[pe daily review] trading sentiment weakens, spot prices from holders show some easing

1. Summary of Today

①. Russia's previously attacked port has returned to normal loading operations, easing geopolitical concerns and leading to a drop in international oil prices. NYMEX crude oil futures for the December contract fell by $0.18 per barrel to $59.91, a decrease of 0.30% compared to the previous period; ICE Brent crude futures for the January contract fell by $0.19 per barrel to $64.20, a decrease of 0.30% compared to the previous period.

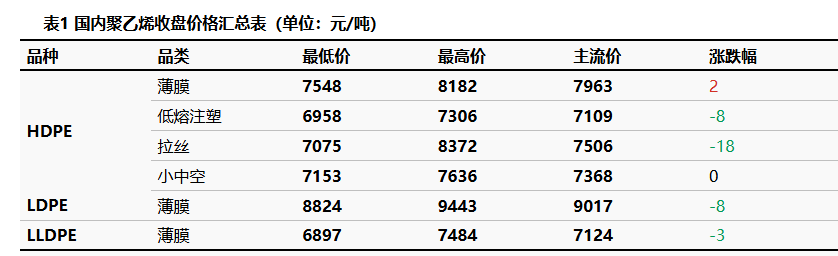

②、 The HD PE market price fluctuated between -18 to 2 yuan/ton, the LDPE market price decreased by 8 yuan/ton, and the LLDPE market price decreased by 3 yuan/ton.

2. Spot Overview

Today, the spot market for polyethylene in China is experiencing weak fluctuations. Due to the decline in futures, market trading sentiment has weakened, and holders are slightly loosening their spot quotations. Currently, there is still supply pressure in the market, while on the demand side, there is an expectation of weakening. The HDPE market price fluctuated by -18 to 2 yuan/ton, the LDPE market price by -8 yuan/ton, and the LLDPE market price by -3 yuan/ton.

3 Spot-Futures Basis

The main LL contract fluctuated downward, opening at 6,851 yuan/ton and closing at 6,785 yuan/ton as of 15:00, which is 65 yuan/ton lower than the previous settlement price. The trading volume was 260,600 lots, and the open interest was 548,300 lots. Today's futures-spot basis was 35 yuan/ton, an increase of 38 yuan/ton compared to the previous working day.

4 Production Status

Capacity utilization is== 82.24% changed to 82.88%. Oil-based cost is 7,293 yuan/ton; oil-based profit is -393 yuan/ton; coal-based profit is -43 yuan/ton.

|

Picture 3 Domestic Polyethylene Capacity Utilization Trend |

Picture 4 Domestic polyethylene profit and price comparison (yuan /ton) |

![[PE日评]:供应存增加预期,加哥哥窄幅波动(20251117)](https://oss.plastmatch.com/zx/image/28019752f58440e38d1fb70db55cd23d.png) |

![[PE日评]:供应存增加预期,加哥哥窄幅波动(20251117)](https://oss.plastmatch.com/zx/image/bf868d99ae80416cad1bb015a18bb4b5.png) |

|

Data Source: Longzhong Information |

Data source: Longzhong Information |

5 Market sentiment

Table 2. Sentiment Expectations of Domestic Polyethylene Upstream and Downstream Practitioners

|

Date |

Bearish |

Bullish |

Watch steadily |

|

This week |

43.1% |

2.0% |

55.0% |

|

Last week |

42.1% |

1.0% |

56.9% |

|

Rise and Fall |

1.0% |

1.0% |

-2.0% |

|

Data Source: Longzhong Information |

|||

|

Note: The above data is updated every Thursday. |

|||

6. Price Prediction

On the supply side, although some major maintenance facilities have gradually resumed operations, there has been an increase in temporary shutdowns recently, resulting in little overall change in market supply. On the demand side, downstream industries are gradually entering the off-season, with sectors such as agricultural film and pipe materials being particularly affected. Demand in northern regions is showing a gradual decline. In summary, polyethylene market prices are expected to remain weak in the short term.

7. Relevant Product Information

Crude Oil Market: The main trading logic of the international crude oil market has not changed. The positive factors come from the continuation of U.S. sanctions policies on oil-producing countries and the uncertainty of geopolitical situations, while the negative factors are OPEC+ maintains its stance on increasing production while the global economy and demand remain weak. The market is increasingly characterized by oversupply, and recently expectations of a Fed rate cut in December have cooled. It is expected that tomorrow international oil prices will show a declining trend.

8. Data Calendar

Table 3 Domestic Polyethylene Data Overview Table (Unit: 10,000 tons)

|

Data |

Publication Date |

Previous Data |

Current Trend Forecast |

|

PE production enterprises total inventory (ten thousand tons) |

Wednesday 17:00PM |

52.92 |

↘ |

|

PE social sample warehouse inventory |

Tuesday 17:00PM |

-1.86% |

↘ |

|

PE weekly production (10,000 tons) |

Thursday 17:00PM |

67.37 |

↘ |

|

PE Maintenance Impact Volume (10,000 tons) |

Thursday 17:00PM |

8.89 |

↘ |

|

PE Weekly Capacity Utilization Rate |

Thursday 17:00PM |

83.14% |

↘ |

|

PE downstream industry capacity utilization rate |

Thursday 17:00PM |

-0.36% |

↗ |

|

PE Mentality Survey |

Thursday 12:00AM |

0.99% |

-- |

|

Data Source: Longzhong Information Note: 1. ↓↑ is considered as significant fluctuation, highlighting data dimensions with a change exceeding 3%. 2. ↗↘ is regarded as narrow fluctuations, highlighting data with a rise and fall range within 0-3%. The above data is updated every Thursday. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Fire at Sinopec Quanzhou Petrochemical Company: 7 Injured

-

DuPont plans to sell Nomex and Kevlar brands for $2 billion! Covestro Declares Force Majeure on TDI / oTDA-based / Polyether Polyol; GAC Group Enters UK Market

-

Zf asia-pacific innovation day: Multiple Cutting-Edge Technologies Launch, Leading Intelligent Electric Mobility

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

[International News] European Plastic Recycling Industry on the Verge of Collapse! BASF Plans to Spin Off This Business, Lanxess Faces Pressure in Third Quarter Performance