Plastic market this month: Generally Rising! East China PC Surges 800-1000

Summary: Summary of plastic market prices and trends in January! Driven by rising raw material costs this month, cost support remained strong, and the market showed a steady upward trend. Regarding general-purpose plastics, PE saw more gains than losses, with some prices rising by 85–619 and others falling by 7–238; PP prices continued their rebound; the price center for PVC shifted upward; PS fluctuated upward, with East China PS rising by 539 for the month; EVA market prices rose, driven by the policy of canceling export tax rebates for photovoltaics. Regarding engineering plastics, PC prices rose sharply after holding steady, with East China PC surging by 800–1000; the PET market trended warmer, starting low and finishing high, with a monthly average increase of 327; POM fluctuated upward, with some prices rising by 400; PBT and PA followed the upward trend; PMMA maintained a weak but stable performance.

General material

PP: Geopolitical and cost factors drive high-level market volatility in January, with positive outlook for the future.

I. This Month's Core Hotspots

Geopolitical turmoil combined with extreme weather events, including a cold snap in the US that suppressed crude oil production and slower-than-expected resumption of operations in some oil fields, have pushed international oil prices higher.

Driven by national subsidies for new energy vehicles and the peak season demand for express packaging at the end of the year, the operating rates of downstream polypropylene industries have increased.

Within the month, unexpected equipment overhauls and cost-driven maintenance were concentrated, leading to a rise in polypropylene maintenance losses, and keeping overall market supply pressure manageable.

II. Market Performance Review for the Current Month

In January 2026, the polypropylene market fluctuated around geopolitical risks and changes in raw material costs. At the beginning of the month, tensions in Iran and Venezuela directly pushed international crude oil prices sharply higher, with upstream raw materials such as propylene and propane rising in tandem, providing strong cost support for the polypropylene market. Coupled with the concentrated release of bullish sentiment in the downstream market and smooth destocking within the industry, polypropylene spot prices experienced a rapid increase.

As geopolitical disturbances in Iran gradually ease and market speculation cools down, crude oil prices have retreated from their highs, weakening the distant cost support for polypropylene. Previous gains have been partially given back. However, affected by the continuous rebound in futures prices in the previous period, the availability of spot resources in the market is tight, and overall prices are maintained at high levels with fluctuating trends. On the 22nd of this month, news of a cold wave in the United States stimulated a rebound from the bottom in the market, and market speculation heated up again. Coupled with the overall manageable pressure on upstream producers, spot-end support still exists, and polypropylene prices continue their rebound.

III. Market Outlook

The market demand for polypropylene is expected to show an upward trend.

Key focus for next period

Macro level: Pay attention to the implementation effect of the trade-in consumer stimulus policy. The policy benefits are expected to further boost market participants' confidence.

Supply side: Focus on tracking changes in total market inventory after the Spring Festival. Inventory pressure may increase after the holiday, and it is necessary to be wary of the impact of inventory accumulation on the market.

Cost side: Closely monitor changes in the prices of upstream raw materials such as crude oil and propane, as their trends will directly determine the sustainability of polypropylene price increases.

PE: Supply-demand game intensifies, market outlook positive for February

I. Hot Topics This Month

In January 2025, the domestic polyethylene market in China exhibited a supply-demand surplus, with the supply-demand gap widening further to reach 74,500 tons.

Polyethylene imports in January were 1.12 million tons, down 15.78% month-on-month. It is expected that imports in the next phase will continue to decrease to 1.041 million tons, a month-on-month decline of 7.05%.

II. This Month's Market Review

Source: Longzhong

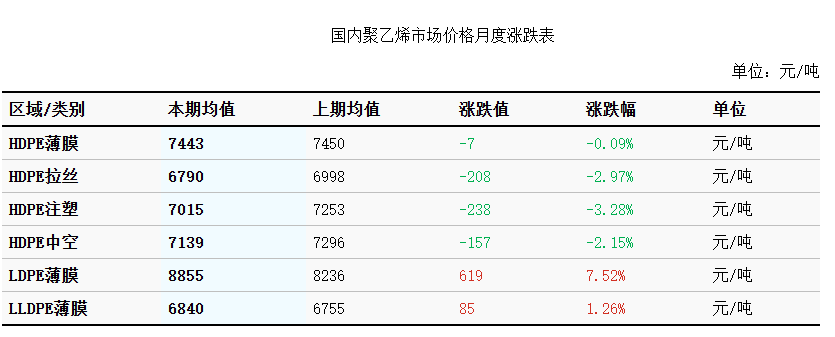

In January, China's domestic polyethylene market saw divergent price adjustments, with price fluctuations ranging from 7 yuan/ton to 619 yuan/ton across different categories.

From the supply side, the number of units undergoing maintenance increased this month, which alleviated market supply pressure to some extent. Meanwhile, upstream enterprises had more overselling activities at the beginning of the month, and there is no immediate supply pressure, thus manufacturers' quotes remained firm, with domestic output increasing by 1.68% month-on-month. However, due to a 15.78% month-on-month decrease in imports, the total supply this month still decreased by 3.67%, falling to 4.1794 million tons.

From a price performance perspective, HDPE prices generally declined across all categories: the average price of HDPE film this period was 7443 yuan/ton, a slight decrease of 7 yuan/ton compared to the previous period; the average price of HDPE drawing this period was 6790 yuan/ton, a decrease of 208 yuan/ton compared to the previous period, a decrease of 2.97%; the average price of HDPE injection molding this period was 7015 yuan/ton, a decrease of 238 yuan/ton compared to the previous period, a decrease of 3.28%; the average price of HDPE blow molding this period was 7139 yuan/ton, a decrease of 157 yuan/ton compared to the previous period, a decrease of 2.15%.

