GGII: Over 282 Public Investment Projects in China's Lithium Battery Industry Chain by 2025, Total Investment Amount Grows Year-On-Year

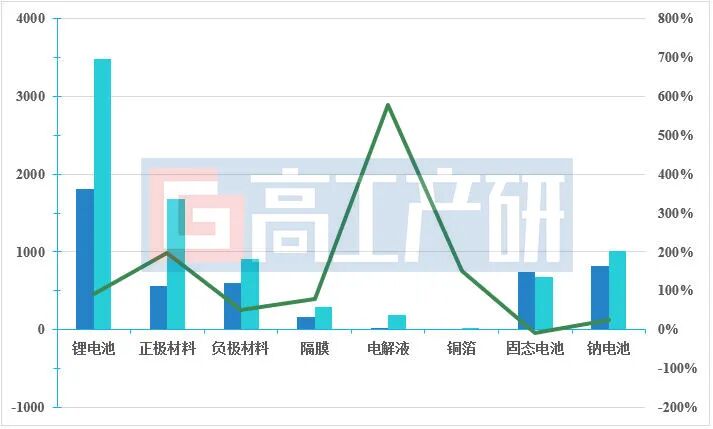

According to incomplete statistics from GGII, by 2025, there are over 282 publicly announced investment projects across all segments of China's lithium battery industry chain (including lithium batteries and main materials, solid-state batteries, and sodium batteries), with a total investment exceeding 820 billion yuan, marking a year-on-year growth of over 74%.

Lithium batteries and key materials remain the main focus of investment, accounting for over 80% of the investment amount.

Lithium battery:In 2025, China plans approximately 64 new lithium battery projects (including signed, announced, and commenced projects), with a planned capacity exceeding 1100 GWh, a year-on-year increase of 105%. In terms of project investment, the total planned investment for the year reaches 348.5 billion yuan, a year-on-year increase of 92%. Since 2025, battery companies such as Contemporary Amperex Technology Co., Ltd. (CATL), Eve Energy, Zhongchuang Innovation Aviation, Envision AESC, and Chuangneng New Energy have successively announced new capacity construction plans, signaling a positive trend of industry expansion.

Lithium battery materials:In 2025, China's total planned investment in the fields of lithium battery cathode materials, anode materials, electrolytes, separators, and copper foil amounts to 308.5 billion yuan, a year-on-year increase of 127%. Among these, the growth in cathode materials and electrolytes is particularly notable. In the cathode materials sector, the market demand for high-voltage, high-density, and long-cycle-life products has surged, driving an acceleration in capacity expansion. The rapid growth in the electrolyte sector is not only driven by adjustments in supply and demand structures and terminal market demand but is also exacerbated by a doubling of upstream raw material prices, which has increased production costs. Combined with a market landscape characterized by product shortages, this has prompted companies to accelerate their expansion pace to ensure market supply.

Solid-state battery

In 2025, China plans approximately 60 new solid-state battery projects with a planned capacity of 189 GWh and a total planned investment of about 67.7 billion yuan, a year-on-year decrease of 9%. It is noteworthy that while the investment amount has decreased year-on-year, the capacity planning has achieved a 23% growth. The core reason for this is the continuous breakthroughs in key processes, with dry electrode and stacking processes gradually maturing, effectively reducing the equipment investment costs for enterprises. Additionally, some companies have achieved "liquid + solid" flexible production by retrofitting traditional lithium battery production lines, which is also one of the reasons for the decline in total project investment.

Sodium battery

In 2025, China has planned 42 new sodium battery projects, with a planned capacity exceeding 290 GWh and a total planned investment exceeding 100 billion yuan. All three indicators have achieved significant growth compared to the previous year. The core driving forces behind the rapid development of the sodium battery industry include three aspects: continuous breakthroughs on the technology front, with CATL having increased the energy density of mass-produced sodium batteries to 175 Wh/kg, comparable to the level of lithium iron phosphate batteries; accelerated penetration on the application front, with increasing penetration rates in fields such as start-stop systems, energy storage, and two-wheeled electric vehicles; and a cost advantage, as the prices of lithium salts and lithium battery materials continue to rise, while sodium batteries, relying on the material characteristics of "de-lithium and de-copper," combined with the abundant reserves of sodium resources, are expected to be more cost-competitive than lithium batteries in the future.

