Cost Pressure! Early 2026 US Cold Snap Hits PDH Polypropylene Industry

In January 2026, the U.S. experienced extreme cold weather, causing natural gas futures prices to surge by the largest weekly gain in nearly 35 years. This sharp energy price fluctuation was transmitted through the industrial chain, significantly impacting the polypropylene (PP) industry using propane dehydrogenation (PDH) technology, manifesting as increased short-term operational pressure and the need for long-term transformation and adjustment.

Natural Gas Price Increase Transmission Path

Soaring natural gas prices have directly driven up the cost of propane. Propane is a core raw material for propylene production in PDH (Propane Dehydrogenation) units, and propylene is a direct raw material for polypropylene. China's annual propane imports are approximately 28.57 million tons, with the United States being one of the main sources. The rise in natural gas prices in the U.S. has led to increased export quotations for its domestic propane, consequently raising raw material procurement costs for Chinese PDH enterprises. Simultaneously, rising natural gas prices have also pushed up naphtha costs. Naphtha cracking, as another mainstream process for propylene production, further exacerbates the overall cost pressure on the polypropylene industry.

II. Short-Term Pressure in the PDH Industry

- Addition of new production capacity stagnates: no new PDH-based polypropylene capacity is expected to come online in 2025. The industry faces dual pressures of overcapacity and weak demand, compounded by an increase in propane import tariffs, leading to reduced willingness among companies to invest in new capacity.

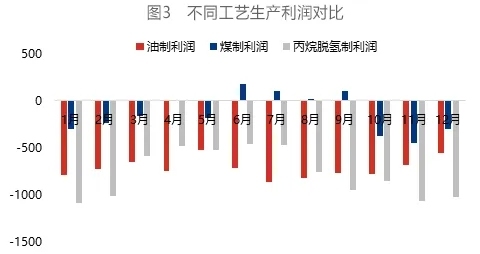

- Profit margin squeeze: Raw material costs account for 70%-80% of PDH-based polypropylene production costs, and propane price fluctuations directly impact polypropylene prices. Currently, terminal demand is recovering slowly, and the price increase of downstream products is not keeping pace with the increase in raw material costs, leading PDH units into deep losses.

- Maintenance and Production Cuts Loom: If natural gas prices remain high, domestic PDH plants are expected to undergo concentrated passive maintenance in the coming weeks, and some long-term loss-making units may shut down to avoid risks. New PDH capacity originally planned to come online in 2026 may also be delayed.

III. Long-Term Development Trends

Starting from 2025, a turning point in China's domestic propylene capacity growth will emerge as the cycle of large-scale capital expenditure draws to a close. Subsequent capacity additions will shift toward Coal-to-Olefins (CTO) and integrated refinery-petrochemical projects, while the dominance of Propane Dehydrogenation (PDH) projects will weaken, leading to a slowdown in overall industry capacity growth and a potential marginal improvement in the supply-demand balance. PDH enterprises are exploring strategic breakthroughs to enhance resilience, including pivoting product structures toward high-value-added downstream derivatives, promoting material exchange within industrial parks, diversifying propane sourcing channels, and reducing unit propane consumption.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

RMB Hits 32-Month High! Alpek Shuts Down PET Recycling Plant; Porsche Sales Plummet

-

Vynova's UK Chlor-Alkali Business Enters Bankruptcy Administration!

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Continental Plans to Begin Sale of ContiTech in Early 2026