Meanwhile, LDPE and LLDPE prices bucked the trend and moved upwards: the average price of LDPE film this period was 8855 yuan/ton, an increase of 619 yuan/ton, or 7.52%, compared to the previous period; the average price of LLDPE film this period was 6840 yuan/ton, an increase of 85 yuan/ton, or 1.26%, compared to the previous period.

While the demand side faces pressure from the continued decline in downstream factory operating rates, some enterprises are engaging in chasing price increases to replenish inventory and preparing for the Spring Festival holiday, providing some support to the market. This, coupled with improved macroeconomic data, cost-side support, and geopolitical conflicts boosting industry confidence, led to market sentiment driving spot prices higher, which is a key reason for the price increases in LDPE and LLDPE.

III. Market Outlook for Next Month

Domestic polyethylene market prices are expected to trend upward in February.

From the supply side, market pressure will significantly weaken. Domestic production is expected to decrease by 196,400 tons, a 6.42% drop compared to the previous period. Simultaneously, importers' willingness to accept deliveries before the Spring Festival will decline to reduce inventory costs, and imports are expected to decrease by 7.05% compared to the previous period. Overall supply pressure will be effectively alleviated.

From the demand side, following the end of the Spring Festival holiday and the widespread resumption of work and production in factories, demand will experience a seasonal rebound, with the market anticipating a phase of restocking, providing strong support for the market. In addition, the concentrated release of positive macroeconomic news during the Spring Festival holiday will further boost market sentiment.

Overall, driven by easing supply pressure and a positive macroeconomic environment and demand side, polyethylene market prices are expected to rise with fluctuations in February, with LLDPE prices projected to reach 7007 yuan/ton.

PVC: Policy Stimulus Boosts Exports, Shifting Price Focus Upward in January

I. Monthly Market Analysis

Returning from the New Year's Day holiday in 2026, the domestic PVC market at the beginning of the month presented an upward trend dominated by "policy expectations + capital speculation." The main contract in the futures market rose continuously, boosting market trading sentiment, and spot market quotations in various regions followed suit. The export tax rebate policy adjustment announced on January 9, coupled with the time difference between the policy's effective date and the present, created a "rush-to-import" demand in overseas markets. Domestic PVC companies' export departments also implemented measures such as advance quoting, price increases for transactions, limited order signing, and increased sales plans. Improved export data provided some support for market sentiment. This, combined with the synchronous rebound of chemical products in the second half of the month and the bottom support benefit of the calcium carbide method, led to an upward shift in the spot price center of gravity in the PVC market in January.

II. Focus Points for the Next Period

1. Changes in non-PVC chlorine consumption products. 2. Changes in the comprehensive profit of chlor-alkali PVC. 3. Changes in macroeconomic factors.

III. Next Month Market Forecast

In February, the PVC industry faces pressure from holiday shipments due to the Chinese New Year, and after prices rose in January, they are expected to be under pressure with limited further increases. In the first half of the month, before the Spring Festival, demand will drop to its lowest point of the year due to high inventory and the shutdown of downstream operations for the holiday. However, supported by the deep losses in the industry's cost structure, prices are expected to remain in a weak bottom-end oscillation. In the second half of the month, after the Spring Festival holiday, prices are expected to gradually stabilize as some downstream businesses resume operations and restock, and due to the anticipated support from overseas demand for exports.

PS: Raw material prices are strongly rising, and the market will fluctuate upwards in January.

I. This Month's PS Market Review

In January 2026, the Chinese PS market showed a fluctuating upward trend, primarily driven by the strong rise in upstream raw material prices. However, a slight easing of supply and demand somewhat hindered the pace of price increases. Overall, the trend was characterized by "cost support dominance, with price increases constrained by supply and demand."

As of the end of this month, the average price of PS 525 in East China was 7,496 yuan/ton, a month-on-month increase of 539 yuan/ton, or 7.7%. In terms of cost, crude oil prices fluctuated slightly upwards this month, and the supply and demand pattern in the pure benzene market improved slightly. In addition, styrene port inventories continued to decline, some units experienced malfunctions, and export negotiations performed well, leading to a sustained rise in market bullish sentiment, providing strong support for PS prices.

On the supply and demand side, due to the strong performance of major home appliance orders, PS manufacturers are operating at full capacity. However, the industry's overall profit is under pressure, and some production facilities in East and South China have shown signs of reduced production. This has led to a slight decrease in market supply in the middle and late parts of the month, easing the previously loose supply and demand situation to some extent.

II. Key Data Trends This Month

1. Production: China's PS output in January is expected to be 417,000 tons, a decrease of 5,000 tons or 1.18% month-on-month. Year-on-year, it is expected to increase by 3.2%. The cumulative output for the month is 417,000 tons, with a cumulative year-on-year increase of 3.2%. Overall production remains stable, with a slight decrease.

2. Inventory: In January, the average domestic PS finished product inventory was 84,000 tons, a decrease of 5,000 tons from the previous month, a decline of 5.6%. The inventory showed a slight destocking trend, which eased market supply pressure to a certain extent.

III. Outlook

China's PS market is expected to show high-level volatile trends in February, with the possibility of a "first fall then rise" phased fluctuation.

