Meilian New Material Forecasts 2025 Net Loss of 55M–79M Yuan and Plans to Raise 1B Yuan to Break the Deadlock

On January 28th, Guangdong Meilian New Materials Co., Ltd. released its 2025 performance forecast, indicating a shift from profit to loss. The company's core fine chemical business was significantly impacted by market conditions. However, the company also announced a fundraising plan of no more than 1 billion yuan to increase investment in new energy and polymer material industrialization projects, attempting to build a new growth curve during the industry adjustment period.

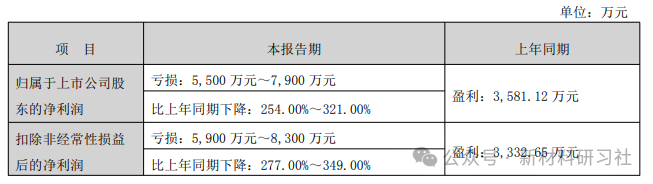

The performance forecast indicates that Meilian New Material is expected to report a net loss attributable to shareholders of the listed company of 55 million to 79 million yuan in 2025, compared to a net profit of 35.8112 million yuan in the same period last year, representing a significant year-on-year decrease of 254.00% to 321.00%. The net loss after deducting non-recurring gains and losses is expected to be 59 million to 83 million yuan, compared to a net profit of 33.3265 million yuan in the same period last year, representing a year-on-year decrease of 277.00% to 349.00%. The impact of non-recurring gains and losses on the company's net profit is estimated to be approximately 3 million to 4.5 million yuan.

Regarding the reasons for the significant decline in performance and the shift to losses, the company explicitly stated that two core factors had an impact. On the one hand, intense market competition and changing demand in 2025 led to a decrease in the unit prices of the company's main fine chemical products, directly resulting in a substantial year-on-year decrease in gross profit margin. On the other hand, based on the principle of prudent accounting, the company made impairment provisions for relevant assets with impairment indicators, further affecting the performance.

As the three core segments of the company's specialty chemicals business, masterbatch, cyanuric chloride, and high-performance pigments and dyes exhibited a clear divergence in 2025, which became a direct cause of the company's performance pressure. According to the 2025 semi-annual report, the masterbatch segment achieved revenue growth, but the growth momentum came solely from increased sales volume. The product unit price decreased by 8.29% year-on-year, and the gross profit margin was 11.94%, a year-on-year decrease of 2.23%. The cyanuric chloride segment fell into a dilemma of declining revenue and gross profit. Revenue declined while costs continued to rise, and the gross profit margin was only 1.09%, a significant year-on-year decrease of 23.41%. Only the high-performance pigments and dyes segment performed brightly, with a gross profit margin as high as 44.10%, becoming a highlight in the segment.

It is worth noting that the price of cyanuric chloride showed signs of a gradual recovery in the fourth quarter of 2025, and sales of masterbatch products also achieved year-on-year growth. The arrival of the industry's peak season may bring marginal improvement opportunities for the company's traditional businesses, but it is still difficult to change the current situation of performance pressure in the short term.

Facing challenges in its traditional business, Meilian New Material is turning its attention to industrial chain upgrading and the new energy sector, planning to raise no more than 1 billion yuan through private placement to fully invest in the Meilian New Energy and Polymer Material Industrialization Construction Project (Phase I). This move is seen by the market as a key strategic layout for the company to break through development bottlenecks.

It is understood that the project is located in Puguang Chemical Park, Xuanhan County, Dazhou City, Sichuan Province, and leverages the unique local resources and location advantages to create an integrated circular industrial chain. Xuanhan County is backed by the Puguang Gas Field, which boasts abundant natural gas reserves. The average price of natural gas used in the project is 1.5 yuan/cubic meter lower than the industry average, which is expected to reduce costs by approximately 150 million yuan annually for energy alone. At the same time, local liquid sulfur can be directly supplied through pipelines, significantly reducing raw material transportation and processing costs. Comprehensive calculations estimate that the production cost of color masterbatch for the project is expected to decrease by about 15%, saving approximately 600 million yuan annually at full capacity.

From the perspective of project planning, the core focus is to build an integrated circular industrial chain of "natural gas → sulfur → sulfuric acid → titanium dioxide → white masterbatch". The project will construct facilities with an annual output of 300,000 tons of full-process masterbatch, 600,000 tons of ferrous sulfate, and 800,000 tons of sulfuric acid. The 600,000 tons of ferrous sulfate produced by the project is a core raw material for lithium-ion and sodium-ion battery cathode materials, directly connecting to the new energy industry chain. It can also be further processed into high-value-added Prussian blue series products, forming a four-level circular system of "resources — raw materials — materials — new energy". Excess sulfuric acid can also be supplied locally to surrounding phosphorus chemical enterprises, achieving synergistic development of the industrial chain.

Currently, the fine chemical industry is exhibiting a structural characteristic of "high-end scarcity, traditional under pressure." The demand for high-end chemicals in new energy, electronic information, and other fields has surged, while traditional categories face pressure from overcapacity and price competition. Meilian New Materials' new project not only upgrades its traditional color masterbatch business's industrial chain, reducing production costs and enhancing product competitiveness, but also enters the new energy materials sector, aligning with industry development trends.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories