Overseas Power Battery Installation Volume Top 10 Changes: One Increased Over Fourfold, One Rises Three Places

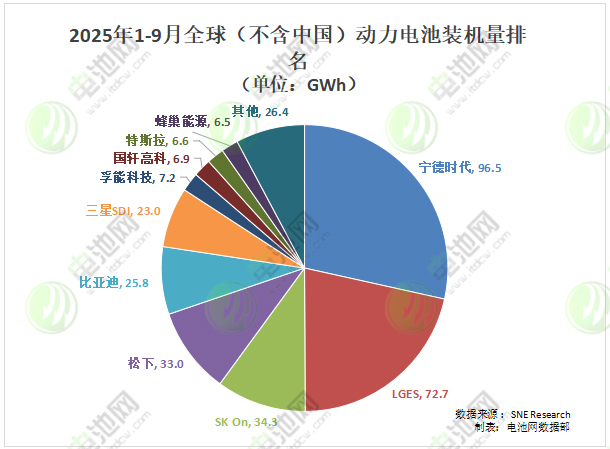

From January to September, the global (excluding China) installed capacity of power batteries reached 338.9 GWh, a year-on-year increase of 29.7%.

Recently, the South Korean research institute SNE Research disclosed that the global (excluding China) power battery installation volume for electric vehicles (EV, PHEV, HEV) reached 338.9 GWh from January to September 2025, a year-on-year increase of 29.7%.

From the perspective of ranking changesCompared to the same period last year, from January to September 2025, PPES and Zhongchuang Xinhang have dropped out of the top 10 rankings, with Guoxuan High-tech and Hive Energy becoming new entrants. CATL, LGES, SK On, and Panasonic continue to hold the top four positions. BYD and Samsung SDI have swapped ranks, with BYD entering the top 5 and Samsung SDI ranking sixth. Aulton Technology has risen from tenth place to seventh, while Guoxuan High-tech and Hive Energy rank eighth and tenth, respectively. Tesla's ranking remains unchanged at ninth.

Compared to the rankings from January to August this year, the global (excluding China) power battery installation volume TOP 10 list for January to September 2025 has maintained overall stability, with only Tesla and Hive Energy swapping their positions. Tesla has risen to ninth place, while Hive Energy is now in tenth place.

From the perspective of year-on-year changes in loading volumeFrom January to September, among the top 10 global (excluding China) electric vehicle battery installation companies, SVOLT Energy and BYD achieved triple-digit growth year-over-year, increasing by 425.2% and 145.9% respectively. Additionally, among the top 10 companies, Samsung SDI is the only company whose installation volume decreased year-over-year, with a decline of 4.5%.

In terms of market shareFrom January to September, among the top 10 global power battery installation companies (excluding China), aside from three Korean battery companies SK On, Samsung SDI, and LGES, whose market shares declined year-on-year, the remaining seven companies achieved positive growth. Among them, BYD saw the most significant growth at 3.6%, followed by Honeycomb Energy and CATL, both with an increase of 1.4%.

Chinese companiesFrom January to September, the total installation volume of power batteries in the overseas market by CATL, BYD, Aulton, Guoxuan High-tech, and Honeycomb Energy reached 142.9 GWh, accounting for a market share of 42.1%.

Specifically, CATL's installation volume reached 96.5 GWh, a year-on-year increase of 36.3%, with its market share rising to 28.5%.

BYD's battery installation volume reached 25.8 GWh, a year-on-year increase of 145.9%, with its market share rising to 7.6%. SNE pointed out that BYD's expansion in the European market is noteworthy, with BYD's battery usage in Europe amounting to 10.3 GWh from January to September this year, a year-on-year growth of 246.2%.

Funeng Technology's loading volume reached 7.2 GWh, a year-on-year increase of 39.6%, with market share rising to 2.1%.

Gotion High-tech's installed capacity reached 6.9 GWh, marking a year-on-year increase of 61.0%, with its market share rising to 2.0%.

Honeycomb Energy's installed capacity reached 6.5 GWh, a year-on-year increase of 425.2%, and its market share rose to 1.9%.

Korean company sideFrom January to September, the total installed capacity of the three major Korean battery companies reached 130 GWh, accounting for 38% of the market share, a year-on-year decrease of 5.4%.

LGES installed capacity reached 72.7 GWh, a year-on-year increase of 13.2%, while its market share fell to 21.5%.