From a cost perspective, the styrene market is expected to maintain a broad balance. Although bullish sentiment currently persists, close attention should be paid to the downward impact on prices caused by weakening market expectations around the Lunar New Year. It remains possible that styrene prices could strengthen again following a correction, which would subsequently transmit to the PS market.

From the supply and demand perspective, the PS market supply in February is likely to see a significant month-on-month decrease. The core reason is the gradually expanding trend of profit losses in the industry, coupled with the fact that downstream enterprises have brought forward some February orders to January. It is expected that the recovery of downstream demand in February will be somewhat delayed, and the supply-demand pattern will remain a key factor affecting market trends.

EVA: The photovoltaic industry experienced a volatile January, starting strong but weakening due to the disruption of the cancellation of the tax rebate policy.

I. This Month's Core Hot Topics

a) Downstream demand shows a pre-holiday concentrated restocking trend, with a narrow increase in restocking volume in the photovoltaic sector, becoming one of the important support points on the demand side.

b) On the supply side, continuous destocking efforts are alleviating inventory pressure and, to some extent, improving the market supply-demand balance.

c) On January 9, the Ministry of Finance and the State Taxation Administration issued an announcement clarifying the cancellation of value-added tax (VAT) export rebates for products such as photovoltaics, effective April 1, 2026. This policy news triggered fluctuations in market sentiment and directly disturbed the price movements of EVA, becoming the core policy factor affecting the market this month.

II. This Month's EVA Market Review

Overall, the core contradiction in the domestic EVA market in January 2026 was that the increase in demand fell short of expectations, and the market showed a trend of being strong first and then weak. Within the month, 3 domestic EVA producers had a total of 5 sets of units shut down for maintenance, while 2 new production lines were successfully put into operation. Despite the unit shutdowns, the overall monthly output still achieved growth, with domestic EVA output reaching 308,800 tons in January, a substantial increase of 16.93% month-on-month.

In terms of price performance, EVA market prices this month followed a trend of rising first and then falling in line with supply and demand dynamics. Prices across different categories saw modest increases: the average price of hard EVA resin rose by 0.54%, soft EVA resin increased by 1.52%, and photovoltaic-grade EVA grew by 0.49%, with the soft resin category showing the most significant gain. Notably, new capacity commissions this month were dominated by EVA-related facilities. Among them, Yulong Petrochemical's 300,000-ton/year integrated EVA/LDPE unit successfully started up on January 18. With the capability to flexibly switch production between EVA and LDPE, it has added a stable supply to the market and become a key pillar supporting the growth in monthly output.

III. Market Forecast for Next Month

The domestic EVA market in China is expected to show a steady and volatile consolidation trend in February, with the possibility of a market with prices but no transactions. On the supply side, the number of domestic EVA plant maintenance plans is significantly reduced, and the previously commissioned new capacity is gradually released, leading to a significant increase in the expected market supply. Meanwhile, the construction of two sets of EVA units in Guangxi Petrochemical started in mid-January. Although it will not affect the supply in the short term, the long-term capacity expectation also has a certain potential impact on the market.

From the demand side, with the approaching Spring Festival holiday, downstream factories will gradually shut down for the holiday, and market demand will show a significant downward trend. The pattern of weak supply and weak demand will lead to a market with prices but no sales. Overall, it is expected that domestic EVA prices in February will maintain a stable and consolidating trend. The EVA price index is expected to remain in the range of 8600-9800 yuan/ton, a decrease of 88 yuan/ton compared to January, a drop of 0.75%.

Engineering material

PC: Driven by price hikes, China's domestic PC market surged in January to its highest level since last year.

I. Core Hot Topics This Month

During the month, individual PC production units experienced maintenance or reduced operating loads. Among them, the phased shutdown and maintenance of Zhejiang Petrochemical's PC Phase II unit had a significant impact, leading to a slight decrease in overall industry supply compared to the previous month and providing a foundational support for price increases.

② The domestic PC industry maintained a tight supply-demand balance. Constrained supply combined with periodic inventory replenishment on the demand side supported continuous market price increases, with prices at the end of the month rebounding to their highest levels since 2025.

③ In terms of price, the average market price of domestic PC materials in January was 11,916 yuan/ton, an increase of 3.90% month-on-month, showing a steady upward trend overall.

II. PC Market Review This Month

Source: Longzhong

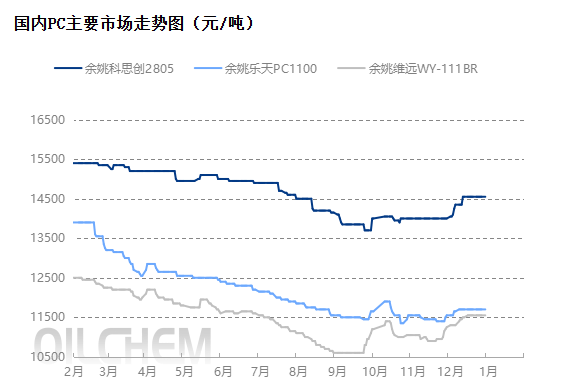

In January 2026, the domestic PC market showed a sustained upward trend, with strong overall performance. By the end of the month, prices had largely rebounded to their highest levels since the previous year, exhibiting a three-stage progression: "gradual ascent - accelerated rise - high-level stabilization."

