thousand units, enough to make any latecomer carefully consider their own capabilities. But precisely because of these emerging trends, car companies can no longer afford to ignore the MPV market as they once did, no matter how much internal conflict they may have. The success of the Denza D9 is especially jarring, shaking up the companies' restless hearts from the very source.

From Voyah Dreamer to Wey Gao Shan, from Li MEGA to Xpeng X9, the continuous entry of these new cars has not immediately changed the market landscape. Even when Buick GL8 uses a sea of models strategy and Toyota Sienna/Granvia uses price wars to besiege competitors, there are signs of repeating the mistakes of models like Mazda 8 in the past.

But the magic of the Chinese auto market lies in the fact that no one can predict its future trends.

What qualities should a good MPV possess? Space? Features? Or price?

In the past, these were some of the key indicators consumers used to judge whether or not to buy a product. Today, while retaining these basic conditions, as intelligent experiences gradually capture people's minds, it is clear that emerging MPV players have the capital to overtake on a curve. Aren't brands like Voyah Dreamer, backed by Huawei, and the revamped smart Wey Gao Shan, achieving strong sales precisely because of these product advantages?

In today's era where large SUVs are dominating the market, some people often worry that MPVs will become casualties of the new landscape, especially considering that last year's total sales volume of 1.03 million units still saw a year-on-year decline of 2.3%. With such fierce competition in the automotive market, these concerns are not unfounded. The total market capacity for MPVs is only around 1 million units per year, so it's understandable that any slight surge from products in the same price range could impact this market.

However, we cannot forget that there have always been many segments among Chinese users. Throughout history, as long as MPVs do not actively expand into other areas, they can certainly thrive based on their inherent advantages, given their irreplaceable position in business reception and multi-person travel scenarios. The fact that newcomers like Wey Gaoshan can still climb to the top of sales rankings in 2025, isn't that just saying this trend will continue?

Compared to SUVs, even similarly priced MPVs have limited competitiveness. Nevertheless, Chinese automakers, in their cutthroat competition, are unwilling to let go of even seemingly insignificant segments like station wagons. In just one year, nearly 10 models of the same type have been launched into the market. Who can say that MPVs won't experience another concentrated surge this year?

02The old order is broken, a new world has come.

We are more than aware of the current trajectory of the MPV market. Backed by industrial transformation, and regardless of expert analysis, the once simple MPV market has now transcended mere space and price dimensions, shifting towards a comprehensive competitive landscape focused on scenario-based and intelligent experiences.

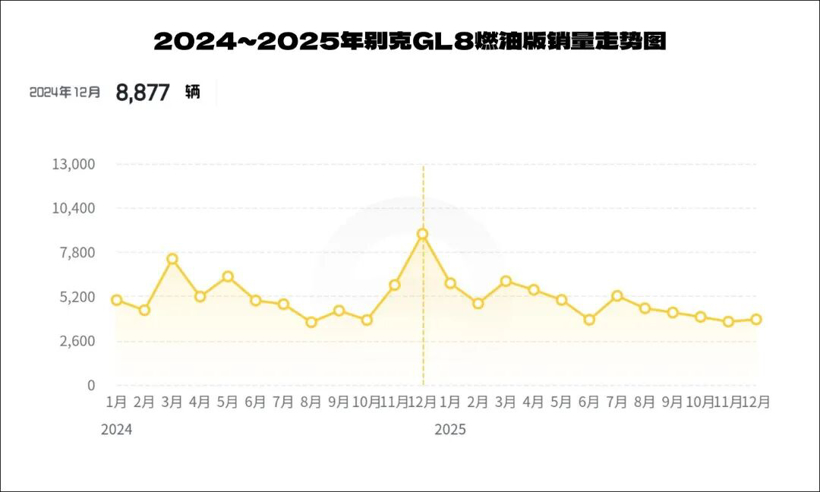

Even the most old-school Buick and Toyota vehicles must arm themselves with continuous evolution. The GL8 adds a plug-in hybrid system to change its overly strong business-oriented image, and the Sienna is equipped with a Huawei-powered infotainment system. These moves share the same goal.

