Dow suffers poor performance, announces major layoffs of 4,500 employees

Global chemical giant Dow simultaneously announced two major pieces of news – the launch of a comprehensive restructuring plan and the disclosure of its 2025 full-year results, attracting industry attention at the start of the year.

Breaking! Dow Chemical announces 4,500 layoffs!

On January 29th, Dow announced a comprehensive restructuring program called "Transform to Outperform," designed to achieve at least $2 billion in near-term operating EBITDA improvement through operational streamlining and cost reduction measures.

Dow plans to cut approximately 4,500 jobs and introduce artificial intelligence and automation technologies. The company expects to incur one-time charges of $1.1 billion to $1.5 billion, including $600 million to $800 million for severance and $500 million to $700 million for implementation costs.

It is worth noting that previously, in early 2025, Dow Chemical had already announced that in order to cope with continued macroeconomic uncertainty and enhance the company's long-term competitiveness, it would implement two major measures: reducing capital expenditures and layoffs, to save approximately $1 billion in costs annually, and planned to lay off 1,500 employees worldwide. Prior to that, in January 2023, Dow Chemical also announced layoffs of approximately 2,000 employees.

Sharp Decline in Performance! Dow's 2025 Forecasts a Loss, Turning from Profit to a Net Loss of $2.4 Billion!

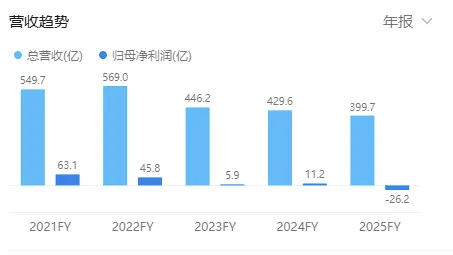

On the same day, Dow Chemical disclosed its full-year 2025 results, which may be the core trigger for Dow's urgent restructuring. The financial report showed a significant decline in the company's 2025 performance, with several key financial indicators performing poorly. Among them, net sales decreased by 6.9% year-over-year, from $42.964 billion in 2024 to $40 billion in 2025. The profit side even turned from profit to loss, with a net loss of $2.4 billion in 2025 according to U.S. Generally Accepted Accounting Principles (GAAP), compared to a profit of $1.2 billion in the same period in 2024.

Industry insiders analyze that Dow's large-scale restructuring and performance decline are not isolated cases, but an epitome of the current global chemical industry's predicament. Dow had previously launched a round of cost reduction plans. This intensified restructuring is both a helpless move to cope with short-term performance pressure and a strategic layout to conform to industry trends and seek long-term development. Whether Dow can successfully break through with the implementation of the restructuring plan remains to be tested by the market.

Global chemical giants collectively "downsizing"!

In 2025, the chemical industry is undergoing an unprecedented structural transformation, with multiple pressures forcing many leading companies to "cut their losses" through measures such as shutting down production capacity, selling assets, and laying off employees.

Dow: Laying off approximately 1,500 employees globally; permanently closing the Böhlen ethylene cracker in Germany, the Schkopau chlorine and vinyl assets, and the Barry basic siloxanes plant in the UK; selling its 50% stake in the DowAksa joint venture.

2. BASF: Selling the Styrodur® business (affecting approximately 50 people), Wintershall Dea exploration and production business (affecting approximately 800 people), food and health functional ingredients business, Brazil decorative coatings business, remaining coatings businesses, optical brighteners business; closing the Ludwigshafen sodium bisulfite production facility (affecting approximately 65 people).

Arkema: Closing chlorine, soda, chloromethane, and technical fluids production at the Jarrie plant, laying off 154 employees; planning to sell its plastic additives business.

4. INEOS: Closing the UK's last synthetic ethanol plant (hundreds of job losses), the Gladbeck phenol and acetone production site in Germany, European propylene oxide and propylene glycol production, and two production plants in Rheinberg, Germany; Selling the INEOS hygiene products business; Cutting 20% of jobs at the acetyls factory in Hull, UK (loss of 60 technical positions).

DuPont: To sell Nomex and Kevlar heat-resistant aramid fiber brands.

Huntsman: Layoffs and closure of Deggendorf (Germany), Kings Lynn (UK) plants, and maleic anhydride plant in Moers (Germany); nearly 10% global workforce reduction (approximately 600 employees) by 2025.

Covestro: Jointly with LyondellBasell, permanently closes the propylene oxide/styrene monomer production unit at the Maasvlakte plant in the Netherlands.

TotalEnergies: To permanently shut down its old cracker in Antwerp, Belgium by the end of 2027 (affecting 253 employees).