SK On's loading volume reached 34.3 GWh, a year-on-year increase of 23.6%, while its market share slipped to 10.1%.

Samsung SDI's installed capacity was 23.0 GWh, a year-on-year decrease of 4.5%, with its market share declining to 6.8%.

Industry analysis indicates that the market share of Korean battery companies is declining, primarily due to a significant cooling of the electric vehicle market in Europe and the United States, while Chinese companies are notably increasing their market share overseas.

Japanese companiesFrom January to September, Panasonic, which mainly supplies batteries to Tesla, had an installed capacity of 33 GWh, representing a year-on-year growth of 31.2%, with its market share rising to 9.7%.

U.S. companiesFrom January to September, Tesla's installed capacity reached 6.6 GWh, a year-on-year increase of 41.4%, with market share rising to 2%.

In addition, recently, the South Korean research institute SNE Research released the latest data on global power battery installation volumes from January to September 2025, including the Chinese market. The data shows that from January to September 2025, the global power battery installation volume reached 811.7 GWh, a year-on-year increase of 34.7%. In terms of market share, the performance of the top 10 companies in global power battery installation volume from January to September 2025 showed significant divergence. Compared to the same period in 2024, five Chinese companies—BYD, SVOLT Energy, Gotion High-Tech, EVE Energy, and CALB—achieved positive growth, with BYD leading the way with an increase of 1.4%. Meanwhile, Panasonic, SK On, CATL, Samsung SDI, and LGES experienced varying degrees of decline, with LGES experiencing the largest decrease of 1.7%.

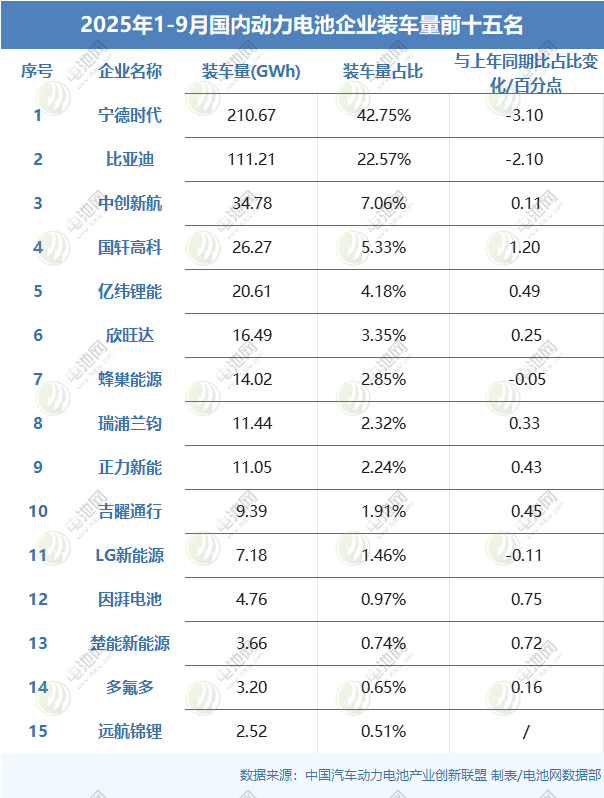

According to data released by the China Automotive Power Battery Industry Innovation Alliance, the cumulative installed capacity of power batteries in China from January to September reached 493.9 GWh, with a year-on-year growth of 42.5%. In terms of market share, compared to January to September 2024, this year from January to September, companies like CALB, Gotion High-tech, EVE Energy, Sunwoda, REPT, Vision Power, JiYao Technology, InPower Battery, Chenergy New Energy, and Do-Fluoride have achieved varying degrees of market share increase. Among them, Gotion High-tech had the highest growth rate, reaching 1.20 percentage points.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

BASF Signs Another Giant: Covestro Already Set Up, Just Missing Wanhua Chemical?

-

Clariant Plans to Shut Down Multiple Plants! Wingtech Releases Latest Statement! Oriental Yuhong Acquires Stake in Brazilian Company

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

ExxonMobil Plans to Close UK Ethylene Plant; GPI's Revenue & Profit Both Decline! Haitian's Serbia Base Enters Mass Production

-

Ineos Styrolution Closes French Plant! UK Lincolnshire Plans £35 Million Waste Plastic Recycling Facility