As of January 28th, the mainstream negotiation range for domestic PC injection molding grade in the East China market was 11450-12900 yuan/ton, an increase of 800-1000 yuan/ton from the end of last month, representing a growth of 7.51%-8.66%. Year-on-year, it remained largely stable or saw a slight increase of 50-200 yuan/ton.

Looking at it in stages: in early January, the ZPC PC Phase II plant continued its maintenance shutdown (this plant is a significant capacity in the industry, and the full line maintenance of Phase II directly led to a tight supply of low-end products). This, coupled with the low overall production and sales pressure of domestic PC plants and limited marketable supply, resulted in a steady and upward trend in market prices. The overall pace was moderate, with factory ex-factory prices cumulatively increasing by about 100 yuan/ton. In mid-January, the ZPC PC auction prices rose sharply, and the tight supply of spot goods in the market did not improve. Driven by the upward trend in the upstream and downstream of the industrial chain, PC spot prices began to accelerate upward. In late January, the ZPC PC plant gradually restarted line by line after maintenance, but the recovery speed of supply was not as expected. Other domestic PC factories still had limited available spot goods for sale before and shortly after the holiday. Coinciding with the end of the lunar year, intermediaries and downstream factories entered the market to build positions and purchase in a concentrated manner. Driven by the dual benefits of supply and demand, PC prices accelerated upward and climbed to their highest level since 2025.

III. Market Forecast for Next Month

The domestic PC market in China is expected to maintain a firm overall trend in February, exhibiting a "pre-holiday stagnation - post-holiday consolidation" pattern due to the Spring Festival holiday. From a supply perspective, there are no scheduled maintenance plans for the domestic PC industry next month, and both industry output and capacity utilization rates will remain high. However, most factories have already implemented proactive pre-sale operations, and the production capacity during the Spring Festival has been diluted in advance through pre-sales, so there is no significant inventory accumulation expected during the holiday. Although downstream demand recovery will be slow after the holiday, based on expectations of future supply and demand balance, the market will likely adopt a wait-and-see approach with price support as the main strategy.

From the demand side, early February coincides with the Chinese New Year holiday, and PC downstream enterprises will gradually stop work and take holidays, leading to stagnation in market transactions. After the Chinese New Year holiday ends in late February, the recovery of downstream demand is expected to be slow. Overall PC consumption will shrink significantly within the month due to a lack of effective transaction support, and market prices may enter a consolidation phase.

Overall, the pressure from domestic PC spot sales in February has been released in advance through pre-sales. However, considering that downstream demand has almost stalled due to the Chinese New Year atmosphere, the market as a whole is expected to show a quiet and narrow range consolidation. Taking the price of Lihua Yiwei Yuan WY-111BR in the East China market as an example, the average price in February is expected to be around 12,500 RMB/ton, a month-on-month increase of 4.90%.

PET: Front low, back high, running warm; polyester bottle chip prices steadily rose in January.

Core Hot Topics This Month

Geopolitical uncertainties persist in regions such as Russia-Ukraine and Iran-Israel. In the short term, geopolitical disturbances may trigger volatility in related industry chains, posing potential supply risks to the polyester bottle flake market.

Within the month, multiple sets of polyester bottle chip devices underwent unscheduled maintenance, coupled with some planned maintenance, leading to a continuous tightening of industry spot supply, which became one of the core drivers supporting the upward movement of market prices.

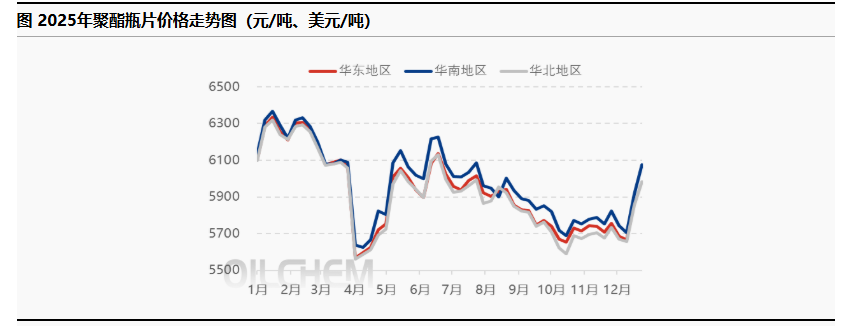

③ In terms of price, the average monthly price of PET bottle chips in East China in January was 6123 yuan/ton, an increase of 327 yuan/ton from the previous month, a month-on-month increase of 5.34%, showing a steady upward trend overall.

II. Polyester Bottle Chip Market Analysis This Month

Source: Longzhong

In January 2026, the domestic PET bottle chip market generally showed a warming trend, with prices starting low and rising later in the month. The average monthly price saw a significant increase month-on-month, with mainstream prices ranging from 5940-6500 yuan/ton. Looking at the performance in major markets, the average price in East China was 6123 yuan/ton in January, an increase of 327 yuan/ton from 5796 yuan/ton in December 2025, representing a month-on-month increase of 5.34%. Compared to January 2025, the price of 6238 yuan/ton, it was a year-on-year decrease of 1.84%. In South China, the average price in January was 6095 yuan/ton, up 321 yuan/ton from 5774 yuan/ton last month, a month-on-month increase of 5.27%. Compared to January of last year, 6272 yuan/ton, it was a year-on-year decrease of 2.82%. In North China, the average price in January was 6160 yuan/ton, an increase of 314 yuan/ton from 5846 yuan/ton last month, a month-on-month increase of 5.09%. Compared to January of last year, 6225 yuan/ton, it was a year-on-year decrease of 1.04%. The trend in all three major markets was consistent, showing month-on-month increases and slight year-on-year decreases.

