Gold Price Bounces Back After Plunge! Crude Oil Volatility Lifts Plastics, Futures Main Contracts Surge Across the Board

Overnight Crude Oil Market Dynamics

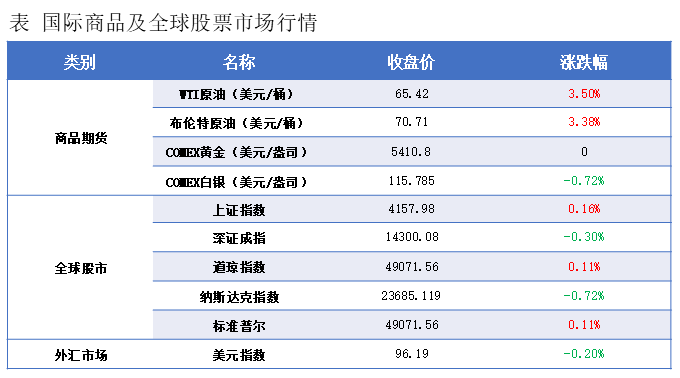

International oil prices rose due to market concerns about potential new US military actions against Iran, which heightened supply risk. NYMEX crude oil futures for March delivery closed at $65.42, up $2.21/barrel, a change of +3.50%; ICE Brent crude oil futures for March delivery closed at $70.71, up $2.31/barrel, a change of +3.38%.

Market outlook

Overall sentiment in the commodities market remains buoyant, with continuous hot spots fostering an optimistic atmosphere. Furthermore, unresolved geopolitical factors have largely offset concerns regarding oversupply in the crude oil market. Despite sharp volatility in oil prices on Thursday, the prompt spread continues to strengthen rapidly, indicating that market anxiety over near-term geopolitical risks is still escalating. However, considering that the current rebound in oil prices has already reached $10—a performance exceeding expectations—crude oil, which is fundamentally characterized by overall loose supply, is expected to face a significant correction once market sentiment cools down. At current levels, the risk-reward ratio for chasing further gains is no longer favorable, and the market is showing clear signs of overheating. The Shanghai Futures Exchange (SHFE) also recently issued a notice stating that the current international situation is complex and volatile, with increasing uncertain and unpredictable factors affecting market operations and leading to significant price fluctuations. As the Lunar New Year approaches, investors are advised to further enhance their risk prevention awareness and invest rationally. Judging by recent intraday movements, market sentiment is unstable and prices are in a high-volatility phase; therefore, careful attention should be paid to market timing and rhythm.

II. Macro Dynamics

Trump: The Federal Reserve Chair announcement will be made next week. Interest rates should be lowered by 2 to 3 percentage points; we should have the lowest interest rates in the world, and the Fed should cut rates substantially now; we will take a bipartisan approach to avoid a government shutdown.

2、Trump says Putin agreed to a one-week ceasefire in parts of Ukraine. Zelenskyy: The ceasefire on energy infrastructure will begin on the night of the 29th.

Iran issues warning to commercial vessels.Live-fire naval exercises will be conducted in the Strait of Hormuz on Sunday and Monday.Iranian Parliament Speaker: In the current situation, it is difficult to trust US President Trump. Deputy Commander of the Iranian Revolutionary Guard: We are not afraid of any threats. With our deterrent power and the will of the people, we have successfully prevented the enemy from taking any adventurous actions.

4、CME Group Raises Margins for Gold, Copper, and Some Aluminum Futures。

5. U.S. Department of the Treasury releases report: No trading partner labeled as currency manipulator.

The US Treasury: Recent depreciation of the Korean won is inconsistent with South Korea's economic fundamentals.

7、World Gold Council: Global central banks net purchased 230 tonnes of gold in Q4. Strong gold demand is expected to continue into 2026.。

8. The Indonesian stock market has once again experienced a sharp decline, triggering circuit breakers, prompting urgent responses from Indonesian authorities: the minimum free float ratio for stocks will be doubled, and sovereign funds may enter the market. MSCI stated that it will closely monitor the Indonesian market, communicate with relevant parties, and announce subsequent actions in due course.

The General Office of the State Council issued the "Work Plan for Accelerating the Cultivation of New Growth Points in Service Consumption."

10. People's Bank of China: In the fourth quarter of 2025, the weighted average interest rate for newly issued commercial individual housing loans nationwide was 3.06%.

11. Bank of China:Adjust the business parameters of the Silver Deferred Contract, increasing the margin ratio from 48.26% to 50.80%.

12、SDIC Silver LOF: Trading suspended from market open on January 30 until market close.

China will layout more "Space+" future industries, preparing for space mining and the normalization of space tourism flights.

Kweichow Moutai investing in SpaceX's Series A funding round? False!

15、On January 29th, international precious metals experienced a sharp plunge during trading. Spot gold reached a historical high of $5598.75, then plummeted as much as 5.9% during the session, hitting a low of $5097.36/ounce. Spot silver fell as much as 8.4%, hitting a low of $106.76/ounce. As of press time, spot gold's decline had narrowed to 0.4%, at $5393.21/ounce; COMEX gold futures rose 1.47% to $5418.4/ounce. Spot silver fell 0.21% to $116.3/ounce; COMEX silver futures rose 2.02% to $115.83/ounce.

