11,000 Auto Repair Shops Await Buyers While 28,000 New Players Enter: Who Gets Eliminated, Who Soars?

Even with 2025 being hailed by the industry as "the best year in the next decade," survival anxiety remains undiminished.

In the fiercely competitive automotive repair industry, which operates in a saturated market, businesses are still deeply mired in operational difficulties such as "declining revenue and profit, attracting customers through low-price promotions, and a reduction in accident vehicle business." The particularly dismal traditional "Golden September and Silver October" peak season has delivered a final blow to those in the auto repair sector.

The continuation of this dilemma is directly reflected in the survival data of retail stores across the industry.

In the fourth quarter of this year, AC Auto data on "auto repair and beauty" shop transfers from a certain local website, primarily focusing on 31 provincial capitals and direct-controlled municipalities. A total of 2,760 shops were listed for transfer, which is not significantly different from the transfer data for the same period last year.

However, another set of data reveals the other side of the coin. Between 2023 and 2025, the number of auto repair shops nationwide decreased by 79,000, an average of 26,000 closures per year, far exceeding the annual number of transfers of just over 10,000 – more often, shops are simply closing down because they can't be transferred.

The lament "business is getting tougher year after year" still echoes in the minds of auto repair shop owners, yet the expansion of auto repair chains is progressing rapidly. Tuhu Auto has reached 8000+ stores, JD Auto 4000+ stores, Xiaomuzhi 3500+ stores... Even car manufacturers and 4S groups are deploying stores in the independent aftermarket.

It's clear that on one hand, auto repair shops are struggling to survive, while on the other, giants are accelerating their expansion. In the assertion that "50% of auto repair shops will close in the next three years," who will be eliminated, and who is rewriting the rules of the game?

01. 28,100 new stores opened in 2025, with an average of 26,000 stores closing.

Currently, the transfer of auto repair shops is becoming more rational, while direct closure and exit have become a more common choice.

According to AC Auto statistics, over 20,000 stores were transferred in 2021, slightly decreased to 19,000 in 2022, continued to decline to 14,000 in 2023, and reached 10,000 in 2024. The full-year estimate for 2025 is 11,000.

It should be noted that the above data was obtained under relative conditions. In reality, due to limitations in statistical caliber, website coverage area, and more unreleased transfer information of stores, there are even more exits hidden beneath the tip of the iceberg.

Public data shows that between 2023 and 2025 alone, the number of traditional auto repair shops nationwide decreased by 18.7%, from 423,000 to 344,000, a total decrease of 79,000, averaging 72 closures per day.

Also keeping pace with the exit trend are the previously thriving 4S dealerships, whose wave of closures and shutdowns continues to intensify.

According to data from the China Automobile Dealers Association, 1,379 4S dealerships withdrew from the market in 2021. This number increased to 1,757 in 2022 and further climbed to 2,540 in 2023. By 2024, this figure rapidly rose by 74% to reach 4,419, marking the first negative growth in the scale of 4S dealerships in nearly five years.

According to Lang Xuehong, Deputy Secretary-General of the China Automobile Dealers Association, over 5,000, and possibly even up to 6,000, 4S dealerships are expected to exit their original brand operations in 2025. Some of these will transition to new energy vehicle brands, resulting in a net reduction of nearly 1,500 dealerships for the year.

Each closed store has its own difficulties, but the enthusiasm that once poured into opening shops in the aftermarket has rapidly cooled in the face of the current cold reality, and market entrants are becoming increasingly cautious.

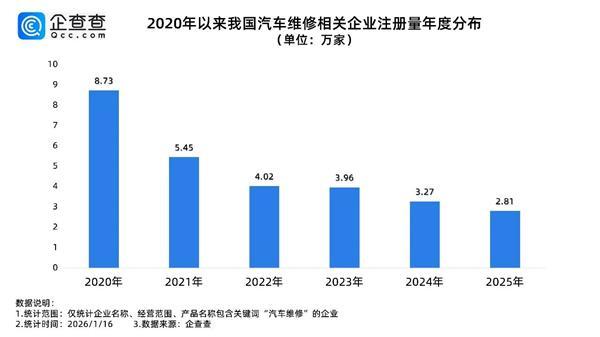

According to Qichacha data, as of now, there are 643,000 existing automotive repair-related enterprises in China. Since 2020, the number of registered related enterprises has continuously declined, with 28,100 registered throughout 2023, a year-on-year decrease of 14.2%. Compared to the peak of 116,500 in 2019, the decline reached 75.88%.