In phases, in early January, the market supply side received multiple positive supports: two PET bottle chip units experienced unexpected equipment failures and shutdowns, coupled with a planned maintenance shutdown of a 1.2 million tons/year unit. The combination of these factors led to a tightening of PET bottle chip spot supply, providing strong support for market prices, which showed a steady upward trend. In the latter half of the month, the cost side experienced a strong surge driven by positive macroeconomic factors. However, downstream companies and traders maintained a weak purchasing sentiment and did not follow the market sentiment to chase higher prices, only maintaining a rigid replenishment rhythm. The overall market lacked momentum to chase gains, and market participants were largely in a wait-and-see mode. By the end of the month, as upstream raw material prices retreated, the PET bottle chip market prices also weakened synchronously, ending the earlier upward trend. The overall pattern was a "rise in early January, decline in late January" with a low-high structure.

III. Market Outlook for Next Month

The market price focus of PET bottle chips is expected to continue to move upward in February. From the cost side, the PX expectation structure is relatively optimistic, but the earlier geopolitical premium has been given back. Crude oil lacks sustained upward momentum, and the PX reality structure has limited cost support for PTA, which is difficult to offset the negative supply and demand side. The PTA supply and demand structure is weakening, and the support for PET bottle chips has declined, but the capital sentiment and market expectation structure prevent the PTA price from continuing to fall significantly, and the cost side can still provide certain support. The supply side maintains a tight pattern, providing basic support for prices. Although downstream consumption is significantly weaker due to the Spring Festival holiday, the overall apparent consumption is expected to strengthen. In summary, it is expected that the price of PET bottle chips in February will rise to 6,200 yuan/ton, an increase of 77 yuan/ton month-on-month in January, an increase of 1.24%.

PMMA: Cost support, weak demand, particle prices maintain a stable and weak pattern in January

I. Key Market Focus Areas of the Month

Regarding the capacity utilization rate, some domestic PMMA particle production units were shut down for maintenance in January, leading to a decrease in the industry's capacity utilization rate to only 55%, which directly impacted the market supply structure.

In terms of output, domestic PMMA particle production in January was 41,100 tons. Based on capacity utilization and plant maintenance, overall production remained stable without significant fluctuations.

In terms of profits, the average theoretical monthly profit for PMMA particles in January was 1108 yuan/ton, a month-on-month decrease of 33.09%. The industry's profitability has significantly declined, highlighting the pressure from market supply and demand dynamics.

II. PMMA Particle Market Analysis This Month

In January 2026, the domestic PMMA pellet market generally showed a weak and stable pattern, with prices fluctuating narrowly in a stalemate, without a significant one-sided trend. The core characteristic was a "cost support, demand suppression" game. From the regional price performance, the prices of domestic and imported PMMA pellets in East China moved consistently, with an average price of 12047 yuan/ton this month, a decrease of 431 yuan/ton from last month's 12478 yuan/ton, a month-on-month decrease of 3.45%. Year-on-year, domestic materials fell by 4953 yuan/ton from 17000 yuan/ton in the same period last year, a decrease of 29.14%, and imported materials fell by 5053 yuan/ton from 17100 yuan/ton in the same period last year, a decrease of 29.55%. The significant year-on-year decline reflects the overall weak operating trend of the current market.

From a layered perspective, the raw material end became the main supporting factor in the market this month: the MMA market trended downwards first and then upwards, with the monthly average price rising month-on-month, providing a solid cost foundation for PMMA particles. Specifically, in early January, MMA prices experienced a brief correction before gradually rebounding, and entered a horizontal consolidation phase in mid-January; entering the latter half of the month, some units in the Northeast and South China regions successively shut down for maintenance. Under the dual positive influences of cost support and supply contraction, the market negotiation center for MMA rose slightly, further transmitting to the PMMA particle market and suppressing its price decline.

Demand continues to be weak, failing to form a support with costs: The main downstream sectors of PMMA particles, such as home appliances and automobiles, are currently experiencing low prosperity. Terminal factories generally have weak purchasing intentions, mostly maintaining small, essential orders and just-in-time replenishment. There has been no large-scale inventory replenishment, leading to a light overall market trading atmosphere and limited actual transactions. Even with raw material cost support, prices are difficult to break through upwards, consistently maintaining a narrow, stable, and weak pattern. At the same time, current PMMA market holders' quotations are generally stable, but small concessions can be made during actual negotiations, further highlighting the transaction pressure brought by weak demand.

III. Market Forecast for Next Month

The domestic PMMA particle market in China is expected to continue its range-bound fluctuation in February, maintaining the gaming dynamic of "cost floor, demand suppression" and exhibiting a stalemate of low profits and weak transactions.

POM: Limited positive support, the market tested higher in January before showing an initial rise followed by a decline.

I. Core Hot Topics This Month

In terms of equipment maintenance, the POM unit of Yankuang Luhua Phase I underwent startup and shutdown maintenance in January, which to some extent affected the industry supply landscape and became one of the short-term positive factors for the market.

2) Regarding price adjustments, domestic POM manufacturers in China collectively raised their ex-factory prices this month, with increases ranging from 500-900 yuan/ton, directly pushing market prices to tentatively rise.

3) In terms of market trends, the POM market this month generally showed a trend of rising first and then falling, driven by positive factors such as proactive price support from traders and price increases from manufacturers. However, the support from these positive factors was limited and failed to sustain a continuous upward trend.

II. This Month's POM Market Analysis

In January 2026, the domestic POM market generally showed a stable-to-rising trend, characterized by an initial upward movement followed by a decline. The core features were "gains driven by positive factors and speculative increases, followed by pressure and retreat due to insufficient demand." Price performance varied slightly across different regions. Looking at mainstream market prices, the average price in East China for this month was 11,100 yuan/ton, which remained unchanged from the previous month's average. The average price in South China for this month was 10,500 yuan/ton, an increase of 300 yuan/ton from the previous month's 10,200 yuan/ton, presenting an overall pattern of localized increases and general stability.

Breaking down the month's market trend, we can clearly distinguish three phases: The first ten days coincided with the New Year holiday, during which most operators withdrew from the market for vacation, resulting in virtually no trading activity in various markets. After the holiday, domestic petrochemical plants collectively raised their ex-factory prices, triggering a "buy high, sell low" sentiment among market participants, leading to concentrated restocking by downstream businesses and continuous release of manufacturers' inventory. However, due to the overall pressure on market shipments, some traders were cautious about following the price increases, while others actively supported prices due to tight supply. Furthermore, limited inventory digestion capacity at end-user factories resulted in lackluster overall spot transactions during this phase, with price increases lacking solid demand support.

Mid-month, petrochemical plants have sufficient pre-sale orders and no short-term inventory pressure, presenting relatively solid market fundamentals. However, market participants lack confidence in the future market, weakening upward momentum. Some traders face significant inventory pressure and are widening negotiation margins to boost sales, while others are tentatively raising prices. However, downstream demand is slow to catch up, with mostly sporadic transactions in the spot market, leading to a stalemate and fluctuating prices.

In the latter half of the month, advance orders for petrochemical plants gradually decreased, total inventory continuously accumulated, and shipping pressure progressively increased, shifting the market focus towards inventory digestion. Meanwhile, there were no significant signs of improvement in terminal demand, leading to a sustained increase in bearish sentiment among market players. High quotes followed by lower actual prices became more common, with real transactions often based on quantity negotiation. The earlier upward trend could not be sustained, and the market showed a downward trend, ultimately forming a pattern of initial rise followed by a decline.

III. Market Forecast for Next Month

In February, the domestic POM market is expected to show a wait-and-see consolidation trend, with limited overall fluctuations, making it difficult to form a clear one-sided trend. This is primarily due to the Chinese New Year holiday, which will lead to subdued market activity.

In phases, as the Spring Festival holiday approaches in early February, businesses will gradually enter the final stocking and winding-down phase, and market activity in various regions will become increasingly subdued. Petrochemical plant inventories will continue to accumulate, increasing their shipment pressure, while end-user factories will gradually cease operations for the holiday, leading to a significant reduction in replenishment demand. Traders' interest in market operations will be low, and actual transactions will be sparse.

Mid-month marks the official start of the Spring Festival holiday. Market participants have withdrawn and are on vacation, with no restocking activity in any region. Mainstream quotations will remain stable, and there will be no actual transactions in the market, leaving the overall market in a standstill.

In late January, after the Spring Festival holiday, petrochemical plant inventories will remain at high levels, leading to significant short-term selling pressure. However, with some traders yet to return and resume operations, inquiries in various markets are scarce, lacking effective upward momentum for market sentiment. Concurrently, downstream factories have not yet fully resumed operations, with many users adopting a wait-and-see attitude, making it difficult to secure substantial follow-up orders.

Overall, the POM market lacks clear positive support in February. With demand failing to provide momentum and supply-side pressure persisting, the market is expected to maintain a wait-and-see consolidation trend with limited fluctuations.

PBT: Strong raw materials drive, January market follows the rise and explores higher.

I. Key Highlights and Hotspots of the Month

① Demand side: The pre-holiday stocking atmosphere this month is generally weak, downstream enterprises and the terminal market have strong bargaining sentiment, and their acceptance of high-priced goods is not high. Procurement is mostly cautious, failing to form strong demand support.

② Device end: There are few planned maintenance shutdowns for PBT devices this month. The industry's overall operating rate remains relatively stable, supply continues to be high and shows a trend of continuous accumulation, and supply-side pressure is becoming evident.

③ Cost side: The raw material market performed strongly, providing strong cost support, which directly drove up domestic PBT market prices, becoming the core driver of the market's upward trend this month.

II. PBT Market Review for This Month

In January 2026, the domestic PBT market generally showed an upward trend following the increase in raw material prices. Driven by the strong raw material side, and with ongoing bargaining between supply and demand sides, the market did not experience a unilateral sharp rise, and the overall trend was relatively stable.

From the supply side, there are few PBT plant maintenance plans this month, and the overall operating rhythm of the industry is stable. The output in the month has increased compared to last month, and the supply remains at a high level, showing a continuous accumulation trend. The supply side is generally abundant.

From the perspective of raw materials, the PTA market in January showed a high-level volatile trend, providing strong cost support for the PBT market. Coupled with the approaching Spring Festival and the pre-holiday stocking period, PBT suppliers' sentiment to support and stabilize the market significantly increased. Some manufacturers issued price increase letters, actively raising ex-factory prices, further boosting market sentiment.