9. ExxonMobil: Seeking to spin off Esso France; looking to sell or shut down European chemical plants in the UK and Belgium.

LyondellBasell: Sale of European ethylene and polyethylene assets and related businesses.

Invista: Closing Maitland, Canada plant, affecting approximately 100 positions.

LANXESS: Sells polyurethane systems business and entire stake in Envalior; Prepones closure of hexane oxidation plant in Krefeld-Uerdingen; Closes fragrance chemicals plant in Widnes, UK in 2026.

Celanese: Intends to exit the Elotex® redispersible powder plant in Sempach, Switzerland, and the Vamac® Engineered Materials plant in Sarnia, Canada.

Solvay: Closing some production lines at the Bad Wimpfen, Germany plant (trifluoroacetic acid-related organics to cease in early 2026, some inorganics to cease by the end of 2026), resulting in approximately 100 job cuts; Closing the Gabsheim plant in 2028, resulting in approximately 40 job cuts.

15. Syensqo: Laying off approximately 200 employees; selling its oil and gas business; spinning off its aroma and functional chemicals business.

16. Trinseo: Permanently closing MMA production facility in Rho, Italy and ACH production facility in Porto Marghera, Italy; potential closure of PS production site in Schkopau, Germany.

17. Shell: Restructuring global chemicals business, potential partial or complete closure of European chemicals division; Sale of Singapore energy and chemicals park assets.

Honeywell: Selling personal protective equipment business.

Clariant: Plans to close its last production site in Switzerland; to sell its Venezuelan legal entity.

Ascend: Closing its hexamethylenediamine (HMD) production facility in Lianyungang, China.

Westlake: Shut down bisphenol A and liquid epoxy resin units at its Pernis, Netherlands plant, and will not restart the plant's allyl chloride and epichlorohydrin units (230 jobs lost); shut down three U.S. vinyl chloride plants and one U.S. styrene plant (295 jobs lost).

Röhm: Closing Westwego, Louisiana plant.

ARLANXEO: Plans to cease operations at its Port-Jérôme, France, plant.

Fuller: Closed nearly one-third of its global factories (reducing from 82 to 55).

25. Mitsubishi Chemical (Japan): To sell Mitsubishi Tanabe Pharma; To completely terminate chemical production at Onahama Plant and Iwaki Plant in Iwaki City, Fukushima Prefecture by the end of March 2027; To withdraw from the PET bottle business; To withdraw from the manufacturing of polyester resin for printer toner; To transfer J-Film Corporation.

26. Mitsui Chemicals (Japan): Sold 66.5% stake in Japan A&L Company; exited the nitrogen trifluoride (NF3) business; permanently reduced TDI production capacity in Omuta, Japan; transferred 50% equity in Sinopec Mitsui Chemicals Co., Ltd.

27. Asahi Kasei of Japan: Exiting multiple businesses including MMA monomers and closing the Kawasaki acetonitrile refining plant; selling the lead-acid battery separator business Daramic; ceasing production of hexamethylenediamine.

Teijin Corp. of Japan plans to close its aramid fiber production facility in Arnhem, Netherlands.

29. Kuraray Japan: Discontinued production of Vecstar™ FCCL flexible copper clad laminate; ceased production of polyester resin and polyester filament at its subsidiary; transferred all shares of Kuraray Acrylic (Zhangjiagang) Co., Ltd.

Toray Industries, Inc.: To sell 50% stake in LG Toray Hungary Battery Separator Kft.

South Korea's LG Chem: Selling its water treatment business.

Polyplastics: Daicel Corporation plans to absorb and merge, acquiring all of its business.

33. Ube (Japan): Closing cyclohexanone, nylon, and related product lines; accelerating the reduction and withdrawal of basic chemical business production in Thailand (advanced to March 2026).

34. Hyosung (Korea): Hyosung Spandex (Jiaxing) Co., Ltd. will completely shut down all production lines by the end of 2026.

SABIC: Permanently shutting down Olefins 6 cracker in Teesside, England, UK and Olefins 3 cracker in Geleen, Netherlands.

SGL Carbon: Closure of Lavradio production site in Portugal (approx. 250 employees).

Kuraray Co.: Exiting Dover, Ohio production site, phasing out dimer and polyamide production lines.

In recent years, the global chemical industry has faced multiple challenges, including weak demand, high costs, and stricter regulations. The survival rules for enterprises have completely shifted from the past "scale expansion" and "cost control" to "strategic focus," "technological innovation," and "agile adaptation." Whoever can divest old assets faster, bet on new tracks more accurately, and respond more flexibly to geopolitical and energy changes will win the next era in this once-in-a-century transformation.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories