Car Preservation Rates for January 2026 Released

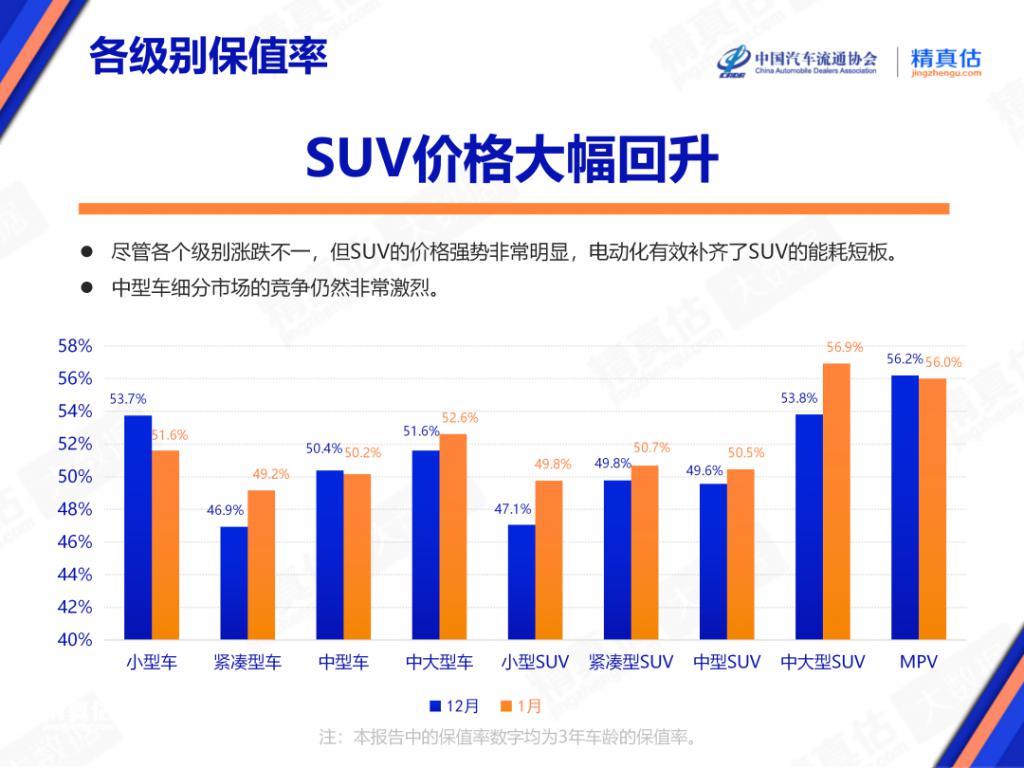

On February 2nd, the China Automobile Dealers Association released the "China Automobile Retention Rate Research Report for January 2026." The report shows that in January, the highest three-year retention rate among all vehicle classes was the mid-to-large SUV class, at 56.9%, a significant increase of 3.1% month-over-month. The three-year retention rate for the MPV class was 56.0%, a month-over-month decrease of 0.2%. Mid-to-large sized cars and small cars had retention rates of 52.6% and 51.6%, respectively, with the former increasing by 1.0% month-over-month and the latter decreasing by 2.1% month-over-month. In addition, the three-year retention rates for compact SUVs, mid-size SUVs, mid-size cars, small SUVs, and compact cars were 50.7%, 50.5%, 50.2%, 49.8%, and 49.2%, respectively. The report pointed out that "Although the retention rates of various vehicle classes fluctuated, the price strength of SUVs is very obvious, and electrification has effectively compensated for the energy consumption shortcomings of SUVs."

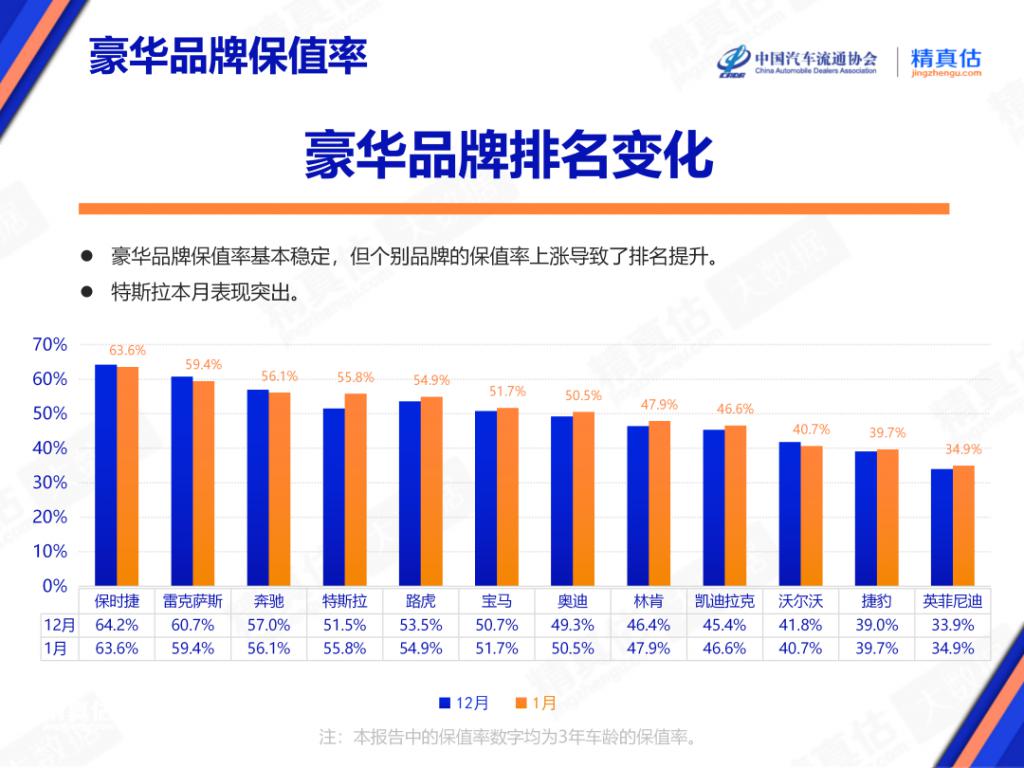

In the three-year value retention rates of international brands, the top three luxury brands in January were Porsche, Lexus, and Mercedes-Benz, with rates of 63.6%, 59.4%, and 56.1%, respectively, representing month-on-month declines of 0.6%, 1.3%, and 0.9%. Volvo also experienced a month-on-month decrease, with its three-year value retention rate dropping by 1.1% to 40.7%. All other brands recorded month-on-month growth. Tesla and Land Rover, which rounded out the top five, saw their three-year value retention rates reach 55.8% and 54.9%, with month-on-month increases of 4.3% and 1.4%, respectively. Additionally, BMW (51.7%), Audi (50.5%), Lincoln (47.9%), Cadillac (46.6%), Jaguar (39.7%), and Infiniti (34.9%) all achieved month-on-month growth in their three-year value retention rates.

In the joint venture brands, the top three models on the January list all came from Japanese brands: Honda, Toyota, and Mazda, with three-year residual values of 57.2%, 56.1%, and 55.7% respectively, an increase of 1.1%, 0.8%, and 4.8% month-on-month. Nissan and Mitsubishi, also Japanese brands, ranked twelfth and thirteenth on the list with residual values of 47.3% and 45.0% respectively, an increase of 1.4% and 1.9% month-on-month. Simply put, all five Japanese brands on the January list saw month-on-month growth, especially Mazda, which significantly improved its ranking and growth rate.

In terms of other brands, Volkswagen and Ford both ranked among the top five, with three-year resale value rates of 52.0% and 51.2%, representing month-on-month increases of 0.4% and 2.3%, respectively. Kia followed closely behind, though its three-year resale value rate fell by 1.6% month-on-month to 49.9%. Additionally, Buick, Citroën, Hyundai, Peugeot, Škoda, and Chevrolet all saw month-on-month growth in their three-year resale value rates, which stood at 49.4%, 49.1%, 48.9%, 48.1%, 47.8%, and 40.0%, respectively.

Among domestic brands, the Trumpchi brand maintained the highest residual value in January, at 60.4%, an increase of 4.9% month-on-month. The Tank brand also saw a good increase, rising 4.8% month-on-month to 60.1%. Jetour, Lynk & Co, MG, Chery, Changan, Li Auto, Denza, Geely, and Haval all achieved three-year residual values above 50%, at 54.1%, 53.9%, 52.2%, 52.0%, 51.6%, 51.5%, 51.0%, 50.8%, and 50.7% respectively. Among these, Lynk & Co, MG, Chery, and Li Auto showed significant month-on-month growth, increasing by 4.3%, 6.4%, 6.2%, and 6.9% respectively. In addition to the brands mentioned above, BYD, Harmony OS Intelligent Driving, Roewe, Zeekr, Wuling, NIO, AION, Oshan, and Leapmotor also entered the list, with three-year residual values of 48.2%, 47.8%, 47.8%, 47.8%, 46.6%, 46.3%, 46.2%, 46.2%, and 46.1% respectively. The report points out that the increase in residual value for domestic brands is closely related to product upgrades and replacements, with significant progress generally seen across the industry.

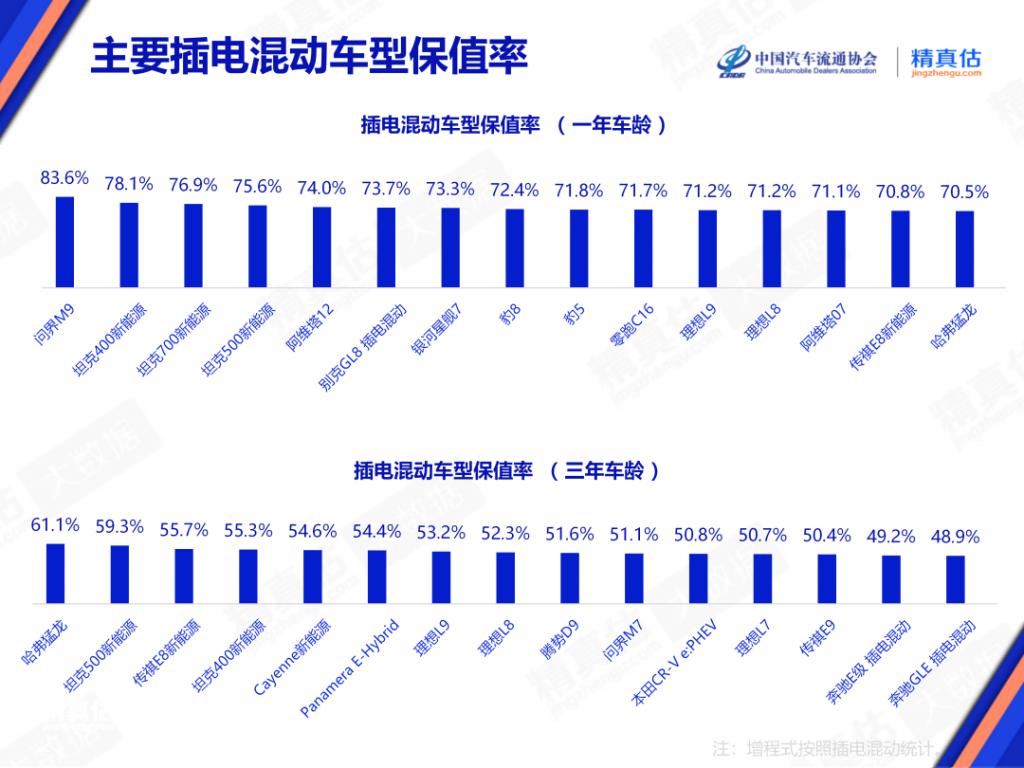

Finally, let's look at the new energy vehicle sector. Divided by powertrain type, the three-year residual value of plug-in hybrid models in January was 46.8%, an increase of 4.1% compared to 42.7% in December. The residual value of pure electric models was 44.8%, an increase of 2.4% compared to 42.4% in December. The report points out: "The overall residual value of new energy vehicles has significantly rebounded in the new year, including a large number of models that have undergone 'official price cuts' after facelifts. Hybrid vehicles have seen a larger increase in residual value, which is precisely due to the hot sales of plug-in hybrid vehicles accelerating the elimination of fuel vehicles."

In the specific vehicle models, among the plug-in hybrid vehicle rankings, the top three plug-in hybrid models for one-year residual value are AITO M9, Tank 400 NEV, and Tank 700 NEV, with residual values of 83.6%, 78.1%, and 76.9% respectively. The top three models for three-year residual value are Haval Menglong, Tank 500 NEV, and Trumpchi E8 NEV, with residual values of 61.1%, 59.3%, and 55.7% respectively.

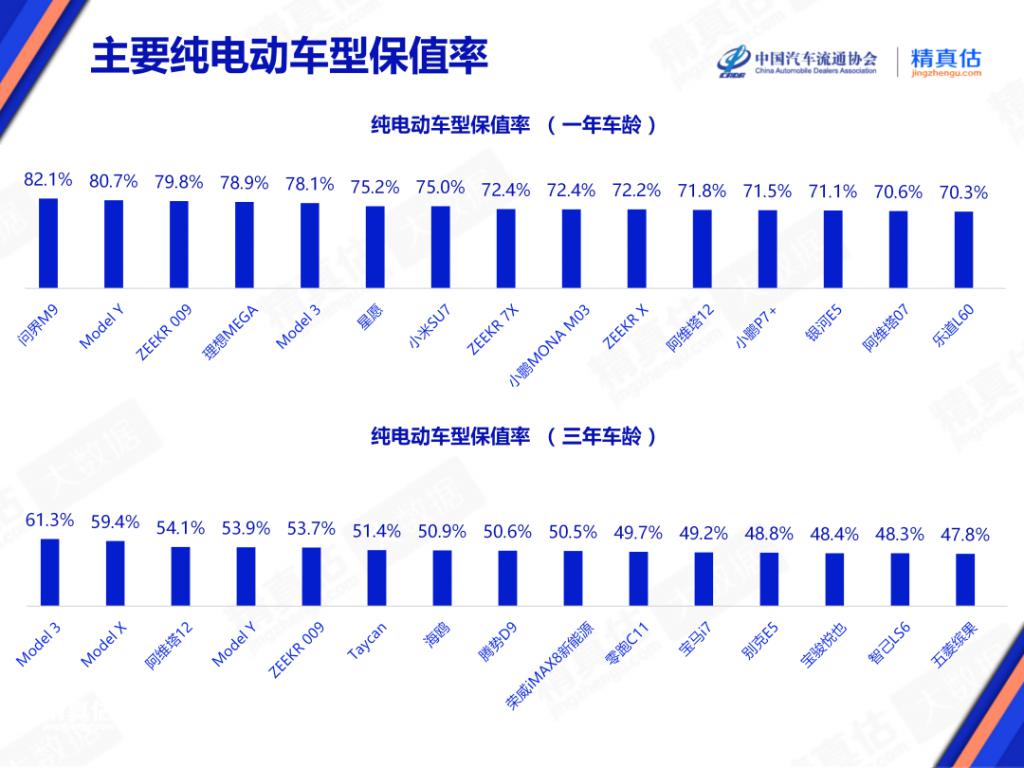

In the pure electric vehicle rankings, the top three pure electric models for one-year retention rate are AITO M9, Model Y, and Zeekr 009, with retention rates of 82.1%, 80.7%, and 79.8% respectively; the top three models for three-year retention rate are Model 3, Model X, and Avatr 12, with retention rates of 61.3%, 59.4%, and 54.1% respectively.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

Multifaceted Collaboration: PA Prices Rebound Against Trend to Break Through

-

Dow suffers poor performance, announces major layoffs of 4,500 employees