Overall, while the channel contraction of 4S stores remains in dire straits, the "transfer tide" in auto repair shops is stabilizing, and the "opening boom" is simultaneously cooling down. This reflects that both exiting and entering players are becoming more rational in the harsh market environment, and the auto repair industry is no longer a "gold rush" for speculative followers.

However, this is not the end of the storm, but likely the prelude to another major shake-up.

The tens of thousands of auto repair shops that have recently exited the market are more likely to be those with the weakest risk resistance. Moving forward, as chain giants expand their networks and competition escalates, once the industry enters a mid-game battle of comprehensive capabilities, the industry reshuffle will no longer be about a wave of departing numbers, but rather a concentration and restructuring of market share and living space.

02. Aftermarket value declined for 11 months of the year, with continued shrinkage in gasoline vehicle business.

Reflecting on the entirety of 2025, the survival status of auto repair shops is not optimistic.

Although there was a small peak in February after the Spring Festival, it only lasted for a little over ten days and ended quickly. In March, passenger traffic plummeted. The upcoming months of April to June will inevitably enter the off-season. The traditional peak season of "Golden September and Silver October" was originally anticipated, but this year saw a double decline in output value and profit. In particular, the number of vehicles entering the premises in September dropped by 64% overall, and a revenue decline of 30%-40% has become a common phenomenon.

Data from the F6 Big Data Research Institute confirms this: in 2025, 64% of stores will see a year-on-year decline in vehicle entries, with 15% experiencing a drop of over 25%. The difficulties in business operations will also accelerate the transfer and closure of some stores, making this survival competition even more brutal.

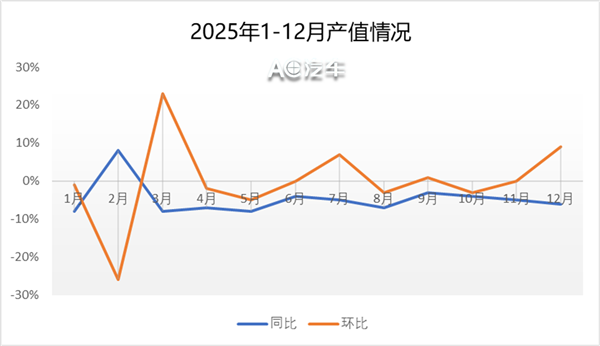

Specifically, let's look at the output value and the number of units put into operation in 2025.

As can be seen from the chart, February saw an 8% year-on-year increase in output but a 26% month-on-month decrease, due to Chinese New Year's Eve falling in early February in 2024 and late January in 2025. Subsequently, output continued to decline year-on-year, with year-on-year declines of up to 8% in several individual months, and continuous revenue decline became the main theme throughout the store's annual operation.

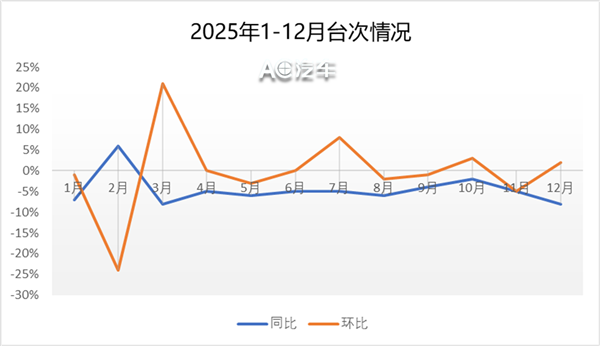

Concurrently, the data line for inbound vehicle counts synchronizes with output value, showing sequential increases of 21%, 8%, 3%, and 2% respectively in March, July, October, and December. This clearly indicates that the brief rebound in inbound vehicle counts was primarily driven by factors such as holidays and seasonality, but the limited growth magnitude was far from sufficient to reverse the overall decline throughout the year.