For those who came later, as the full-year data shows, the Denza D9 secured the top spot among domestically produced MPV models with sales of 93,000 units. The Voyah Dreamer, with sales of over 80,000 units, has established a firm foothold in the high-end market above 300,000 yuan. The Great Wall Gaoshan series, with an astonishing growth rate several times higher than in the past, achieved a market reversal. All of these are examples of this trend. Behind this data lies the dual driving force of technological breakthroughs and changing consumer perceptions.

This brings a new inspiration to the market: to survive and thrive with the help of hybrid technology and intelligence, and to play a winning hand and avoid homogenization, the key is not only to maintain the basic principle of product upgrades, but also to transform from "stacking configurations" to "building a system," and to shift from pursuing pragmatism to entering the realm of luxury enjoyment or high-end business.

Recently, when the Stelato V9 was just unveiled, Zhao Changjiang, the brand's newly appointed Executive Vice President, jokingly commented on the new car's product power, saying, "Conservatively speaking, it will have no rivals for the next 3 years." Some say that after having the experience of sending the Denza D9 to the iron throne of MPV sales, Zhao Changjiang is too confident. In the MPV market, where the strong get stronger, it is not easy to gain market share by competing head-on.

Based on reality, however, we must acknowledge that the AITO V9, powered by Huawei, undeniably possesses the power to disrupt the market. Just look at the sales trends of the traditional gasoline-powered GL8 in the past two years, and you can see that the styles of the old and new eras are very different.

Looking back at the Chinese auto market after these two years of re-education, it's clear that any new car empowered by Huawei is almost guaranteed to be a bestseller. This trend is likely to continue in the MPV sector.

Given that the competitive landscape of the MPV market in 2025 has significantly changed, and previously large size was the key requirement for MPVs, now that these configurations are standard across the board, should the competitive focus for high-end MPVs shift towards areas like intelligent cockpits and advanced driver-assistance systems?

In other words, as intelligence becomes the core competitive point, the competition between Huawei's HarmonyOS smart cockpit + ADS and various manufacturers' self-developed solutions will determine the standard for the next generation of MPV intelligent experience. Furthermore, as scenarios become more refined, the differences in demand between niche markets such as family-oriented, business-oriented, and high-end customized models will become more pronounced. MPVs are increasingly becoming a new trend, and it is only natural for car companies to rush into this market.

What can the mighty AITO M-series and Li Auto L-series do about this? The MPV's livelihood has never depended on its tall and powerful body, or seemingly good off-road capabilities – superficial efforts. At the high end, vehicles like the Alphard are about a sense of elegant riding and a strong sense of identity. At the lower end, the deepening and redoubling of family attributes, with functional configurations like sliding doors as a typical example, have become an increasingly irreplaceable part.

Against this backdrop, even the existing influx of new players has made the already crowded MPV segment even more lively. According to incomplete statistics, there are currently over 10 major new MPV models on sale, with prices ranging from 150,000 to 800,000 yuan. In the future, brands such as Luxeed, Denza, and Li Auto will continue to compete in the 500,000 yuan high-end MPV market, while brands such as Leapmotor, Geely Galaxy, Xpeng, and Voyah will focus on competing in the 300,000 yuan high-performance-price ratio MPV segment.

Based in China, as long as the industry transformation is not yet complete, we can still believe that MPVs have enormous potential for consumers.

After more than a decade of cycles, China's automotive industry has been able to move from the confusion of "market for technology" to the confidence of "technology for market." The transformation of the MPV market will be a microcosm of this journey: from the dominance of Buick GL8 to the collective rise of independent brands, from fuel dominance to the popularization of electric drive, and from single business use to the coverage of diverse scenarios. This year, with brands with a broad mass base such as Denza, Stelato, and Leapmotor stirring things up in turn, the market is bound to see an even greater reshaping of the landscape.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Sony Joins 13 Chemical Material Firms to Build World's First Renewable Plastic Supply Chain in Electronics

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

Polyolefin Monthly Report: Stronger Cost Support, Focus on Downstream Follow-up Before the Holiday

-

BASF and Lanxess Announce Price Hikes! ExxonMobil Commissions Third Advanced Recycling Unit

-

Lutai's Major Equity Change! Uniqlo's Parent Company Joins Hands With Chenfeng to Enter the Market, Creating a "Community of Destiny" in the Textile Industry