Really? United States (US) Government's $9.5 Billion Order for Plastic Products, 60% Goes to Defense

At the beginning of 2026, news of the Venezuelan president being "kidnapped" by U.S. special forces sparked global outrage, once again making the influence of U.S. military capabilities a hot topic of discussion. Additionally, a recent report from the American Chemistry Council (PLASTICS) revealed some jaw-dropping data: out of the $9.5 billion total spending on plastic products by the U.S. federal government in 2024, $5.7 billion flowed into the defense sector, far exceeding the $3.8 billion allocated for non-defense spending. This means that approximately $180 worth of plastic is used every second to manufacture lightweight composite components for the F-35 fighter jet, high-temperature casings for Tomahawk missiles, individual soldier protective equipment, or field medical facilities. America's military advantage is not only built on well-known technologies like chips and IT; a seemingly traditional and inconspicuous plastic industry has also become a hidden pillar of the U.S. military-industrial complex.

A industrial base worth 551 billion US dollars.

According to the "Global Trends 2025" report released by PLASTICS, the U.S. plastics industry contributed approximately $551 billion in output in 2024, directly creating over 1 million jobs, making it the eighth-largest manufacturing sector in the U.S. and one of the key pillars of the American economy. More crucially, its economic quality is notable: after adjusting for inflation, the value added by the U.S. plastics manufacturing industry grew by 2.0% from 1997 to 2024, while the increasingly hollowed-out U.S. manufacturing sector as a whole saw a decline of 0.1% during the same period.

This means that the U.S. plastics industry is not only growing but also continuously creating higher value. Compared to materials in the same packaging and other sectors, plastics have clear advantages: in the second quarter of 2025, the added value of the U.S. plastics manufacturing industry was $68.1 billion, 26% higher than paper products and 40% higher than glass and other non-metallic mineral products.

The vitality of the industry is rooted in continuous technological iterations and material revolutions. In response to the demand for lightweight materials in new energy vehicles, the pursuit of biocompatibility in healthcare, and the requirements for recyclability in the circular economy, plastics are continuously evolving and expanding their application boundaries, with their economic contributions already surpassing the realm of a single material.

The Global Chessboard Behind a 23.7 Billion Surplus

In the year 2025, amid escalating global trade frictions, the U.S. plastic industry exhibits a complex trade profile.

On one hand, as the world's second-largest plastic trading nation after China, the United States has a resin (plastic raw material) trade surplus of $23.7 billion, with Mexico and Canada as its key export markets. It is noteworthy that over the past 27 years, the U.S. plastic industry has only experienced a trade deficit in four years.

On the other hand, in the fields of plastic products, machinery, and molds, the United States has a trade deficit, reflecting the division of labor in the global industrial chain. China is its third-largest export market (with exports worth $7.3 billion in 2024), but it is also the largest source of the trade deficit in this industry ($12.4 billion).

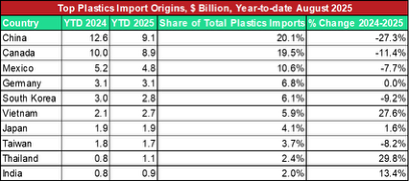

Main sources of plastic imports to the United States (in billion dollars, as of August 2025)

On April 2, 2025 (referred to as "Liberation Day" by Trump), the United States announced tariffs on imported goods. However, by July of that year, the import volume of plastic-related products had only decreased by 1.0% year-on-year, and the supply chain did not experience the anticipated disruption. Dr. Perc Pineda, chief economist at PLASTICS, analyzed that this was due to the ample domestic capacity and inventory buffers in the U.S. (with inventories reaching 15.5 billion in July 2025, only 800 million below the peak in 2023).

"Higher tariffs have increased manufacturing costs," Pineda pointed out, "but at the same time, tax incentives such as 100% full expensing of capital expenditures, along with the Federal Reserve's interest rate cuts, have partially offset these impacts." This policy "combination" reflects the complex considerations of the U.S. in reshaping the competitiveness of its manufacturing industry.

Stumbling forward amidst interest rate cuts, government shutdown, and midterm elections.

In 2025, the U.S. plastic industry underwent multiple stress tests.

In the first half of the year, the manufacturing and plastic demand slowed down due to the federal funds rate remaining above 4.0%. However, as the Federal Reserve cut interest rates twice during the year, totaling 50 basis points, the situation turned around in the second half. The market widely anticipates that the Federal Reserve will continue to cut rates in 2026, which may reduce the borrowing costs for U.S. plastic manufacturing companies and encourage equipment upgrades and capacity expansion. Pineda predicts: "If the interest rate falls to 3.4% (the long-term median target for 2026), the demand for composite materials and molds in the plastic industry will significantly rebound." However, this is contingent upon trade policy uncertainties (such as whether tariffs on Chinese plastic machinery are further adjusted) not intensifying.

In the third quarter of 2025, the shipment value of primary plastic machinery in the United States reached 303.2 million USD, marking a 19.5% increase both quarter-on-quarter and year-on-year. Among them, the shipment volume of injection molding machines driven by industries such as automotive showed strong growth. Meanwhile, the capacity utilization rate of the plastic products manufacturing industry steadily increased from 73.0% in July to 74.3% in September, indicating a revival in production activities.

Interestingly, during the 43-day federal government shutdown from October 1 to November 12, the demand for plastics exhibited extraordinary stability. This is due to the fact that plastic products have become as essential to societal functioning as water and electricity—ranging from medical supplies and food packaging to municipal pipelines, the rigid demand remains unaffected by political turmoil.

As the midterm elections in November 2026 approach, the American plastics industry remains cautiously optimistic about the future. A survey conducted by the PLASTICS Association among its member companies shows that more than half of the equipment manufacturers believe the market will remain stable or improve over the next 12 months. The industry's focus has shifted from short-term tariff fluctuations to longer-term competitiveness issues: how to consolidate technological advantages through innovation and navigate the global trend towards a circular economy.

Stable demand, lower loan costs, tariff clarity, and stable producer prices suggest that the outlook for the U.S. plastic manufacturing industry may be expansionary, although this forecast could change due to unforeseen disruptions and other internal and external factors.

Challenges faced by China

Since October last year, the Sino-U.S. tariff war has been paused for a year, with U.S. imports from China subject to a basic mutual tariff of 10%. The announced trade agreement mainly eliminates or reduces the tariffs imposed on China, such as lowering the tariff rate on fentanyl and suspending/allowing the expiration of other import control measures. China has also taken similar actions, such as canceling its retaliatory measures and restoring rare earth exports. It remains to be seen whether there will be further actions to improve U.S.-China trade relations after the agreement takes effect.

For China's plastic industry, changes in the U.S. market pose both export challenges and hidden opportunities for supply chain restructuring and technological cooperation.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Nissan Cuts Production of New Leaf EV in Half Due to Battery Shortage

-

Vynova's UK Chlor-Alkali Business Enters Bankruptcy Administration!

-

Case Study | Clariant AddWorks™ Additives Solve Plastic Yellowing Problem

-

[PET Weekly Outlook] Polyester Bottle Chips Expected to Oscillate and Warm Up with Costs Today

-

[Today's PP and PE Prices in Fujian] Mixed Changes! PP Up by a Maximum of 475, PE Down by a Maximum of 350