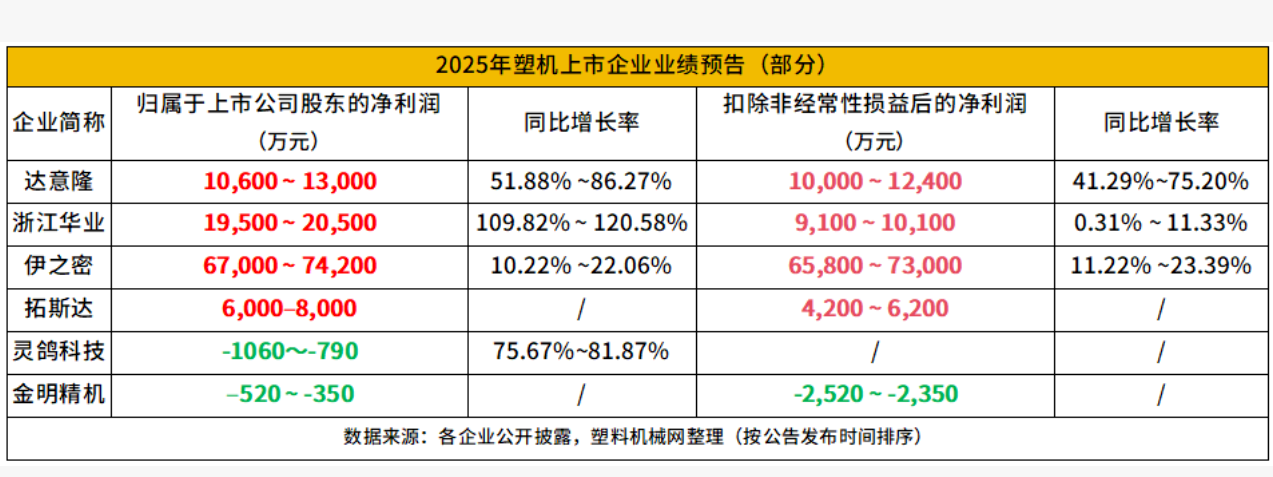

Many Plastic Machinery Companies Release 2025 Earnings Forecasts, One Expects Net Profit to Double

Recently, several domestic listed companies in the plastic machinery industry have released their 2025 annual performance forecasts, covering various sub-sectors such as packaging machinery, plastic molding equipment, and industrial robot accessories. The disclosed data indicates a diversified and differentiated trend in the industry as a whole. Some companies have achieved steady profit growth and significant year-on-year increases, while others have successfully turned losses into profits, achieving a turning point in their operations. At the same time, some companies still face loss pressures but are showing a positive trend of loss reduction. The performance changes of each company are closely related to their own operating measures, the industry environment, and policy guidance.

Guangzhou Tech-Long Packaging Machinery Co., Ltd.

On January 21, Tech-Long released its 2025 annual performance forecast. Data shows that from January 1, 2025, to December 31, 2025, the net profit attributable to shareholders of the listed company is expected to be between RMB 106 million and RMB 130 million, while the net profit after deducting non-recurring gains and losses is expected to be between RMB 100 million and RMB 124 million.

Regarding its positive performance, Guangzhou Tech-Long Packaging Machinery Co., Ltd. stated that during the reporting period, the company effectively enhanced its operational efficiency and core competitiveness through a series of management initiatives, including active market expansion, product structure optimization, intensified cost-reduction and efficiency-enhancement measures, and strengthened quality control. These efforts have continuously driven the steady growth of both operating revenue and profits.

Zhejiang Huaye Plastic Machinery Co., Ltd.

On January 27th, Zhejiang Huaye released its 2025 annual performance forecast. Data shows that from January 1st, 2025 to December 31st, 2025, the company expects the net profit attributable to shareholders of the listed company to be a profit of 195 million yuan to 205 million yuan, and the net profit after deducting non-recurring gains and losses to be a profit of 91 million yuan to 101 million yuan.

公司业绩大幅预增主要得益于两大因素:

1. During the reporting period, benefiting from the strong support of the national "trade-in" government subsidies and the growing demand for plastic molding equipment in the new energy vehicle and 3C electronics industries, the company closely followed market demands and technological development trends. Maintaining long-term and stable cooperative relationships with major downstream plastic molding equipment manufacturers such as Haitian International and Yizumi, the company rapidly responded to demands with its accumulated process technology and product quality, ensuring stable main business operations.

2、本报告期,公司原全资子公司宁波华业塑料机械有限公司取得的13,841.68万元征收补偿资金计入非经常性损益,对当期损益产生了显著的正面影响。

YIZUMI Group

On January 27th, Yizumi released its 2025 annual performance forecast. The data shows that from January 1, 2025 to December 31, 2025, the net profit attributable to shareholders of listed companies is expected to be between RMB 670 million and RMB 742 million, representing a year-on-year increase of 10.22% to 22.06%. The non-recurring net profit is expected to be between RMB 658 million and RMB 730 million, representing a year-on-year increase of 11.22% to 23.39%.

