Eastman Releases 2025 Third Quarter Financial Report

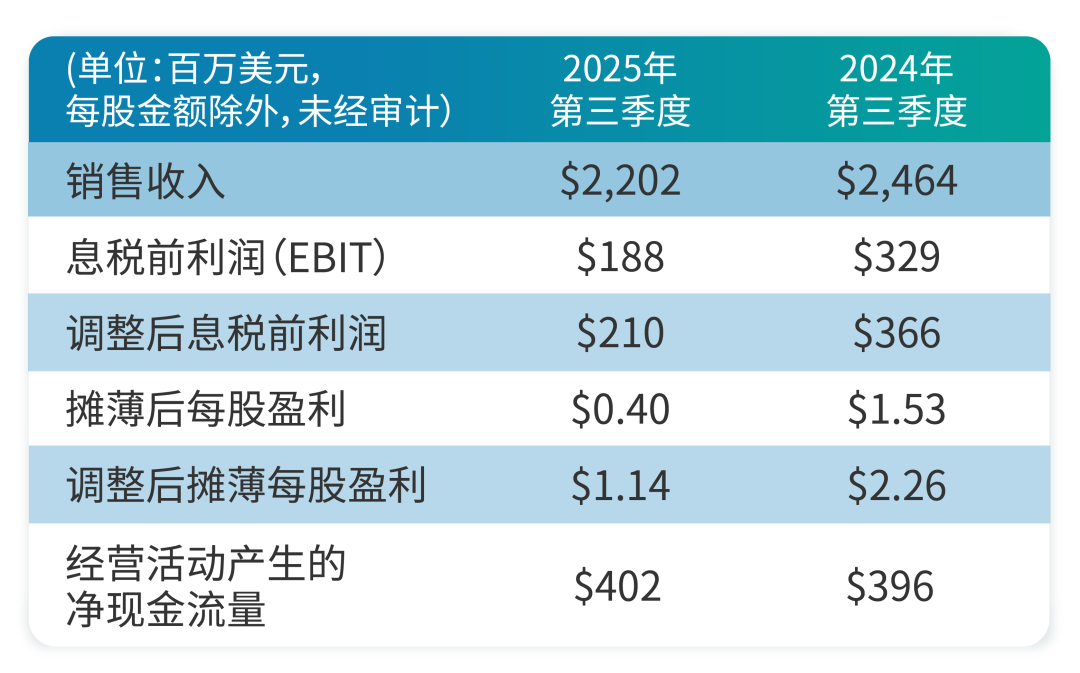

Eastman Chemical Company (NYSE: EMN) released its financial report for the third quarter of 2025.

● Achieved strong operating cash flow of $402 million, consistent with the same period last year, fully demonstrating our steadfast commitment to continuously generating stable cash flow.

Significant progress has been made in inventory reduction measures, with a decrease of approximately $200 million compared to the level in the second quarter of 2025.

In a weak economic environment, continuously maintain product value through excellent business operational capabilities.

- It is planned to reduce the cost structure by over $75 million by 2025, after accounting for inflation, and to further reduce it by about $100 million in 2026 (after accounting for inflation).

● Continue to advance commercialization on the circular economy platform and achieve strong operational performance.

Returned $146 million to shareholders through dividends and stock buybacks.

Due to a 10% decline in sales/production mix and a 1% decline in sales prices, sales revenue decreased by 11%. The decline in sales/production mix is attributed to weak demand in the non-essential consumer goods end market and customers digesting inventory accumulated in the first half of the year to avoid tariff risks, a situation particularly evident in the specialty materials and fibers business.

The main reason for the decline in operating profit before tax is the decrease in sales/product mix across all business operations, as well as the significantly reduced capacity utilization aimed at promoting cash flow generation. Our specialty products business maintained a stable price-cost ratio, while the chemical intermediates business faced competitive margin compression. Due to the implementation of more proactive inventory management measures, the adverse impact of capacity utilization was slightly higher than expected. However, we partially offset these negative factors by reducing our cost structure.

Sales revenue decreased by 7% due to a decline in sales volume/product mix.

