World's largest! Ningbo's 1.68 billion yuan polyester new materials project expected to begin production in the first half of the year! Potential for 10-fold growth in the future.

On Thursday afternoon, there will be a tea gathering with the founder of Chemical Fiber Bang. Everyone is welcome to sign up to join the conversation! Please reach out to us in the background and let us know what you would like to discuss!

In March this year, the textile market saw a downturn in conventional products, but differentiated fabrics emerged as a standout, especially functional fabrics made from some special raw materials, which were in short supply. As the third-generation polyester fiber, PTT combines the characteristics of polyester and nylon, possessing excellent fiber properties such as stain resistance, easy dyeing, and soft hand feel, offering broad market potential. This has also led to a scramble among chemical industry leaders to commence production.

The world's largest single PTT project is about to commence production.

The 150,000-ton/year special polyester new material project, located in the southern plant area of Ningbo Juhua Chemical Technology Co., Ltd., has seen its new factory building, covering more than 40 acres, rise from the ground, and the equipment has been installed.

Zhou Qiang, chairman of Ningbo Juhua, stated: "This polyester new materials project is the world's largest single-unit project and a provincial 'Thousand Projects, Trillion Investment' initiative, with a total investment of 1.68 billion yuan. It is scheduled to begin production in the first half of the year, and upon reaching full capacity, it is expected to generate an additional annual sales revenue of 2.5 billion yuan. This project will break long-standing foreign technological monopolies and achieve full supply chain localization."

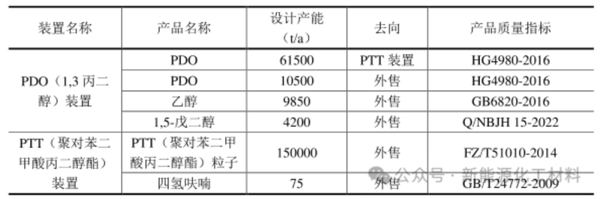

The project officially commenced construction on July 4, 2023, with an annual production of 72,000 tons of PDO (including 10,500 tons of commercial products and 61,500 tons of intermediate products) and 150,000 tons of PTT.

Among them, the main raw material for PTT production in this project, 1,3-propanediol, is self-supplied by the PDO (1,3-propanediol) unit, using a titanium-based component as a catalyst, titanium dioxide as a delustering agent, and 1,4-butanediol as a modifier. Refined terephthalic acid (PTA) and 1,3-propanediol (PDO) are used as raw materials to synthesize the monomer propylene terephthalate (BHPT) through direct esterification and dehydration, which is then polycondensed into polytrimethylene terephthalate (PTT). The polyester melt production line adopts a four-reactor process, namely two-stage esterification, pre-polycondensation, and final polycondensation. The process, from feedstock preparation to pelletizing, is a closed system, resulting in fewer pollution nodes and a high collection rate of the three wastes.

Possessing both the properties of spandex and nylon

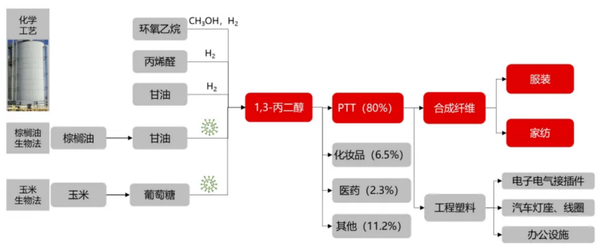

PTT fiber is the abbreviation for polytrimethylene terephthalate fiber. It is a polyester resin derived from purified terephthalic acid (PTA) and 1,3-propanediol, successfully developed by Shell Chemical of the United States in 1995 as a new spinning polymer. As the third-generation polyester material, PTT fiber combines the properties of both polyester and nylon, featuring excellent characteristics such as stain resistance, ease of coloring, and soft hand feel. Additionally, its "Z"-shaped structure gives the fiber elasticity, placing it between PBT and spandex in terms of elasticity and offering better resilience and memory function. This makes PTT fiber highly promising in the market.

The main potential application fields of PTT are to replace spandex and nylon. The spandex market is at the level of 1 million tons. Take polyester-wrapped spandex as an example, where spandex is used as the core yarn, polyester accounts for 90%, and spandex accounts for 10%. If the same elasticity is to be achieved, the blended ratio of PTT will increase from 10% to 50%. Therefore, in an aggressive scenario, the future market space will reach 5 million tons.

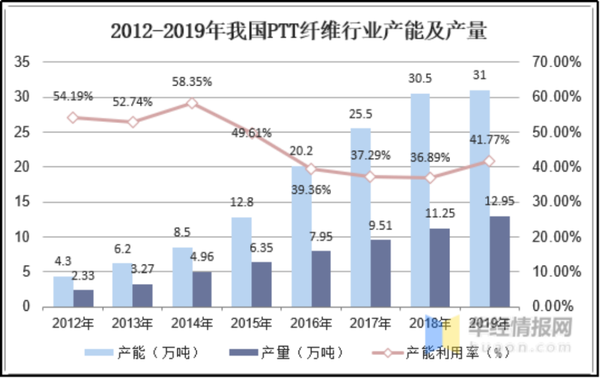

Rapid growth in domestic production capacity

In the PDO-PTT industry chain, China's production capacity has grown rapidly in recent years. As of May 2024, the domestic PDO production capacity was 179,000 tons, with an additional planned capacity of 242,000 tons. If the new capacity is put into production as scheduled, China's PDO capacity will reach 421,000 tons in the next two years. The production capacity of bio-based PTT fiber is about 150,000 tons. Even so, due to the excellent performance of PTT fiber, according to an aggressive estimate, there is still a market potential of about 10 times in the future.

This capacity growth is mainly attributed to the expansion projects of domestic companies such as Qingda Zhixing, Huaheng Bio, Ningbo Juhua, and Huafeng Ruixun, as well as the rapid development of the bio-based materials industry under policy support.

Key capacity projects examples:

Guangdong Qingda Zhixing: Multiple production bases have been established in Shanxi, Guangxi, and other regions, including an annual 20,000-ton sugar-based PDO project, with plans to further expand to 100,000 tons per year.

Huaxing Biology: The 50,000-ton bio-based PDO project in Chifeng, Inner Mongolia is under construction and is expected to enhance domestic substitution capabilities upon completion.

Hefei Changfeng: The 50,000-ton bio-based PDO R&D and industrial demonstration project is in the environmental impact assessment stage.

Zhejiang Huafeng Ruixun: The Bio-PDO factory in the United States (formerly DuPont Susterra® PDO) has an annual production capacity of 77,000 tons. The local annual production of the bio-based PTT project in Zhejiang will be completed in May 2024, with an additional 60,000-ton PTT polymerization project starting the environmental assessment public announcement in December 2024.

Source | Huajing Intelligence Network, New Energy Chemical Materials, First Material Intelligence, Yongpai, Internet

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track