According to the announcement, the company's steady performance growth is mainly due to three points:

In 2025, the company's operations are in good condition, production is busy and orderly, and operating revenue has increased year-on-year.

In 2025, with the industry's recovery, the company continuously improved operational efficiency and intensified sales efforts, leading to sustained enhancement in profitability and a year-on-year increase in net profit attributable to shareholders of the listed company.

3. In 2025, the estimated impact of non-recurring gains and losses on the company's net profit is approximately 12.6 million RMB, a decrease of about 3.6 million RMB compared to 16.2 million RMB in the previous year. This is primarily due to a reduction in government subsidies received by the company in 2025 compared to the previous year.

广东拓斯达科技股份有限公司

Topstar released its 2025 annual performance forecast on January 28th. The estimated net profit attributable to shareholders of the listed company is expected to be between RMB 60 million and RMB 80 million, turning losses into profits year-on-year, compared to a loss of RMB 245 million in the same period last year. The estimated net profit after deducting non-recurring gains and losses is expected to be between RMB 42 million and RMB 62 million, compared to a loss of RMB 250 million in the same period last year.

公司能够实现经营拐点,主要得益于:

1. The company continues to deepen its strategic transformation of "focusing on products and shrinking projects." In 2025, the profitability of product-based businesses will improve, with a significant increase in the gross profit of industrial robots, injection molding machines, supporting equipment, and automatic feeding systems. The company has significantly reduced its smart energy and environmental management system business and achieved profitability through measures such as controlling order intake and implementing refined management.

2. In 2024, the company incurred interest expenses due to convertible bonds. "Topstar Convertible Bonds" were delisted at the end of 2024, and no such expenses were incurred in 2025.

Government subsidies increased year-over-year compared to 2024 in this period.

Wuxi Lingge Mechanical Technology Co., Ltd.

On January 28th, Lingge Technology released its full-year performance forecast. The data shows that the company expects its net profit attributable to the parent company to be between -10.6 million yuan and -7.9 million yuan from January to December 2025. Compared with -43.5717 million yuan in the same period last year, net profit increased by 75.67% to 81.87%, showing significant results in reducing losses.

Regarding the reasons for the performance change, Lingge Technology stated in the announcement:

In 2025, the lithium battery industry as a whole experienced a recovery. The company's new orders for the year reached 430 million yuan, a 122% increase compared to the same period of the previous year. However, due to the installation, commissioning, and other processes required for the company's products, revenue can only be recognized after customer acceptance. This long order execution and revenue recognition cycle resulted in some orders not yet being delivered and revenue not being recognized, thus preventing the full release of performance.

2. In 2024, the company made specific provisions for doubtful accounts due to uncertainties in accounts receivable. In 2025, the company accelerated the collection of long-overdue accounts receivable, with 76% of the original specifically provided accounts being recovered. However, the reversal of bad debt provisions was not included in operating profit, which had a certain impact on operating profit.

In 2025, the company implemented an employee stock ownership plan (ESOP) equity incentive, resulting in an increase of share-based compensation expenses of 2.5458 million yuan, which also had a certain impact on operating profit.

Guangdong Golden Cup Machinery Co., Ltd.

On January 30th, Jinming Machinery released its 2025 annual performance forecast. The company expects to incur losses in its 2025 performance from January to December, with a net profit attributable to shareholders of the listed company ranging from -3.5 million yuan to -5.2 million yuan (compared to a profit of 7.114 million yuan in the same period last year); the net profit after deducting non-recurring gains and losses is expected to range from -23.5 million yuan to -25.2 million yuan (compared to a loss of 13.8387 million yuan in the same period last year).

Company performance is expected to be loss-making, primarily due to multiple factors.

In 2025, the company's overall operations were impacted by complex external circumstances, intensified industry competition, and fluctuating downstream demand. The plastics machinery business was temporarily affected by the slower pace of equipment acquisition among downstream customers, leading to delays in the delivery of some products. The biaxially oriented film business continued to face pressure due to a combination of factors including a downturn in industry prosperity and fluctuations in raw material prices. The high-barrier flexible packaging film business achieved good results in overseas expansion, with both sales and orders experiencing double-digit growth.

2. Based on the current market environment and adhering to the principle of prudence, the company, in conjunction with preliminary asset impairment testing as of the end of 2025, plans to accrue an asset impairment provision of approximately RMB 14 million for certain inventories. In addition, exchange losses have increased due to fluctuations in the USD exchange rate, as the company's export sales are primarily settled in USD.

3、报告期内,公司非经常性损益累计数约为2,000 万元,主要包括政府补助及现金管理产生的投资收益,对公司净利润产生一定影响。

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

Multifaceted Collaboration: PA Prices Rebound Against Trend to Break Through

-

Dow suffers poor performance, announces major layoffs of 4,500 employees