Price Hikes Continue Despite Holiday: How Businesses Should Cope with Soaring Raw Material Costs Post-Chinese New Year

Before the Spring Festival, a sudden surge in polyester raw material prices disrupted the holiday plans of many textile enterprises. How will this textile market trend change the market after the Spring Festival?

The current round of polyester raw material price increases originated from the futures market, largely due to capital impact. Coupled with some positive factors within the industry itself, this has led to a value recovery for polyester chain products and has also driven up the prices of polyester filament yarn. Compared to mid-month, POY 150D has increased by 200-250 yuan/ton, a rise of 3.4%. However, facing the sharp increase in polyester filament prices, textile enterprises are showing some hesitation.

With less than two weeks left until the Spring Festival, a large number of textile factories are already on holiday. Some companies, in fact, have been on vacation for nearly half a month. These businesses had already made their pre-holiday plans well in advance. While the price increase in polyester filament was somewhat unexpected, it has had little impact on them.

A portion of textile enterprises, possibly needing to rush orders or build up inventory, have not yet fully closed for the holidays. Consequently, they continue to consume raw materials, leading to a sustained increase in polyester yarn prices. This directly drives up their production costs, forcing some weaving mills to raise the prices of their greige fabrics, while they themselves also have inventory procurement needs.

However, firstly, the excessively high raw material prices will occupy a large amount of capital; secondly, the sudden surge in polyester filament also makes textile people uneasy, fearing that the price will fall after the new year if they hoard too much, so the amount purchased is relatively limited. Moreover, some textile companies have chosen to start their holidays early due to the soaring raw material prices. The recent average production and sales also show that they are hovering around 40-50%, leaving textile companies in a dilemma of whether to buy or not to buy.

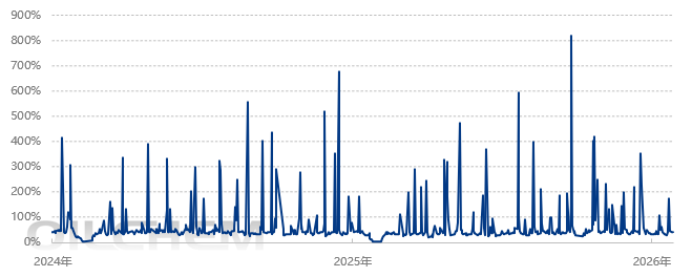

Domestic Polyester Filament Capacity Utilization Trends, 2024-2026

In any case, as the Lunar New Year approaches, the market trends before the holiday are unlikely to see further significant fluctuations. For textile enterprises, a more critical issue is how to cope with the skyrocketing prices of polyester yarn once the holidays are over.

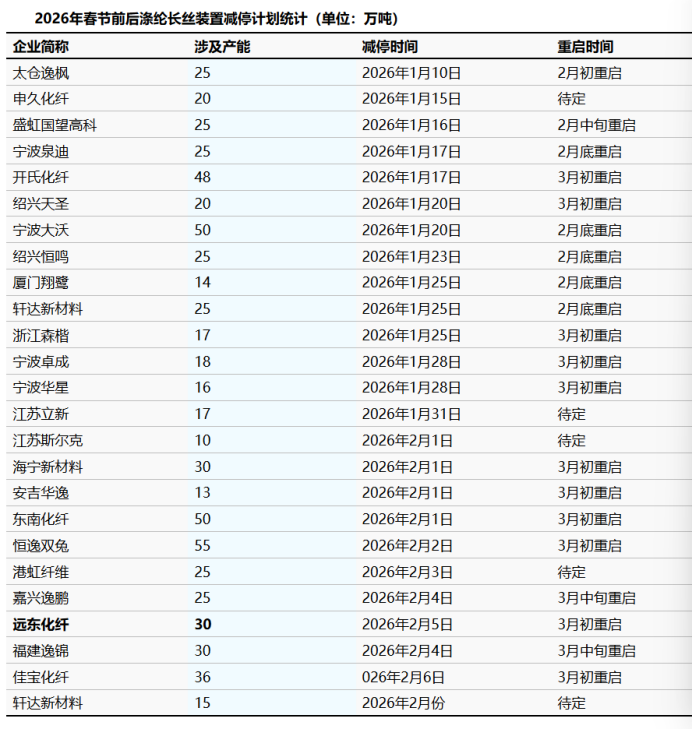

Although the recent surge in polyester futures is largely driven by capital, the fact that these products repeatedly hit new lows in 2025 is indeed a regrettable consequence of extreme market competition. Under the shared understanding of resisting involution, to maintain profits, polyester factories are more willing to reduce production than to lower prices for promotion. This year, polyester factories have already undertaken significant maintenance, effectively sustaining the price of polyester filament. Even if future increases in polyester futures prices impact downstream demand, polyester factories can further intensify maintenance to protect prices.

Therefore, after the Spring Festival, textile enterprises will likely face higher raw material prices. If they continue to sell fabrics at pre-holiday prices, they will probably incur losses. However, considering the existence of some low-cost inventory in the market, this inventory will, to some extent, suppress the recovery of greige fabric prices.

On the other hand, the holiday period for textile enterprises this year is earlier than in previous years, so the inventory accumulated in the market may be relatively limited. The wave of orders after the Spring Festival may digest more inventory than expected, potentially breaking through the inventory dam and driving up greige fabric prices, thus ushering in a long-awaited peak season.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

Multifaceted Collaboration: PA Prices Rebound Against Trend to Break Through

-

Dow suffers poor performance, announces major layoffs of 4,500 employees