Indonesia's Coal Export Ban Shifts Polyolefin Cost Logic

February 4th news: The Indonesian government has requested major mining companies to suspend spot coal exports due to a plan to significantly reduce production. According to Indonesian mining officials, production quotas issued last month to large mining companies for 2026 were slashed by 40% to 70% compared to actual 2025 levels. The core objective is "to control volume, raise prices, and optimize fiscal revenue." As the world's largest exporter of thermal coal, Indonesia's move is not an isolated policy. It is part of a broader strategy, alongside parallel announcements of nickel ore production cuts and increased export tariffs, to shift from "resource dumping" to "strategic control."

This move comes at a time of heightened sensitivity in the international energy landscape. The reimposition of US sanctions on Venezuela and the Iranian nuclear issue fueling tensions in the Middle East have driven Brent crude oil prices above $65 a barrel, a new high in over a year. With concerns about global oil and gas supply disruptions still lingering, the tightening of coal exports, a key alternative energy source, has further amplified market anxieties about energy security.

For the Chinese polyolefin market, the impact of Indonesia's coal production cuts is not transmitted through electricity, but directly hits the core profit structure.

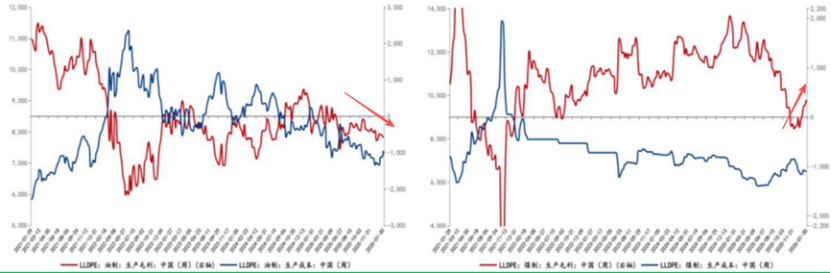

Recently, high oil prices have significantly squeezed the cracking margins of oil-based polyolefins (PE/PP). For naphtha-based plants, the rapid rise in crude oil prices coupled with weak downstream demand has led to a continuous narrowing of processing margins, with some companies even on the verge of losses. Conversely, the coal-based route has benefited from low coal prices in recent months, and coal-based margins have rebounded sharply following the increase in polyolefin prices.

Cost and Profit Trend Chart of PE Oil-Based (Left) vs. Coal-Based (Right)

However, this profit pattern of "strong coal, weak oil" is being broken. Although Indonesia's export restrictions do not directly affect coal used for chemical production, they quickly heightened market concerns about the overall coal supply. Domestic port power coal prices rebounded in response, and expectations for pithead coal price increases strengthened. As nearly 70% of methanol production relies on coal, rising coal prices will directly increase the central cost of methanol. Once methanol reaches 2500 yuan/ton, the profit loss margin for MTO production will expand again, and coal chemical plants operating at high capacity may be forced to reduce their operating rates.

As oil-based production grapples with high costs and coal-based processes face shrinking margins, the dual-track supply logic of the polyolefin market is under simultaneous pressure. Even without a significant recovery in downstream demand, the overall elevation of cost platforms has established a new floor for prices. Indonesia’s export suspension may seem distant, but it is quietly rewriting the cost-pricing equation for polyolefins—this time, it is not a demand-driven rally, but a passive price floor forged under the dynamics of energy geopolitics.

Author: Zhou Yongle, Senior Market Analysis Expert

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

Multifaceted Collaboration: PA Prices Rebound Against Trend to Break Through

-

Dow suffers poor performance, announces major layoffs of 4,500 employees