Output Continues to Decline Year-on-Year, Polyolefins Outlook Remains Pessimistic

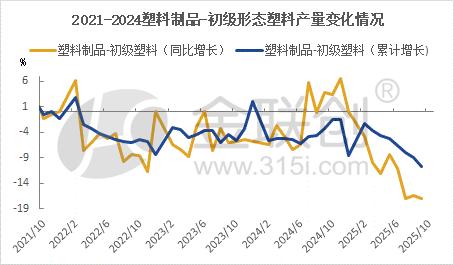

In October 2025, the monthly production of primary form plastic raw materials steadily expanded, far exceeding the growth rate for the entire previous year and surpassing the growth rate of plastic products production. The monthly production of plastic products decreased year-on-year, continuing the divergent trend between the growth rates of the two. Overall, the growth rates in upstream and downstream production reflect the reality of supply and demand. Since 2025, the fundamentals of polyolefins have been characterized by strong supply and weak demand, driving plastic raw material prices on a downward trajectory. Except for a slight narrow fluctuation in February, polyolefin spot and futures prices have maintained a bearish trend. In June, the polyolefin market showed strong performance due to geopolitical tensions following Israel's military strikes on Iran, leading to a sustained rebound as geopolitical risks dominated. In July, the market saw a temporary rebound driven by anti-involution efforts. August experienced overall weak fluctuations, influenced by China's plans to rectify the petrochemical industry to address overcapacity issues, leading to a bottom rebound. Once macro news is digested, the market will return to fundamentals and continue its downward trend. In September, amidst the seasonal demand and increased supply, the market experienced narrow, weak fluctuations. October saw continued lackluster peak season, with prices further exploring bottom levels. November is expected to remain constrained by weak fundamentals, continuing the downward exploration, and December is likely to see weak bottom fluctuations.

The growth rate of plastic production in its primary form steadily expanded in the current month.

Data Source: National Bureau of Statistics, Jinlian Chuang

In October 2025, the domestic output of primary plastic raw materials reached 12.736 million tons, a year-on-year increase of 9.4%, with the growth rate narrowing by 1 percentage point compared to September. From January to October, the domestic output of primary plastic raw materials totaled 122.263 million tons, representing an 11.2% year-on-year increase, which was a narrowing of 0.4 percentage points compared to the first nine months. The cumulative output of primary plastic raw materials for the entire year of 2024 is expected to be 127.516 million tons, with a year-on-year increase of 4.3%, maintaining a growth trend for the entire year. In the first ten months of 2025, the growth rate of primary plastic raw materials significantly improved, exceeding the annual growth rate of the previous year by 6.9 percentage points, due to the increased concentration of production starting in the first half of 2025.

The monthly output of plastic products continues to decrease year-on-year.

Data source: National Bureau of Statistics, Jin Lian Chuang

In October 2025, the domestic production of plastic products was 6.833 million tons, a year-on-year decrease of 7.6%, with the decline expanding by 1.9 percentage points compared to September. From January to October, the domestic production of plastic products was 65.573 million tons, a year-on-year increase of 0.5%, with the growth rate narrowing by 2.2 percentage points compared to January to September. The cumulative production in 2024 was 77.076 million tons, a year-on-year increase of 2.9%. The cumulative growth rate for the first 10 months of 2025 was 1.7 percentage points lower than the entire year of last year.

Data source: Jin Lian Chuang

Since 2025, the difference in the monthly growth rates between plastic products output and primary form plastic raw materials has been declining. This is due to the faster growth rate of primary form plastic raw materials compared to the relatively slower growth rate of plastic products. In July, it was evident that the growth rate of plastic products output was less than that of primary form plastic raw materials, and the difference continued to widen. The year-on-year growth rate difference was -11% in July, -16.9% in August, -16.3% in September, and further expanded in October, maintaining the trend of faster raw material growth and slower product growth.

The polyolefin market is still affected by weak fundamentals.

From the perspective of the growth rate of primary plastic raw material production, plastics maintain steady growth, while the growth rate of plastic products has entered negative territory, showing a divergence between the two, reflecting the reality of strong supply and weak demand. Macro factors and geopolitical factors have a limited impact on polyolefin prices, and fundamentals still dominate the trend. In October, both polyolefin futures and spot prices continued to decline, and the downward journey continued in November. It is expected that December will not have impressive performance and will continue to fluctuate weakly.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

BASF Signs Another Giant: Covestro Already Set Up, Just Missing Wanhua Chemical?

-

DuPont plans to sell Nomex and Kevlar brands for $2 billion! Covestro Declares Force Majeure on TDI / oTDA-based / Polyether Polyol; GAC Group Enters UK Market

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

ExxonMobil Plans to Close UK Ethylene Plant; GPI's Revenue & Profit Both Decline! Haitian's Serbia Base Enters Mass Production

-

Ministry Of Commerce Releases Implementation Opinions On Green Trade, Focusing On Import And Export Of Biodegradable Materials And Other Products