From the demand side, influenced by the pre-holiday stocking period, some downstream enterprises showed increased purchasing interest, leading to a phased increase in market transactions around mid-month, which pushed prices up slightly. However, after mid-month, the market entered a brief stalemate. As PTA prices rose again, the PBT market followed suit more noticeably, with manufacturers generally quoting higher prices, attempting to further push up prices. Nevertheless, downstream and end-user markets showed strong resistance to high-priced goods and a prominent desire for negotiation. The intensified tug-of-war between supply and demand meant that the actual negotiation focus remained in a stalemate, failing to rise in tandem with manufacturers' quotations, which limited the overall market increase.

III. Next Month's PBT Market Forecast

The domestic PBT market is expected to show a strong trend in February. Affected by the Spring Festival holiday, the overall trend will exhibit a phased characteristic of "tentative price increase before the festival, slight pullback after the festival." The market may experience a situation of "price but no transaction."

Looking at it in phases, in early February, as the Chinese New Year holiday approaches, downstream enterprises may see a slight increase in pre-holiday stocking demand. There's a possibility of low-price promotions in the market to boost sales and alleviate inventory pressure. Closer to the Spring Festival, supported by raw material costs and suppliers holding firm on prices, market prices are still expected to primarily rise.

In mid-February, with the official arrival of the traditional Spring Festival holiday, downstream enterprises and the logistics industry will mostly withdraw from the market for vacation, causing market transactions to stall. This will likely result in a situation of "prices available but no buyers," with mainstream quotations likely remaining stable.

Following the end of the Chinese New Year holiday in late February, market trading activity is expected to gradually increase. However, some companies may offer price concessions to clear inventory pressure, potentially leading to a decline in PBT market prices.

Overall, the PBT market trend in February will still need to focus on raw material price fluctuations and demand recovery trends. It is expected to operate with a generally positive bias. The mainstream negotiation price range for low-to-medium viscosity PBT chips in East China is expected to be 7600-8000 yuan/ton.

PA6: Cost support remains strong, PA6 market fluctuated and rose in January.

Key Focus Areas in Core Markets This Month

① In terms of market trends, the PA6 market in January still faced relatively high cost pressure. Downstream companies mainly replenished their stocks cautiously and at lower prices, resulting in an overall fluctuating upward trend of a slight dip followed by a rise, primarily driven by changes in upstream raw material prices.

Regarding raw material settlement prices, Sinopec's high-end caprolactam settlement price for January 2026 is 9770 yuan/ton (liquid excellent grade, six-month acceptance, self-pickup), a decrease of 115 yuan/ton compared to the December 2025 settlement price, indicating a phased pullback.

Regarding the upstream raw material listed price, Sinopec Chemical Sales' January 2026 listed price for pure benzene (SPCP basic) is 5445 yuan/ton (tax included), an increase of 145 yuan/ton from December 2025's 5300 yuan/ton. This significant increase provides support for the cost side.

II. PA6 Market Review for This Month

In January 2026, the domestic PA6 market as a whole showed a fluctuating upward trend, mainly divided into two stages: "a slight decline in the first ten days and a rise in the mid-to-late period." The price trends of different types of chips varied slightly, but overall, they were driven by the cost side to achieve an increase.

Regarding PA6 conventional spinning chips, prices this month initially declined slightly before rising: In the first ten days, polymerization companies underwent maintenance and reduced production loads simultaneously, leading to a temporary easing of caprolactam supply. This drove down caprolactam prices, and PA6 chip manufacturers proactively negotiated price concessions to promote shipments, causing a slight decline in chip prices. Subsequently, driven by rising international crude oil and benzene prices, chip prices gradually stopped falling and rebounded. In the last ten days, significantly increased upstream benzene prices put substantial cost pressure on raw material caprolactam, further pushing up caprolactam prices. Coupled with polymerization companies’ long-term profit losses, they followed raw material prices and raised chip quotations. The cost-driven price increases improved market transaction sentiment. Downstream production companies entered the market as needed, purchasing at lower prices for inventory, and market transaction activity significantly increased. As of January 28, the price of ordinary PA6 conventional spinning chips in the East China market was 9900-10300 RMB/ton for spot short delivery, and the spot price of premium PA6 conventional spinning chips in the East China market was 10000-10200 RMB/ton ex-factory.

Regarding PA6 high-speed spinning chips, the price this month showed a trend of initially stabilizing and then rising. At the beginning of the month, polymerization enterprises continued to face profit losses and significant cost pressures, while downstream spinning enterprises mainly replenished inventory on demand. Polymerization enterprises maintained a negotiation-based shipping rhythm, and prices remained stable. Later, with the synchronous increase in upstream products and raw material prices, polymerization enterprises were subjected to cost pressure and raised the price of high-speed spinning chips. However, downstream spinning enterprises remained cautious in replenishing inventory, with overall purchases still mainly on demand, and no bulk replenishment occurred, limiting the price increase. As of January 28, the spot price of ordinary slices in the East China market for PA6 high-speed spinning was 9900-10200 yuan/ton (cash ex-factory), and the spot price of superior slices in the East China market for high-speed spinning was 10500-10700 yuan/ton (acceptance delivered).

III. PA6 Market Forecast for Next Month

In February, the domestic PA6 market is expected to show a trend of first rising and then stabilizing. This will primarily be influenced by three factors: cost support, supply adjustments, and a seasonal decline in demand. The overall fluctuation is expected to be limited.

On the supply side, PA6 units of Yuehua New Materials and Hubei Tianyue are planned to continue commissioning after the Spring Festival. Meanwhile, enterprises undergoing maintenance in January will gradually complete their overhauls and resume production in February, which theoretically points to an increase in supply. However, due to the impact of the Spring Festival holiday on the downstream sector, some polymerization enterprises may experience temporary load reductions. Taken together, the supply of PA6 chips in February is expected to decrease compared to January, leading to a slight easing of supply pressure.

From the cost side, the price of benzene is expected to remain strong, driving up the cost of caprolactam. Although downstream sectors are gradually reducing production for holidays and downstream PA6 polymerization enterprises continue to reduce their operating rates, leading to a decrease in caprolactam demand and maintaining a low supply-demand balance, the strong cost boost is expected to keep caprolactam prices firm in February. PA6 chips will continue to face cost pressure, providing bottom support for prices.

From the demand side, as the Spring Festival holiday approaches, some downstream PA6 enterprises will gradually enter a state of holiday or reduced operating rates, which will further reduce the demand for PA6 chips. Downstream procurement will mainly focus on appropriate pre-holiday stocking, and overall demand will be limited, making it difficult to substantially boost the market.

Overall, the PA6 market price in February is expected to see a phased increase supported by costs, followed by stabilization due to seasonally weakening demand. It is estimated that the average price for conventional spinning ordinary chips in the East China PA6 market in February will be 10,200 RMB/ton (cash, short delivery), and the average price for high-speed spinning chips will be 10,600 RMB/ton (acceptance, delivered).

PA66: Cost-side pressure is evident, domestic PA66 prices rose steadily in January.

I. Key Market Focus Areas of the Month

① Raw material end: This month, the prices of the core raw materials for PA66, hexamethylenediamine and adipic acid, both showed a strong upward trend. The cost side formed a strong support, becoming the core driving force for the increase in PA66 prices. (The core statement of the original text is correct; according to search data, in January, the price of hexamethylenediamine in Shandong region remained at 15,000-16,500 yuan/ton, and the price of adipic acid remained at 6,600-7,300 yuan/ton, both showing a strong upward trend, which is consistent with the original text.)

② Price: In January, the average monthly price of PA66 in East China was 15,045 yuan/ton, an increase of 102 yuan/ton compared to the previous month. The overall trend was steady upward, with a moderate rise and a stable trajectory.

II. PA66 Market Review for This Month

In January 2026, the domestic Polyamide 66 (PA66) market generally showed a strong upward trend, with prices steadily increasing. This was primarily driven by strong cost support from raw materials, while the industry's supply and demand dynamics and market sentiment collectively pushed the trading focus higher.

From a regional price performance perspective, the average price of PA66 EPR27 in the Yuyao region of East China this month is 15,045 yuan/ton, an increase of 102 yuan/ton compared to 14,943 yuan/ton last month, a month-on-month increase of 0.68%. Compared to 17,411 yuan/ton in the same period last year, it decreased by 2,366 yuan/ton, a year-on-year decrease of 13.59%, showing a trend of "month-on-month increase and year-on-year decrease," reflecting that while the current market is supported by costs, it has not yet escaped the long-term weak pattern.

Specifically, the strong rise in raw material prices was the core support for the market this month: the prices of hexamethylenediamine and adipic acid, the two core raw materials, both rose strongly, directly pushing up the production cost of PA66. The cost pressure on polymerization enterprises significantly increased, providing a solid foundation for price increases. In terms of supply, the capacity utilization rate of PA66 polymerization enterprises increased this month compared to the previous period.

On the demand side, downstream enterprises mainly purchased small quantities for immediate needs this month, without bulk restocking, resulting in a generally lackluster demand performance that failed to strongly drive the market. However, influenced by both the industry’s anti-internal competition atmosphere and the cost pressures on polymer companies, suppliers' reluctance to sell at low prices continued to increase, low-price offers in the market significantly decreased, and traders' willingness to support prices was strong, pushing the overall transaction center of gravity upwards, ultimately achieving a steady price increase this month.

III. Next Month's PA66 Market Forecast

The domestic PA66 market in China is expected to experience high-level volatility with a slightly bullish trend in February. Price increases may slow down, primarily influenced by cost support, ample supply, and seasonal demand contraction. However, the overall market is still expected to maintain upward momentum.

From the cost side, support will continue to become prominent: Invista has clearly announced a price increase of RMB 500/ton for PA66 in February, adjusting the price to RMB 17,800/ton, which will directly drive positive market price expectations. Simultaneously, the adipic acid market is expected to maintain a high and upward trend, further exacerbating cost pressure on PA66 polymerization enterprises, providing strong bottom support for prices and limiting downside potential.

From the supply side, the capacity utilization rate of PA66 polymerization enterprises is expected to remain high, ensuring ample supply in the market. Additionally, most enterprises are experiencing oversold orders, indicating no immediate inventory pressure. This robust fundamental performance provides a solid foundation for operators to maintain prices. It is anticipated that suppliers will continue to hold back from selling at lower prices.

From the demand side, a seasonal contraction is expected: As mid-February approaches the Spring Festival holiday, downstream small and medium-sized manufacturers will gradually enter the shutdown and holiday phase, and procurement demand will significantly decrease, only maintaining a small amount of replenishment for immediate needs. This will restrain market increases, leading to a slower pace of price increases and making significant surges unlikely.

Overall, although the PA66 market in February was affected by the seasonal contraction of downstream demand, the price increase was limited. However, strong support from the cost side and solid fundamentals will drive the market to maintain a high level of fluctuation with a slightly upward trend, and the overall price still has room for upward movement.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories