BOPET Spring Festival: 50% Production Capacity Maintenance Drives Valuation Bottom Repair

As the 2026 Spring Festival holiday approaches, the domestic BOPET industry is witnessing a key industrial trend: core enterprises within the industry have reached a consensus to collectively schedule up to 50% of their production capacity for maintenance during the holiday period. This large-scale centralized maintenance is not a short-term industry adjustment, but a crucial self-rescue measure to address long-term overcapacity and vicious competition. It will directly change the short-term supply and demand landscape, provide substantial positive support for the BOPET market, and gradually drive the industry valuation to recover from the bottom.

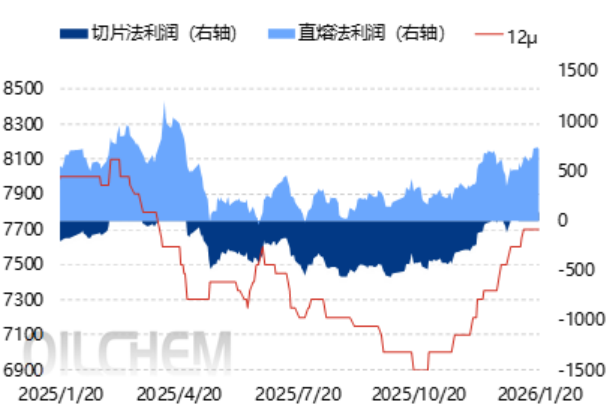

Looking back at the current round of involution in the BOPET industry, the sustained deterioration of the supply-demand mismatch is the primary reason for the prolonged downturn in market prices. From 2021 to 2025, China's BOPET industry experienced irrational capacity expansion, with cumulative new capacity exceeding 3.8 million tons over five years. In contrast, downstream demand growth remained sluggish, with demand increasing by only 8.98% during the same period, leading to a widening supply-demand gap. It is estimated that the domestic BOPET supply-demand difference reached 914,300 tons by 2025, and capacity utilization fell to a low of 68%. This imbalance directly triggered a fierce price war, with the mainstream quotation for 12μ printing film in East China falling to 6800 yuan/ton in 2025, a new low since 2020. Industry profitability continues to be under pressure, and the market has been in a long-term undervalued range.

Figure: Domestic BOPET Profit and Price Trends (RMB/ton) 2025-2026

As a core supplier of BOPET capacity globally, China accounts for over 60% of the world's total, and marginal changes in its industry supply directly determine the global market landscape. This 50% capacity overhaul is not a single company's action but an anti-involution measure led by leading enterprises and coordinated by the entire industry: core enterprises, spearheaded by Shuangxing New Materials, first reached a consensus on production cuts in December 2025, initially implementing a 20% basic reduction, and further increasing it to 50% during the Spring Festival, forming a large-scale supply contraction. This aligns with the current central government's anti-involution policy orientation and is a crucial step for the industry to transition from disorderly competition to rational development. From the perspective of capacity structure, this overhaul primarily targets low-end packaging film capacity, while the utilization rate of high-end optical film capacity remains above 90%, not affecting high-end supply, which is consistent with the industry's long-term philosophy of transformation and upgrading.

From a market impact perspective, the implementation of this 50% centralized maintenance will clearly benefit the supply side, directly alleviating short-term supply-demand imbalances. According to industry survey data, the maintenance plan has entered the implementation phase. A leading enterprise in Jiangsu plans to shut down a melt production unit around January 20, involving 6 production lines and an annual capacity of 180,000 tons, with the shutdown lasting over 30 days. Other small and medium-sized enterprises have also successively announced their maintenance plans, with the maintenance periods concentrated around the Chinese New Year holiday, covering a total capacity accounting for 50% of the industry's total capacity. From a price perspective, the expectation of supply contraction has already been realized. From early November 2025 to early January 2026, the spot price of BOPET has cumulatively increased by approximately 800 yuan/ton, a rise of 9.1%. The market has simultaneously followed the spot recovery, with prices increasing by over 7%, indicating initial support from the supply side.

In summary, this 50% concentrated maintenance of BOPET industry capacity during the Chinese New Year is a key measure to combat involution in the industry. In the short term, it will alleviate supply-demand imbalances through supply contraction, leading to a market valuation recovery. In the long term, it will promote the optimization of the industry's supply structure and the return to value. In the future, close attention should be paid to the progress of the maintenance implementation, the coordinated execution of capacity, and the recovery of downstream demand.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

Multifaceted Collaboration: PA Prices Rebound Against Trend to Break Through

-

Dow suffers poor performance, announces major layoffs of 4,500 employees