Summary of Planned Investment Amounts for Lithium Batteries and Main Materials, Solid-State Batteries, and Sodium Batteries from December 2023 to Mid-2025

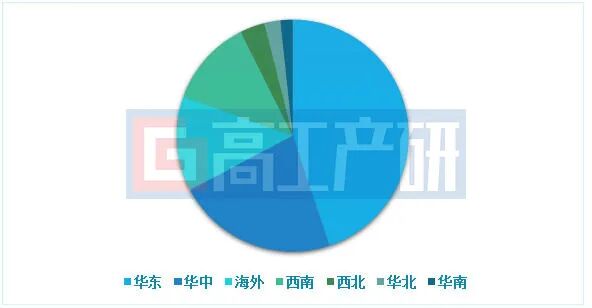

From a regional perspective,In the field of lithium batteries.In 2025, domestic lithium battery investment and expansion projects are primarily concentrated in the East and Central China regions. The East China region, centered around Fujian, Shandong, and Jiangsu, focuses on the development of the lithium battery and materials manufacturing industry, leveraging abundant chemical resources, strategic layout of leading enterprises, and the advantages of a well-established industrial chain. This area has already developed a significant industrial scale. Meanwhile, the Central China region, with Hubei as the core growth pole, is committed to building an integrated "resource + manufacturing" industrial base. For instance, Yichang in Hubei, relying on a world-class phosphorus chemical recycling industrial cluster, has attracted leading enterprises from both upstream and downstream of the lithium battery industry chain, such as CATL, Envision AESC, Tianci Materials, and Chuanneng New Energy, to concentrate their presence.

In terms of overseas markets,In 2025, the layout of Chinese lithium battery companies is most concentrated in Thailand, Spain, Portugal, and other locations. Thailand, with its core advantages of low geopolitical risk, friendly foreign investment policies, being a transportation hub in Southeast Asia, and a developed automotive industry, has attracted several leading battery companies such as CATL (300750.SZ), EVE Energy (300014.SZ), and Gotion High-tech (002074.SZ) to establish operations. The European market, driven by massive electrification demand, a stable political environment, and localization policies, has become an important destination for domestic companies to expand overseas. In 2025, the zero-carbon AI super factory of CALB in Portugal and the joint venture factory of CATL and Stellantis Group in Spain commenced construction, accelerating the implementation of local production capacity in Europe.

The regional distribution of investment and expansion project capacity of Chinese lithium battery enterprises from January to mid-December 2025 (%)

Lithium battery materialsIn 2025, investment in the expansion of lithium battery cathode material projects is highly concentrated in the southwestern region, accounting for 59%, with Sichuan being the core area. Sichuan, leveraging policy support as a national strategic hub, abundant green electricity resources, and low electricity costs, has become a core advantage for industrial agglomeration. In recent years, Sichuan's lithium battery industry has developed rapidly. Yibin, as a key production hub for CATL, has driven the province's completed battery production capacity to exceed 350 GWh, forming a strong industrial siphon effect that has attracted numerous lithium battery material companies to settle in.

Negative electrode materialThe regional distribution of project investment expansion is relatively balanced. Graphitization, being the most cost-intensive segment in the production of anode materials, is significantly influenced by electricity prices. The North China and Northwest regions, with their low electricity costs and abundant raw materials, have become the preferred areas for project implementation. The East China and Central China regions, relying on the cluster effect of lithium battery projects, are also key areas for the concentration of anode material projects.

2025ElectrolyteInvestment expansion projects are mainly concentrated in the East China region. This area is not only the core production center for power and energy storage batteries in China but also has the largest number of chemical parks in the country. With the dual advantages of a complete industrial chain and proximity to downstream markets, it has become the preferred choice for electrolyte companies to establish their presence.