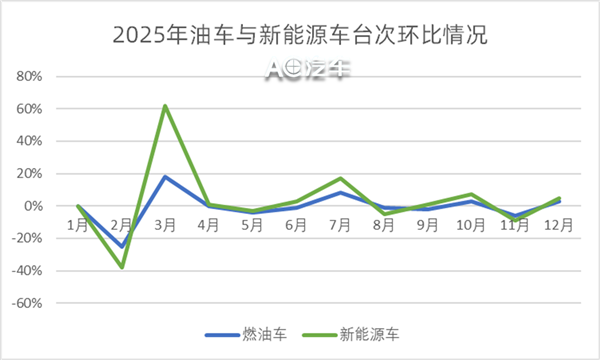

Next, let's look at the comparison of entry volume between ICE vehicles and new energy vehicles in 2025.

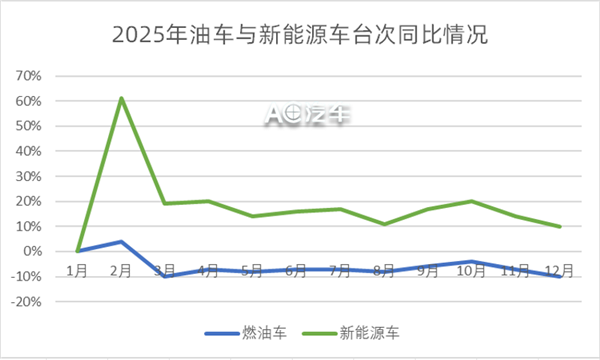

It is widely recognized that the new energy business is the prevailing trend and a top priority for stores to undergo early transformation, a fact that is most intuitively reflected in the data.

In the chart formed by F6 data, new energy vehicle entries showed positive year-on-year growth throughout 2025, with February seeing a remarkable 57% increase. In contrast, gasoline-powered vehicles only experienced a slight 4% year-on-year increase in February, while declining in all other 11 months, with March and December showing a 10% drop.

That is to say, compared to 2024, the business of fuel vehicles will continue to shrink in 2025, leading to a further reduction in customer traffic for stores that rely on fuel vehicle maintenance, amplifying the anxiety about customer flow. At the same time, stores that have proactively laid out their new energy vehicle business may be able to stabilize their core operations, whether they are specialized new energy repair shops or "oil and electric repair" shops, gaining a much-needed breathing room.

However, on a month-on-month basis, the number of fuel vehicle entries to workshops kept pace with the overall aftermarket; while the number of new energy vehicle entries declined by 13%, 4%, and 3% in February, August, and November, respectively. This fluctuation also indicates that new energy business is a new direction for auto repair shops to explore for growth, but it still requires a long period of preliminary accumulation.

On one hand, the high-priced "three-electric" maintenance services for new energy vehicles are firmly locked within the 4S dealership system. Auto repair shops can only undertake "peripheral" services such as car washes, detailing, film application, chassis maintenance, and tire replacement, making it difficult for them to access the lucrative core business.

On the other hand, although the total number of out-of-warranty new energy vehicles flowing into the independent aftermarket, as well as "unfinished cars" due to brand closures, exceeds 5 million units, if we consider that 10% of the 643,000 stores surveyed by Qichacha are capable and willing to undertake new energy vehicle business, each store would only receive an average of 77 vehicles, which is far from enough to sustain a business.

Struggling with declining foot traffic, falling revenue, and the pain of transformation, auto repair shops are grappling with the dilemma of "difficulty finding growth and difficulty retaining existing customers" in 2025. It can be said that if the auto repair business doesn't improve in the near future, the survival pressure faced by most shops will likely only increase.

