China's Polypropylene (PP) Industry in 2026: New Supply-Demand Landscape and Rebalancing Path Amid Slower Capacity Expansion

With the pace of polypropylene capacity expansion slowing down and the commissioning window being postponed, the market supply pressure will be marginally alleviated by 2026. The differentiated development of oil-based, PDH, and coal-based processes, along with the adjustment of regional capacity expansion patterns, will drive the industry to achieve supply-demand rebalancing supported by rigid demand.

The expansion of China's polypropylene (PP) industry is expected to slow down significantly in 2026, and with downstream demand maintaining steady growth, the industry's supply-demand imbalance is likely to ease. Furthermore, the concentration of new capacity coming online in the second half of the year will provide strong support for market prices in the first half.

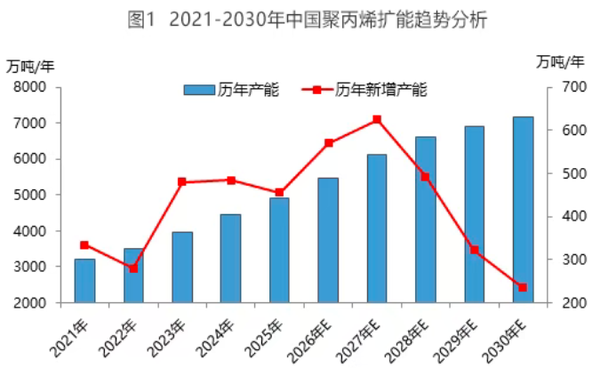

Judging from the capacity expansion over the years, the pace of expansion in the polypropylene industry has become differentiated and slowed down. In 2025, domestic polypropylene capacity is expected to increase by 4.555 million tons/year, a decrease of 295,000 tons/year compared to 2024, representing a year-on-year decline of 6.15%. However, the capacity utilization rate in 2025 is projected to rise significantly by 4 percentage points. Coupled with the fact that new capacity will be concentrated in the first half of the year, the annual polypropylene supply is expected to grow by 16.72% year-on-year. This will increase market supply pressure and exert long-term suppression on price trends.

The diversification and differentiation of polypropylene production capacity processes in China are becoming increasingly apparent. In terms of process share, oil-based processes will account for 54.91% in 2025, an increase of 2.36 percentage points year-on-year, still dominating the market; the share of PDH processes will decline by 2.06 percentage points year-on-year to 20.14%. This is because PDH-to-polypropylene has been suffering long-term losses, and its future capacity expansion will slow down significantly, with some existing plants also facing difficulty in maintaining stable operation due to poor economics.

The expansion trends in future polypropylene processes show significant differences. Although oil-based processes have a large installed base, their share is expected to slightly decline to 53.55% by 2026 due to a slowdown in commissioning, with a total capacity of 38.345 million tons/year. The uncertainty surrounding PDH (propane dehydrogenation) process commissioning is high. On one hand, it relies 100% on imported propane, and high raw material prices make products uneconomical, reducing companies' willingness to invest. On the other hand, its product structure is singular, mainly homopolymers, leading to fierce competition and severe overcapacity in application areas, thus squeezing its (survival space). Consequently, some new PDH units are likely to be delayed or shelved in the future. Coal-based processes, owing to their cost advantage, are becoming the main force for future commissioning. These plants are concentrated in the northwest regions rich in coal resources, where raw material costs are controllable. By 2026, their total capacity is expected to reach 14.815 million tons/year, increasing their share to 20.69%.

From the perspective of regional capacity expansion distribution, North China, South China, and Northwest China are the core regions for domestic polypropylene capacity expansion, but the pace and structure of expansion differ. Northwest China is dominated by coal-to-polypropylene enterprises, with high certainty in capacity expansion. South China is mainly based on the PDH process, and the expansion is subject to many variables due to insufficient process economics. The capacity expansion progress of local refineries in North China has slowed down, and it is estimated that the region's capacity share will rise to 26.71% by 2030, ranking first in the country. The capacity expansion progress in East China has slowed down significantly, and the capacity share will gradually decrease to 19.83% by 2026, with the regional supply and demand gap continuing to widen.

According to incomplete statistics, the domestic polypropylene new capacity in 2026 is expected to be 5.7 million tons/year, with commissioning concentrated in the second half of the year. The process routes are mainly oil-based and coal-based. Considering the uncertainty of new plant commissioning and the insufficient stability during the initial operation of plants after concentrated commissioning in the second half of the year, the release rhythm of new capacity will slow down, which can effectively alleviate the market supply pressure throughout the year.

Overall, China's polypropylene industry has entered a cycle of overcapacity, with fierce market competition. The pace of future capacity expansion will further slow down. At the same time, some marginal capacity will gradually be phased out, optimizing the industry's supply structure and alleviating market pressure. On the demand side, polypropylene has a wide range of downstream applications, with strong rigid demand in fields such as home appliances, automobiles, and packaging, and there are currently no large-scale substitute products. Overall consumption is expected to maintain a stable growth rate of around 5%. In this context, China's polypropylene industry will embark on a rapid rebalancing process.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

RMB Hits 32-Month High! Alpek Shuts Down PET Recycling Plant; Porsche Sales Plummet

-

Vynova's UK Chlor-Alkali Business Enters Bankruptcy Administration!

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Continental Plans to Begin Sale of ContiTech in Early 2026