Production Capacity Exceeds 5 Million Tons! 24 New Facilities Planned for Construction Amid BDO Investment Boom, Overcapacity Risks Already Looming

In a short span of days from late October to early November 2025, two significant announcements were made in China's BDO (1,4-butanediol) industry. First, the 100,000-ton BDO project in Yichuan, Shaanxi, completed its filing process. Subsequently, the EPC bidding for the 100,000-ton BDO facility in Yangpu, Hainan, was initiated. The total investment for these two projects exceeds 4 billion yuan.

These projects being launched intensively reflect the level of attention BDO is receiving in the chemical industry, while also raising concerns within the industry about overcapacity.

01 Project investment remains hot, and capacity expansion continues to accelerate.

The Hainan Yangpu fully biodegradable plastic industry chain project (Phase I), as a key project in Hainan Province, has a total investment of approximately 2.4 billion yuan and covers an area of 186 acres. The planned construction period is 1,095 calendar days. This project adopts the maleic anhydride process route and plans to build a 200,000 tons/year maleic anhydride unit and a 100,000 tons/year BDO unit. The products include BDO, tetrahydrofuran, and γ-butyrolactone, with by-products such as pentane and isobutane. It is noteworthy that the project is 100% funded by private capital, indicating market confidence in the prospects of BDO.

Image: Hainan Yangpu 100,000-ton BDO Plant Initiates EPC Tender (Image Source: National Public Resource Trading Platform)

At almost the same time, the BDO project in Yichuan, Shaanxi Province has also completed its filing. The project has an investment of 1.9 billion yuan, covers an area of 100 acres, and employs a natural gas method for acetylene production. It includes the construction of a 40,000-ton/year natural gas acetylene facility, a 100,000-ton/year methanol facility, and a 200,000-ton/year formaldehyde facility, forming a complete supporting industrial chain.

Yichuan County Industrial Park Investment Development and Construction Co., Ltd. Annual Production of 100,000 Tons of 1,4-Butanediol Project (Source: Official Website)

These new projects are just a reflection of the investment boom in BDO. According to data from the China Petroleum and Chemical Industry Federation, as of September 2025, there are 34 BDO enterprises in China, with a production capacity reaching 5.797 million tons, a 167% increase compared to 2020. More importantly, there are currently 24 proposed construction facilities, with a total capacity of 6.964 million tons per year, primarily scheduled to be put into operation between 2024 and 2026.

02 The advantages of the industrial chain are obvious, and BDO is highly favored.

1,4-Butanediol, abbreviated as BDO, is an important fine chemical product widely used in solvents, pharmaceuticals, plasticizers, curing agents, fibers, and engineering plastics.

The reason BDO is highly favored is due to its rich potential for industrial chain extension.

The current BDO production processes mainly include the Reppe process (calcium carbide process), maleic anhydride process, propylene oxide process, and butadiene process. Among these, the calcium carbide process accounts for as much as 83%, while emerging processes like the maleic anhydride process account for approximately 17%.

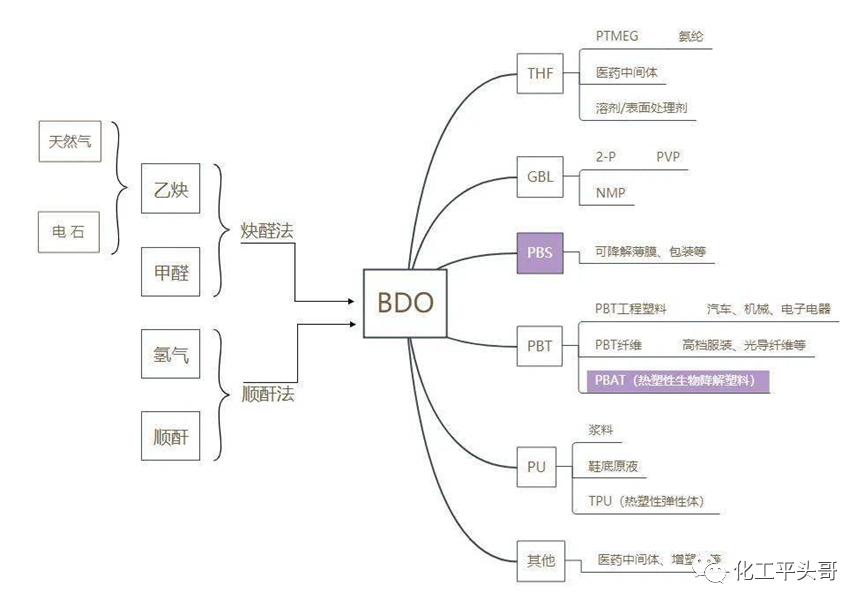

From the perspective of downstream applications, BDO primarily extends in three directions:

Source of image: Chemical Ping Tou Ge

The THF-PTMEG industry chain is the most mature application field of BDO. As an important raw material for spandex, PU slurry, etc., PTMEG has stable demand in the textile and clothing sectors. With the improvement of people's living standards, the demand for such high-end materials continues to grow.

The field of biodegradable plastics is a new engine driving the demand for BDO. BDO downstream products PBAT and PBS are important varieties of biodegradable plastics, and their demand has rapidly increased under the promotion of the "plastic restriction order" policy. Since the release of the "Opinions on Further Strengthening Plastic Pollution Control" in 2020, many regions across the country have successively introduced implementation plans for plastic pollution control, creating a huge market space for biodegradable plastics.

The field of new energy materials has opened up a new avenue for BDO. BDO can be used to produce NMP (N-Methyl-2-pyrrolidone), which serves as an auxiliary material in lithium battery production. With the rapid development of the new energy vehicle industry, the demand in this area is showing explosive growth.

In addition, the attention on the BDO industry is closely related to the transformation needs of the chemical industry. For carbide enterprises, under the backdrop of oversupply in traditional products such as PVC and vinyl acetate, BDO has become an important direction for industrial upgrading; for natural gas chemical enterprises, BDO is an important choice for achieving raw material diversification and enhancing added value.

03 BDOConcerns about overcapacity emerge, experts urge rational development.

Behind the investment boom, the BDO industry has shown signs of overcapacity concerns.

Data shows that China's BDO consumption in 2024 is expected to reach 2.62 million tons, a year-on-year increase of 16.4%, but still far behind the growth rate of production capacity and output.

Under the impact of, BDO prices have fallen, and corporate profits have declined. By 2025, the number of companies in the industry chain with idle assets and long-term shutdowns has significantly increased, with idle capacity exceeding one million tons and the scale of occupied funds surpassing 33.3 billion yuan.

The BDO industry is facing a serious predicament of overcapacity, and the reasons are multifaceted.The primary reason is the serious imbalance between supply and demand.National production capacity has far exceeded market demand, leading to a sharp decline in prices and widespread losses for enterprises.Secondly, the cost pressure is uneven.The cost differences among different production processes are significant, and coupled with rising raw material prices, some enterprises' cost disadvantages have become pronounced, making it difficult for them to participate in market competition.The third is that downstream demand is below expectations.The application of biodegradable plastics in key areas has not been able to effectively expand due to factors such as the enforcement of the "plastic restriction order," while demand in traditional downstream industries like spandex has weakened, resulting in overall sluggish demand.In addition, sudden malfunctions and regular maintenance of complex production equipment are also direct technical reasons for the shutdown of the facilities.It is the combination of these multiple factors that has collectively led to the widespread shutdown of BDO enterprises.

Special Plastics Vision has noted that these BDO facilities have already ceased production:

Shaanxi Shaanxi Chemical: The first phase 30,000 tons/year unit will shut down at the beginning of August 2024, and the second phase 100,000 tons/year unit will shut down on February 22, 2025, with the restart time yet to be determined.

Shaanxi Guorong Chemical: The 60,000 tons/year BDO unit will be shut down in mid-April 2024, with the restart time yet to be determined.

Inner Mongolia Huaheng has three sets of BDO plants, each with a capacity of 104,000 tons. One set is currently shut down, another is operating stably, and the catalyst of one set is being replaced with a BYD catalyst starting from June 3, which is expected to take three days.

The 300,000-ton BDO facility in Inner Mongolia has temporarily halted operations due to unexpected equipment failure since June 3, with an estimated downtime of 7 to 15 days.

Xinjiang Meike Chemical: The Phase III 100,000-ton facility is currently shut down, and the Phase II 100,000-ton facility will be shut down on April 3, 2025, with the restart time yet to be determined.

Xinjiang Tianye: The 210,000 tons/year BDO unit will be completely shut down by the end of September 2024, with no scheduled restart time.

Henan Energy Hebi Coal Chemical: The 100,000 tons/year BDO plant will undergo a complete shutdown for major inspection on July 10, 2024, with the restart time yet to be determined.

Henan Kaixiang: The 110,000-ton BDO plant will be completely shut down on February 5, 2025, with the restart time yet to be determined.

Dalian Hengli: The second 300,000-ton/year unit is scheduled to shut down around March 11, 2025.

Faced with this situation, industry experts are calling for rational development. At the 4th China (Wuhai) BDO and Biodegradable Materials Industry Development Conference held on October 30, 2025, the attending experts pointed out that the BDO industry urgently needs to recognize changes, adapt to changes, and seek changes. It is necessary to accelerate technological innovation, expand downstream applications, and strengthen industry self-discipline.

Zhao Jungui, Vice President and Secretary-General of the China Petroleum and Chemical Industry Federation, made three suggestions: First, strengthen application innovation to explore high-end consumption areas in emerging industries; second, strengthen the extension and supplementation of the industrial chain and establish a coordinated cooperation mechanism with upstream and downstream industries; third, strengthen capacity warning and improve the capacity warning work mechanism to send a signal to the whole society to strictly control the increase of new capacity.

04 Conclusion

The investment boom in the BDO industry is the result of the combined effects of market demand, policy guidance, and industrial transformation. However, the current pace of capacity expansion has clearly outpaced the growth in demand, making intensified industry competition inevitable. The key to the future development of BDO enterprises lies in differentiated competition.

On one hand, it is necessary to reduce production costs and improve product quality through technological innovation; on the other hand, attention should be paid to downstream application development to explore new market opportunities. Especially in the fields of biodegradable plastics and new energy materials, there are still numerous niche markets to be tapped. However, in the short term, the industry may undergo a round of reshuffling, and only companies with advantages in technology, cost, and the industrial chain will stand out in the fierce competition.

Edited by: Lily

Source of materials: BDO Research Institute, PingTouGe, Zhonghua Xinwang, China Petroleum and Chemical Industry Federation, Inner Mongolia Chemical Industry, etc.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Mexico officially imposes tariffs on 1,400 chinese products, with rates up to 50%

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Progress on plastic reduction in packaging released by 16 fast-moving consumer goods brands including nestlé, pepsi, unilever, coca-cola, and mars

-

Significant Data Gaps in Plastic Additive Safety! Cheap Catalyst with Air Enables Efficient PET Decomposition

-

Brazil Imposes Five-Year Anti-Dumping Duty of Up to $1,267.74 Per Ton on Titanium Dioxide From China