The main reason for the decline in sales/product mix of specialty plastics is the weak demand in the high-value non-essential consumer goods end market. Additionally, customers are using pre-positioned inventory to reduce the impact of tariffs on consumer prices and to cope with sluggish consumption. In terms of automotive-related business, the basic sales trend of our advanced interlayer product line is relatively stable and slightly better than initially expected. However, the sales of the high-performance film product line in the automotive aftermarket have declined because consumers are either choosing not to purchase accessories due to purchasing power issues or are turning to lower-priced products. Thanks to excellent commercial execution in securing prices and market share, prices have remained generally stable.

The main reasons for the decline in earnings before interest and taxes (EBIT) are the decrease in sales/product mix, lower capacity utilization (including proactive inventory reduction measures), and rising energy and tariff costs.

The 8% decline in sales/product mix overshadowed the favorable impact of a 3% increase in sales price, resulting in a 4% decrease in sales revenue.

The decline in sales/product mix is due to the scheduling of the completion of the heat transfer oil project, as well as the continued weak demand in the building and construction and automotive refinish end markets. The increase in sales prices is attributed to cost pass-through agreements.

The slight decline in EBIT was primarily due to the adverse impact of lower sales/product mix being largely offset by the decrease in manufacturing costs (including planned maintenance expenses).

The decline in sales/product mix led to a 24% decrease in sales revenue.

Compared to last year, the ongoing destocking activities by customers, adjustments in industry capacity share, and the continued sluggish sales of textiles to China under the influence of global trade disputes have led to a decline in acetate tow sales, which in turn has resulted in a drop in sales/product mix. Additionally, the reduction of inventories established by acetate tow and textile customers in the first half of the year to avoid tariff risks also adversely impacted the business this quarter.

The reason for the decline in EBIT is the decrease in sales/product mix and the rise in raw material and energy costs.

Sales revenue decreased by 16% due to an 8% decline in volume/product mix.

This reflects the continued weakness in demand in the North American building and construction end markets. Since profit margins in North America are much higher than in export businesses, the decline in sales in this region has led to an unfavorable product mix effect. At the same time, due to the weakening fundamentals of the commodity market, prices have decreased by 8%.

The reason for the decline in EBIT is the narrowing of interest margins and the decrease in sales/product mix.

In the third quarter of 2025, cash generated from operating activities amounted to $402 million, compared to $396 million in the third quarter of 2024. The expansion of cash flow was mainly due to measures in managing working capital, including inventory reduction of $204 million. The company returned $146 million to shareholders through dividends and stock repurchases. Available cash in 2025 will be prioritized for capital expenditures, quarterly dividend payments, and reduction of net debt.

Costa said regarding the outlook for the fourth quarter and the entire year of 2025: "Considering the macroeconomic environment remains challenging, especially in the non-essential consumer goods market (such as building and construction, durable goods, and the automotive aftermarket), we expect a decline in sales greater than the normal seasonal range. We have observed signs of increasingly cautious consumer behavior, including a trend towards cost-effective consumption downgrade. Customers through retail channels are also continuously digesting the regionally pre-stocked goods from the first half of the year, aimed at avoiding tariff risks. We expect most of these pre-purchase inventories to be depleted by the end of the year."

In this rapidly changing environment, we will continue to focus on controllable factors, particularly the ongoing creation of robust cash flow. In the third quarter, we achieved strong cash flow through inventory adjustments and proactive cost management. We expect the price-cost ratio to remain stable as our business team demonstrates exceptional capability in stabilizing prices and solidifying market share through the innovative value of our products. At the same time, the Kingsport methanol decommissioning facility is expected to contribute a slight increase in revenue. By 2025, we are on track to achieve cost reductions exceeding $75 million after accounting for inflation, with an additional anticipated structural cost reduction of approximately $100 million in 2026 (also adjusted for inflation). As the inventory reduction measures from the third quarter are essentially completed, we expect planned production shutdown costs to decrease, and capacity utilization to recover slightly. In summary, we anticipate that the adjusted earnings per share for the full year of 2025 will be between $5.40 and $5.65, with operating cash flow expected to approach $1 billion.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Mexico officially imposes tariffs on 1,400 chinese products, with rates up to 50%

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Progress on plastic reduction in packaging released by 16 fast-moving consumer goods brands including nestlé, pepsi, unilever, coca-cola, and mars

-

Significant Data Gaps in Plastic Additive Safety! Cheap Catalyst with Air Enables Efficient PET Decomposition

-

Brazil Imposes Five-Year Anti-Dumping Duty of Up to $1,267.74 Per Ton on Titanium Dioxide From China