III. Early Morning Market Dynamics of Plastics

Crude oil futures surged to the daily limit overnight before sharply pulling back! Domestic plastic futures contracts also rose across the board overnight.

Plastic 2609 contract was quoted at 7,118 yuan/ton, up 1.66% from the previous trading day.

PP2605 contract reported at 6945 yuan/ton, an increase of 1.67% from the previous trading day.

PVC2605 contract was reported at 5004 yuan/ton, up 2.21% from the previous trading day.

Styrene futures contract 2602 was quoted at 8000 yuan/ton, up 2.16% from the previous trading day.

IV. Market Outlook

PE: As the Chinese New Year approaches, the polyethylene market exhibits a distinct characteristic of "emotion-driven vs. fundamental divergence." Although downstream demand has entered its final stage, with operating rates in traditional sectors such as agricultural film and pipes continuing to decline, companies are mainly focused on clearing existing inventory and fulfilling pre-holiday orders. Proactive purchasing interest is low, and overall market transactions have not seen substantial growth. However, driven by the strong upward trend in futures, market sentiment has significantly rebounded, and spot prices have moved upward accordingly. Traders are largely adopting a "follow the market" sales strategy, flexibly adjusting quotations to align with market rhythms. On the supply side, the recent accelerated destocking of inventory by the two major oil companies, coupled with an increase in the number of industry maintenance units, has effectively alleviated previous potential supply pressure, providing some support to the market. However, it should be noted that during the Chinese New Year holiday, downstream factories will completely cease operations, leading to a complete halt in demand. Meanwhile, some previously maintained units may gradually restart, releasing goods. It is expected that there will be phased inventory accumulation pressure, but the current absolute inventory level is relatively low, and the extent of accumulation may be limited and controllable. Overall, the short-term market increase relies more on the transmission of futures sentiment and marginal improvements on the supply side, rather than a substantial recovery in demand. This "weak reality, strong sentiment" pattern is unlikely to persist. It is expected that the polyethylene market will maintain a volatile but upward trend in the short term, but the upside potential is limited. After the holiday, as downstream factories gradually resume operations, if demand recovery falls short of expectations, coupled with the pressure from new capacity releases, the market may face a risk of correction. The overall trend is likely to be "volatile before the holiday, then stable followed by weakness after the holiday." Close attention should be paid to the pace of post-holiday production recovery and inventory digestion.

The current polypropylene (PP) market is characterized by a mix of bullish and bearish factors, with the core positive stemming from strong cost-side support. OPEC+'s pause in production increases, the continuation of US sanctions against oil-producing countries, and geopolitical uncertainties have pushed up crude oil and upstream raw material prices, driving futures prices higher and the spot market to follow suit. Regarding inventory, Sinopec and CNPC's inventory increased by 25,000 tons compared to yesterday, but overall inventory remains within a reasonable range, and supply pressure is still manageable. With the Spring Festival approaching, demand is showing significant structural divergence. End-users are only maintaining restocking for immediate needs, while festival-related areas are the only bright spots. Orders for food packaging such as New Year's gift box laminations, candy and nut sealing bags, plastic fresh produce trays and storage boxes for supermarket turnover, and waterproof lamination materials for Spring Festival couplets and blessings are still being rushed. However, demand in conventional areas continues to weaken. Production of injection-molded parts for household appliance shells, automotive interior accessories, daily-use plastic products such as plastic basins and buckets, and products such as express packaging straps and woven bags have all seen sharp declines in procurement due to the completion of end-user stocking. Overall, although cost support provides a floor for the market, structural demand cannot reverse the industry's off-season downturn. Negative factors such as the weak global economic recovery and the slow pace of the Federal Reserve's interest rate cuts continue to suppress the market. It is expected that the polypropylene market will remain range-bound in the short term, and the gradual contraction of demand will become apparent as downstream factories gradually shut down and take holidays.

PVC: As time goes by, spot and futures markets are gradually entering the pre-Spring Festival market. However, prices have risen relative to the previous low range. From the supply side, chlor-alkali enterprises still face sales pressure and the need for reasonable factory inventory. On the demand side, it is heard that some enterprises have demand for taking and hoarding goods, but intermediaries are divided. Some believe that the current market lacks major fluctuations, and it is expected that the post-holiday market will continue, so there is no need to take too much goods. Some merchants have a slight willingness to hoard goods, but they are mainly those with their own warehouses. There are not many variable factors on the supply and demand side. On the foreign exchange market, international oil prices climbed to their highest level since the end of September last year due to growing concerns about the situation in Iran and an unexpected drop in US crude oil inventories. Overall, PVC spot prices are likely to continue to adjust narrowly in the short term.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

New 3D Printing Extrusion System Arrives, May Replace Traditional Extruders, Already Producing Car Bumpers