Other materialsThe diaphragm project is primarily located in the Southwest region. The representative project in the Southwest is the first phase of the Jiangsu Housheng Chongqing base, with an annual production of 1.2 billion square meters of lithium battery diaphragms. The copper foil project is relatively less, with investment expansion areas in 2025 mainly concentrated in the East China region, such as Jiangxi and other places.

In terms of overseas developments, in 2025, with lithium battery companies such as CATL, CALB, and REPT laying out their overseas plans, lithium battery material companies, which are part of the supporting chain, are also actively responding to the call to "go global." These include cathode material companies like Hunan Yuneng, Longpan Technology, Dangsheng Technology, and GEM; anode material companies like Shantaitech and Zhongke Electric; electrolyte companies like Tianci Materials and Kunlun New Materials; and separator companies like Senior Material and Sinoma Lithium Film, all of which are following suit and establishing themselves overseas.

Distribution of Capacity Expansion Projects of Lithium Battery Material Enterprises in China in 2025 (%)

In the field of solid-state batteries.In 2025, the investment and expansion of solid-state battery projects will be mainly concentrated in the East China region, with approximately 30 new planned projects, a planned capacity of 74 GWh, and a total investment of 28 billion yuan. Among them, Anhui and Zhejiang are the major locations for the projects, with planned capacities of 27 GWh and 22 GWh, respectively, and corresponding total investments of 10 billion yuan and 11.3 billion yuan. The combined capacity and investment of these two places account for nearly 80% of the East China region. The Southwest region is the second major concentration area, with 9 new planned projects, a planned capacity of 56 GWh, and a total investment of 18.4 billion yuan, with Sichuan accounting for 70% of the projects in the Southwest region due to its industrial layout advantages.

Sodium batteriesIn 2025, the Southwest region will become the main area for investment and expansion of sodium battery projects, with nine new planned projects and a planned capacity of 81 GWh, totaling an investment of 32.2 billion yuan, accounting for nearly one-third. Sichuan contributes significantly, accounting for more than 85% of the new planned capacity in the Southwest region, initially forming an industrial cluster centered on Zigong and Bazhong, with Yibin, Dazhou, and Deyang as collaborators. The East China region, as a developed area for the battery industry, relies on its mature lithium battery industry chain and strong capital advantage, attracting 78 GWh of capacity and 15.9 billion yuan of investment.

The Regional Distribution (%) of Investment and Expansion Projects for Solid-State Batteries and Sodium Batteries by Chinese Companies in 2025

Overall,In China, the lithium battery new energy industry has experienced a two-year period of "supply-demand imbalance, declining prices, extreme competition, slowing growth, and performance downturns" from 2023 to 2024. Since 2025, with the continuous rapid growth of the energy storage market, coupled with the recovery in prices of core materials such as lithium salts, copper foil, and electrolytes, leading enterprises have maintained a high capacity utilization rate, and major companies are continuously expanding their production bases both domestically and internationally. These multiple positive signals indicate that the Chinese lithium battery new energy industry is beginning to emerge from its period of difficulties.

Looking ahead to 2026GGII predicts that 2026 is expected to become the starting point of a new cycle of healthy and orderly development in China's lithium battery new energy industry. Specifically, the supply-demand pattern in the lithium battery and core materials field will continue to improve. In 2026, high-quality capacity is expected to be in short supply, combined with high capacity utilization rates and strong market demand expectations, potentially spurring more companies to promote investment and expansion. The application process of solid-state batteries will accelerate, with small-scale trial use by car companies and emerging fields such as embodied robots and low-altitude economy bringing incremental demand, further driving technological iteration and industrial development. The sodium battery industry will experience rapid growth, with shipments expected to achieve 100% growth by 2026 and potentially reach hundreds of GWh by 2030, leading to a 30-50 fold growth in upstream and downstream materials.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

[PET Weekly Outlook] Polyester Bottle Chips Expected to Oscillate and Warm Up with Costs Today

-

EVA Morning Prices on September 12: Most of the Market Holds Steady, Highest Rise of 50 Yuan

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Case Study | Clariant AddWorks™ Additives Solve Plastic Yellowing Problem