03. Independent aftermarket stores are exiting in droves, but giants are still accelerating their expansion.

On one hand, auto repair shops are struggling and closing down, while on the other, chain giants are still accelerating their expansion. This increasingly stark polarization indicates that the industry reshuffle is not just about the exit of small and medium-sized stores, but also a restructuring of industry concentration.

Several new changes are worth noting in the new stores opening in 2025:

First, OEMs are making a comeback in the independent aftermarket (IAM). In 2015, OEMs entered the IAM in an attempt to disrupt and outcompete hundreds of thousands of independent auto repair shops. However, to this day, the current survival status of brands such as Eurorepar, Chery Chebeijian, SAIC Chexiangjia, SAIC-GM ACDelco (Chegongfang), BAIC Haoxiuyang, Sun-Repair, and Ford Quick Lane has provided a definitive answer to that ambition.

However, some automakers have not given up on the independent aftermarket. For example, Chery Automobile has launched its auto service chain brand "Bai Jia Shi"; SAIC has "SAIC Yangche" with 1,000 locations; GAC Honda has "Le Xiang Yangche"; and Changan has "Che He Mei", among others. In addition, BYD submitted trademark registration applications for "Didi Yangche," "Xiao Di Yangche," and "Jing Cheng Yangche" in March 2025, which the industry interprets as the company personally entering the car maintenance chain business.

Second, there is an "overflow" of after-sales technicians starting their own businesses. First, large comprehensive repair shops are closing or consolidating facilities and laying off staff, leading some unemployed technicians to open their own shops. Second, amidst the wave of 4S dealership closures and network withdrawals, a large number of after-sales professionals are choosing to leave—either voluntarily or involuntarily—to establish specialized repair centers. These individuals have emerged as a new force challenging traditional auto repair shops.

Based solely on data from 4S dealerships, 4,419 4S dealerships exited the market in 2024, resulting in at least 10,000 auto repair technicians losing their jobs. Some of these technicians have moved into other industries to make a living, while many more have opened their own shops to serve former 4S dealership customers. It is projected that 5,000-6,000 4S dealerships will exit the market in 2025, and the number of skilled professionals leaving the industry will only increase.

Third, large 4S groups continue to invest in after-sales service. For example, after car detailing and body and paint services, Zhongsheng Group rehired former after-sales managers to open a "second workshop" within the 4S store, using non-original parts and operating on a "partnership and profit-sharing" model. This "store-within-a-store" approach aims to create new after-sales growth points for dealers.

Once successful, other dealers will follow suit. A Porsche 4S store in Chongqing leased its basement to a former after-sales manager and took an equity stake to convert it into an "independent after-sales center," which quickly achieved profitability. Such stores, backed by official endorsement, will undoubtedly become "formidable rivals" to independent after-sales workshops.

Fourth, leading chain brands such as Tuhu, JD Auto, and Xiaomuzhi are continuing to expand. As of now, Tuhu has over 8,000 stores, JD Auto has surpassed 4,000, and Xiaomuzhi has reached 3,500, among others. However, the expansion of these chains is not merely a simple accumulation of store numbers and a battle for market share; it is also about reshaping car owners' perceptions and choices through online and offline integration.

Strategic investments, especially those backed by capital, make it even harder for auto repair shops. Towards the end of 2025, Tuhu launched a campaign offering a free annual car wash card with the purchase of two or more tires. This kind of "no-cost" customer acquisition strategy, employed at specific times, often leaves resource-strapped traditional stores feeling threatened and unable to compete.

As can be seen, the survival space of traditional small and medium-sized stores is being squeezed from both ends: one end is the standardized and branded service network of leading chain stores, and the other end is the specialized repair shops derived from the 4S system, as well as the "small but beautiful" professional niche stores.

As industry concentration intensifies irreversibly, the trials for auto repair professionals are far from over.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

RMB Hits 32-Month High! Alpek Shuts Down PET Recycling Plant; Porsche Sales Plummet

-

Vynova's UK Chlor-Alkali Business Enters Bankruptcy Administration!

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Continental Plans to Begin Sale of ContiTech in Early 2026